Let’s dig into the relative performance of Goodyear (NASDAQ: GT) and its peers as we unravel the now-completed Q3 automobile manufacturing earnings season.

Much capital investment and technical know-how are needed to manufacture functional, safe, and aesthetically pleasing automobiles for the mass market. Barriers to entry are therefore high, and auto manufacturers with economies of scale can boast strong economic moats. However, this doesn’t insulate them from new entrants, as electric vehicles (EVs) have entered the market and are upending it. This has forced established manufacturers to not only contend with emerging EV-first competitors but also decide how much they want to invest in these disruptive technologies, which will likely cannibalize their legacy offerings.

The 11 automobile manufacturing stocks we track reported a strong Q3. As a group, revenues beat analysts’ consensus estimates by 4.7%.

Thankfully, share prices of the companies have been resilient as they are up 7.9% on average since the latest earnings results.

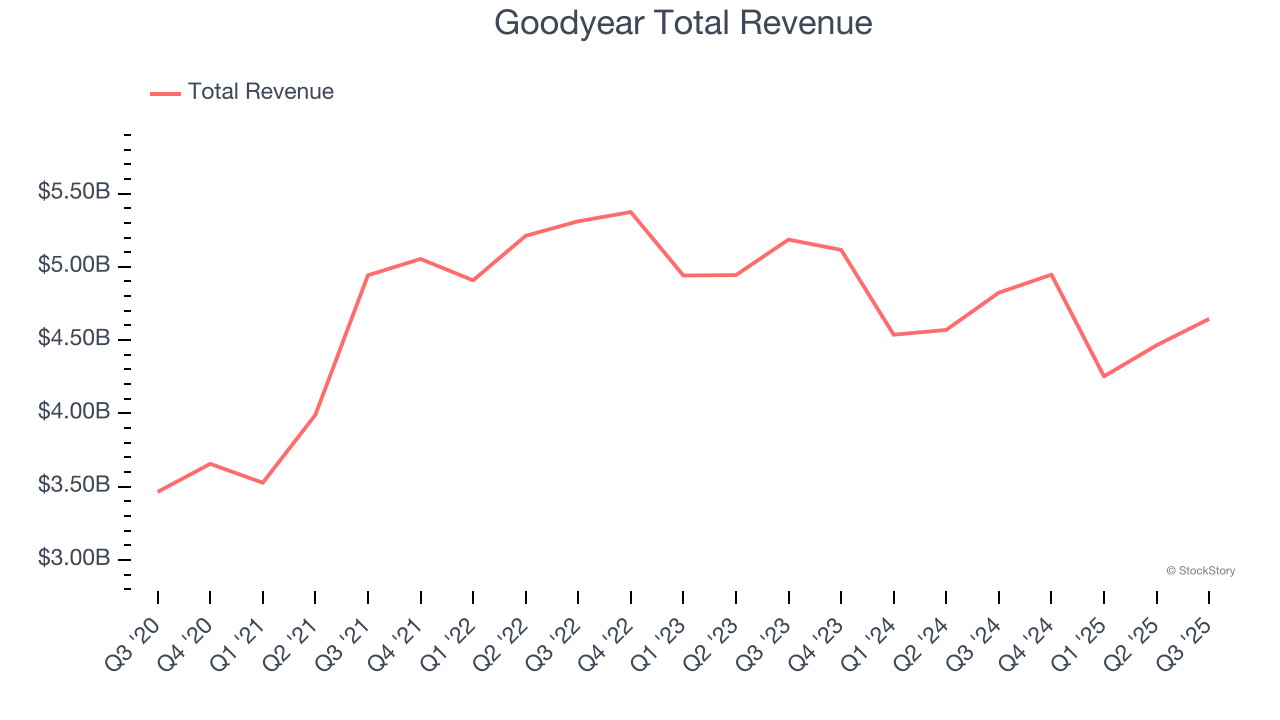

Goodyear (NASDAQ: GT)

With its iconic blimp floating above major sporting events since 1925, Goodyear (NYSE: GT) is one of the world's largest tire manufacturers, producing and selling tires for automobiles, trucks, aircraft, and other vehicles, along with related services.

Goodyear reported revenues of $4.65 billion, down 3.7% year on year. This print fell short of analysts’ expectations by 0.7%, but it was still a satisfactory quarter for the company with a beat of analysts’ EPS estimates but a significant miss of analysts’ adjusted operating income estimates.

"We delivered a meaningful increase in segment operating income relative to the second quarter in an industry environment that continued to be marked by global trade disruption," said Mark Stewart, chief executive officer and president.

Interestingly, the stock is up 32.4% since reporting and currently trades at $9.16.

Is now the time to buy Goodyear? Access our full analysis of the earnings results here, it’s free.

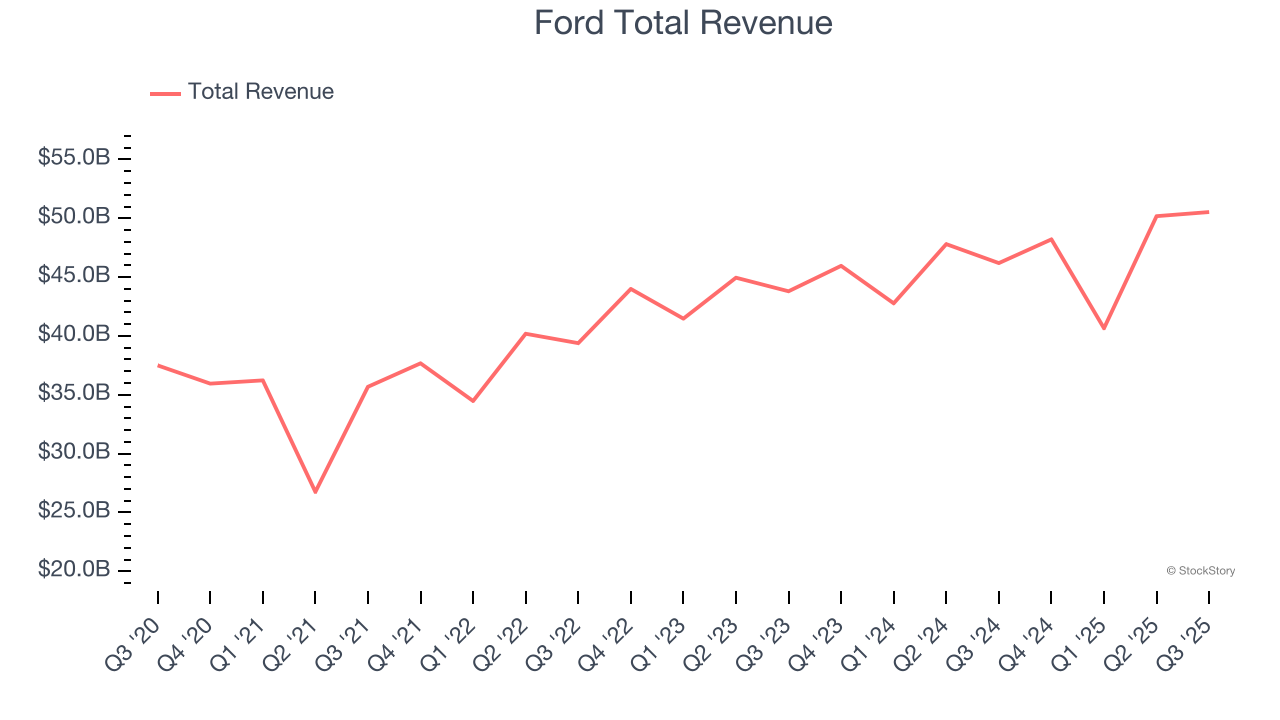

Best Q3: Ford (NYSE: F)

Established to make automobiles accessible to a broader segment of the population, Ford (NYSE: F) designs, manufactures, and sells a variety of automobiles, trucks, and electric vehicles.

Ford reported revenues of $50.53 billion, up 9.4% year on year, outperforming analysts’ expectations by 9.1%. The business had an incredible quarter with a beat of analysts’ EPS estimates and an impressive beat of analysts’ EBITDA estimates.

The market seems happy with the results as the stock is up 13.7% since reporting. It currently trades at $14.02.

Is now the time to buy Ford? Access our full analysis of the earnings results here, it’s free.

Lucid (NASDAQ: LCID)

Founded by a former Tesla Vice President, Lucid Group (NASDAQ: LCID) designs, manufactures, and sells luxury electric vehicles with long-range capabilities.

Lucid reported revenues of $336.6 million, up 68.3% year on year, falling short of analysts’ expectations by 3.2%. It was a disappointing quarter as it posted a significant miss of analysts’ revenue estimates and a significant miss of analysts’ adjusted operating income estimates.

As expected, the stock is down 34.7% since the results and currently trades at $11.27.

Read our full analysis of Lucid’s results here.

Rivian (NASDAQ: RIVN)

The manufacturer of Amazon’s delivery trucks, Rivian (NASDAQ: RIVN) designs, manufactures, and sells electric vehicles and commercial delivery vans.

Rivian reported revenues of $1.56 billion, up 78.3% year on year. This number beat analysts’ expectations by 4.9%. It was a strong quarter as it also put up an impressive beat of analysts’ adjusted operating income estimates and a solid beat of analysts’ revenue estimates.

Rivian pulled off the fastest revenue growth among its peers. The stock is up 52.2% since reporting and currently trades at $19.11.

Read our full, actionable report on Rivian here, it’s free.

Autoliv (NYSE: ALV)

With products estimated to save over 30,000 lives annually in traffic accidents worldwide, Autoliv (NYSE: ALV) develops and manufactures passive safety systems for vehicles, including airbags, seatbelts, and steering wheels that protect occupants during crashes.

Autoliv reported revenues of $2.71 billion, up 5.9% year on year. This print surpassed analysts’ expectations by 1%. Overall, it was an exceptional quarter as it also logged an impressive beat of analysts’ adjusted operating income estimates and a solid beat of analysts’ EBITDA estimates.

The stock is up 4.8% since reporting and currently trades at $126.91.

Read our full, actionable report on Autoliv here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Hidden Gem Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.