VANCOUVER, BC / ACCESSWIRE / October 21, 2021 / Group Ten Metals Inc. (TSX.V:PGE | OTCQB:PGEZF; FSE:5D32) (the "Company" or "Group Ten") is pleased to report the first independent National Instrument 43-101 ("NI 43-101") mineral resource estimate (the "2021 Resource") for its 100%-owned Stillwater West platinum group element, nickel, copper, cobalt, and gold ("PGE-Ni-Cu-Co + Au") project in Montana, USA. The study was completed by SGS Geological Services ("SGS").

The Company will host a live webcast on Thursday October 28th at 9am Pacific time (12pm Eastern) to discuss the 2021 Resource, recent drill campaign, and plans for the Stillwater West project. To register, click here.

Highlights

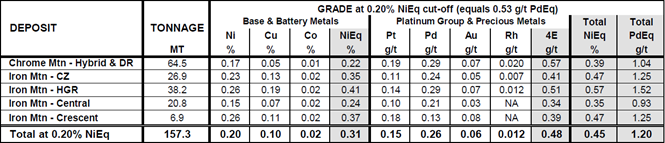

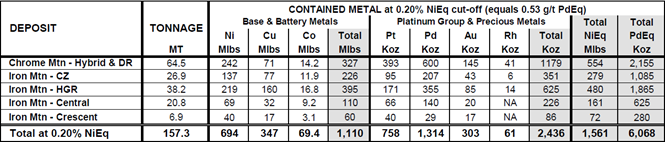

- Inferred mineral resources total 2.4 million ounces palladium, platinum, rhodium, and gold ("4E") plus 1.1 billion pounds of nickel, copper and cobalt in a constrained model totaling 157 million tonnes at an average grade of 0.45% total nickel equivalent ("NiEq") (equal to 1.20 g/t palladium equivalent, or "PdEq") using a 0.20% NiEq cut-off grade. See detailed breakdown in Tables 1 and 2 below.

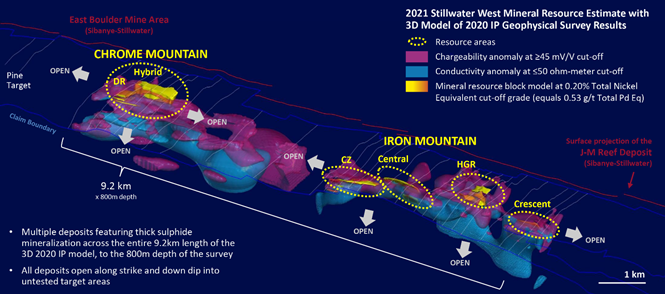

- The 2021 Resource incorporates five deposits of sulphide mineralization that cover 8.7 kilometers of strike length within the central area of the project. The strong correlation that is demonstrated between resource areas and untested high-level geophysical targets (Figure 1), and metal-in-soil anomalies, provides a strong basis for expansion of the resource with 2021 drill results, and future drill campaigns (Figures 2 to 6).

- Mineralization, consisting of thick horizons of nickel and copper sulphide that are enriched in palladium, platinum, rhodium, gold and cobalt, is consistent with Group Ten's "Platreef-style" geological model that is based on known parallels with South Africa's Bushveld Igneous Complex.

- Deposits in the 2021 Resource are defined by 83 drill holes from a total of 216 holes drilled at Stillwater West prior to 2021, including all holes from Group Ten's 2019 and 2020 campaigns. A number of the remaining drill holes provide early confirmation of target mineralization in otherwise untested anomalies across much of the 32-kilometer project, accelerating future exploration programs and demonstrating significant expansion potential outside of the known deposit areas.

- Assays are pending from the 14-hole 2021 drill campaign, which focused on expansion of three of the five deposits by completing step-out holes designed to build onto the 2021 Resource.

- Rhodium totaling 61,000 ounces was modeled at three of the five target areas, where sufficient data was available. At recent spot prices, this endowment is equivalent to over 400,000 ounces palladium and over 750,000 ounces platinum. The Company believes rhodium results are understated due to the lack of historic assay data and is working to fully include rhodium in future mineral resource updates.

The 2021 Resource estimate will be incorporated into an NI43-101-compliant technical report for the Stillwater West project to be filed within 45 days.

Michael Rowley, Group Ten's President and CEO states, "We are extremely pleased with the results of our inaugural resource estimate that provides a robust debut of high-demand battery and platinum group metals in a top US mining district. This is a major milestone in the advancement of both the project and Group Ten Metals. Mineralization in the five deposits shows excellent continuity and grade across large areas, with strong geophysical and geochemical signatures that remain open in all directions demonstrating excellent potential for expansion in subsequent drill campaigns. In this regard, we look forward to reporting results from our 2021 campaign, our biggest yet, which we believe met the objective of increasing the 2021 Resource. More than ever we see extraordinary potential for Stillwater West to become a large-scale and strategically significant US-based source of battery metals to meet growing electrification needs while also supplying PGEs for catalytic convertors and increasing fuel cell demand."

