Biotech company Vertex Pharmaceuticals (NASDAQ: VRTX) reported revenue ahead of Wall Street’s expectations in Q2 CY2025, with sales up 12.1% year on year to $2.96 billion. The company expects the full year’s revenue to be around $11.93 billion, close to analysts’ estimates. Its non-GAAP profit of $4.52 per share was 6.3% above analysts’ consensus estimates.

Is now the time to buy Vertex Pharmaceuticals? Find out by accessing our full research report, it’s free.

Vertex Pharmaceuticals (VRTX) Q2 CY2025 Highlights:

- "Based on these results [from Phase 2 trials], Vertex will not further advance VX-993 as monotherapy in acute pain."

- Revenue: $2.96 billion vs analyst estimates of $2.90 billion (12.1% year-on-year growth, 2.1% beat)

- Adjusted EPS: $4.52 vs analyst estimates of $4.25 (6.3% beat)

- Adjusted Operating Income: $1.33 billion vs analyst estimates of $1.29 billion (44.7% margin, 2.7% beat)

- The company slightly lifted its revenue guidance for the full year to $11.93 billion at the midpoint from $11.88 billion

- Operating Margin: 38.8%, up from -133% in the same quarter last year

- Market Capitalization: $118.7 billion

“Vertex delivered a strong quarter of revenue growth with each of our three product launches — ALYFTREK, JOURNAVX, and CASGEVY — contributing, as well as continued advancement of our clinical programs,” said Reshma Kewalramani, M.D., Chief Executive Officer and President of Vertex.

Company Overview

Founded in 1989 with a mission to create medicines that treat the underlying causes of disease rather than just symptoms, Vertex Pharmaceuticals (NASDAQ: VRTX) develops and markets transformative medicines for serious diseases, with a focus on cystic fibrosis, sickle cell disease, and pain management.

