AT&T Inc. (T), valued at $174.8 billion by market cap, is a major American multinational telecommunications and technology services company headquartered in Dallas, Texas. AT&T offers wireless voice and data services, fiber and broadband internet, fixed wireless and managed connectivity solutions, and related equipment, including handsets and network devices, through its Communications segment, and also serves customers in Latin America with wireless services. It ranks among the world’s largest telecom providers and is a leading U.S. wireless carrier and broadband services operator.

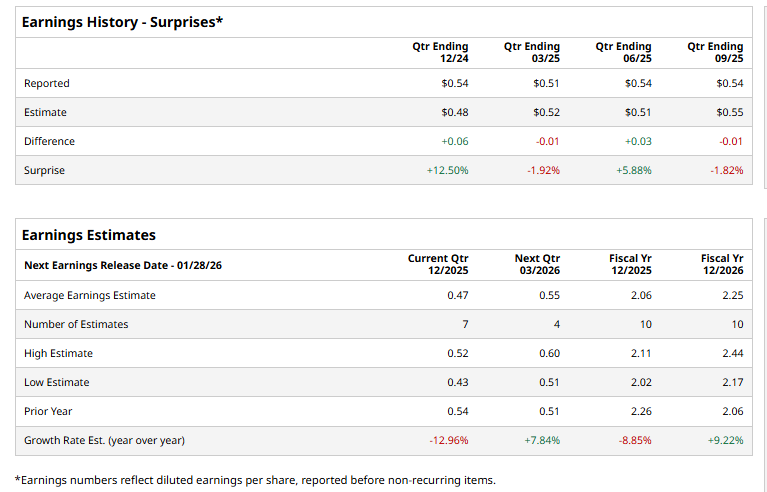

The telecom giant is expected to announce its fiscal fourth-quarter earnings soon. Ahead of the event, analysts expect T to report a profit of $0.47 per share on a diluted basis, down 13% from $0.54 per share in the year-ago quarter. While the company beat the consensus estimates in two of the last four quarters, it missed the forecast on two other occasions.

For the current year, analysts expect T to report EPS of $2.06, down 8.9% from $2.26 in fiscal 2024. However, its EPS is expected to rise 9.2% annually to $2.25 in fiscal 2026.

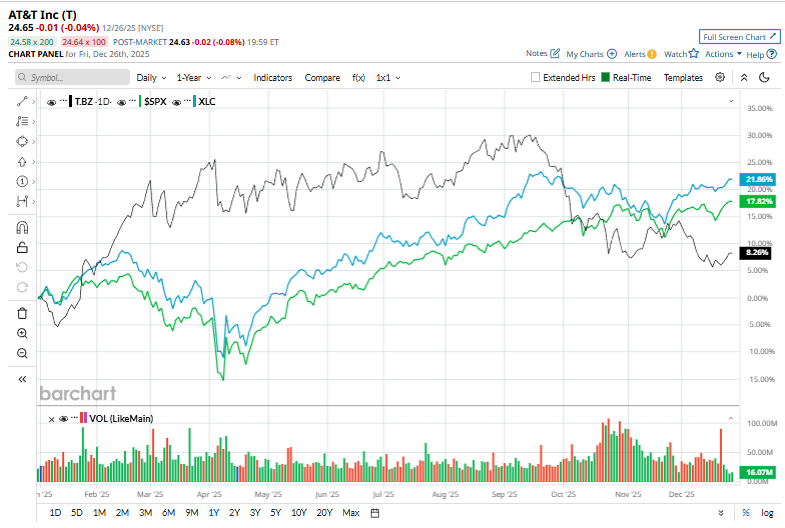

T shares have climbed 7.4% over the past year, trailing the S&P 500 Index’s ($SPX) 14.8% gains and the Communication Services Select Sector SPDR ETF’s (XLC) 19.1% uptick over the same time frame.

Over the past year, AT&T’s shares have lagged the broader market as the company continues to grapple with structural headwinds, notably a sustained five-year revenue decline averaging 5.6% annually and forecasts for modest compression in free cash flow margins. Although return on invested capital has shown steady improvement, suggesting recent investments are beginning to deliver returns, this progress has not been sufficient to offset concerns around weak underlying growth and overall business quality.

On the bright side, JPMorgan Chase & Co. (JPM) recently named AT&T the sole telecommunications stock on its 2026 list of 47 Top Picks, assigning it an “Overweight” rating and a $33 price target, implying roughly 35% upside. The stock offers a forward dividend yield of about 4.5%, with its consistent and relatively high dividend payout standing out as a key attraction for income-focused investors despite recent share price volatility.

Analysts’ consensus opinion on T stock is reasonably bullish, with a “Moderate Buy” rating overall. Out of 28 analysts covering the stock, 15 advise a “Strong Buy” rating, three suggest a “Moderate Buy,” and ten give a “Hold.” The average analyst price target is $29.68, indicating a potential upside of 20.4% from the current levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart