It’s once again time to break down into bullet points the bullish and bearish elements impacting the gold (GCZ25) and silver (SIZ25) markets. I’ll also give you my take on where prices are headed in the coming weeks and months.

The Bull Case for Gold and Silver Prices

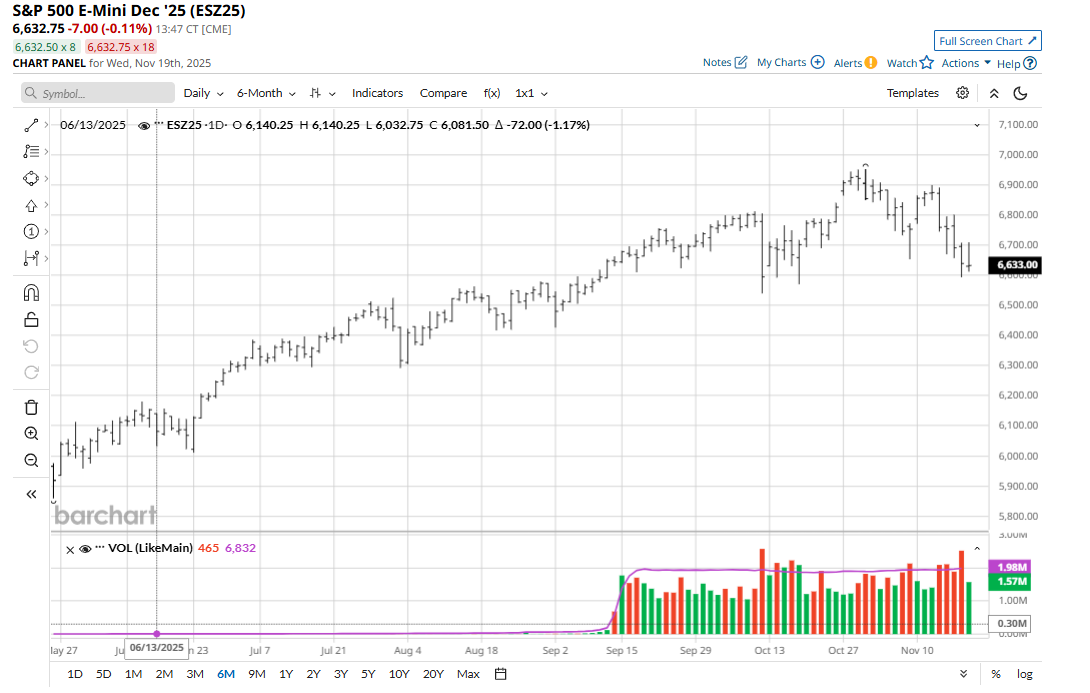

- Risk aversion is elevated at present, as seen by the wobbly global stock markets. Wall Street’s so-called fear gauge, the CBOE Volatility Index ($VIX), this week topped 24 — above the key 20 level that causes concern for traders — and reached its highest level in a month. This is driving safe-haven buying of gold and silver at mid-week. Traders and investors are also monitoring the private credit situation in the financial markets. There are some indications that some big borrowers are stretched very thin.

