Flooring manufacturer Mohawk Industries (NYSE: MHK) beat Wall Street’s revenue expectations in Q2 CY2025, but sales were flat year on year at $2.80 billion. Its non-GAAP profit of $2.77 per share was 6.3% above analysts’ consensus estimates.

Is now the time to buy Mohawk Industries? Find out by accessing our full research report, it’s free.

Mohawk Industries (MHK) Q2 CY2025 Highlights:

- Revenue: $2.80 billion vs analyst estimates of $2.74 billion (flat year on year, 2.2% beat)

- Adjusted EPS: $2.77 vs analyst estimates of $2.61 (6.3% beat)

- Adjusted EBITDA: $371.4 million vs analyst estimates of $364.6 million (13.3% margin, 1.9% beat)

- Adjusted EPS guidance for Q3 CY2025 is $2.61 at the midpoint, below analyst estimates of $2.72

- Operating Margin: 6.7%, in line with the same quarter last year

- Free Cash Flow Margin: 4.5%, similar to the same quarter last year

- Market Capitalization: $7.29 billion

Commenting on the Company’s second quarter, Chairman and CEO Jeff Lorberbaum stated, “In challenging conditions across our regions, our results reflect the impact of our ongoing operational improvements, cost containment actions and market development initiatives. Our premium residential and commercial products and new collections introduced during the past 24 months benefited our performance. Our restructuring actions are on schedule and delivering the expected savings as we have closed high-cost operations, eliminated inefficient assets, streamlined distribution and leveraged technology to improve our administrative and operational costs. Our global operations teams continue to identify productivity initiatives to lower our costs through enhancements to equipment, conserving energy, optimizing our supply chain and re-engineering products. Our industry faced continued pricing pressure from lower market volumes, which we are mitigating through strengthening product and channel mix.

Company Overview

Established in 1878, Mohawk Industries (NYSE: MHK) is a leading producer of floor-covering products for both residential and commercial applications.

Revenue Growth

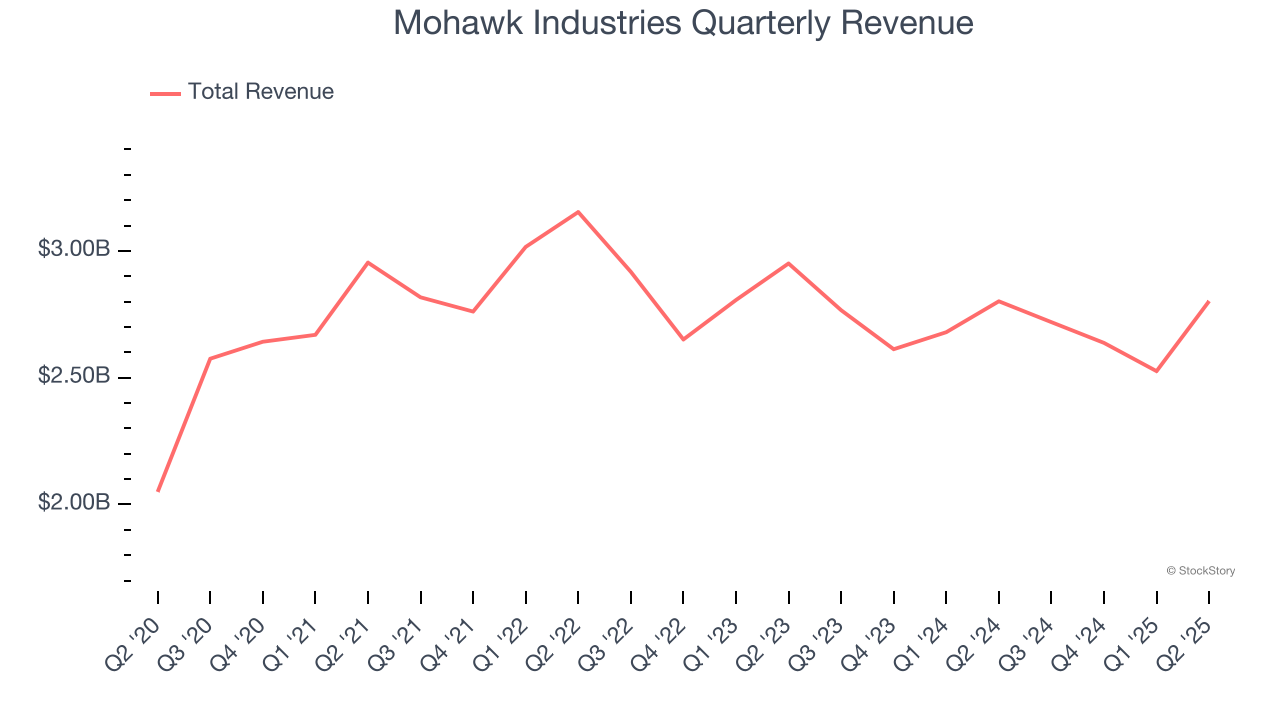

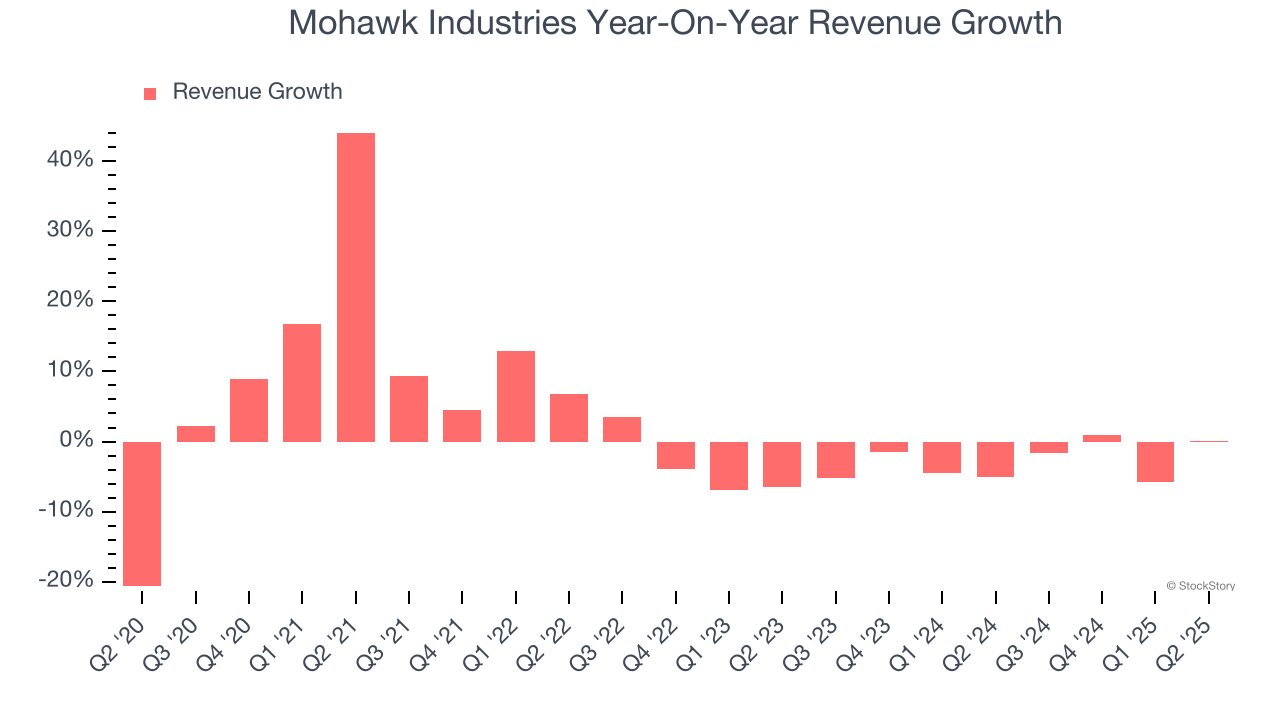

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Unfortunately, Mohawk Industries’s 2.9% annualized revenue growth over the last five years was weak. This was below our standards and is a poor baseline for our analysis.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. Mohawk Industries’s performance shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 2.9% annually.

This quarter, Mohawk Industries’s $2.80 billion of revenue was flat year on year but beat Wall Street’s estimates by 2.2%.

Looking ahead, sell-side analysts expect revenue to grow 1.8% over the next 12 months. Although this projection suggests its newer products and services will catalyze better top-line performance, it is still below the sector average.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

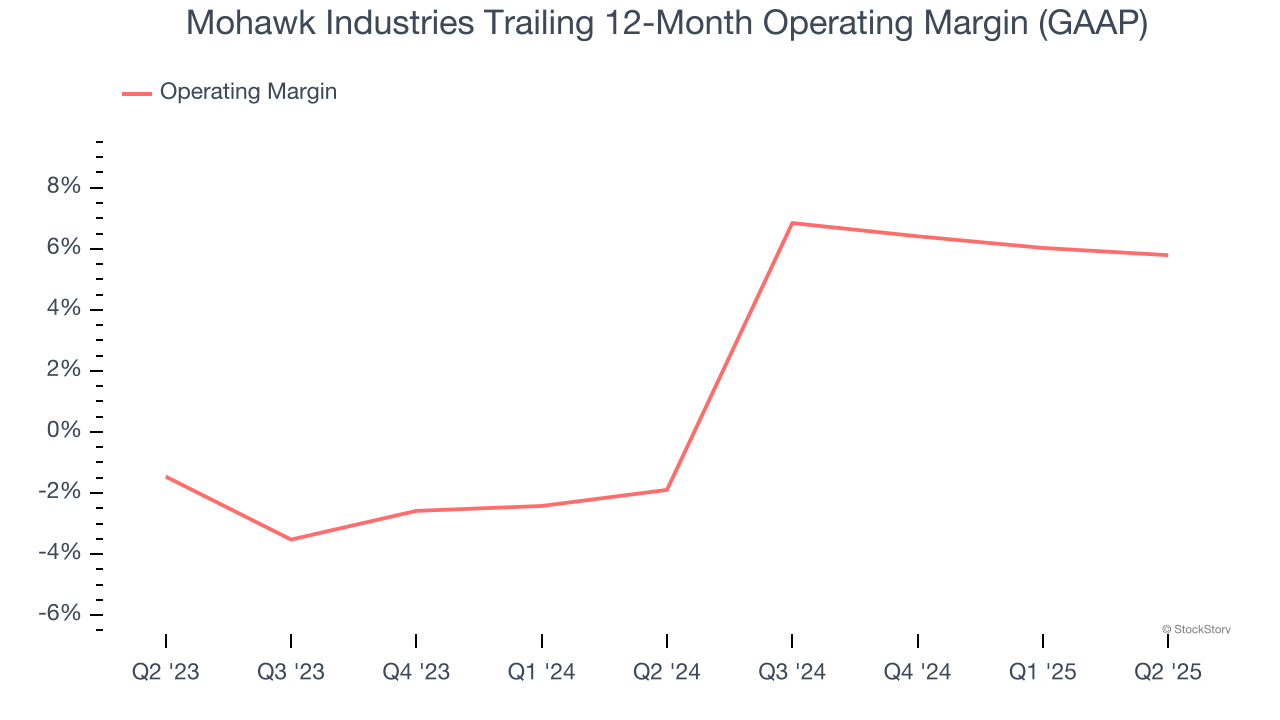

Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Mohawk Industries’s operating margin has been trending up over the last 12 months and averaged 1.9% over the last two years. The company’s higher efficiency is a breath of fresh air, but its suboptimal cost structure means it still sports inadequate profitability for a consumer discretionary business.

