Over the last six months, PayPal’s shares have sunk to $59.90, producing a disappointing 19.4% loss - a stark contrast to the S&P 500’s 11.7% gain. This might have investors contemplating their next move.

Following the pullback, is now an opportune time to buy PYPL? Find out in our full research report, it’s free for active Edge members.

Why Does PayPal Spark Debate?

Originally spun off from eBay in 2015 after being acquired by the auction giant in 2002, PayPal (NASDAQ: PYPL) operates a global digital payments platform that enables consumers and merchants to send, receive, and process payments online and in person.

Two Things to Like:

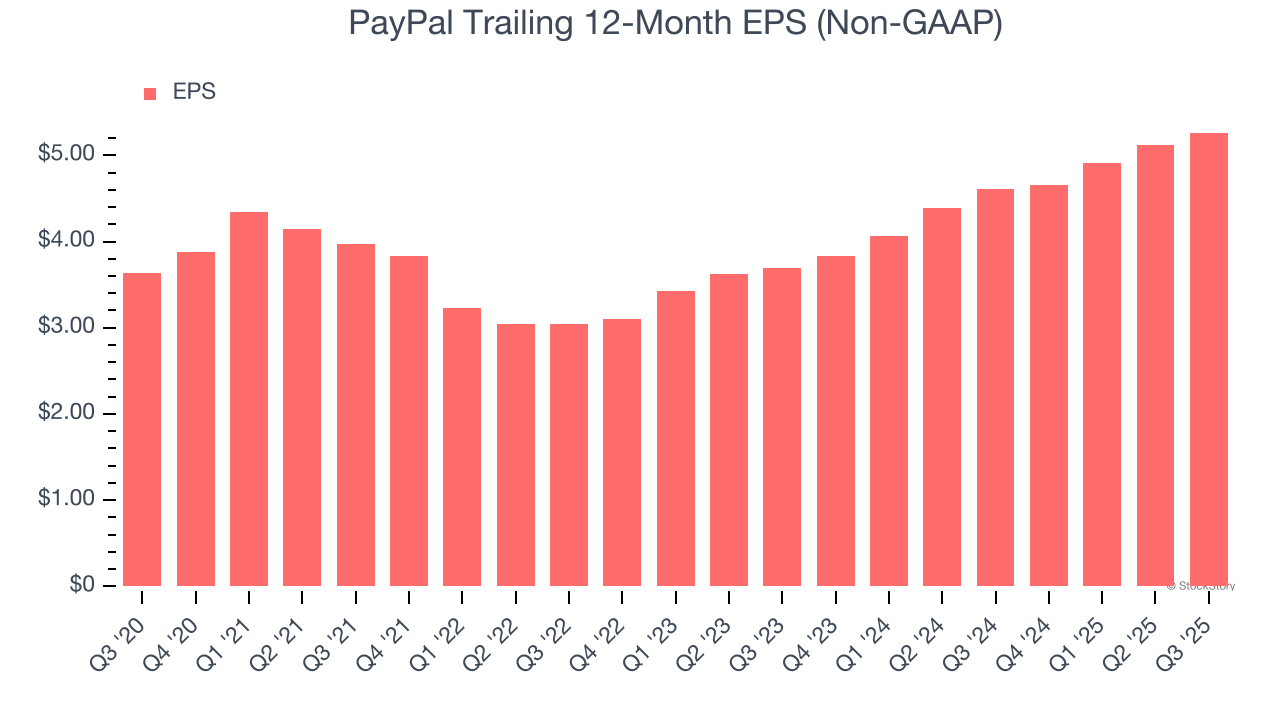

1. EPS Surges Higher Over the Last Two Years

Although long-term earnings trends give us the big picture, we like to analyze EPS over a shorter period to see if we are missing a change in the business.

PayPal’s EPS grew at a remarkable 19.4% compounded annual growth rate over the last two years, higher than its 6.2% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

