Dole trades at $15.60 and has moved in lockstep with the market. Its shares have returned 11.4% over the last six months while the S&P 500 has gained 13.1%.

Is there a buying opportunity in Dole, or does it present a risk to your portfolio? Get the full stock story straight from our expert analysts, it’s free for active Edge members.

Why Do We Think Dole Will Underperform?

We don't have much confidence in Dole. Here are three reasons why DOLE doesn't excite us and a stock we'd rather own.

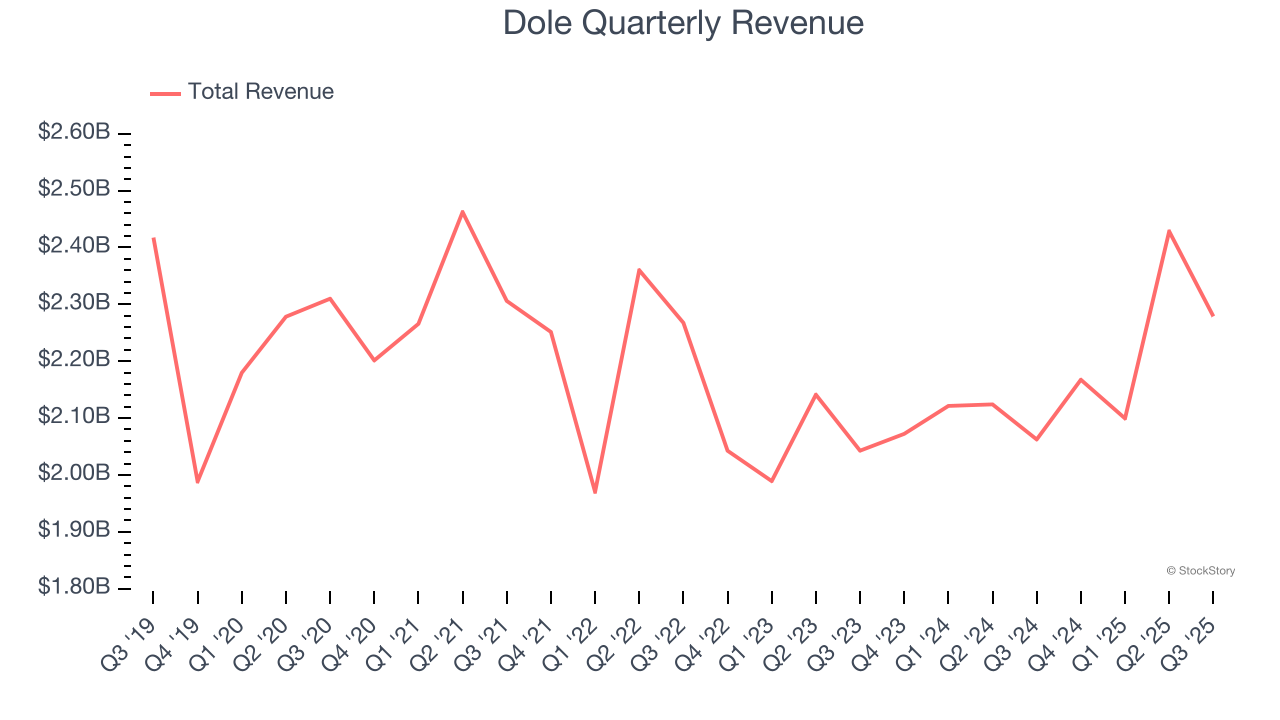

1. Long-Term Revenue Growth Flatter Than a Pancake

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Unfortunately, Dole struggled to consistently increase demand as its $8.97 billion of sales for the trailing 12 months was close to its revenue three years ago. This was below our standards and signals it’s a low quality business.

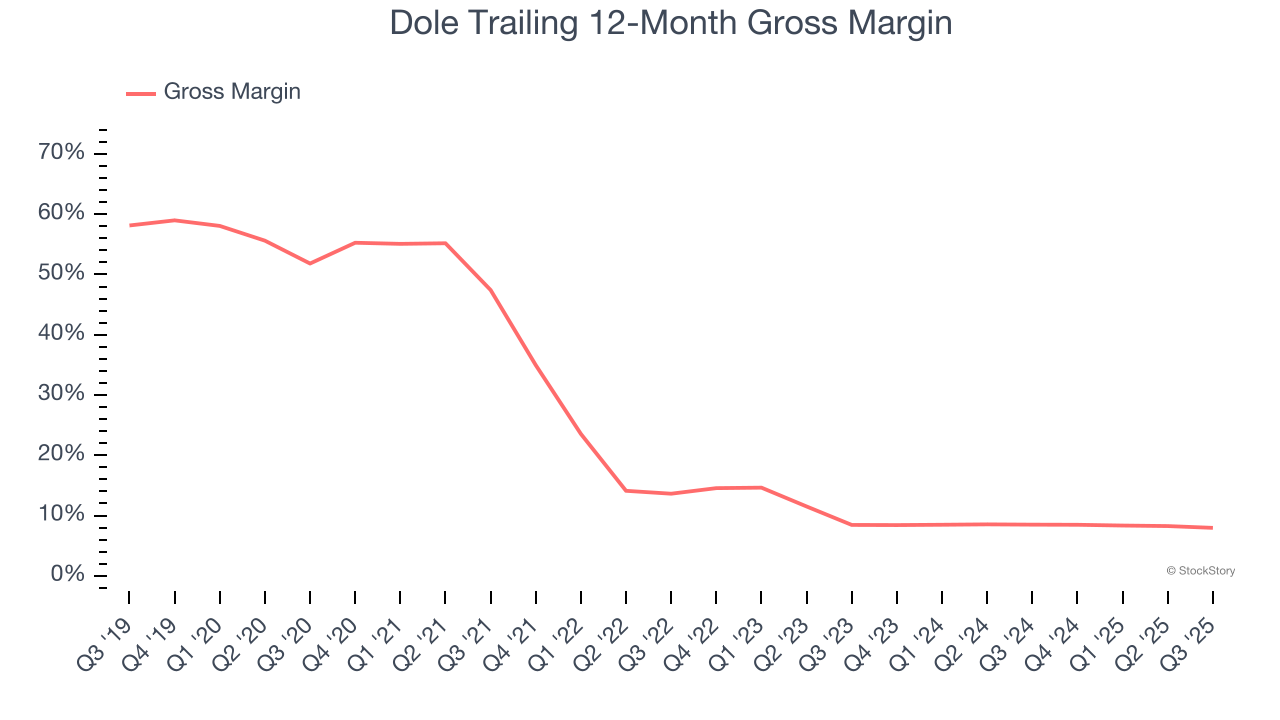

2. Low Gross Margin Reveals Weak Structural Profitability

All else equal, we prefer higher gross margins because they make it easier to generate more operating profits and indicate that a company commands pricing power by offering more differentiated products.

Dole has bad unit economics for a consumer staples company, signaling it operates in a competitive market and lacks pricing power because its products can be substituted. As you can see below, it averaged a 8.2% gross margin over the last two years. Said differently, for every $100 in revenue, a chunky $91.79 went towards paying for raw materials, production of goods, transportation, and distribution.

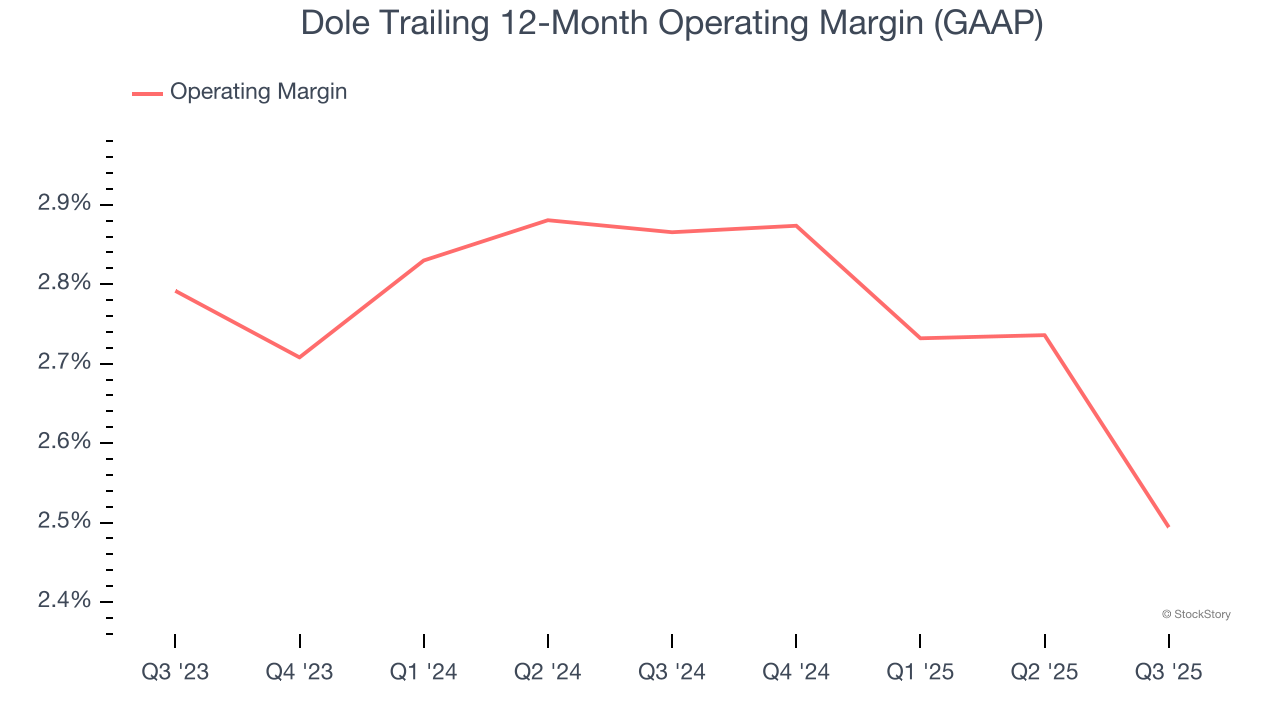

3. Weak Operating Margin Could Cause Trouble

Operating margin is a key profitability metric because it accounts for all expenses enabling a business to operate smoothly, including marketing and advertising, IT systems, wages, and other administrative costs.

Dole’s operating margin might fluctuated slightly over the last 12 months but has generally stayed the same, averaging 2.7% over the last two years. This profitability was paltry for a consumer staples business and caused by its suboptimal cost structureand low gross margin.

Final Judgment

We cheer for all companies serving everyday consumers, but in the case of Dole, we’ll be cheering from the sidelines. That said, the stock currently trades at 11.1× forward P/E (or $15.60 per share). This valuation is reasonable, but the company’s shaky fundamentals present too much downside risk. There are better investments elsewhere. We’d recommend looking at the most dominant software business in the world.

Stocks We Like More Than Dole

If your portfolio success hinges on just 4 stocks, your wealth is built on fragile ground. You have a small window to secure high-quality assets before the market widens and these prices disappear.

Don’t wait for the next volatility shock. Check out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.