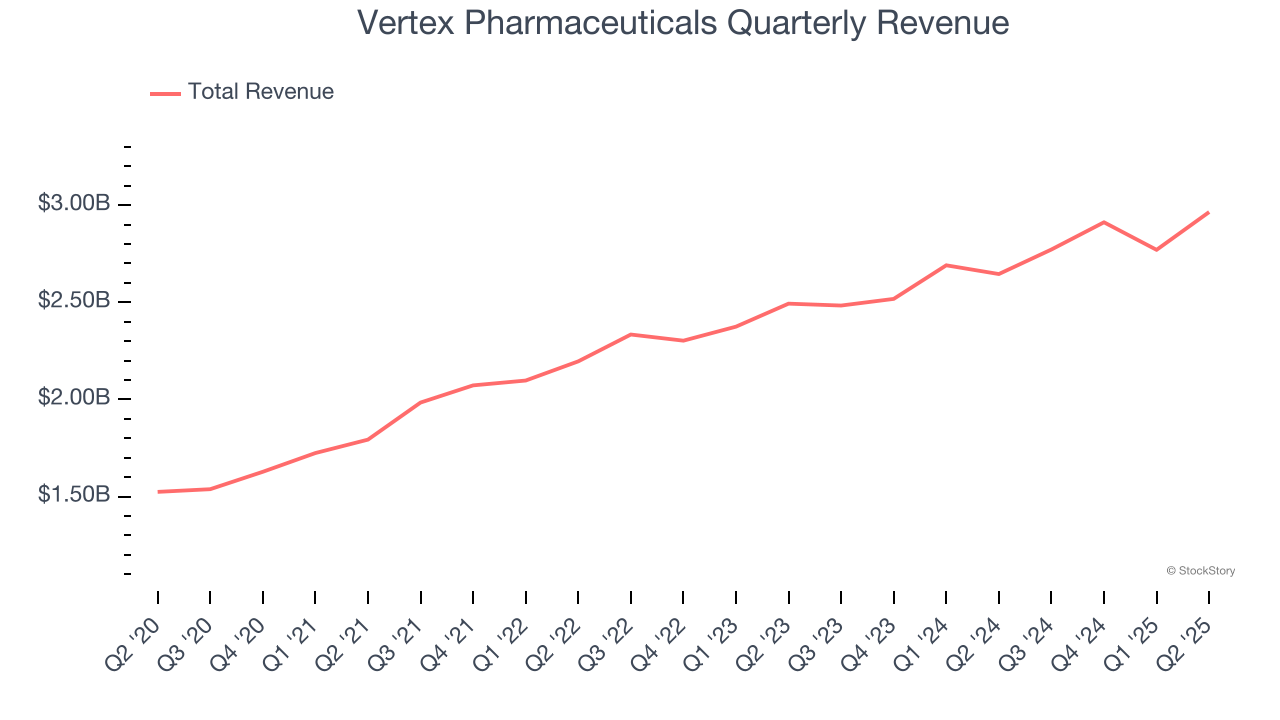

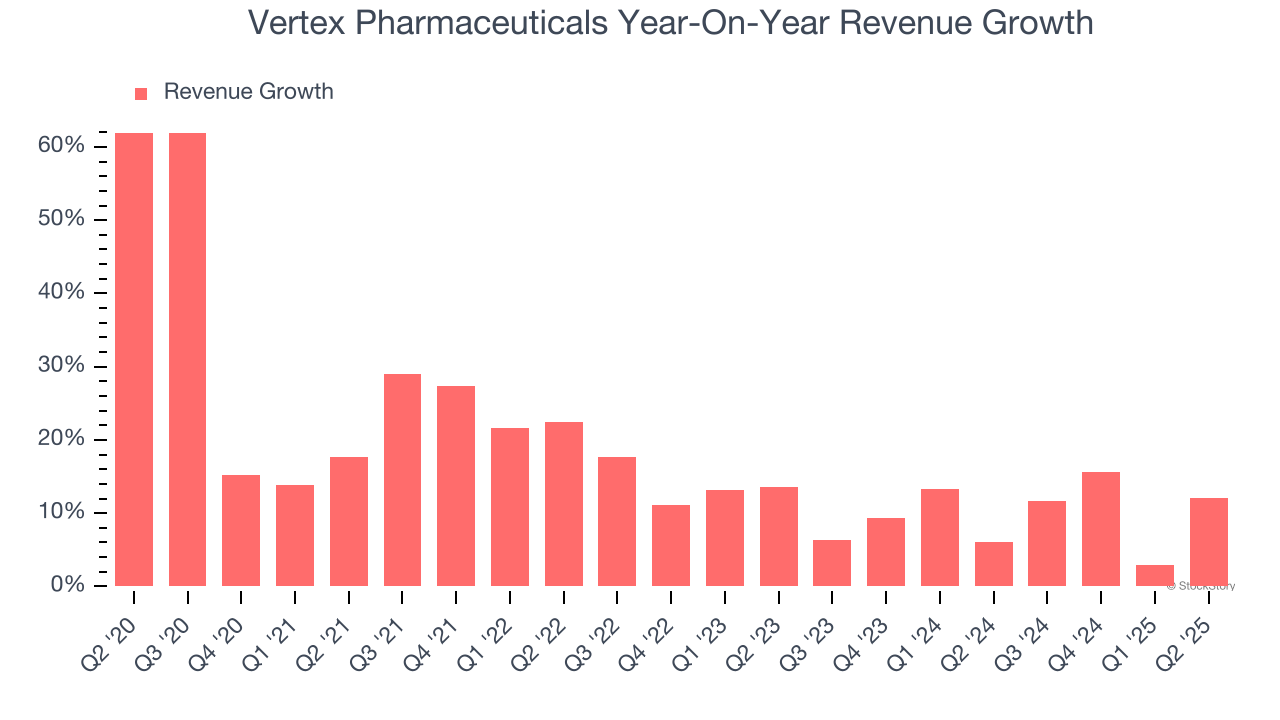

Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Thankfully, Vertex Pharmaceuticals’s 16.1% annualized revenue growth over the last five years was solid. Its growth beat the average healthcare company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within healthcare, a half-decade historical view may miss recent innovations or disruptive industry trends. Vertex Pharmaceuticals’s annualized revenue growth of 9.6% over the last two years is below its five-year trend, but we still think the results were respectable.

This quarter, Vertex Pharmaceuticals reported year-on-year revenue growth of 12.1%, and its $2.96 billion of revenue exceeded Wall Street’s estimates by 2.1%.

Looking ahead, sell-side analysts expect revenue to grow 10% over the next 12 months, similar to its two-year rate. This projection is particularly noteworthy for a company of its scale and indicates the market sees success for its products and services.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

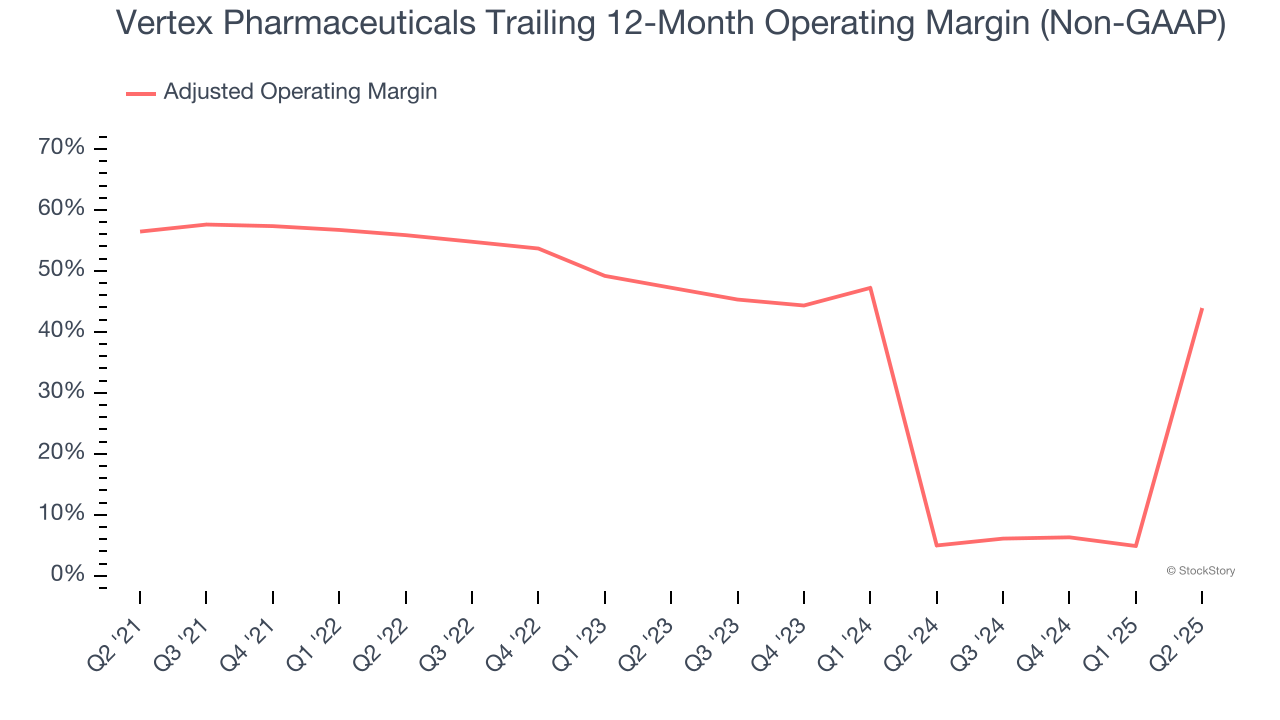

Adjusted Operating Margin

Vertex Pharmaceuticals has been a well-oiled machine over the last five years. It demonstrated elite profitability for a healthcare business, boasting an average adjusted operating margin of 39.9%.

Looking at the trend in its profitability, Vertex Pharmaceuticals’s adjusted operating margin decreased by 12.5 percentage points over the last five years. The company’s two-year trajectory also shows it failed to get its profitability back to the peak as its margin fell by 3.3 percentage points. This performance was poor no matter how you look at it - it shows its expenses were rising and it couldn’t pass those costs onto its customers.

In Q2, Vertex Pharmaceuticals generated an adjusted operating margin profit margin of 44.7%, up 163.6 percentage points year on year. This increase was a welcome development and shows it was more efficient.

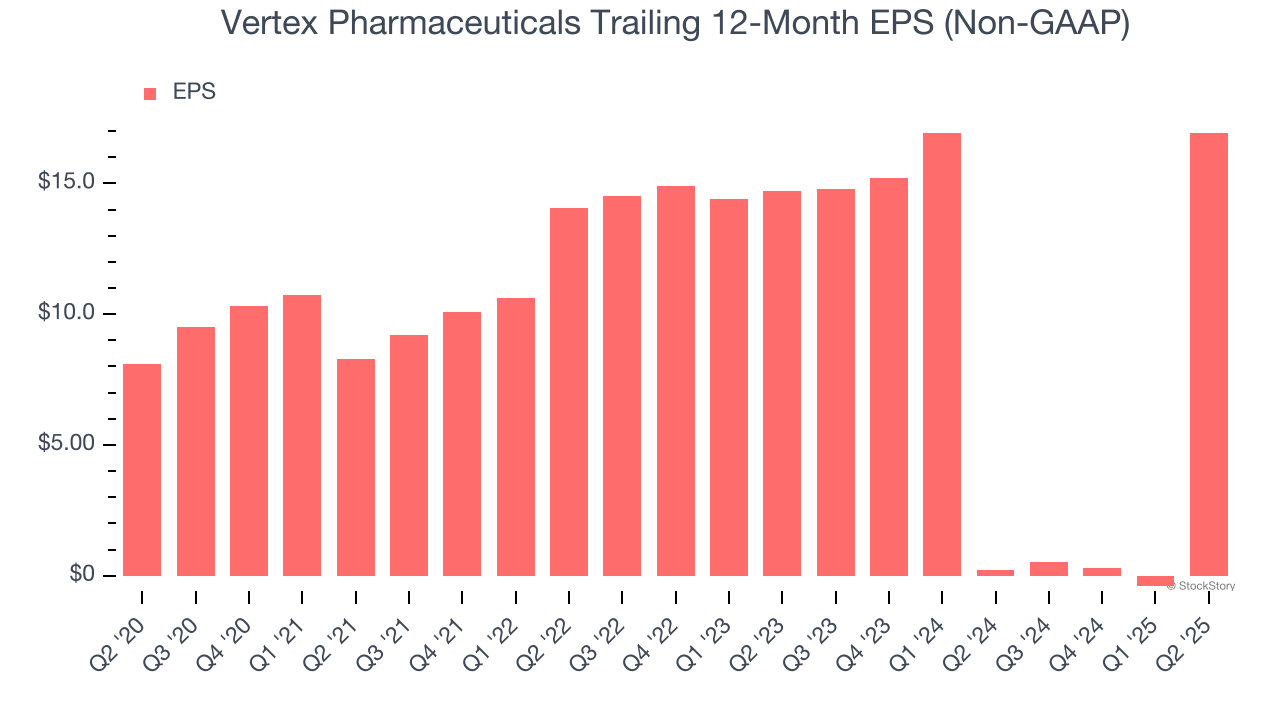

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Vertex Pharmaceuticals’s astounding 15.9% annual EPS growth over the last five years aligns with its revenue performance. This tells us it maintained its per-share profitability as it expanded.

In Q2, Vertex Pharmaceuticals reported adjusted EPS at $4.52, up from negative $12.83 in the same quarter last year. This print beat analysts’ estimates by 6.3%. Over the next 12 months, Wall Street expects Vertex Pharmaceuticals’s full-year EPS of $16.94 to grow 15.7%.

Key Takeaways from Vertex Pharmaceuticals’s Q2 Results

The focus this quarter was the fact that Vertex will not further advance its VX-993 monotherapy for acute pain, and this weighed on the stock. As for the quarter's financials themselves, it was encouraging to see Vertex Pharmaceuticals beat analysts’ revenue expectations this quarter. We were also happy its EPS outperformed Wall Street’s estimates. Overall, this print had some key positives. Due to the VX-993 news, the stock traded down 13.5% to $407 immediately following the results.

Should you buy the stock or not? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.