DENVER, March 18, 2024 (GLOBE NEWSWIRE) -- American Rare Earths (ASX: ARR | OTCQX: ARRNF and AMRRY) (“ARR” or the “Company”) is pleased to announce the results of the “Halleck Creek Scoping Study Technical Report” (“Study”) compiled by Stantec Consulting Services Inc (Stantec - an independent engineering consulting firm). Located in the major mining hub of Wyoming, USA, the Halleck Creek project provides compelling economics and the ARR board has unanimously recommended the project advance to the next phase of development.

Highlights:

- Under our base case 3Mtpa operating scenario, Scoping Study outlines NPV8 of US$673.9 and NPV10 of US$505.1m (pre-tax) at Halleck Creek, equating to an IRR of 22.5% and payback period of 2.9 years with total initial capex of US$456.1m (inc. US$76.0m contingency).

- LOM average Cost (USD/kg NdPr Equivalent) = $38.38/kg, which is favorable when compared to the most recently reported US$50/kg cash cost of NdPr by China Northern Rare Earths1 – the world’s largest integrated producer. A full breakdown of operating costs by product is illustrated in the Project Metrics table below.

- Low operating costs are attributable to favorable geology and mining economics, coupled with the beneficiation and concentration circuit (Density Separation and Wet High Intensity and Magnetic Separation (WHIMS), which provides a 10X upgrade in grade) along with good recovery/extraction via direct leaching, without the need for cracking. The recoveries are illustrated in the Project Metrics table below.

- The Study is based on an initial phase of 3.0 Million tonnes per annum (Mtpa) of mining to create a low capital cost for market entry and financing. A 6 Mtpa economic case was also prepared to illustrate future potential.

- The project had previously evaluated mining cases of 15, 10, 7 and 5 Mtpa before settling on this 3Mtpa mining case; making the project uniquely scalable over time, given the vast resource base (540 Mt total that were modeled in scoping exercise to identify grade for mine sequencing: 180 years at 3Mtpa and 90 years at 6Mtpa).

- The Study was designed to include separation of individual rare earth products in Wyoming, avoiding sending a concentrate overseas and includes all capital costs to separate products (sorted by revenue % attributable). The products include the heavy rare earths Terbium and Dysprosium as separated products, contributing 30% of revenue:

- 66%: Neodymium (Nd)/Praseodymium (Pr) Oxide also referred to as “Didy”

- 16%: Dysprosium Oxide (Dy)

- 14%: Terbium Oxide (Tb)

- 2%: Samarium (Sm), Europium (Eu), Gadolinium (Gd) “SEG” concentrate

- 2% : Lanthanum (La) Carbonate

- The mine plan averaged an in-situ grade of 3,805 ppm TREO, the entirety of the cash flow presented (20+ years) is limited to approximately 400 acres on Wyoming state lands, which provides a very compact footprint. The planned design allows future optionality and enhances project economics by accelerating permitting and leveraging established infrastructure in later stages.

- Late in 2023 the US Treasury Department released a proposed rule for the Advanced Manufacturing Production Tax Credit, part of the Inflation Reduction Act (IRA), better known as 45X. This production tax credit, equal to 10 percent of the costs incurred by the producing taxpayer, seeks to incentivise the domestic production of, among other things, critical minerals, including rare earths. The Study has applied this 10 percent tax credit to costs incurred during the project’s production process, with certain exclusions as detailed in the full report.

- A long-term price of US$91/kg of NdPr was used based on consensus estimates from leading investment banks along with those for Tb and Dy. Various sensitivity analyses are provided in this summary.

________________________

1 https://news.metal.com/newscontent/102656189/China-Northern-Rare-Earth-(Group)-High-Tech-cut-March-rare-earth-listing-prices%C2%A0/

Project Metrics

The study is a preliminary assessment based on Class 5 Association for the Advancement of Cost Engineering (AACE) compliant cost development +/- 25-35% and includes a contingency factor of 20%.

| Project | Unit | Value | Capital Expenditures | Unit | Value | |

| Phase 1 Mine Plan | Yrs | 20+ | Initial Mine Capital | USD | 5.4 m | |

| Processing Run-of-Mine (ROM) | Mtpa | 3.0 | Initial Processing Capital | USD | 374.7 m | |

| Total Production | Mt | 64,263,399 | Contingency (20%) | USD | 76 m | |

| Construction Period | Yr | 2.5 | Total Initial Capital | USD | 456.1 m | |

| Operating Costs | Unit | Value | Pricing | Unit | Value | |

| NdPr Oxide | USD$/kg | 38.38 | NdPr Oxide | USD$/kg | 91.00 | |

| Tb Oxide | USD$/kg | 632.56 | Tb Oxide | USD$/kg | 1,500.00 | |

| Dy Oxide | USD$/kg | 168.68 | Dy Oxide | USD$/kg | 400.00 | |

| SEG Concentrate | USD$/kg | 4.22 | SEG Concentrate | USD$/kg | 10.00 | |

| La | USD$/kg | 0.84 | La | USD$/kg | 2.00 | |

| Total | USD$/kg | 25.66 | Total | 60.85 | ||

| Before Tax Financials | Unit | Value | Recovery | Unit | Value | |

| Free Cash Flow | USD | 2,081.1 m | NdPr | % | 63.9% | |

| NPV | at 8% | 673.9 m | Tb | % | 70.2% | |

| NPV | at 10% | 505.1 m | Dy | % | 66.5% | |

| IRR (%) | % | 22.5 | SEG | % | 70.1% | |

| Payback Period | Yr | 2.9 | La | % | 68.6% | |

| After Tax Financials | Unit | Value | Annual production (average) | Unit | Value | |