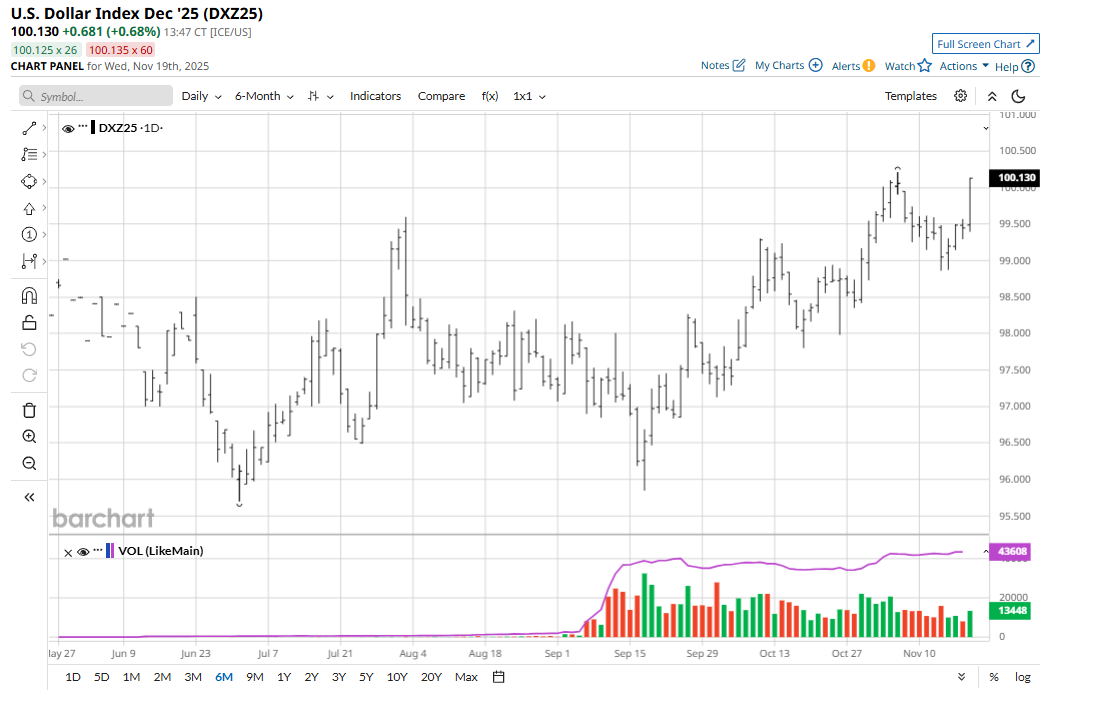

- The U.S. and China economies are showing signs of slowing growth, which has led to easing of the central bank monetary policies of both countries. This is bullish for the precious metals on two fronts. First, lower interest rates and borrowing costs mean better demand for gold and silver from consumers wanting to buy jewelry in countries like China and India. Second, lower interest rates in the U.S. are likely to cause some depreciation in the U.S. dollar on the foreign exchange market. On a daily trading basis, gold and silver prices tend to be supported by a lower U.S. dollar index.

- Global central banks are still stocking up on gold. China added an estimated 15 tons of gold to its forex reserves in September as central banks accelerated their purchases of bullion after a seasonal summer lull, according to Goldman Sachs. Analysts estimated that central banks globally bought 64 tons of gold in September, more than tripling from the month before. The buying spree is likely continuing in November, according to Goldman. Central-bank buying has been a key driver of gold’s bull run in the past three years. Despite the sovereign purchases’ key role in gold prices, they are shrouded in mystery as countries often under-declare their buying, said a Bloomberg report.

- Major economies like the U.S., China, India, and the European Union are racking up big budget deficits and doing more borrowing in their bond markets. Traders and investors are increasingly worried about the deficits creating a world credit crisis and even a contagion. Those concerns are making for increased safe-haven demand for gold and silver.

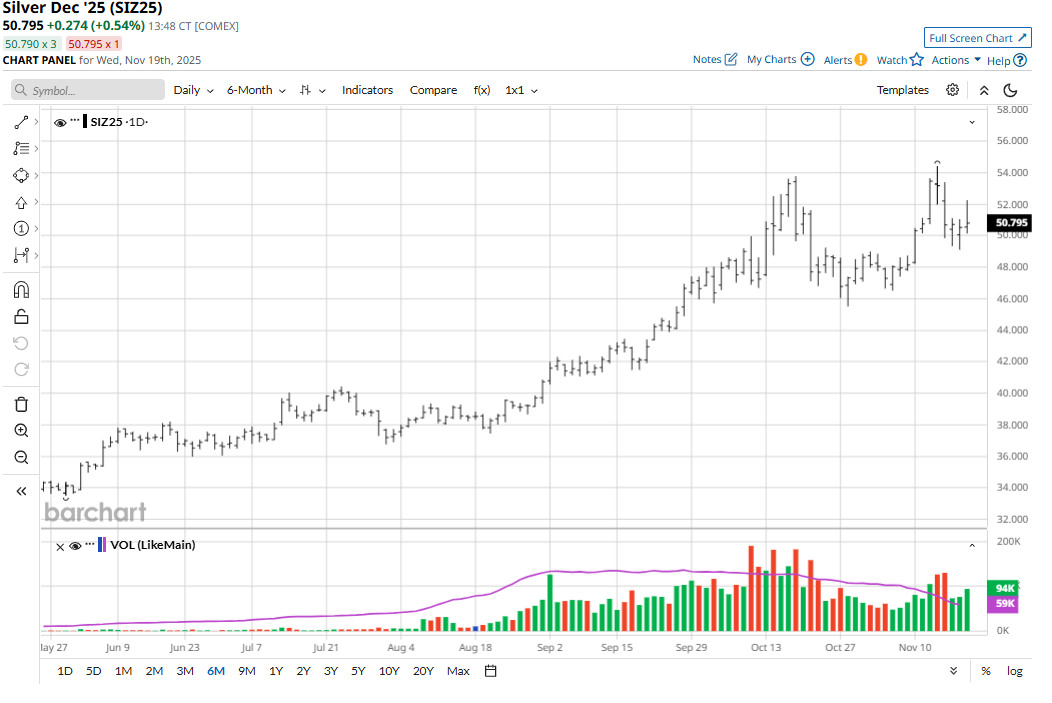

- Longer-term technical charts remain bullish overall. The weekly and monthly continuation charts for nearby gold and silver futures show prices still in solid longer-term uptrends.

The Bear Case for Gold and Silver Prices

- U.S. and other global stock markets, while seeing some turbulence the past couple weeks, are still historically elevated. It’s likely that many equities and stock index traders are now looking to do some value-buying from a longer-term perspective. Solid rebounds in the stock indexes in the coming weeks would be a significantly bearish development for safe-haven gold and silver, from a competing asset class perspective.

- The Federal Reserve has leaned more hawkish on its monetary policy in the past few weeks. Such has called into serious question whether the Fed will be able to cut the Fed funds rate at its December FOMC meeting. If the Fed stops cutting its interest rate, other major central banks may be likely to do the same. Higher borrowing costs for consumers and businesses are bearish for gold and silver from a demand perspective. A more hawkish Fed is also bullish for the U.S. dollar, which would also be a negative for gold.

- The record-setting bull runs in gold and silver are now long in the tooth. The bull run in gold is 10 years old, while silver’s bull move is 5.5 years old. Veteran commodity traders know that commodity markets are highly cyclical. They go through periods of boom and bust. Gold and silver are in lengthy boom cycles at present. That means bust will most certainly come, and maybe sooner than most reckon.

- Shorter-term daily charts for gold and silver showing bearish clues. Higher daily price volatility at higher price levels is a sign of a climaxing bull market move. Gold and silver have seen extreme daily price volatility in the past several weeks. Their near-term price uptrends on the daily charts have also been negated, suggesting market tops are in place.

- It can be argued the geopolitical tensions have eased the past few months. The Israel-Hamas ceasefire is mostly holding, and Middle East tensions have ratcheted down following major U.S. airstrikes on Iran’s nuclear facilities. While geopolitics never completely goes away in markets, it seems at present that it is not on the front burner of the marketplace. That’s bearish for the safe-haven metals.

Where I Think Gold and Silver Prices Are Headed Next

I’m still overall bullish on gold and silver, based on the very bullish longer-term technicals still in place, with the shorter-term technicals in both metals not bearish.

With silver prices above $50.00 again, I see silver’s next major upside target as $60.00. That’s not a stretch and could even come before the end of this year. The silver market now has a downside price benchmark that if breached would suggest a market top is in place: the October low of $45.51, basis December Comex futures.

For gold, the next upside target is the record high of $4,398.00 an ounce, basis December Comex futures. Above that it’s $5,000.00. It’s my bias that the $5,000.00 price target could be hit next year. A signal that the gold bulls don’t have the power to continue their record-setting run would be a close in December Comex futures below solid chart support at the late-October low of $3,901.30.

Tell me what you think. I really enjoy getting emails from my valued Barchart readers all over the world. Email me at jim@jimwyckoff.com.

On the date of publication, Jim Wyckoff did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- The Bull and Bear Cases for Gold, Silver Prices in November 2025

- Ray Dalio Warns the Next Big Debt Crisis Won’t Come From Banks. It’ll Come From Governments.

- Silver Prices Are Back Above $50. Why That Matters, and What It Means for Gold Too.

- ‘Cockroach’ Bankruptcies and Palantir Stock’s Post-Earnings Selloff: A Ticking Time Bomb Puts a Price Floor Under Gold, Silver