Apple's (AAPL) resurgence in China is turning heads, as the iPhone 17 series accounts for one in four smartphones sold in the world's largest mobile market. The 37% year-over-year (YoY) sales jump in October marks the first time Apple has hit this milestone since 2022, when competition in the premium segment was considerably weaker.

Every iPhone 17 model, from the base version to the Pro Max, is outperforming its iPhone 16 predecessor by double-digit percentages, validating CEO Tim Cook's confidence that the company will return to growth in China this quarter.

The momentum appears strong, as new iPhone models now account for over 80% of Apple's unit sales in the country. Additionally, higher average selling prices should amplify Apple's top-line growth in the holiday season.

Over the years, Apple has wrestled with competition from Chinese smartphone makers such as Huawei, Xiaomi (XIACY), and Oppo. However, the iPhone’s premium positioning and product execution continue to resonate with consumers in China, despite sluggish economic growth.

Is Apple Stock a Good Buy Right Now?

In fiscal Q4 of 2025 (ended in September), Apple reported revenue of $102.5 billion, an increase of 8% YoY. It posted adjusted earnings of $1.85 per share, while Services revenue grew 15% to almost $29 billion. In fiscal 2025, the iPhone maker reported revenue of $416 billion, establishing new records across multiple product categories and geographic regions.

The iPhone 17 lineup is driving consumer demand despite supply constraints on several models. iPhone revenue reached $49 billion in the quarter, up 6% YoY, and would have been higher if Apple had been able to meet demand.

CEO Tim Cook attributed the constraint issue to lower demand forecasts rather than manufacturing problems. Apple’s management expects double-digit iPhone growth in the current quarter, allowing it to post record revenue in fiscal Q1.

The Services business continues to exceed expectations with broad-based strength across categories. The division surpassed $100 billion in annual revenue for fiscal 2025, growing 14% YoY.

Apple set all-time records in payment services, the App Store, cloud services, Music, and video during the September quarter. The company sees future opportunities as its installed base of active devices reached another all-time high across all product categories.

Looking ahead, Apple guided December-quarter revenue growth of 10% to 12%, which would deliver the best quarter ever for both the total company and iPhone specifically. Gross margins are expected to be between 47% and 48%, factoring in $1.4 billion of tariff-related costs.

Apple continues to ramp up investments in artificial intelligence (AI) while maintaining disciplined financial management. Operating expenses are also rising due to research and development spending on AI capabilities and the product roadmap.

Despite higher OpEx growth relative to revenue, Apple maintains healthy operating leverage through gross margin expansion, keeping operating income growth ahead of revenue growth.

What Is the AAPL Stock Price Target?

Analysts tracking AAPL stock forecast revenue to increase from $416.16 billion in fiscal 2025 to $577 billion in fiscal 2030, indicating an annual growth rate of 6.8%. In this period, adjusted earnings per share are forecast to increase from $7.46 to $13.77, representing an annual growth rate of 13%.

Today, AAPL stock trades at a forward price-to-earnings (P/E) multiple of 32.5x, which is above its 10-year average of 22.3x. If the tech stock reverts to its historical average, it should trade around $307 in late 2029, indicating an upside potential of less than 20% from current levels.

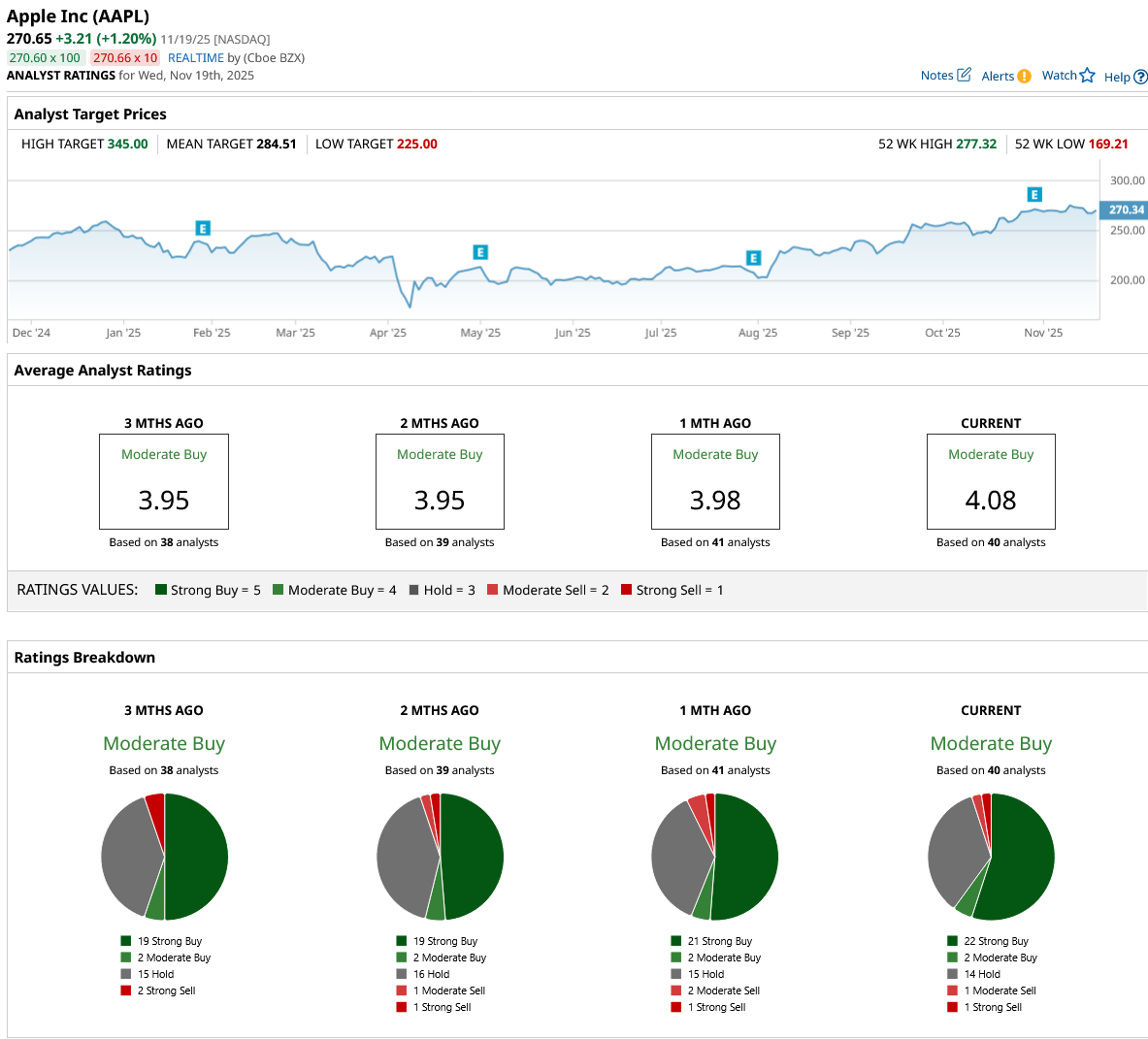

Out of the 40 analysts covering AAPL stock, 22 recommend “Strong Buy,” two recommend “Moderate Buy,” 14 recommend “Hold,” one recommends “Moderate Sell,” and one recommends “Strong Sell.” The average AAPL stock price target is $284.51, barely above the current price of $270.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Here’s How You Can Have Your Cake with AMD Stock and Eat It Too – With Just 6.6% Downside Risk

- As Arm Bets on AI Infrastructure with Nvidia, Should You Buy, Sell, or Hold ARM Stock?

- Adobe Is Buying Semrush. Is It Too Late to Buy SEMR Stock?

- Analysts Think This Tech Stock Will Power the Next Wave of Hyperscaler Growth. They Just Gave It a New Street-High Price Target.