| Free Cash Flow | USD | 1,845.1 m | NdPr Oxide | mt | 1,529 | |

| Federal & State Taxes Paid | USD | (236 m) | Tb Oxide | mt | 17 | |

| NPV | at 8% | 582.2 m | Dy Oxide | mt | 91 | |

| NPV | at 10% | 430 m | SEG Concentrate | mt | 383 | |

| IRR (%) | % | 21 | La Carbonate | mt | 1,486 | |

| Payback Period | Yrs | 3.1 | Total | mt | 3,506 |

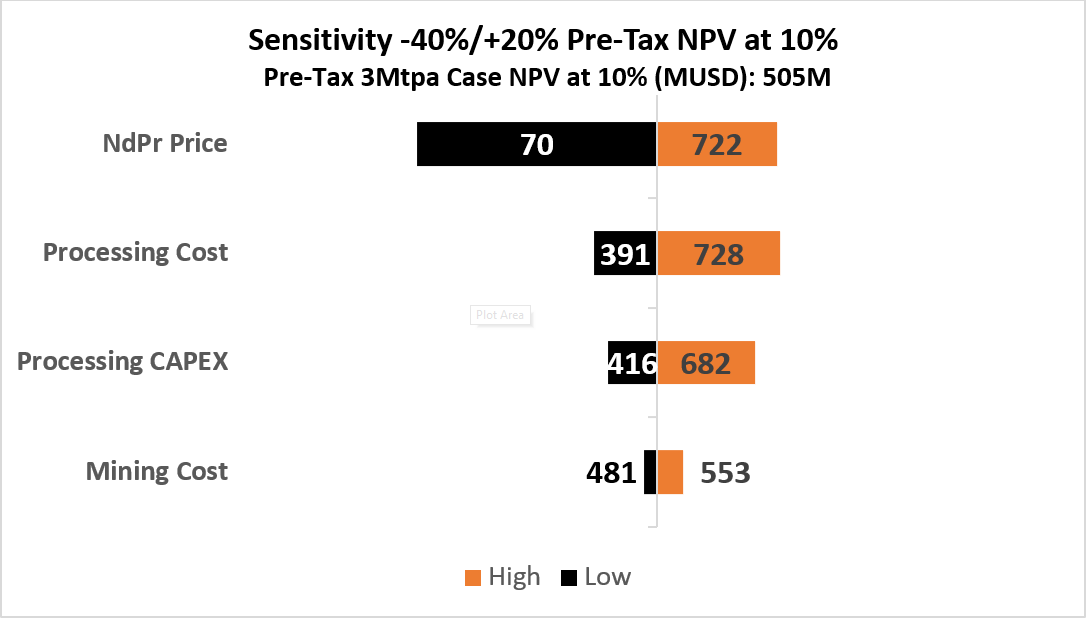

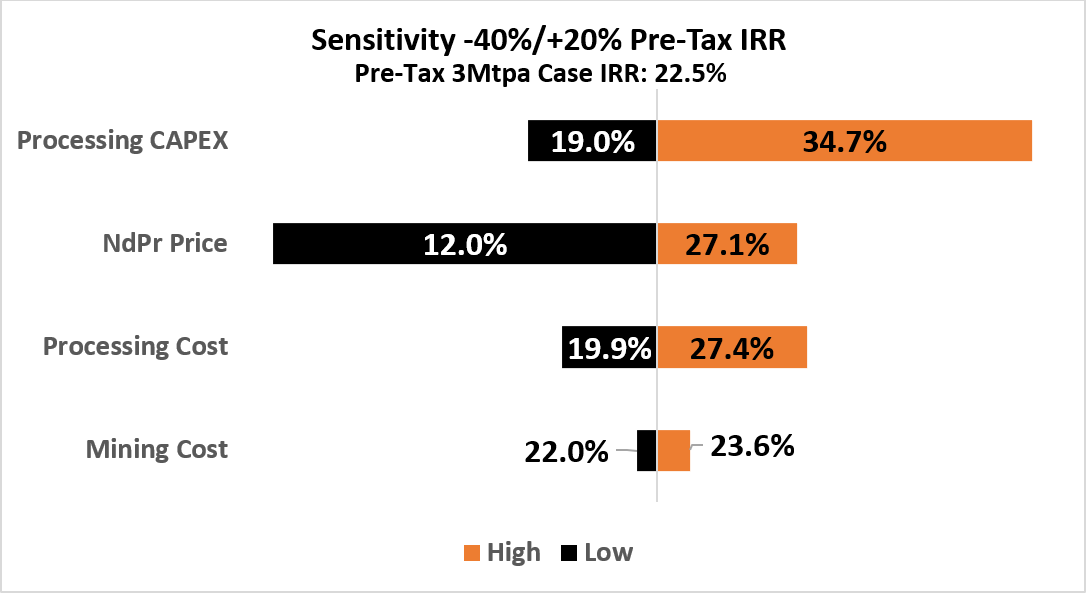

Sensitivities of Base Case 3 Mtpa

- As illustrated above, the project is most sensitive to Processing Capital and NdPr prices.

- At currently depressed spot prices ($54.60/kg) for NdPr, the project still provides a 12% IRR at 10% discount factor, further illustrating the potential of the project as a low-cost producer. We note these prices are not sustainable given current prices are at the cash costs of China Northern Rare Earths.

- Stantec completed a high-level comparison of a 6.0 Mtpa alternative production rate and compared to the Base Case of 3.0 Mtpa to investigate the upside of the property in the case that a higher demand for rare earths is realised. A mine life of 20 years was kept constant and supported by a design targeting the best grade within the required tonnage within the Cowboy State Mine. Operating and capital costs were factored for the higher production rate. The 6.0 Mtpa scenario has a superior NPV at all discount rates. Future planned prefeasibility study will assess the annual production rate options. At a 10% discount factor, a 24% IRR was achieved at $920MM NPV. The Company believes there is additional upside in contiguous claims at higher grade that will be evaluated in further phases of study as this sensitivity was limited to just the Cowboy State Mine area.

