With a market cap of $12.9 billion, Jack Henry & Associates, Inc. (JKHY) is a leading provider of technology solutions and payment processing services for community and regional financial institutions. Founded in 1976, the Missouri-based company delivers core banking, core credit union, digital banking, and data processing platforms that enable banks and credit unions to operate efficiently, manage risk, and enhance customer engagement.

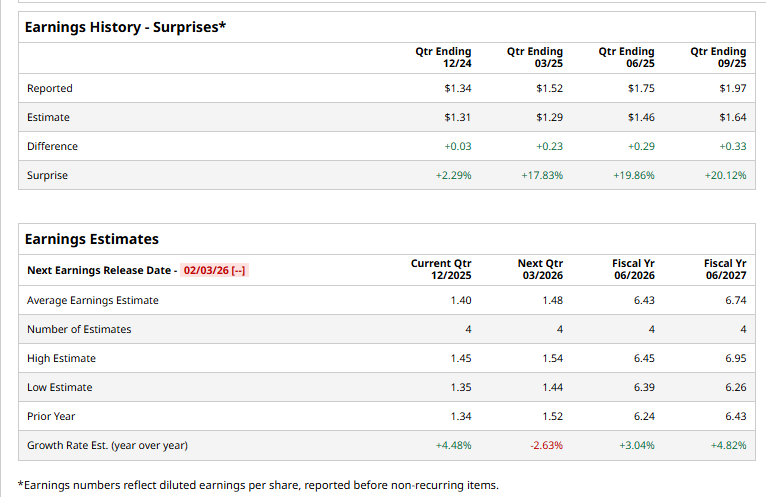

The fintech giant is set to announce its second-quarter results soon. Ahead of the event, analysts expect JKHY to report a non-GAAP profit of $1.40 per share, up 4.5% from $1.34 per share reported in the year-ago quarter. On a more positive note, the company has surpassed analysts’ earnings expectations in each of the past four quarters.

For fiscal 2026, JKHY is expected to deliver an adjusted EPS of $6.43, up 3% from $6.24 in fiscal 2025. In fiscal 2027, its earnings are expected to surge 4.8% year over year to $6.74 per share.

JKHY stock prices have plunged 9.4% over the past 52 weeks, notably underperforming the S&P 500 Index’s ($SPX) 16.2% gains and the Technology Select Sector SPDR Fund’s (XLK) 22.9% surge during the same time frame.

On Nov. 20, shares of Jack Henry & Associates rose more than 1% after Raymond James Financial, Inc. (RJF) double-upgraded the stock to “Strong Buy” from “Market Perform” and set a $198 price target.

Analysts remain cautiously bullish about JKHY’s prospects. The stock has a consensus “Moderate Buy” rating overall. Of the 17 analysts covering the stock, opinions include five “Strong Buys,” two “Moderate Buy,” nine “Holds,” and one “Strong Sell.” It currently trades above the mean price target of $185.08.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart