Restaurant company Cracker Barrel (NASDAQ: CBRL) met Wall Street’s revenue expectations in Q1 CY2025, but sales were flat year on year at $821.1 million. The company’s outlook for the full year was close to analysts’ estimates with revenue guided to $3.48 billion at the midpoint. Its non-GAAP profit of $0.58 per share was significantly above analysts’ consensus estimates.

Is now the time to buy Cracker Barrel? Find out by accessing our full research report, it’s free.

Cracker Barrel (CBRL) Q1 CY2025 Highlights:

- Revenue: $821.1 million vs analyst estimates of $824.5 million (flat year on year, in line)

- Adjusted EPS: $0.58 vs analyst estimates of $0.21 (significant beat)

- Adjusted EBITDA: $48.12 million vs analyst estimates of $41.1 million (5.9% margin, 17.1% beat)

- The company reconfirmed its revenue guidance for the full year of $3.48 billion at the midpoint

- EBITDA guidance for the full year is $220 million at the midpoint, above analyst estimates of $212.6 million

- Operating Margin: 1.8%, up from -2.4% in the same quarter last year

- Free Cash Flow was -$13.24 million, down from $7.83 million in the same quarter last year

- Locations: 728 at quarter end, up from 721 in the same quarter last year

- Same-Store Sales rose 1% year on year (-1.5% in the same quarter last year)

- Market Capitalization: $1.29 billion

Commenting on the third quarter results, Cracker Barrel President and Chief Executive Officer Julie Masino said, "Our third quarter performance exceeded our expectations and represents the fourth consecutive quarter of positive comparable store restaurant sales growth. We remain focused on executing our transformation plan and believe we are well-positioned to deliver a strong finish to the fiscal year."

Company Overview

Known for its country-themed food and merchandise, Cracker Barrel (NASDAQ: CBRL) is a beloved American restaurant and retail chain that celebrates the warmth and charm of Southern hospitality.

Sales Growth

A company’s long-term sales performance is one signal of its overall quality. Any business can have short-term success, but a top-tier one grows for years.

With $3.51 billion in revenue over the past 12 months, Cracker Barrel is one of the larger restaurant chains in the industry and benefits from a well-known brand that influences consumer purchasing decisions. However, its scale is a double-edged sword because it’s harder to find incremental growth when your existing restaurant banners have penetrated most of the market. To expand meaningfully, Cracker Barrel likely needs to tweak its prices, start new chains, or enter new markets.

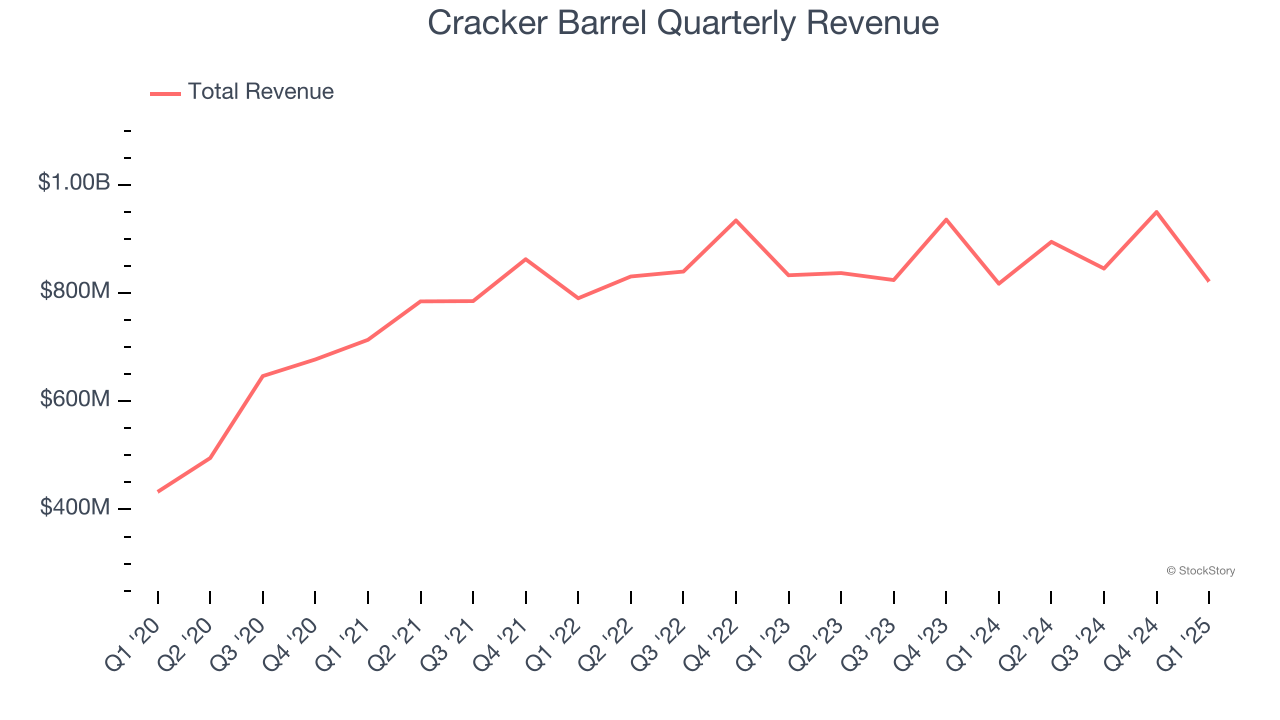

As you can see below, Cracker Barrel grew its sales at a weak 2.1% compounded annual growth rate over the last six years (we compare to 2019 to normalize for COVID-19 impacts) as its restaurant footprint remained unchanged and it barely increased sales at existing, established dining locations.

This quarter, Cracker Barrel’s $821.1 million of revenue was flat year on year and in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months, a slight deceleration versus the last six years. This projection doesn't excite us and suggests its menu offerings will face some demand challenges.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Restaurant Performance

Number of Restaurants

A restaurant chain’s total number of dining locations influences how much it can sell and how quickly revenue can grow.

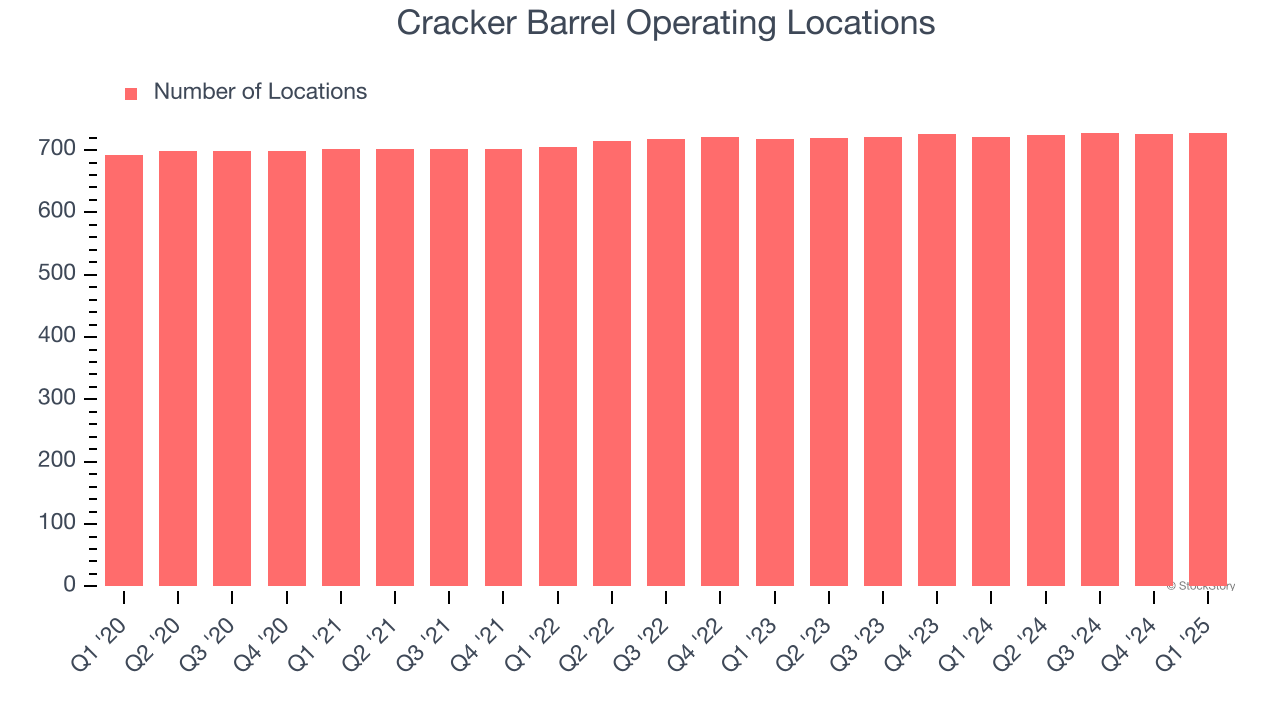

Cracker Barrel operated 728 locations in the latest quarter, and over the last two years, has kept its restaurant count flat while other restaurant businesses have opted for growth.

