Healthcare services company The Ensign Group (NASDAQ: ENSG). reported revenue ahead of Wall Street’s expectations in Q2 CY2025, with sales up 18.5% year on year to $1.23 billion. The company’s full-year revenue guidance of $5.01 billion at the midpoint came in 1.8% above analysts’ estimates. Its non-GAAP profit of $1.59 per share was 2.6% above analysts’ consensus estimates.

Is now the time to buy The Ensign Group? Find out by accessing our full research report, it’s free.

The Ensign Group (ENSG) Q2 CY2025 Highlights:

- Revenue: $1.23 billion vs analyst estimates of $1.22 billion (18.5% year-on-year growth, 0.7% beat)

- Adjusted EPS: $1.59 vs analyst estimates of $1.55 (2.6% beat)

- Adjusted EBITDA: $146.6 million vs analyst estimates of $140.3 million (11.9% margin, 4.5% beat)

- Adjusted EPS guidance for the full year is $6.40 at the midpoint, beating analyst estimates by 1.5%

- Operating Margin: 8.5%, in line with the same quarter last year

- Sales Volumes fell 18.8% year on year (8.2% in the same quarter last year)

- Market Capitalization: $7.95 billion

“Our local teams achieved another outstanding quarter, raising the bar again for what is possible, even in a quarter where we historically have experienced more seasonality. The clinical results they achieved continue to be the primary driver of our success. As our teams work tirelessly to gain the trust of the communities they serve, our operations continue to earn the reputation as the facility of choice for thousands of patients. This trust is apparent from the strong trends in occupancy and skilled mix, which we believe is only achievable, over time, through consistent quality care and the dedication of amazing local leaders,” said Barry Port, Ensign’s Chief Executive Officer.

Company Overview

Founded in 1999 and named after a naval term for a flag-bearing ship, The Ensign Group (NASDAQ: ENSG) operates skilled nursing facilities, senior living communities, and rehabilitation services across 15 states, primarily serving high-acuity patients recovering from various medical conditions.

Revenue Growth

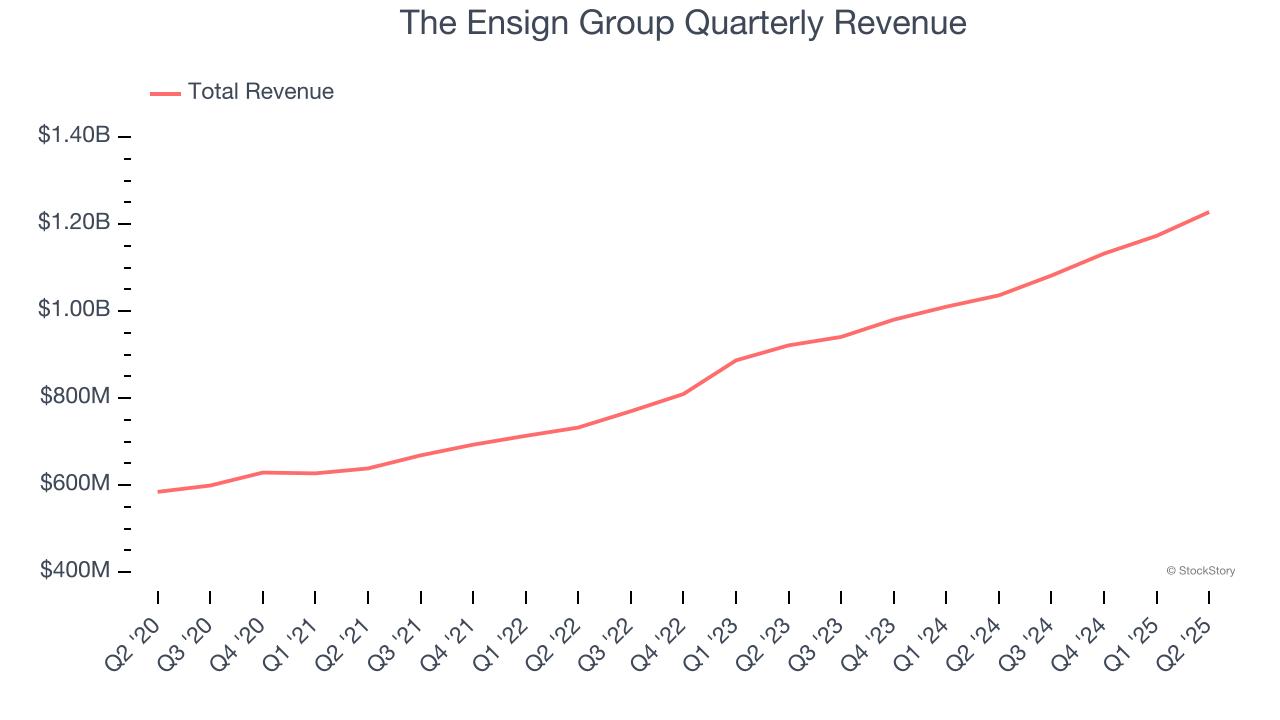

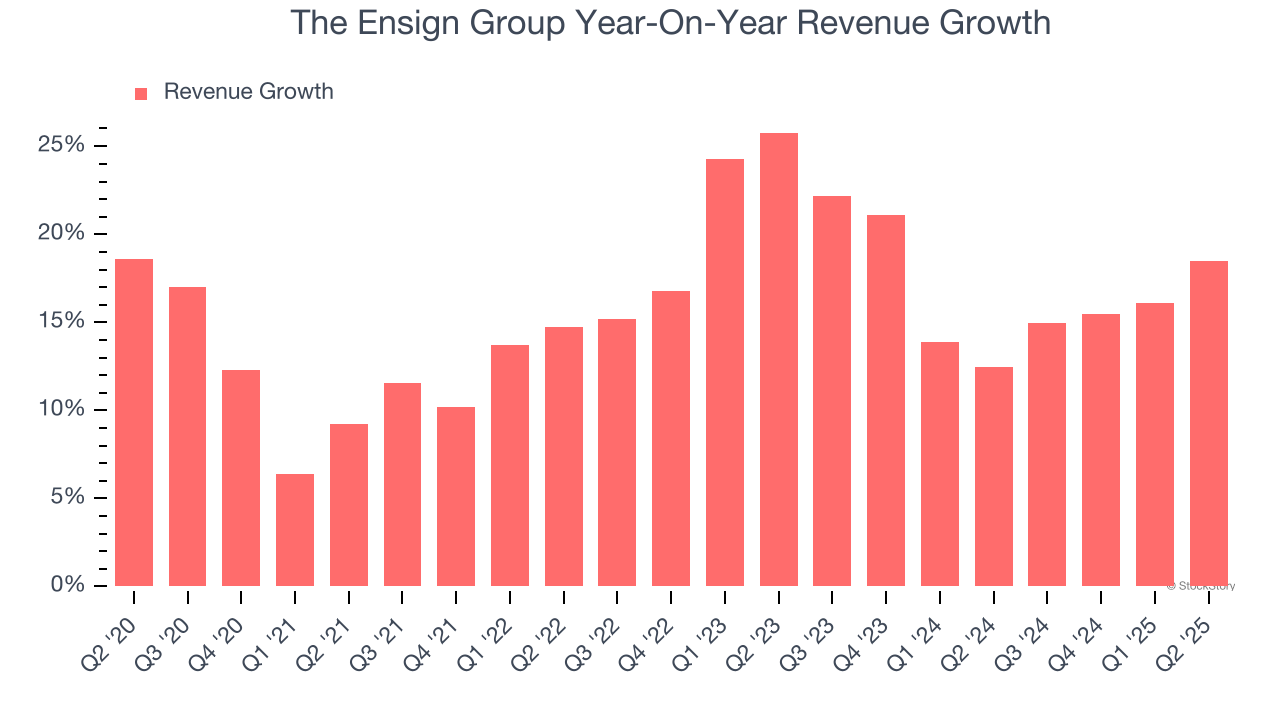

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last five years, The Ensign Group grew its sales at a solid 15.5% compounded annual growth rate. Its growth beat the average healthcare company and shows its offerings resonate with customers, a helpful starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within healthcare, a half-decade historical view may miss recent innovations or disruptive industry trends. The Ensign Group’s annualized revenue growth of 16.7% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated.

