Earnings results often indicate what direction a company will take in the months ahead. With Q3 behind us, let’s have a look at Intuit (NASDAQ: INTU) and its peers.

Organizations are constantly looking to improve organizational efficiencies, whether it is financial planning, tax management or payroll. Finance and HR software benefit from the SaaS-ification of businesses, large and small, who much prefer the flexibility of cloud-based, web-browser delivered software paid for on a subscription basis than the hassle and expense of purchasing and managing on-premise enterprise software.

The 14 finance and HR software stocks we track reported a mixed Q3. As a group, revenues beat analysts’ consensus estimates by 1.4% while next quarter’s revenue guidance was 1% below.

Thankfully, share prices of the companies have been resilient as they are up 8.3% on average since the latest earnings results.

Intuit (NASDAQ: INTU)

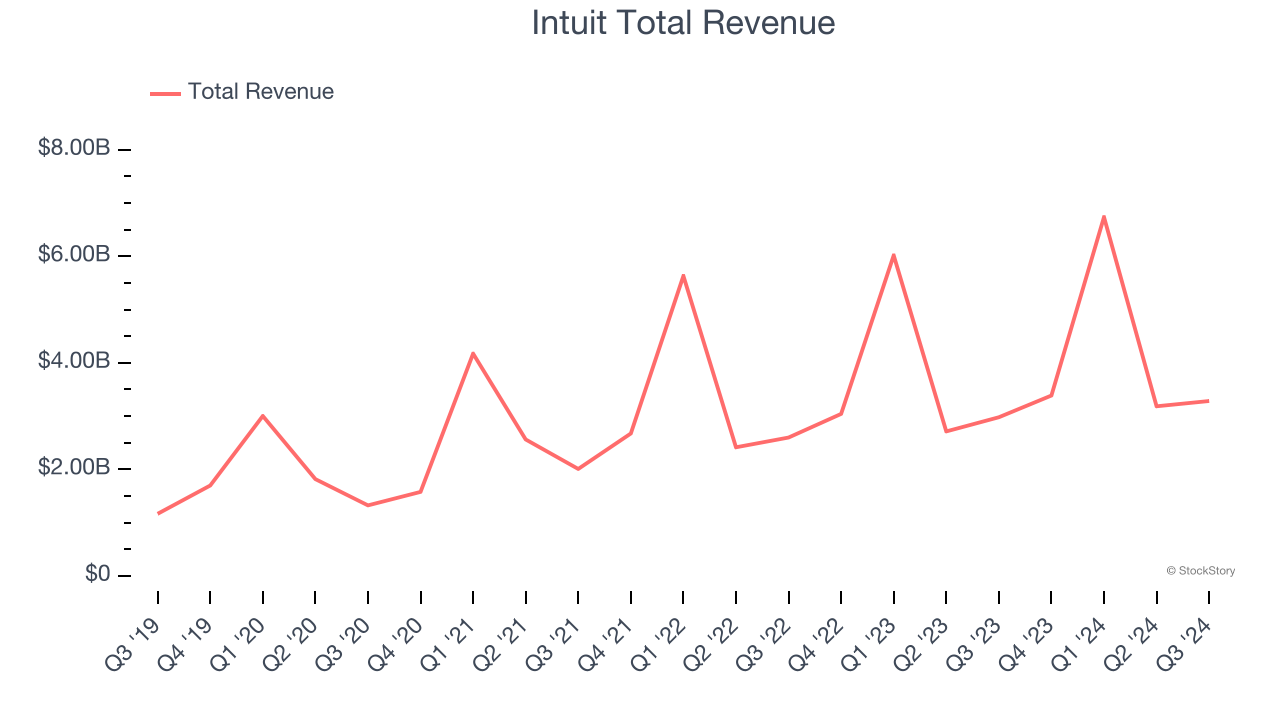

Created in 1983 when founder Scott Cook watched his wife struggle to reconcile the family's checkbook, Intuit provides tax and accounting software for small and medium-sized businesses.

Intuit reported revenues of $3.28 billion, up 10.2% year on year. This print exceeded analysts’ expectations by 4.6%. Despite the top-line beat, it was still a mixed quarter for the company with an impressive beat of analysts’ billings estimates but EPS guidance for next quarter missing analysts’ expectations significantly.

"We've had a strong start to the year as we demonstrate the power of Intuit's AI-driven expert platform strategy. By delivering 'done-for-you' experiences, enabled by AI with access to AI-powered human experts, we continue to fuel the success of consumers and businesses," said Sasan Goodarzi, Intuit's chief executive officer.

Unsurprisingly, the stock is down 4.8% since reporting and currently trades at $646.31.

Is now the time to buy Intuit? Access our full analysis of the earnings results here, it’s free.

