Intel (INTC) ended 2025 as a different company than how it entered the year. Last year marked a company undergoing significant transformation with a renewed focus on artificial intelligence (AI). Intel might still be in the early stages of this turnaround. But its fourth-quarter results showed a firm that has a clear roadmap, financial discipline, and growing ambitions across the AI compute stack. In fact, Intel’s Q4 revealed a problem that long-term investors might love.

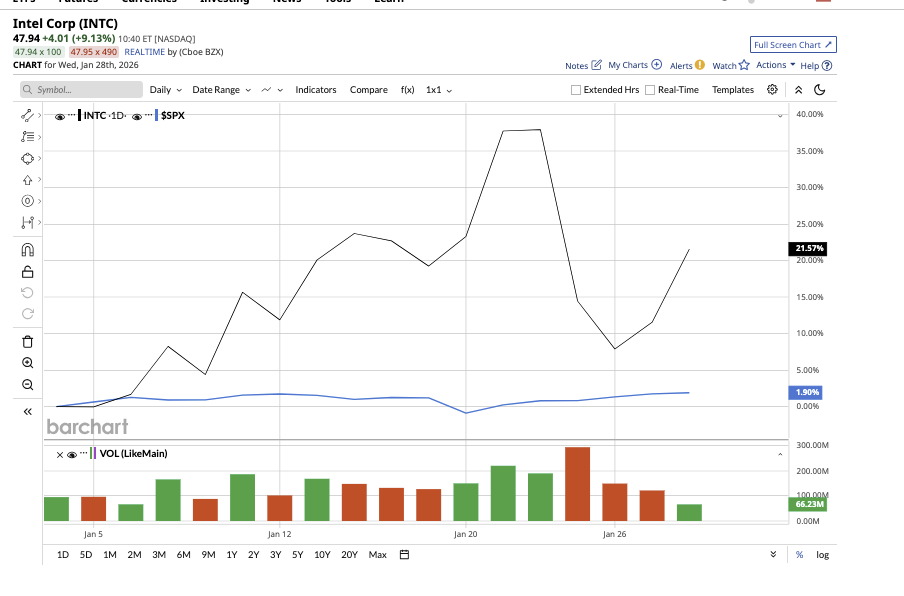

Intel stock is up 30% so far this year, and analysts predict even more upside from current levels. Should long-term investors grab INTC stock now?

Q4 Results Showed a Company Under Transition

In the fourth quarter, revenue of $13.7 billion fell 4% year-over-year (YOY), but full-year revenue of $52.9 billion remained flat YOY. Earnings for the quarter increased by 15% to $0.15. For the full year, the company reported a profit of $0.42 per share compared to a loss of $0.13 in 2024. Both revenue and earnings in the quarter surpassed consensus estimates. Intel Foundry remained unprofitable, posting a $2.5 billion operating loss in Q4, owing mainly to the early ramp of Intel 18A. However, strategic progress was significant as Intel 14A development remains on track with customer engagements already underway. Management anticipates clients to make “firm supplier decisions” in the second half of 2026 and early 2027.

In the Client Computing Group, Intel strengthened its position with the launch of Core Ultra Series 3, built on the Intel 18A process. With Nova Lake also set to arrive by the end of 2026, Intel believes it has a client roadmap that can regain market share and profitability in AI PCs over time. Despite negative adjusted free cash flow for the full year, Intel generated $3.1 billion in the second half alone, reflecting improving operational leverage.

Intel also strengthened its balance sheet through asset monetization involving Mobileye and Altera, government funding, and strategic investments from partners including SoftBank (SFBQF) and Nvidia (NVDA). It ended the year with $37.4 billion in cash and short-term investments and repaid $3.7 billion of debt. These steps gave Intel flexibility at a time of high capital intensity.

Demand Is Stronger Than Q4 Numbers Suggest

Intel’s biggest issue right now is that the company can’t make enough chips to meet customer demand. This is why revenue is constrained, margins are under pressure, and supply bottlenecks are limiting how much product reaches customers. While this might look like a red flag, this combination of strong demand, disciplined capital allocation, and intentional scarcity is what long-term investors might find attractive in this growth stock now.

During the Q4 earnings call, management repeatedly emphasized that if supply weren’t constrained, Q4 results would have been better. Client, data center, AI infrastructure, networking, and custom silicon all showed strong demand. Hyperscalers, in particular, signaled a sharp increase.

Instead of overspending to chase short-term growth, Intel is stabilizing yields, strengthening financial discipline, and increasing wafer starts across current nodes, which enhances supply while minimizing capital risk. At the same time, the company is showing new cost discipline by refusing to build future 14A capacity until customers commit volumes, reducing the chances of costly overbuilds. While short-term investors might view this as a setback, long-term investors see it as a company learning from its past mistakes. Intel enters 2026 as a company that prioritizes discipline over expansion.

If Intel continues to execute on this path of tight supply management, improved margins, disciplined capital allocation, and increasing relevance across AI infrastructure, it may contribute to long-term growth.

Analysts that cover Intel expect earnings to increase by 16% in 2026, followed by a 104% increase in 2027, suggesting strong recovery after near-term pressures.

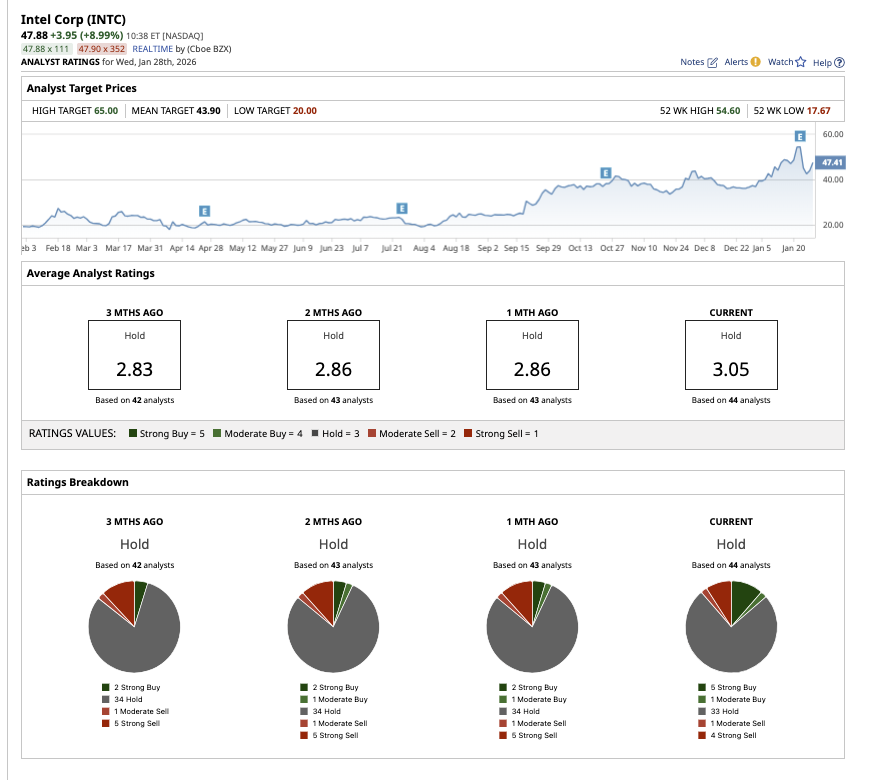

Is INTC Stock a Buy, Hold, or Sell on Wall Street?

Recently, Tigress Financial increased the target price for INTC stock to $66 from $52 with a “Buy” rating, citing how AI data center tailwinds and AI PC refresh present an “increasingly compelling multi-year upside story.”

Given that Intel’s turnaround story is shaping up well, Wall Street gives Intel stock an overall “Hold" rating. Of the 44 analysts covering the stock, five rate it a “Strong Buy,” one says it is a “Moderate Buy,” 33 rate it a “Hold,” one analyst has a “Moderate Sell,” and four suggest a “Strong Sell" rating. INTC stock has surpassed its average target price of $44.27. However, the Street-high estimate of $66 suggests the stock has an upside potential of 37% over the next 12 months.

On the date of publication, Sushree Mohanty did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart