Wynn Resorts has been treading water for the past six months, recording a small return of 2.1% while holding steady at $109.26. The stock also fell short of the S&P 500’s 10.2% gain during that period.

Is there a buying opportunity in Wynn Resorts, or does it present a risk to your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.

Why Do We Think Wynn Resorts Will Underperform?

We're swiping left on Wynn Resorts for now. Here are three reasons you should be careful with WYNN and a stock we'd rather own.

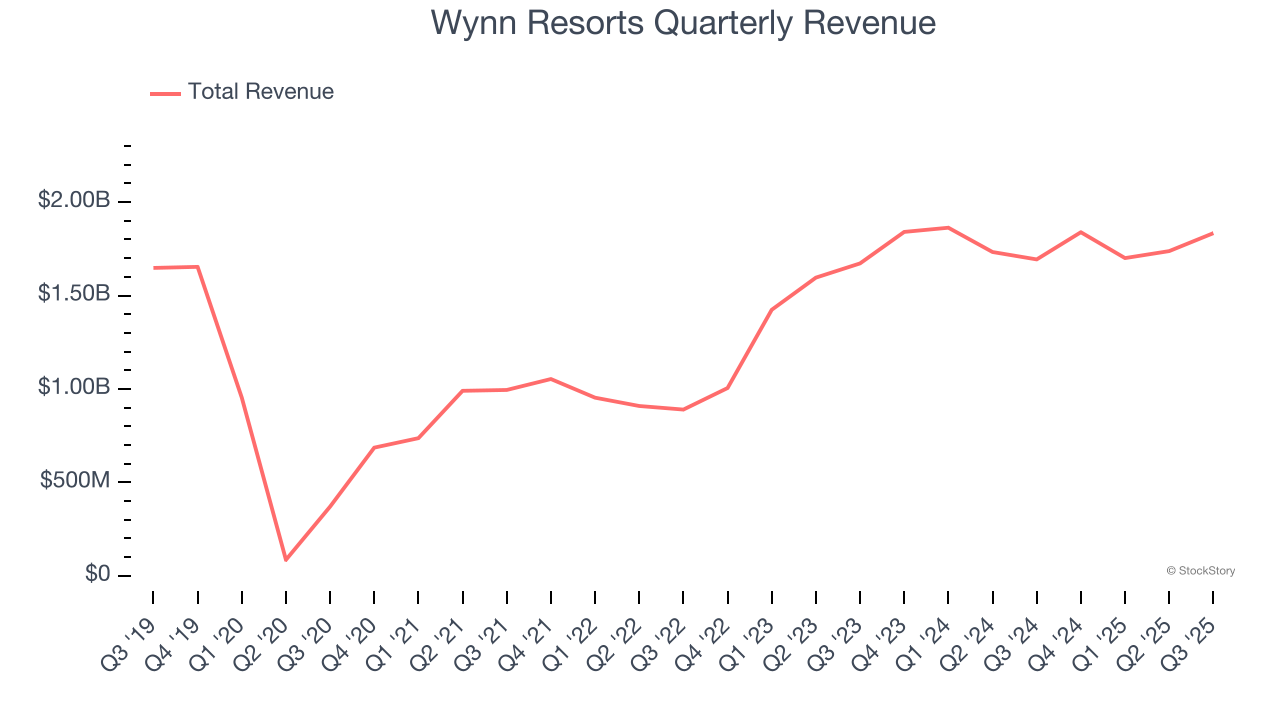

1. Long-Term Revenue Growth Disappoints

A company’s long-term sales performance is one signal of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last five years, Wynn Resorts grew its sales at a 18.3% annual rate. Although this growth is acceptable on an absolute basis, it fell slightly short of our standards for the consumer discretionary sector, which enjoys a number of secular tailwinds.

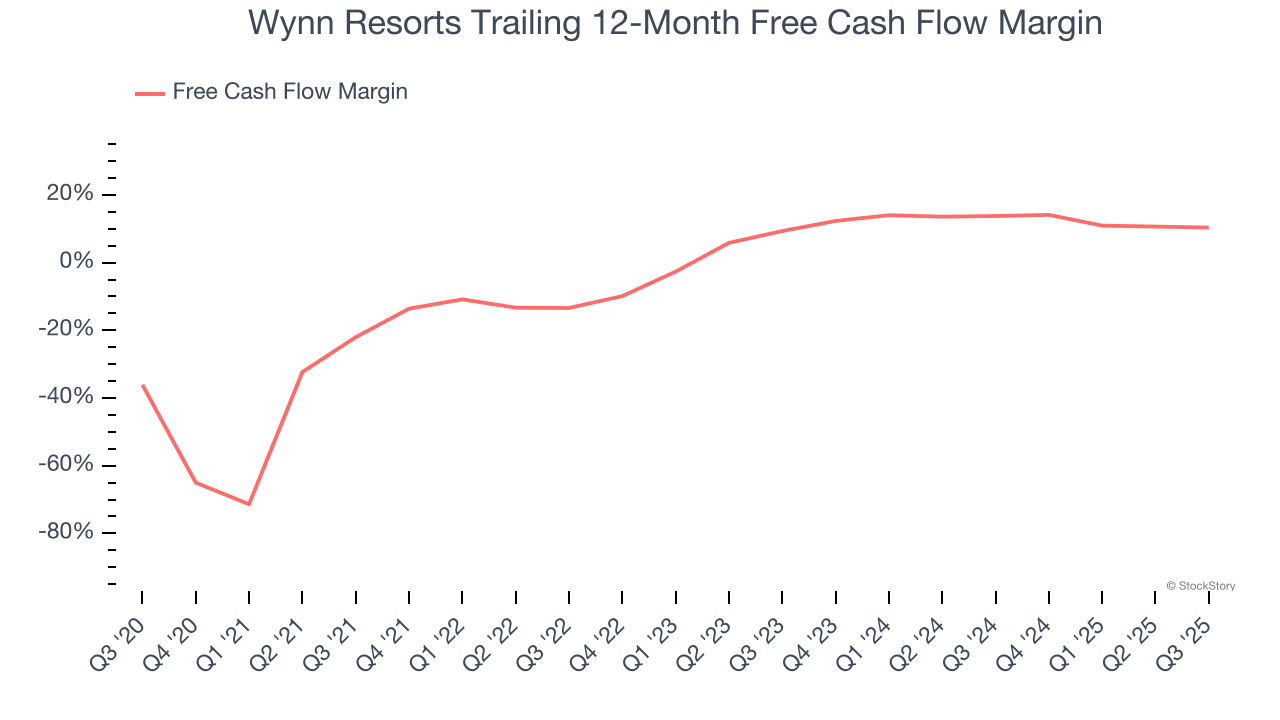

2. Mediocre Free Cash Flow Margin Limits Reinvestment Potential

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Wynn Resorts has shown poor cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 12.1%, lousy for a consumer discretionary business.

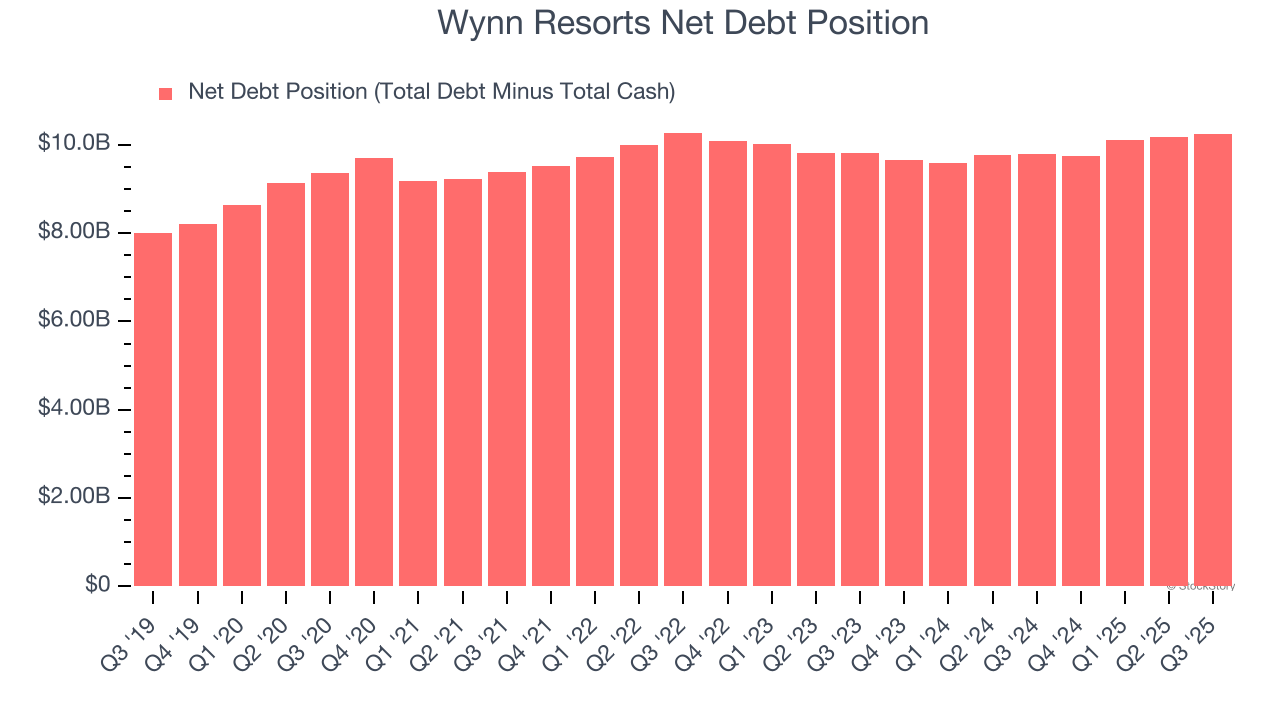

3. High Debt Levels Increase Risk

Debt is a tool that can boost company returns but presents risks if used irresponsibly. As long-term investors, we aim to avoid companies taking excessive advantage of this instrument because it could lead to insolvency.

Wynn Resorts’s $12.2 billion of debt exceeds the $1.96 billion of cash on its balance sheet. Furthermore, its 5× net-debt-to-EBITDA ratio (based on its EBITDA of $1.89 billion over the last 12 months) shows the company is overleveraged.

At this level of debt, incremental borrowing becomes increasingly expensive and credit agencies could downgrade the company’s rating if profitability falls. Wynn Resorts could also be backed into a corner if the market turns unexpectedly – a situation we seek to avoid as investors in high-quality companies.

We hope Wynn Resorts can improve its balance sheet and remain cautious until it increases its profitability or pays down its debt.

Final Judgment

Wynn Resorts falls short of our quality standards. With its shares trailing the market in recent months, the stock trades at 19.4× forward P/E (or $109.26 per share). While this valuation is fair, the upside isn’t great compared to the potential downside. There are more exciting stocks to buy at the moment. Let us point you toward one of our top digital advertising picks.

Stocks We Would Buy Instead of Wynn Resorts

If your portfolio success hinges on just 4 stocks, your wealth is built on fragile ground. You have a small window to secure high-quality assets before the market widens and these prices disappear.

Don’t wait for the next volatility shock. Check out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.