Cybersecurity platform provider Palo Alto Networks (NASDAQ: PANW) announced better-than-expected revenue in Q3 CY2025, with sales up 15.7% year on year to $2.47 billion. The company expects next quarter’s revenue to be around $2.58 billion, close to analysts’ estimates. Its non-GAAP profit of $0.93 per share was 4.4% above analysts’ consensus estimates. Palo Alto Networks also announced its intent to acquire Chronosphere, a next-generation observability platform for the data center era.

Is now the time to buy Palo Alto Networks? Find out by accessing our full research report, it’s free for active Edge members.

Palo Alto Networks (PANW) Q3 CY2025 Highlights:

- Revenue: $2.47 billion vs analyst estimates of $2.46 billion (15.7% year-on-year growth, 0.5% beat)

- Adjusted EPS: $0.93 vs analyst estimates of $0.89 (4.4% beat)

- Adjusted Operating Income: $746 million vs analyst estimates of $715.8 million (30.2% margin, 4.2% beat)

- The company slightly lifted its revenue guidance for the full year to $10.52 billion at the midpoint from $10.5 billion

- Management raised its full-year Adjusted EPS guidance to $3.85 at the midpoint, a 1.3% increase

- Operating Margin: 12.5%, in line with the same quarter last year

- Market Capitalization: $136.1 billion

"Our strong start to the fiscal year was marked by excellent results across all metrics, and significant platformization wins," said Nikesh Arora, chairman and CEO of Palo Alto Networks.

Company Overview

Founded in 2005 by security visionary Nir Zuk who sought to reimagine firewall technology, Palo Alto Networks (NASDAQ: PANW) provides AI-powered cybersecurity platforms that protect organizations' networks, clouds, and endpoints from sophisticated threats.

Revenue Growth

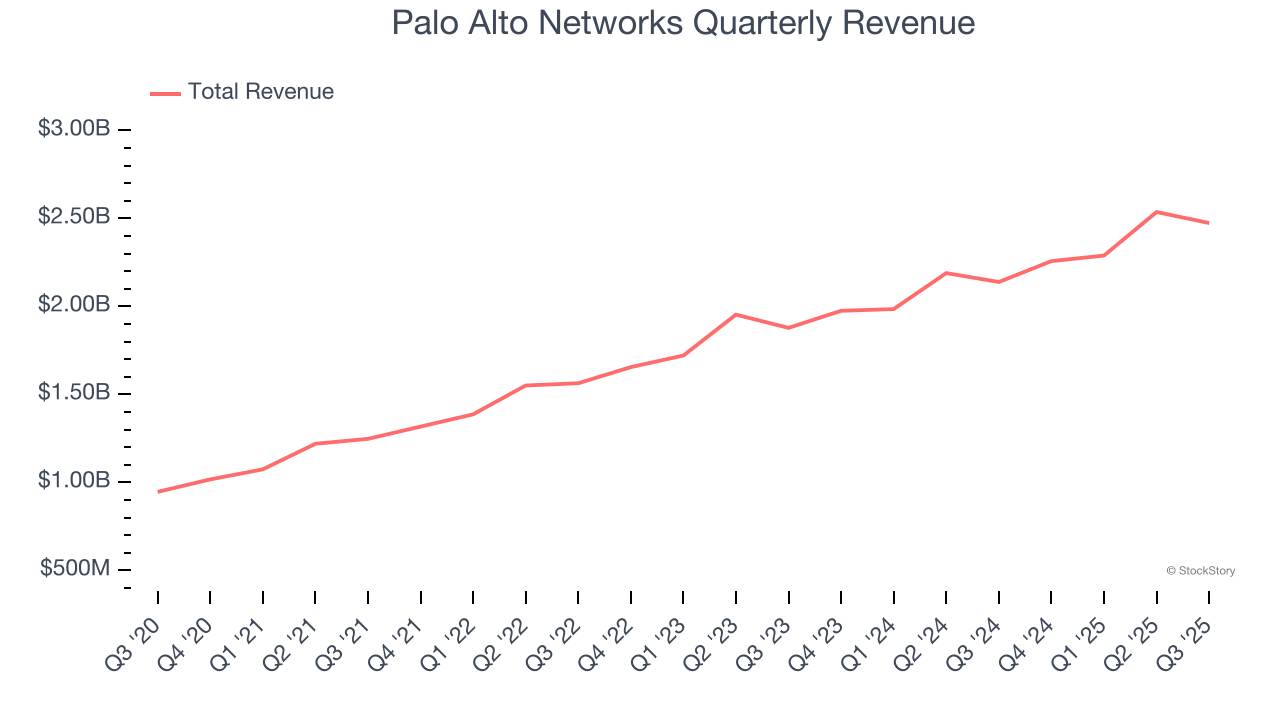

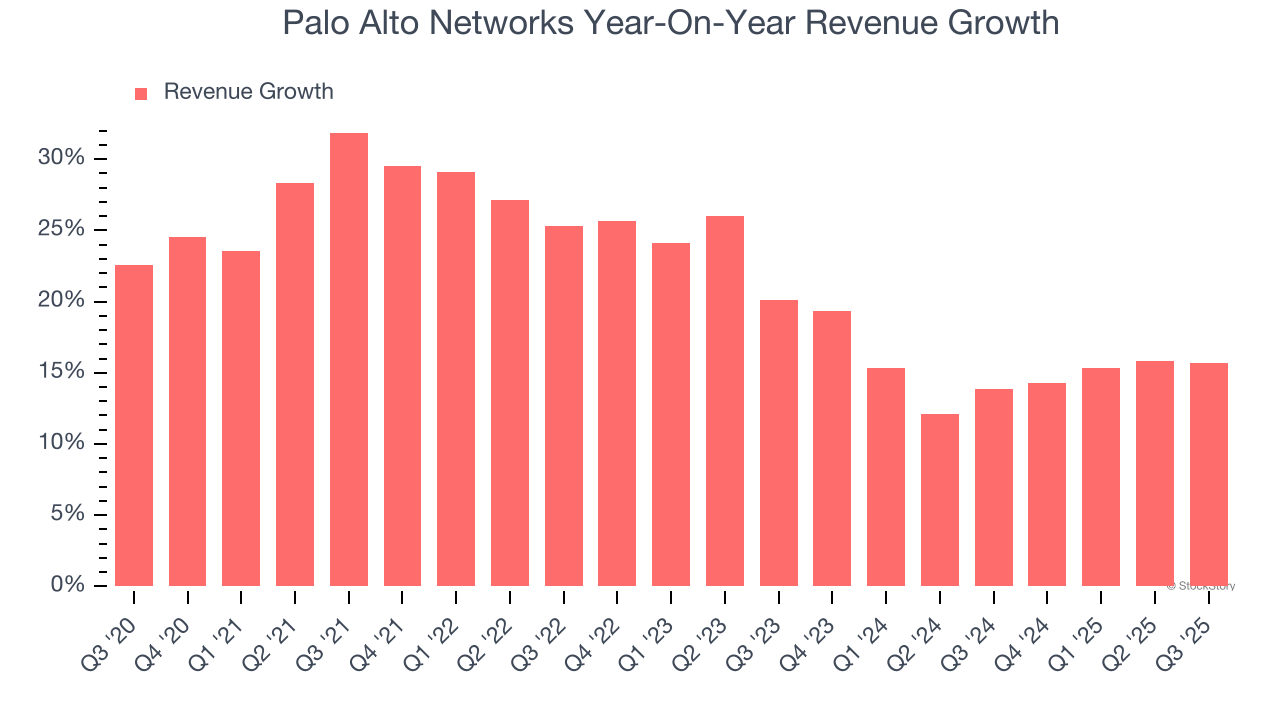

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, Palo Alto Networks grew its sales at a decent 21.7% compounded annual growth rate. Its growth was slightly above the average software company and shows its offerings resonate with customers.

Long-term growth is the most important, but within software, a half-decade historical view may miss new innovations or demand cycles. Palo Alto Networks’s annualized revenue growth of 15.2% over the last two years is below its five-year trend, but we still think the results were respectable.

This quarter, Palo Alto Networks reported year-on-year revenue growth of 15.7%, and its $2.47 billion of revenue exceeded Wall Street’s estimates by 0.5%. Company management is currently guiding for a 14.3% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 13.4% over the next 12 months, a slight deceleration versus the last two years. This projection is underwhelming and suggests its products and services will see some demand headwinds. At least the company is tracking well in other measures of financial health.

The 1999 book Gorilla Game predicted Microsoft and Apple would dominate tech before it happened. Its thesis? Identify the platform winners early. Today, enterprise software companies embedding generative AI are becoming the new gorillas. a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period measures the months a company needs to recoup the money spent on acquiring a new customer. This metric helps assess how quickly a business can break even on its sales and marketing investments.

Palo Alto Networks is extremely efficient at acquiring new customers, and its CAC payback period checked in at 20.7 months this quarter. The company’s rapid recovery of its customer acquisition costs indicates it has a highly differentiated product offering and a strong brand reputation. These dynamics give Palo Alto Networks more resources to pursue new product initiatives while maintaining the flexibility to increase its sales and marketing investments.

Key Takeaways from Palo Alto Networks’s Q3 Results

It was good to see Palo Alto Networks provide full-year EPS guidance that slightly beat analysts’ expectations. We were also glad its EPS guidance for next quarter slightly exceeded Wall Street’s estimates. Overall, this print had some key positives. The market seemed to be hoping for more, and the stock traded down 3.2% to $193.68 immediately following the results.

Big picture, is Palo Alto Networks a buy here and now? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.