Low-Cost Open-Pit Mining in a Favorable Mining Jurisdiction

- A strip ratio of 0.03 : 1

- Open-pit mining well suited to homogenous TREO grades.

- Substantial pre-existing infrastructure (BNSF and UP Tier 1 railroads, I-25 highway).

- Mining hub with availability of skilled labor given the decline of the local coal industry.

- Low-cost power ($0.0349 per kWh).

- Cowboy State Mine designed on Wyoming State Mineral Leases

- The Wyoming Department of Environmental Quality (“WDEQ”) has rigorous and comprehensive, yet well-defined processes for obtaining mining permits on state lands.

- Thorium and Uranium, and associated daughter products, occur in low levels in-situ naturally at Halleck Creek, approximately 68 ppm in the mineralized material.

Rare Earth Element (“REE”) Bearing Allanite can be concentrated 10X using conventional technology

- Up to 86% of Allanite shown to be liberated from in-situ rock mass during crushing and grinding.

- Up to 93% of non-REE gangue material can be separated from the coarse REE bearing allanite.

- Physical separation methods shown to increase grade by approximately 10X with an 84% recovery of TREO.

- In-Situ TREO grades between 3,500ppm and 4,000ppm increased to 35,000ppm (3.5%) to 40,000 (4.0%).

- Gravity and Dense Media Separation removes between 77% and 83% of gangue material from ore material.

- WHIMS can separate another 7% to 10% of non-magnetic material from paramagnetic material.

- Metamict structure observed in SEM micrographs of the non-refractory allanite.

- Metamictization causes allanite to become amorphous and amenable to acid leaching (requires less aggressive techniques).

Favorable Direct Leaching Kinetics

- REE recoveries up to 87% observed when using sulfuric acid at 90oC for 6 hours.

- 90oC is relatively low temperature for acid-leaching processes.

- Low temperatures and shorter residence times reduce the production of silica gel.

- Silica gel contaminates process streams and increases precipitation and filtration costs.

- High-temperature Acid baking not needed to “crack” allanite, compared with others that must heat temperatures to 1,000 oC.

- This affords the project a significant ESG advantage moving forward that will be quantified in future phases of work.

American Rare Earths CEO, Donald Swartz, commented on the results:

“The work presented herein is a culmination of several years of hard work that highlights the potential of Halleck Creek to be the next world-class REE project. The study has revealed a truly elegant solution, as its simplicity unlocks the potential to decouple Western supply chains from Chinese oligopolies. The favorable geology combined with conventional technology, low-operating expenses, modest initial capital expenditures, associated with an expedited path to production have converged to offer a project that is compelling – even when compared against the heavily subsidized Chinese state-owned entities. As the Western downstream industries for rare earths are being advanced from a nascent stage, we have right-sized the initial phase of development to produce a reasonable amount of separated rare earths, within a project area which is highly scalable over time. This is a project that could yield transparent pricing, provide reliable supply, and allow the U.S. to REEshore this industry.”

The study was completed with the expertise of highly experienced and reputable independent engineering consulting firms: Stantec, Tetra Tech and Odessa Resources.

Competent Person(s) Statement:

This work was reviewed and approved for release by Mr. Kelton Smith (Society of Mining Engineers #4227309RM) who is employed by Tetra Tech and has sufficient experience which is relevant to the processing, separation, metallurgical testing and type of deposit under consideration and to the activity which he is undertaking to qualify as a Competent Person as defined in the 2012 JORC Code. Mr. Smith is an experienced technical manager with a degree in Chemical engineering, operations management, and engineering management. He has held several senior engineering management roles at rare earth companies (Molycorp and NioCorp) as well as ample rare earth experience as an industry consultant. Mr. Smith consents to the inclusion in the report of the matters based upon the information in the form and context in which it appears.