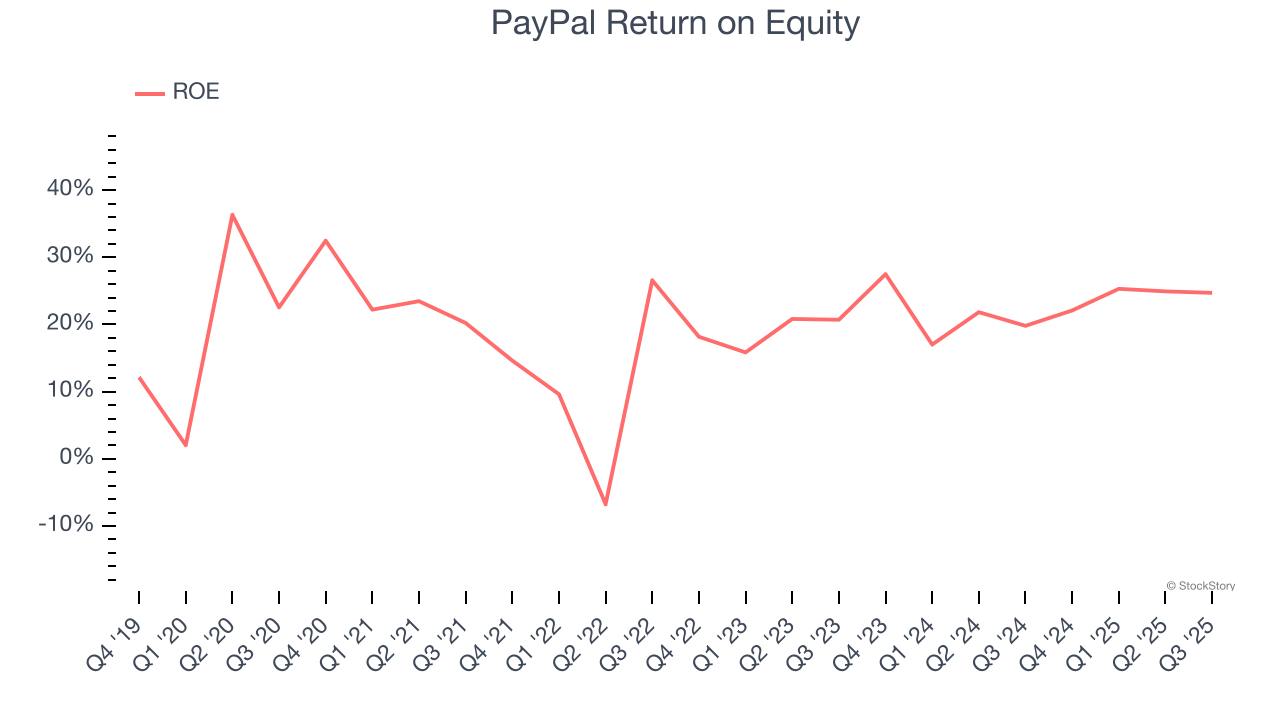

2. Stellar ROE Showcases Lucrative Growth Opportunities

Return on equity (ROE) measures how effectively banks generate profit from each dollar of shareholder equity - a critical funding source. High-ROE institutions typically compound shareholder wealth faster over time through retained earnings, share repurchases, and dividend payments.

Over the last five years, PayPal has averaged an ROE of 20.1%, excellent for a company operating in a sector where the average shakes out around 10% and those putting up 25%+ are greatly admired. This shows PayPal has a strong competitive moat.

One Reason to be Careful:

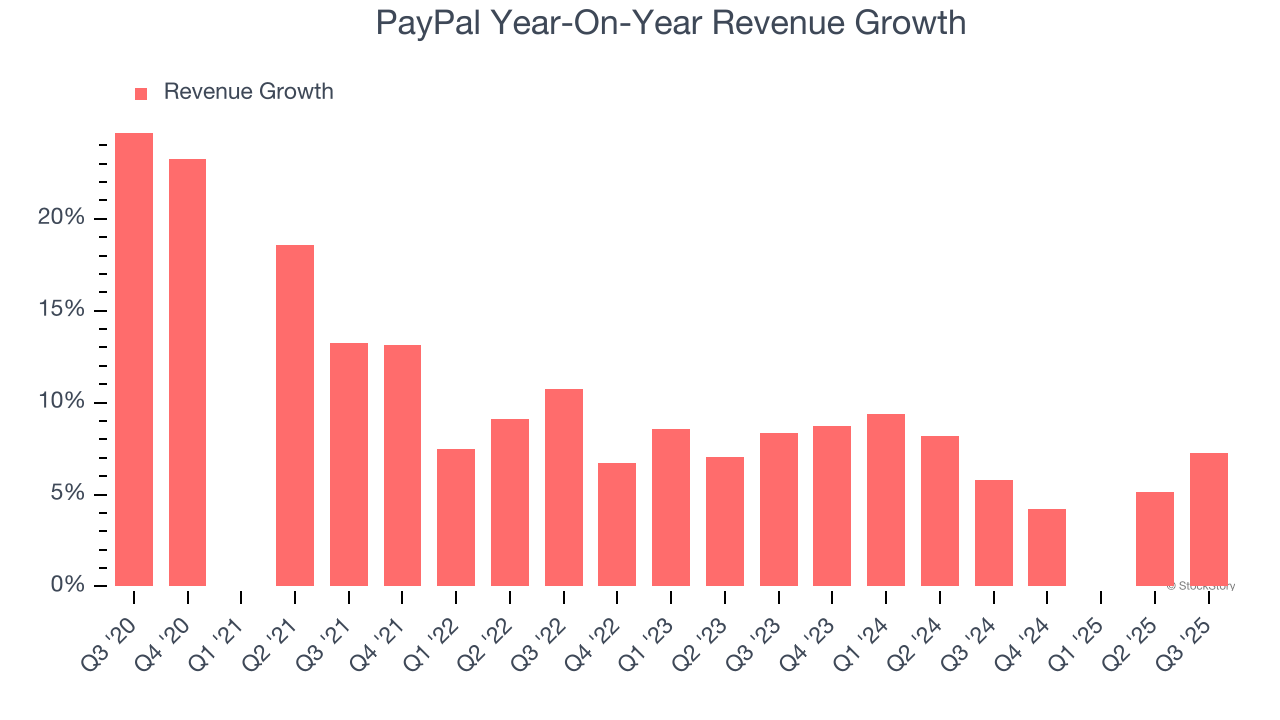

Lackluster Revenue Growth

We at StockStory place the most emphasis on long-term growth, but within financials, a stretched historical view may miss recent interest rate changes, market returns, and industry trends. PayPal’s recent performance shows its demand has slowed as its annualized revenue growth of 6.2% over the last two years was below its five-year trend.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Final Judgment

PayPal’s positive characteristics outweigh the negatives. After the recent drawdown, the stock trades at 10.7× forward P/E (or $59.90 per share). Is now the right time to buy? See for yourself in our full research report, it’s free for active Edge members.

Stocks We Like Even More Than PayPal

If your portfolio success hinges on just 4 stocks, your wealth is built on fragile ground. You have a small window to secure high-quality assets before the market widens and these prices disappear.

Don’t wait for the next volatility shock. Check out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.