Looking back on cybersecurity stocks’ Q3 earnings, we examine this quarter’s best and worst performers, including Rapid7 (NASDAQ: RPD) and its peers.

Cybersecurity continues to be one of the fastest-growing segments within software for good reason. Almost every company is slowly finding itself becoming a technology company and facing rising cybersecurity risks. Businesses are accelerating adoption of cloud-based software, moving data and applications into the cloud to save costs while improving performance. This migration has opened them to a multitude of new threats, like employees accessing data via their smartphone while on an open network, or logging into a web-based interface from a laptop in a new location.

The 9 cybersecurity stocks we track reported a strong Q3. As a group, revenues beat analysts’ consensus estimates by 2.3% while next quarter’s revenue guidance was 0.5% above.

In light of this news, share prices of the companies have held steady as they are up 1.2% on average since the latest earnings results.

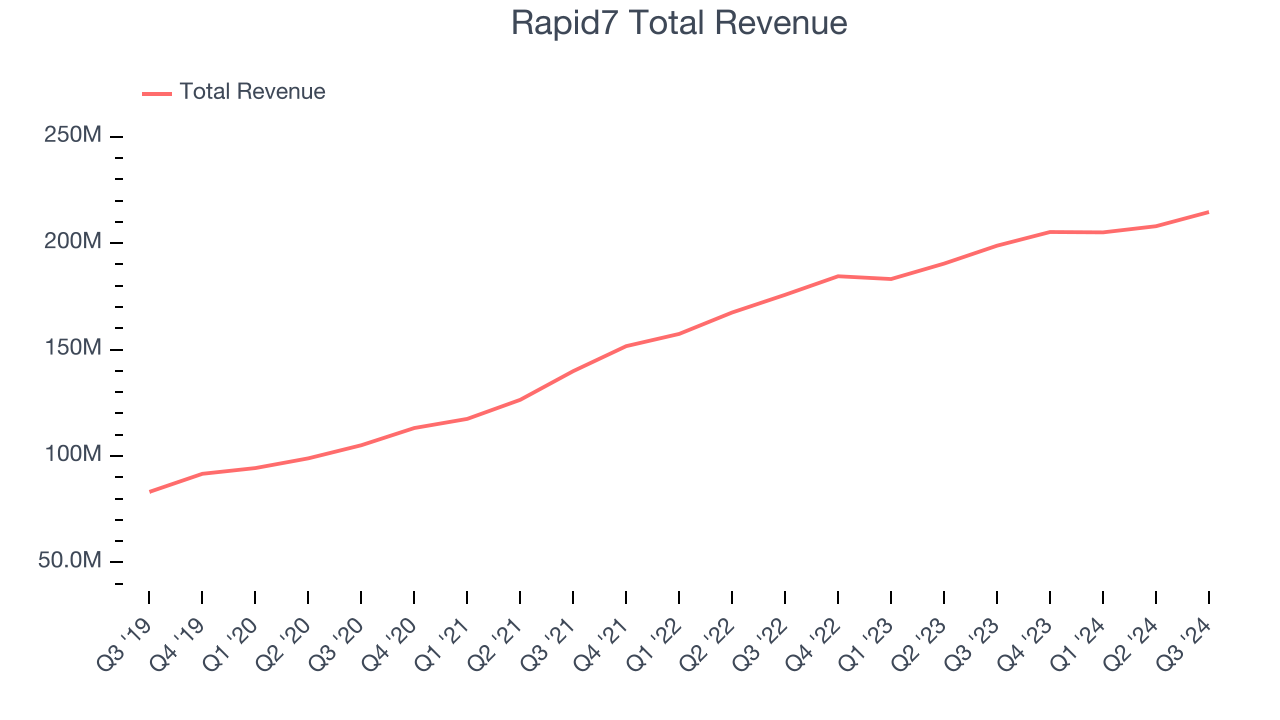

Rapid7 (NASDAQ: RPD)

Founded in 2000 with the idea that network security comes before endpoint security, Rapid7 (NASDAQ: RPD) provides software as a service that helps companies understand where they are exposed to cyber security risks, quickly detect breaches and respond to them.

Rapid7 reported revenues of $214.7 million, up 8% year on year. This print exceeded analysts’ expectations by 2.2%. Overall, it was a satisfactory quarter for the company with accelerating customer growth but EPS guidance for next quarter missing analysts’ expectations significantly.

“Rapid7 continued to see positive momentum across key areas of our business in the third quarter, highlighted by growth in our threat detection and response business, and strong demand for our consolidated offerings, which resulted in revenue and operating income exceeding guided ranges. There are also a number of promising indicators on the horizon, including a stronger sales pipeline and early positive traction from our newly launched Command platform,” said Corey Thomas, Chairman and CEO of Rapid7.

Rapid7 delivered the slowest revenue growth of the whole group. The company added 135 customers to reach a total of 11,619. Interestingly, the stock is up 4.5% since reporting and currently trades at $43.48.

Is now the time to buy Rapid7? Access our full analysis of the earnings results here, it’s free.