In Q2, Mohawk Industries generated an operating margin profit margin of 6.7%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

Earnings Per Share

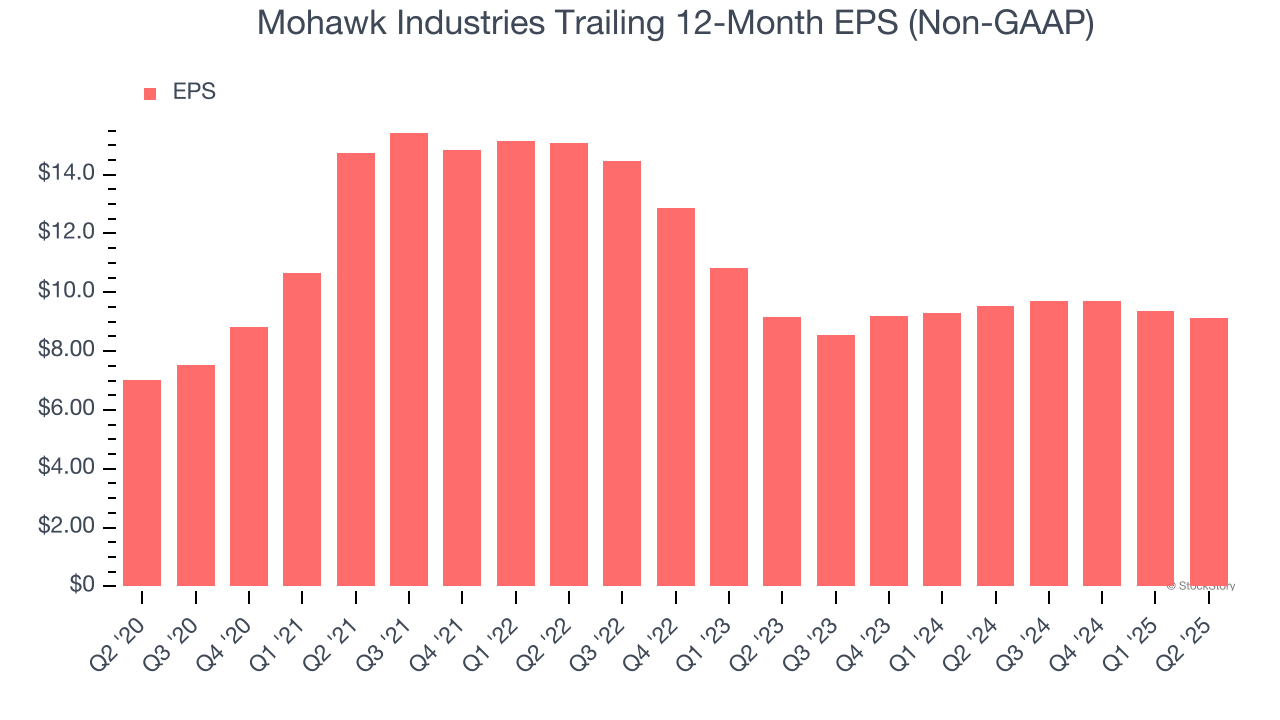

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Mohawk Industries’s EPS grew at an unimpressive 5.4% compounded annual growth rate over the last five years. On the bright side, this performance was better than its 2.9% annualized revenue growth and tells us the company became more profitable on a per-share basis as it expanded.

In Q2, Mohawk Industries reported EPS at $2.77, down from $3 in the same quarter last year. Despite falling year on year, this print beat analysts’ estimates by 6.3%. Over the next 12 months, Wall Street expects Mohawk Industries’s full-year EPS of $9.14 to grow 10%.

Key Takeaways from Mohawk Industries’s Q2 Results

It was encouraging to see Mohawk Industries beat analysts’ revenue expectations this quarter. We were also happy its EPS outperformed Wall Street’s estimates. On the other hand, its EPS guidance for next quarter missed. Zooming out, we think this was a mixed quarter. The stock traded up 3.4% to $120 immediately after reporting.

Big picture, is Mohawk Industries a buy here and now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.