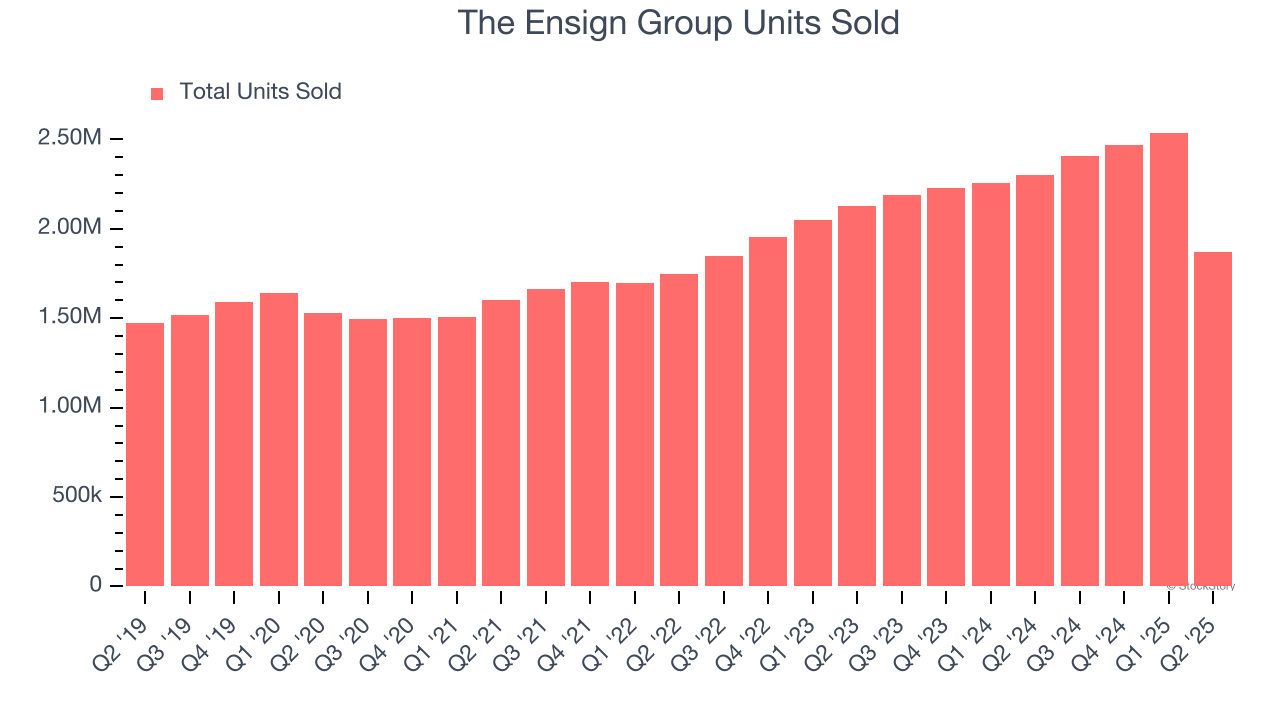

We can better understand the company’s revenue dynamics by analyzing its number of units sold, which reached 1.87 million in the latest quarter. Over the last two years, The Ensign Group’s units sold averaged 8.2% year-on-year growth. Because this number is lower than its revenue growth, we can see the company benefited from price increases.

This quarter, The Ensign Group reported year-on-year revenue growth of 18.5%, and its $1.23 billion of revenue exceeded Wall Street’s estimates by 0.7%.

Looking ahead, sell-side analysts expect revenue to grow 12% over the next 12 months, a deceleration versus the last two years. Despite the slowdown, this projection is noteworthy and suggests the market is forecasting success for its products and services.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Operating Margin