Best Q3: Bill.com (NYSE: BILL)

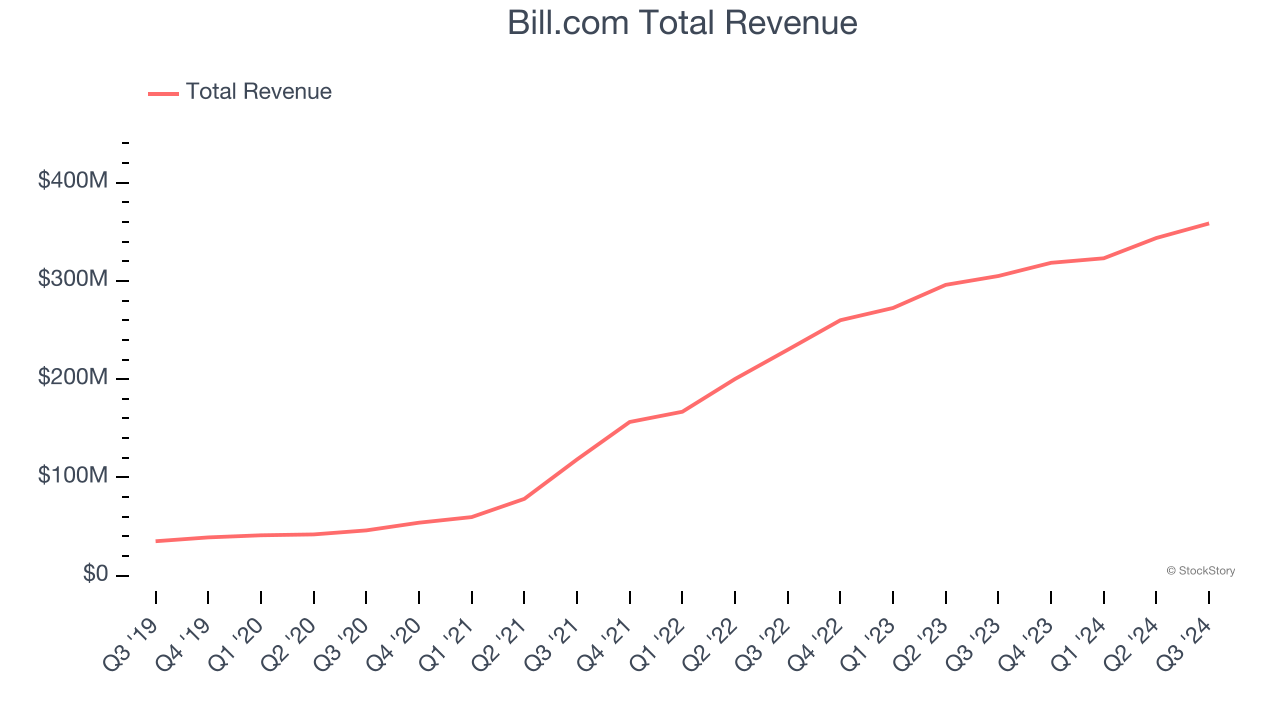

Started by René Lacerte in 2006 after selling his previous payroll and accounting software company PayCycle to Intuit, Bill.com (NYSE: BILL) is a software as a service platform that aims to make payments and billing processes easier for small and medium-sized businesses.

Bill.com reported revenues of $358.5 million, up 17.5% year on year, outperforming analysts’ expectations by 3.3%. The business had a very strong quarter with EPS guidance for next quarter exceeding analysts’ expectations and a solid beat of analysts’ EBITDA estimates.

The market seems happy with the results as the stock is up 32.2% since reporting. It currently trades at $87.

Is now the time to buy Bill.com? Access our full analysis of the earnings results here, it’s free.

Weakest Q3: Asure (NASDAQ: ASUR)

Created from the merger of two small workforce management companies in 2007, Asure (NASDAQ: ASUR) provides cloud based payroll and HR software for small and medium-sized businesses (SMBs).

Asure reported revenues of $29.3 million, flat year on year, falling short of analysts’ expectations by 6.5%. It was a disappointing quarter as it posted revenue guidance for next quarter missing analysts’ expectations.

Asure delivered the weakest performance against analyst estimates, slowest revenue growth, and weakest full-year guidance update in the group. As expected, the stock is down 8.1% since the results and currently trades at $9.13.

Read our full analysis of Asure’s results here.

Global Business Travel (NYSE: GBTG)

Holding close ties to American Express, Global Business Travel (NYSE: GBTG) is a comprehensive travel and expense management services provider to corporations worldwide.

Global Business Travel reported revenues of $597 million, up 4.6% year on year. This result missed analysts’ expectations by 2.7%. It was a slower quarter as it also recorded full-year revenue guidance slightly missing analysts’ expectations.

The stock is up 19.7% since reporting and currently trades at $9.17.

Read our full, actionable report on Global Business Travel here, it’s free.

Workday (NASDAQ: WDAY)

Founded by industry veterans Aneel Bushri and Dave Duffield after their former company PeopleSoft was acquired by Oracle in a hostile takeover, Workday (NASDAQ: WDAY) provides cloud-based software for organizations to manage and plan finance and human resources.

Workday reported revenues of $2.16 billion, up 15.8% year on year. This number topped analysts’ expectations by 1.4%. It was a strong quarter as it also recorded a solid beat of analysts’ annual recurring revenue estimates and an impressive beat of analysts’ EBITDA estimates.

The stock is flat since reporting and currently trades at $268.93.

Read our full, actionable report on Workday here, it’s free.

Market Update

Thanks to the Fed's series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market has thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% in November), and a notable surge followed Donald Trump’s presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by potential trade policy changes and corporate tax discussions, which could impact business confidence and growth. The path forward holds both optimism and caution as new policies take shape.

Want to invest in winners with rock-solid fundamentals? Check out our Hidden Gem Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.