When a chain doesn’t open many new restaurants, it usually means there’s stable demand for its meals and it’s focused on improving operational efficiency to increase profitability.

Same-Store Sales

A company's restaurant base only paints one part of the picture. When demand is high, it makes sense to open more. But when demand is low, it’s prudent to close some locations and use the money in other ways. Same-store sales provides a deeper understanding of this issue because it measures organic growth at restaurants open for at least a year.

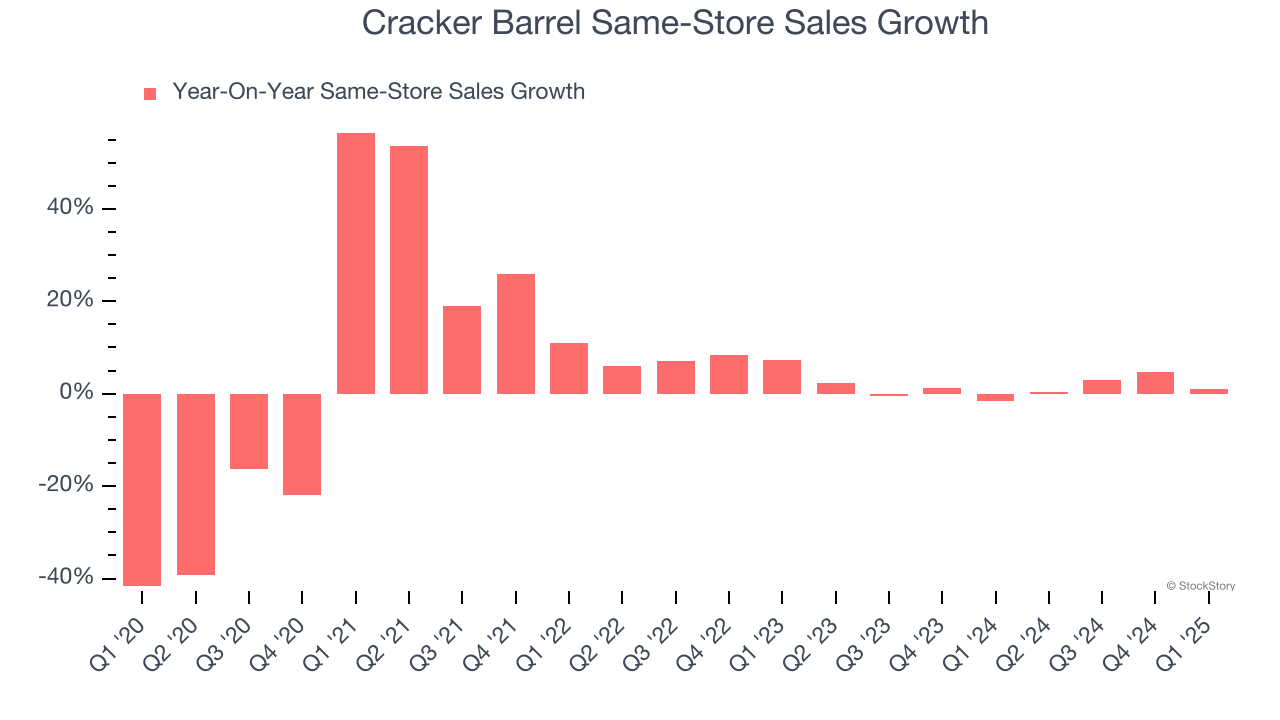

Cracker Barrel’s demand within its existing dining locations has been relatively stable over the last two years but was below most restaurant chains. On average, the company’s same-store sales have grown by 1.3% per year. Given its flat restaurant base over the same period, this performance stems from a mixture of higher prices and increased foot traffic at existing locations.

In the latest quarter, Cracker Barrel’s same-store sales rose 1% year on year. This performance was more or less in line with its historical levels.

Key Takeaways from Cracker Barrel’s Q1 Results

We were impressed by how significantly Cracker Barrel blew past analysts’ EPS and EBITDA expectations this quarter. We were also excited its full-year EBITDA guidance outperformed Wall Street’s estimates. On the other hand, its same-store sales slightly missed, but we still think this was a solid quarter with some key areas of upside. The stock traded up 3% to $59.50 immediately following the results.

Cracker Barrel put up rock-solid earnings, but one quarter doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.