This work was reviewed and approved for release by Mr. Gordon Sobering (Society of Mining Engineers #4061917RM) who is employed by Stantec and has sufficient experience which is relevant to the mining plan and type of deposit under consideration and to the activity which he is undertaking to qualify as a Competent Person as defined in the 2012 JORC Code. Gordon is a Professional Engineer and has 35 years of experience in the minerals industry including senior positions with Barrick, Newmont Mining, Goldcorp Inc., Doe Run, Energy Fuels Resources and ASARCO. Mr. Sobering consents to the inclusion in the report of the matters based upon the information in the form and context in which it appears.

The information in this document is based on information compiled by personnel under the direction of Mr. Dwight Kinnes who is Chief Technical Officer of American Rare Earths. This geological work was reviewed and approved for release by Mr. Kinnes (Society of Mining Engineers #4063295RM) who is employed by American Rare Earths and has sufficient experience which is relevant to the style of mineralization and type of deposit under consideration and to the activity which he is undertaking to qualify as a Competent Person as defined in the 2012 JORC Code. Mr. Kinnes consents to the inclusion in the report of the matters based upon the information in the form and context in which it appears.

This release was authorized for release by the Chairman of American Rare Earths Limited.

| Cautionary Statements ARR has published the study in its entirety on the Halleck Creek project tab at REEshore.com The Study referred to in this announcement is a preliminary technical and economic study of the potential viability of the Halleck Creek Rare Earths project by developing a mine and constructing a beneficiation facility onsite and refinery facility offsite. The Study referred to in this announcement is based on lower-level technical and preliminary economic assessments and is insufficient to support estimation of Ore Reserves or to provide assurance of an economic development case at this stage, or certainty that the conclusions of the Study will be realized. Approximately 85% of the Phase I initial production (20-year cash flow model) is in the Measured + Indicated Mineral Resource category and 15% is in the Inferred Mineral Resource Category. The inferred Mineral Resource is not the determining factor in determining the viability of the Halleck Creek Rare Earths project. There is currently a low level of geological confidence associated with inferred Mineral Resources and there is no certainty that further exploration work will result in the determination of other Measured or Indicated Mineral Resources or that the Production Target or preliminary economic assessment will be realized. The Study is based on the material assumptions highlighted throughout this announcement. While the Company considers all the material assumptions to be based on reasonable grounds, there is no certainty that they will prove to be correct or that the range of outcomes indicated by the Study will be achieved. These include assumptions about the availability of funding. To achieve the potential project development outcomes indicated in the Study, funding in the order of US$380 million + $76 million of contingency is needed (ARR presently has U.S. market capitalization of approximately US$100 million). Investors should note that there is no certainty that the Company will be able to raise funding when needed, however the Company has concluded it has a reasonable basis for providing the forward-looking statements included in this announcement and believes that it will be able to fund the development of the project. This is based on an accepted ratio of initial capital expenditure to market capitalization of 4.6 : 1 which includes 20% contingency. | ||

American Rare Earths (ASX: ARR | OTCQX: ARRNF and AMRRY) owns the Halleck Creek, WY and La Paz, AZ rare earth deposits. The Company’s flagship project at Halleck Creek, WY, has the potential to become the largest and most sustainable rare earth projects in North America. American Rare Earths is developing environmentally friendly and cost-effective extraction and processing methods to meet the rapidly increasing demand for resources essential to the clean energy transition and US national security. The Company continues to evaluate other exploration opportunities and is collaborating with US Government-supported R&D to develop efficient processing and separation techniques of rare earth elements.

Executive Summary and Full Technical report are available here.

Head Office

American Rare Earths Ltd

1658 Cole Blvd, Suite G30

Lakewood, CO, 80401

info@americanree.com

www.americanree.com

For additional information:

Susan Assadi

Media Relations US

sassadi@americanree.com

347 977 7125

Beverly Jedynak

Investor Relations US

Beverly.jedynak@viriathus.com

312 943 1123

Graphs accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/24593369-25c1-4c28-ab39-bb4f13c104f3

https://www.globenewswire.com/NewsRoom/AttachmentNg/a4981372-fc71-4a1b-a93c-50d4370fa0bf