As OpenAI's ChatGPT took the world by storm, just about three years ago, “experts” on Wall Street sounded the death knell for Alphabet's Google (GOOG) (GOOGL). However, not only has the company's stock tripled since then, but with the release of Gemini 3.0, Google's own generative AI chatbot now occupies the apex position among LLMs worldwide.

Not only that, the operator of crucial consumer and enterprise businesses, such as YouTube and Google Cloud, received an endorsement from the most famous investor in the world recently. Warren Buffett's Berkshire Hathaway (BRK.A) (BRK.B) picked up GOOGL stock worth $4.3 billion, marking the first meaningful investment in the tech sector from the “Oracle of Omaha” in several years.

Consequently, skeptics on Wall Street are also turning believers after leading broker Loop Capital upgraded the stock to a “Buy” from “Hold,” raising its price target of the California-based company to $320 from $260. Opining that the “wall of worry [has been] obliterated under waves of AI enthusiasm,” the firm's bullish note on the company further stated that “the sustainability of search revenue growth under AI cannibalization and transition risk is no longer a concern shared by investors.”

Shares of Google parent Alphabet are already up 57% on a YTD basis. However, amid all this optimism, will taking a bet on the $3.4 trillion market cap company be fruitful at this juncture, as valuation fears abound? Let's find out.

Financials As Robust As Its Products

Google's relevance and criticality in the global tech space warrant scant delving into. From the aforementioned YouTube to its major presence in cloud services with Google Cloud to its dominance in the Search market, which has almost seamlessly led to a now leadership position in the domain of LLMs. Further, with close to 4 billion active devices operating on its Android OS, Google stands tall as a major player in both the consumer and enterprise spaces.

However, Google's financials tell an equally compelling story and reflect its tech dominance. For the last two years, the company's quarterly earnings have surpassed Street expectations consecutively. Over the longer period of 10 years, Google has grown its revenue and earnings at impressive CAGRs of 18.31% and 23.43%, respectively.

Notably, the results for the most recent quarter saw the company reporting beats on both the revenue and earnings fronts. Revenues for Q3 2025 came in at $102.3 billion, up 16% from the previous year, after Services revenue of $87.1 billion and Cloud revenues of $15.2 billion represented year-over-year (YoY) growth rates of 14% and 34%, respectively. Earnings per share (EPS) rose by 35.4% yearly to $2.87, coming in much ahead of the consensus estimate of $2.26.

The core Search segment saw its revenues rise by 14.5% from the prior year to $56.6 billion.

Meanwhile, the company remains a cash-generating monster. Net cash from operating activities jumped to $48.4 billion in Q3 2025 from $30.7 billion in the year-ago period as the company exited the quarter with a cash pile of $23.1 billion with no short-term debt on its books.

However, just like its other tech peers, Alphabet's stock is trading at punchy valuations. Its forward P/E, P/S, and P/CF of 27.20, 8.60, and 21.80 are all considerably higher than the sector medians of 14.96, 1.19, and 7.27, respectively. Thus, value-conscious investors may find it difficult to add Alphabet to their portfolios due to these elevated valuations and a perceived lack of margin of safety.

Alphabet's Strong Growth Drivers

Yet, Buffett's sizable investment in the company may allay the fears of at least some of these investors, as the revered elder of value investing sees value in the company. Moreover, analysts have earmarked revenue and earnings growth rates for Alphabet that are ahead of the industry. While the forward revenue growth rate of 13.81% is much more than the sector median of 3.47%, forward EPS growth at 24.20% trumps the industry average of 13.52%.

So, what is exciting analysts about the company's growth prospects?

Well, the company's AI capex is expected to be one of the fundamental drivers of this growth. Touted to be between $91 billion and $93 billion in 2025, and with executives declaring that it will be even more in 2026, it can be safely said that AI will be at the front and center of all of Alphabet's growth aspirations. And it has been paying off.

For instance, the AI mode and AI overview have allowed the company to redefine its Search business, which was supposed to lose users with the advent of generative AI. Further, AI capex has also helped Google Cloud increase its share of the global cloud infrastructure market from about 10% in early 2023 to roughly 11–13% by 2024–2025, while AWS’s share has edged down from roughly 32% to around 29–31% over the same period

Again, Google's own chatbot Gemini now has more than 650 million monthly active users, which may be lower than ChatGPT's 700 million weekly active users, but it is certainly higher than the 400 million monthly active users that CEO Sundar Pichai revealed earlier this year. Additionally, with 300 million paid users across its entire ecosystem (including Google One, YouTube Premium, and YouTube Music) as of October 2025, Google is deriving substantial and stable revenue from its subscription and services businesses underpinned by AI. Lastly, with the launch of Gemini 3.0, this is only going to increase.

To maintain its edge in AI, Google employs a concentration of leading researchers, one of the highest among global technology firms, complemented by an engineering workforce that ranks among the largest worldwide. This depth of expertise supports ongoing advances in foundational models, consumer and enterprise applications, and specialized hardware. The evidence of its effectiveness appears in Google's cadence of nine services, each surpassing one billion users, the broadest reach of any company. For instance, the Veo 3 video-generation tool has already produced more than 230 million clips, while Gemini Enterprise, introduced only weeks ago, has attracted over two million paid seats. Reflecting this momentum, revenue tied to Google's AI-centric products rose, exceeding 200% YoY during the third quarter.

A Growing Hardware Portfolio

The company has also committed substantial resources to physical infrastructure. Beyond procuring Nvidia GPUs at scale, Google continues to expand its owned data center footprint to accommodate them. Equally important is its long-standing program to design bespoke AI accelerators, Tensor Processing Units (TPUs), which are deployed exclusively within its own cloud and research environments. By controlling chip development in-house, Google can potentially secure meaningful unit-cost advantages relative to competitors still reliant on third-party silicon, strengthening its economic moat as AI training and inference expenditures escalate.

In autonomous mobility, Waymo continues to operate from a position of strength. The subsidiary now provides fully driverless commercial ride-hailing to the public across five major U.S. metropolitan areas, including Los Angeles and Austin, with Miami entering active testing. As of mid-November 2025, the operational fleet stands at roughly 2,500 vehicles, and management has outlined plans to roughly double the number of served cities while preparing initial forays into international hubs such as London and Tokyo.

To improve reliability and reduce per-mile costs, Waymo is rolling out its sixth-generation sensor and compute suite, engineered for superior performance in challenging conditions, including rain, fog, and snow. This hardware is being paired with a new purpose-built robotaxi platform developed alongside China's Geely (GELHY), the Zeekr vehicle, which is expected to gradually supplant or augment the existing Jaguar I-PACE-based fleet and deliver further economies at scale.

Analyst Opinion on GOOGL Stock

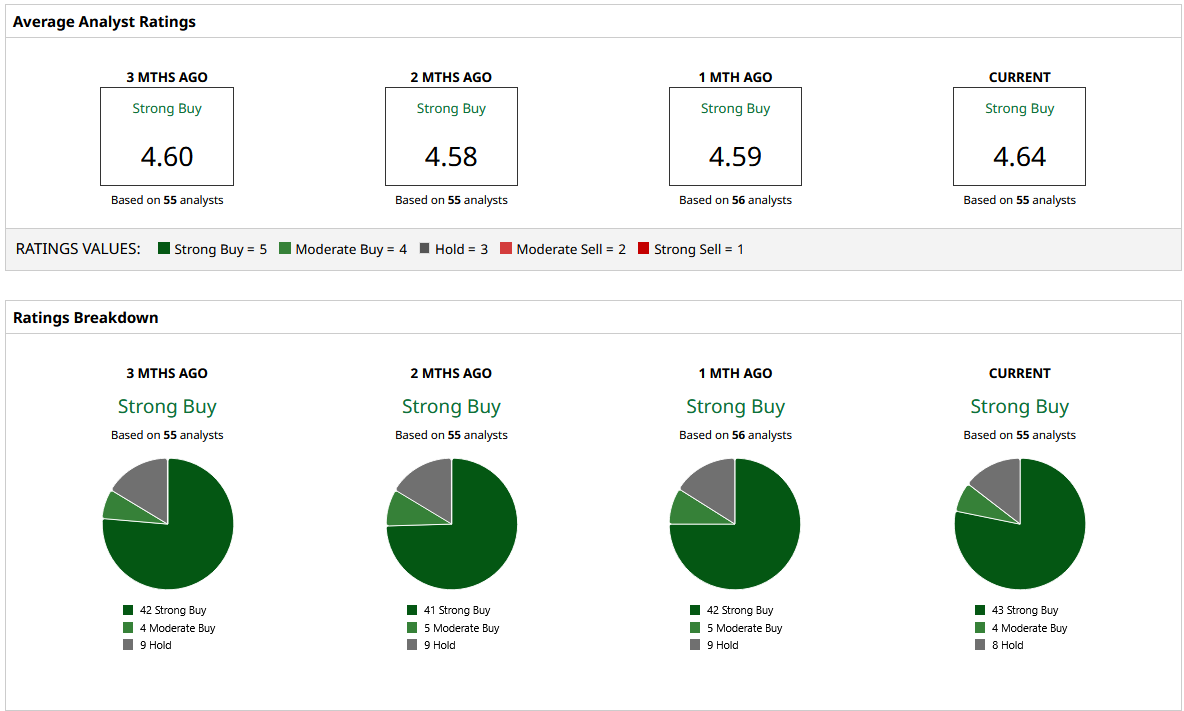

Taking all of this into account, analysts have attributed a rating of “Strong Buy” to the GOOGL stock, with a mean target price of $315. This indicates an upside potential of about 5% from current levels. Out of 55 analysts covering the stock, 43 have a “Strong Buy” rating, four have a “Moderate Buy” rating, and eight have a “Hold” rating.

On the date of publication, Pathikrit Bose did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Large, Unusual Call Options Trading in GOOGL Stock Highlights Its Value

- CoreWeave Plunges 50% in a Single Month. Is This a Red Flag for CRWV Stock or a Dip Worth Buying?

- David Tepper Is Betting Big on This High-Yield Dividend Stock. Should You?

- As Musk Hints That Tesla Could Make Its Own AI Chips, Should You Buy TSLA Stock?