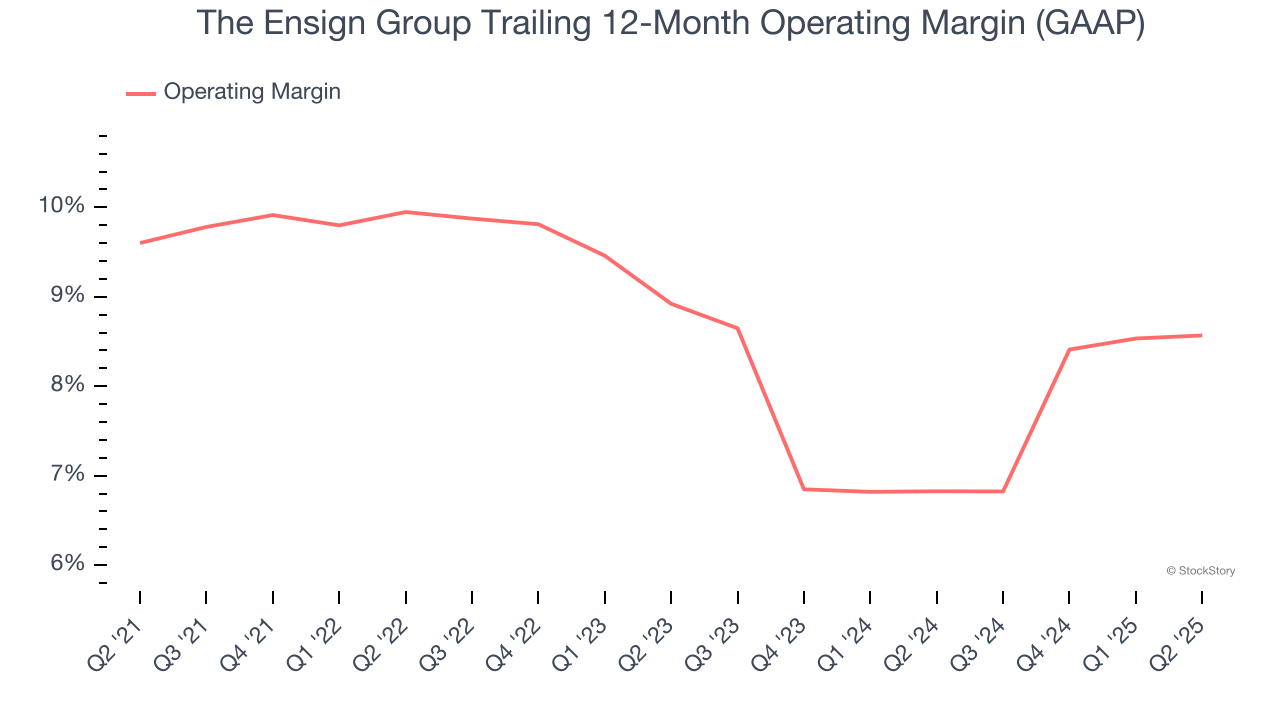

The Ensign Group was profitable over the last five years but held back by its large cost base. Its average operating margin of 8.6% was weak for a healthcare business.

Looking at the trend in its profitability, The Ensign Group’s operating margin decreased by 1 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. The Ensign Group’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers.

This quarter, The Ensign Group generated an operating margin profit margin of 8.5%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

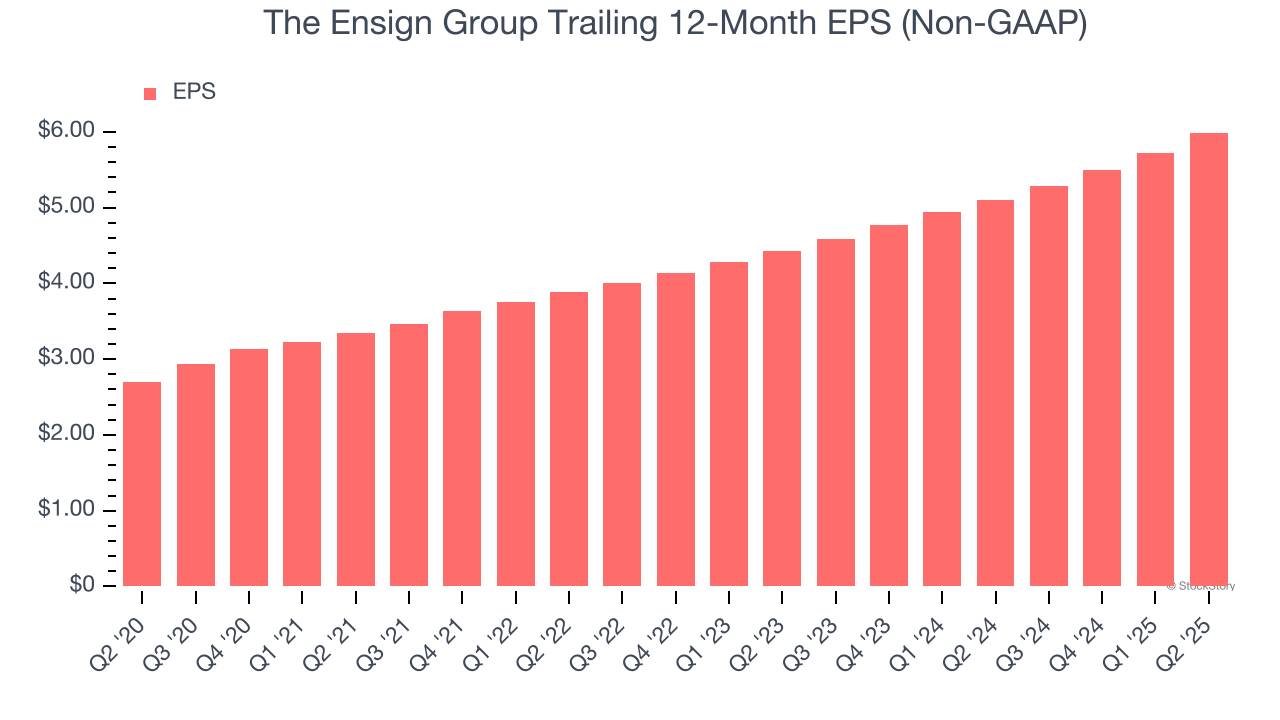

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

The Ensign Group’s astounding 17.3% annual EPS growth over the last five years aligns with its revenue performance. This tells us it maintained its per-share profitability as it expanded.

In Q2, The Ensign Group reported EPS at $1.59, up from $1.32 in the same quarter last year. This print beat analysts’ estimates by 2.6%. Over the next 12 months, Wall Street expects The Ensign Group’s full-year EPS of $5.99 to grow 10.6%.

Key Takeaways from The Ensign Group’s Q2 Results

Revenue and EPS both beat, which is always a good start. Looking ahead, it was also great to see The Ensign Group’s full-year revenue and EPS guidance both top analysts’ expectations. On the other hand, its sales volume missed. Zooming out, we still think this was a very solid quarter. The stock traded up 5.8% to $145.95 immediately following the results.

So do we think The Ensign Group is an attractive buy at the current price? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.