For so many years, Wall Street treated Advanced Micro Devices (AMD) as the little brother of Intel (INTC). Specifically, the type of siblings that fight all the time. AMD was the challenger, and there were many instances when Wall Street analysts wondered if it would survive.

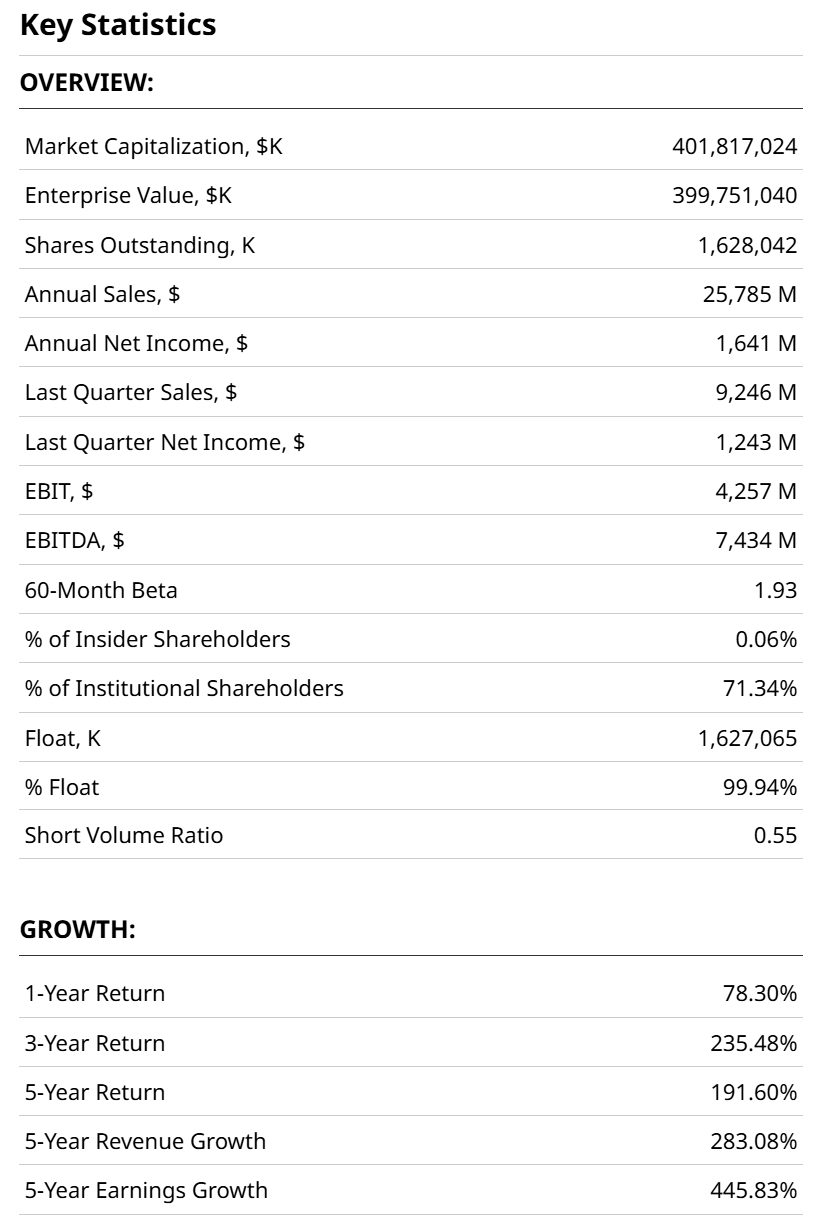

Skip ahead a couple of decades, and while INTC is now 10% owned by the U.S. government, AMD is a $400 billion stock in its own right. That’s more than double the value of INTC. Yet a lot of that ascension came in a very short amount of time.

A 235% cumulative gain the past 3 years will do that!

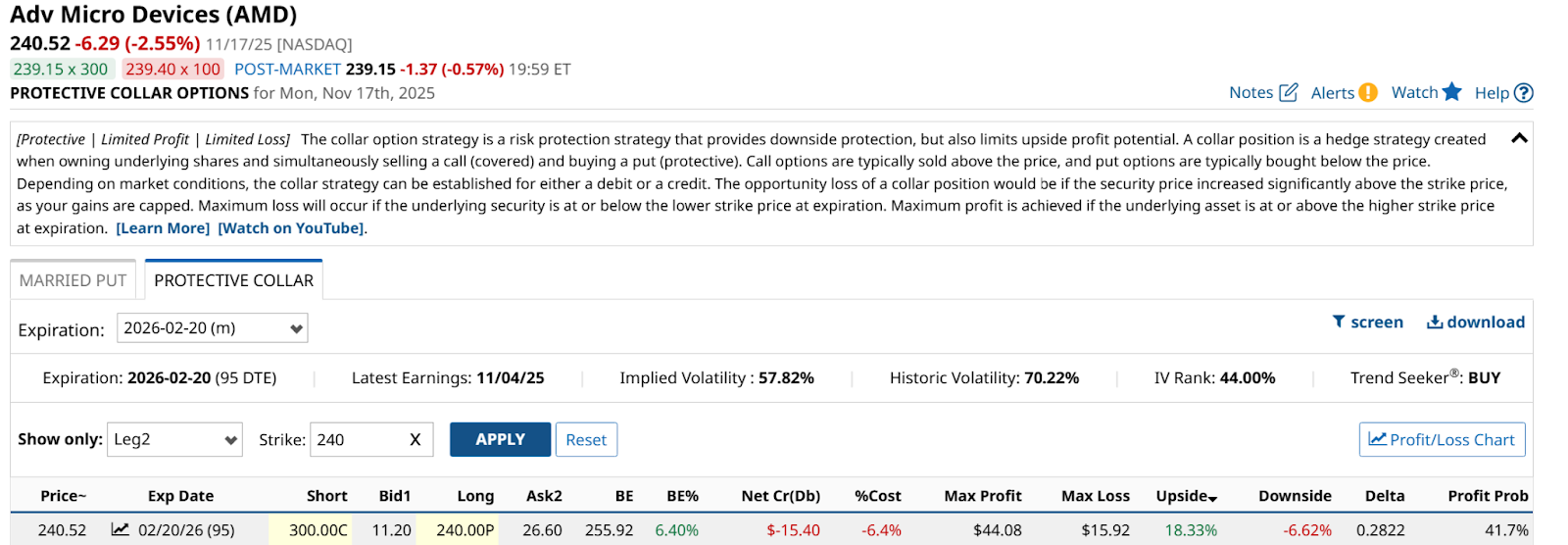

I wrote about AMD for Barchart on Aug. 6, 2025. The stock had just rocketed up in price, then slipped after releasing earnings. I concluded from my chart analysis that AMD had upside potential, but that an option collar could take the edge off. By lowering risk.

How an Option Collar on AMD Stock Lowers Risk

How? By defining a worst-case scenario up front. That’s what the put option purchase side of a protective collar does. The covered call is the other part of the trade, which is placed around lots of 100 shares of a stock one owns.

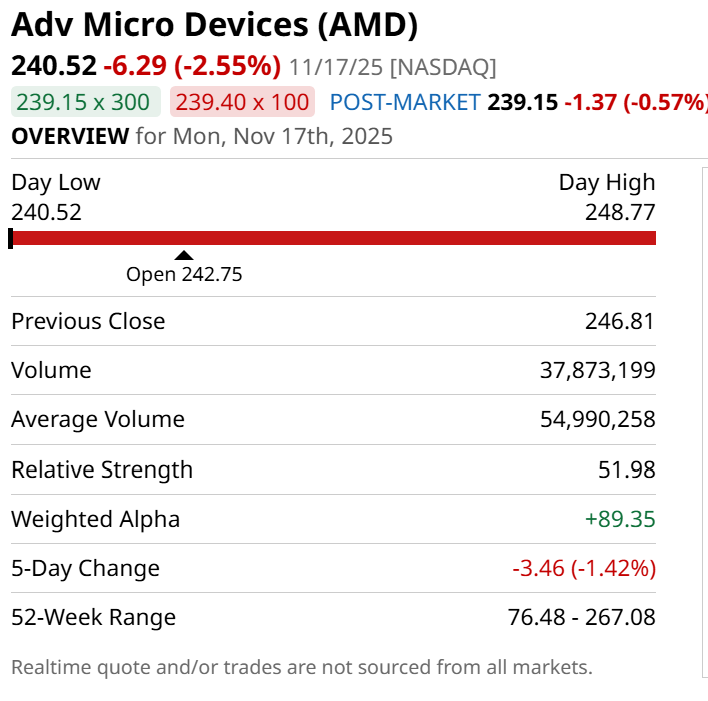

A later article on Oct. 7 mapped out an option collar between $200 and $250, expiring this January. Here’s a quick history of AMD’s stock price during that time, through Monday’s close:

Aug. 6: $163

Oct. 11: $212

Nov. 17: $241

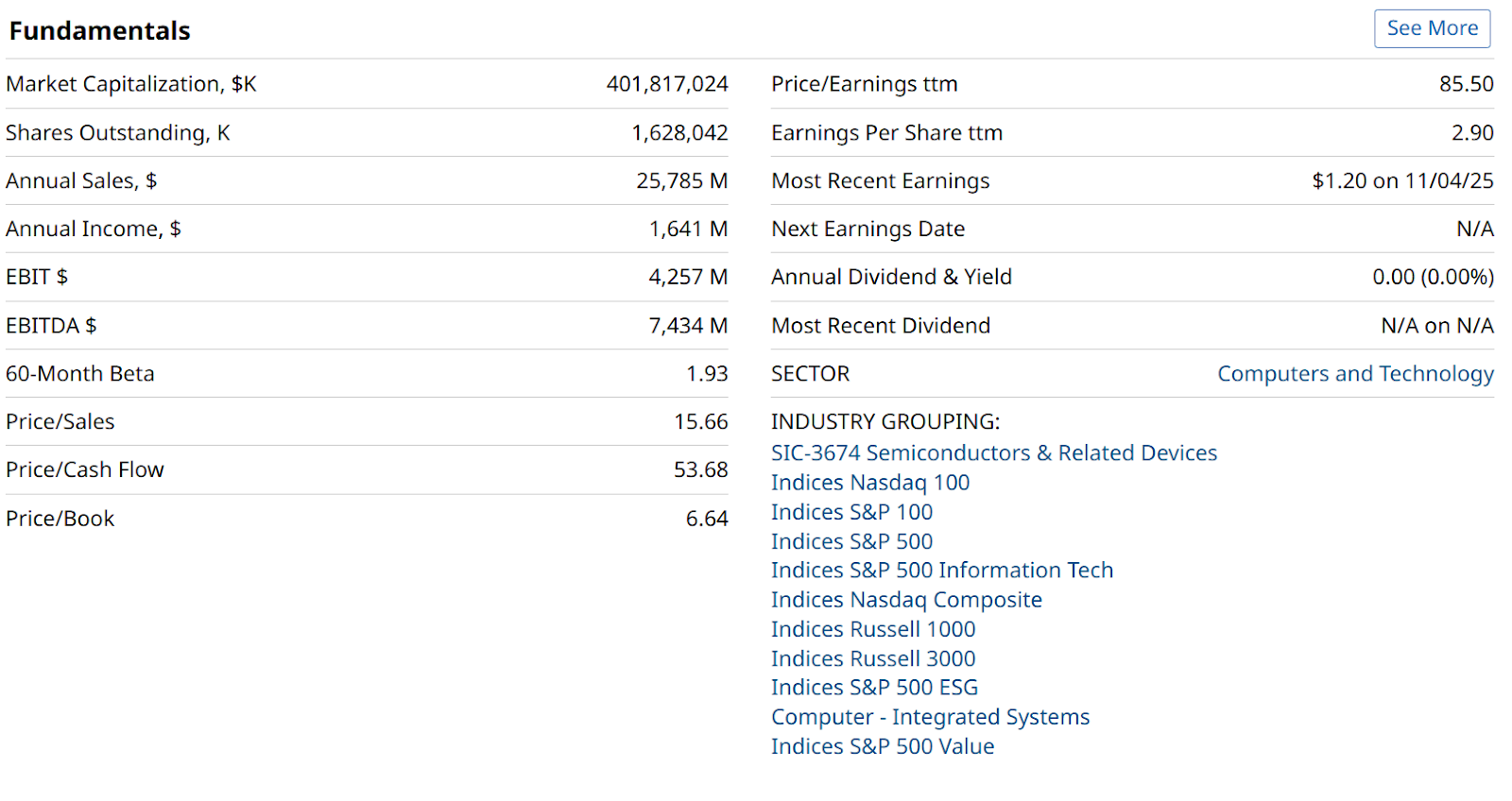

So, what now? AMD reported earnings earlier this month, so that’s out of the way. But the tech sector is under a lot of pressure. And at 15x sales and more than 80x trailing earnings, AMD has the makings of one of those “I told you so” stories. It is now vulnerable to any bad news, whether it is company-driven, sector-related, or a market-wide issue.

We don’t see too many stocks this big that have a 52-week price range from $76 to $267. So as a risk manager, my thought is, as always, to try to have my cake and eat it too.

How to Win on AMD, Either Way

A collar is just as viable as it was the last two times I wrote about AMD. And with the stock’s recent gyrations driving up its volatility, the options pricing is more favorable.

As we see in the picture below, I can go out just three months to next February, and have certainty that I can’t lose more than 6.6% on a stock that has been a top performer already.

That’s because the combination above pairs a $240 strike put option with a $300 call. So in order for me to have a decision about whether to risk being called at that higher level, the stock would have to rise not only back to its all-time high, but nearly 10% above it.

The strike price of the put is right at where it closed Monday, so the downside is essentially just my cost, as depicted above. An 18% upside and less than 7% downside over just 3 months? Not bad at all.

AMD’s stock looks vulnerable here, although it has staved off some of the market’s recent tech decline. And since owning 100 shares of AMD is not in everyone’s budget, for those who determine they’d like to try to profit from a drop in AMD’s stock price, there is this.

The Direxion Daily AMD Bear -1X Shares (AMDD) essentially shorts AMD on a daily basis. It has the same math as other inverse ETFs, which means holding it through extended rises in the stock (which means AMDD is falling in price) is something to be aware of before considering it.

Still, if there was ever a time for traders and investors to look around and scout for ways to make money on stock price drops instead of the gains we’ve been conditioned to expect, it is now. So whether it is a collar, a put option, more cash, smaller position sizes, or inverse ETFs, I strongly encourage you to get more familiar with how to combine defense with the usual offensive game plan every investor is trained to have.

Rob Isbitts, founder of Sungarden Investment Publishing, is a semi-retired chief investment officer, whose current research is found here at Barchart, as well as at his ETF Yourself subscription service on Substack.

On the date of publication, Rob Isbitts did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Elliott Management Is Betting Big on This Dividend-Paying Gold Stock. Should You Buy Shares Now?

- This Leading Gene-Editing Stock Could Be Going Private. Should You Buy Its Shares First?

- Small-Cap Stocks Are Sounding a Very Scary Alarm. Here’s How to Protect Yourself… and Even Profit.

- Here’s How You Can Have Your Cake with AMD Stock and Eat It Too – With Just 6.6% Downside Risk