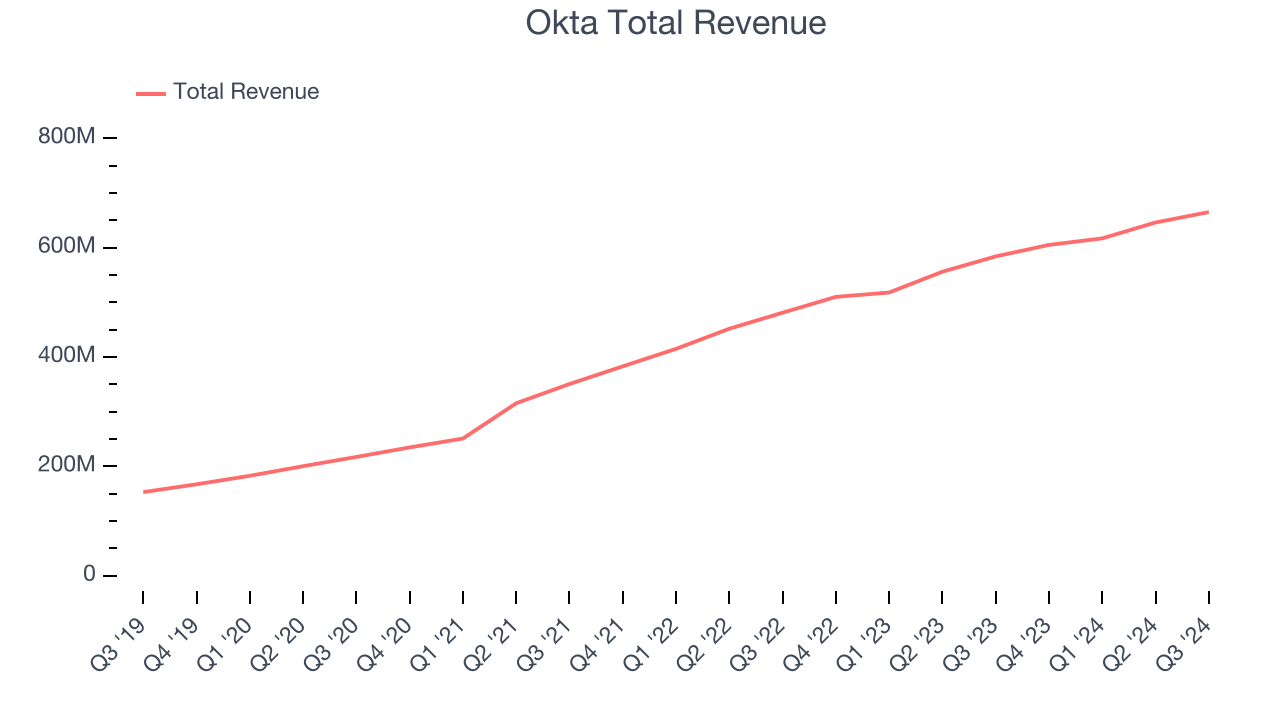

Best Q3: Okta (NASDAQ: OKTA)

Founded during the aftermath of the financial crisis in 2009, Okta (NASDAQ: OKTA) is a cloud-based software-as-a-service platform that helps companies manage identity for their employees and customers.

Okta reported revenues of $665 million, up 13.9% year on year, outperforming analysts’ expectations by 2.4%. The business had a very strong quarter with EPS guidance for next quarter exceeding analysts’ expectations and an impressive beat of analysts’ EBITDA estimates.

The market seems content with the results as the stock is up 3.8% since reporting. It currently trades at $84.90.

Is now the time to buy Okta? Access our full analysis of the earnings results here, it’s free.

Weakest Q3: SentinelOne (NYSE: S)

With roots in the Israeli cyber intelligence community, SentinelOne (NYSE: S) provides software to help organizations efficiently detect, prevent, and investigate cyber attacks.

SentinelOne reported revenues of $210.6 million, up 28.3% year on year, in line with analysts’ expectations. It was a mixed quarter as it posted a solid beat of analysts’ EBITDA estimates but a significant miss of analysts’ billings estimates.

SentinelOne delivered the weakest performance against analyst estimates in the group. The company added 77 enterprise customers paying more than $100,000 annually to reach a total of 1,310. As expected, the stock is down 10.7% since the results and currently trades at $25.63.

Read our full analysis of SentinelOne’s results here.

Zscaler (NASDAQ: ZS)

After successfully selling all four of his previous cybersecurity companies, Jay Chaudhry's fifth venture, Zscaler (NASDAQ: ZS) offers software-as-a-service that helps companies securely connect to applications and networks in the cloud.

Zscaler reported revenues of $628 million, up 26.4% year on year. This number topped analysts’ expectations by 3.7%. It was a very strong quarter as it also produced an impressive beat of analysts’ EBITDA estimates and full-year EPS guidance exceeding analysts’ expectations.

The stock is up 1.5% since reporting and currently trades at $211.83.

Read our full, actionable report on Zscaler here, it’s free.

CrowdStrike (NASDAQ: CRWD)

Founded by George Kurtz, the former CTO of the antivirus company McAfee, CrowdStrike (NASDAQ: CRWD) provides cybersecurity software that protects companies from breaches and helps them detect and respond to cyber attacks.

CrowdStrike reported revenues of $1.01 billion, up 28.5% year on year. This number beat analysts’ expectations by 2.8%. Overall, it was a strong quarter as it also logged a solid beat of analysts’ billings estimates and an impressive beat of analysts’ EBITDA estimates.

CrowdStrike achieved the fastest revenue growth among its peers. The stock is flat since reporting and currently trades at $365.60.

Read our full, actionable report on CrowdStrike here, it’s free.

Market Update

Thanks to the Fed’s rate hikes in 2022 and 2023, inflation has been on a steady path downward, easing back toward that 2% sweet spot. Fortunately (miraculously to some), all this tightening didn’t send the economy tumbling into a recession, so here we are, cautiously celebrating a soft landing. The cherry on top? Recent rate cuts (half a point in September, a quarter in November) have kept 2024 stock markets frothy, especially after Trump’s November win lit a fire under major indices and sent them to all-time highs. However, there's still plenty to ponder — tariffs, corporate tax cuts, and what 2025 might hold for the economy.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Growth Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.