TABLE 1 - Grade and Contained Metal by Deposit at a 0.20% NiEq Cut-Off Grade (Equals 0.53 g/t PdEq) - Stillwater West Inferred Mineral Resource Estimate (Base Case)

CIM (2014) definitions were followed for Mineral Resources Reporting. The constrained Mineral Resources are reported at a base case cut-off grade of 0.20% NiEq. Cut-off grades and metal equivalents are based on metal prices of $7.00/lb Ni, $3.50/lb Cu, $20.00/lb Co, $900/oz Pt, $1,800/oz Pd and $1,600/oz Au, with assumed metal recoveries of 80% for Ni, 85% for copper, 80% for Co, Pt, Pd and Au, a mining cost of US$2.20/t rock, and processing and G&A cost of US$12.75/t mineralized material. Rhodium modeled but not included in equivalency calculations. All figures are rounded to reflect the relative accuracy of the estimate.

The current Mineral Resources are not Mineral Reserves as they do not have demonstrated economic viability. The quantity and grade of reported Inferred Resources in this Mineral Resource Estimate are uncertain in nature and there has been insufficient exploration to define these Inferred Resources as Indicated or Measured. However, based on the current knowledge of the deposits, it is reasonably expected that the majority of Inferred Mineral Resources could be upgraded to Indicated Mineral Resources with continued exploration.

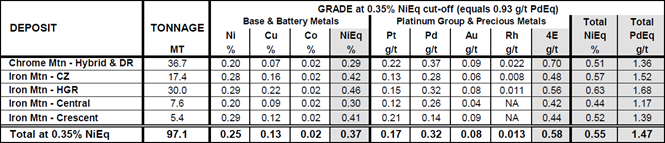

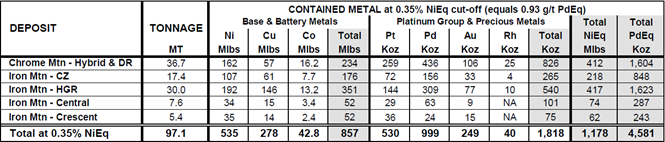

TABLE 2 - Grade and Contained Metal by Deposit at a Higher Grade 0.35% NiEq Cut-Off (Equals 0.93 g/t PdEq)

FIGURE 1 - 2021 Stillwater West Mineral Resource Estimate Over 3D Model of Induced Polarization Survey Results

Sensitivity Analysis

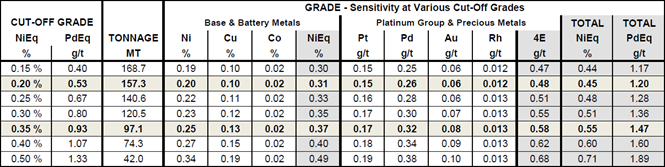

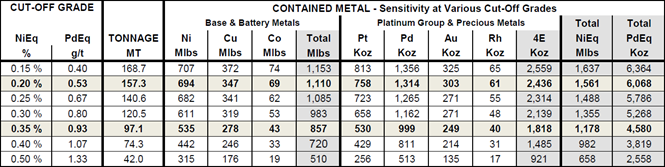

A sensitivity analysis is provided in Table 3 below which demonstrates the variation in grade and tonnage in the deposit at various cut-off grades. Mineralization shows exceptional continuity, enabling models at higher-cut-off grades including inferred mineral resources of 97 million tonnes of 0.55% NiEq (equal to 1.47 g/t PdEq) containing 1.8 million ounces palladium, platinum, rhodium, and gold ("4E") with 857 million pounds of nickel, copper and cobalt (see Table 2, above).

TABLE 3 - Grade and Contained Metal Sensitivity at Various NiEq Cut-off Grades

Constrained Mineral Resources are reported at a base case cut-off grade of 0.20% NiEq. Values in the table reported above and below the cut-off grades should not be misconstrued with a Mineral Resource Statement. The values are only presented to show the sensitivity of the block model estimates to the selection of cut-off grade. All figures are rounded to reflect the relative accuracy of the estimate. Composites have been capped where appropriate.

2021 Exploration Update

Work in 2021 focused largely on diamond core drilling within the area of the 2021 Resource and an Induced Polarization "IP" geophysical survey on the west side of the core project area, including the Pine target.

Phase I of planned expansion drilling has now been completed. 14 holes totaling 5,138 meters were drilled in a two-rig program that tested priority targets at Chrome Mountain (Hybrid and DR deposit areas), and at Iron Mountain at the CZ (formerly Camp) and HGR deposit areas. Holes were prioritized to step out from known mineralization with the primary objective of expanding and upgrading the 2021 Resource estimate in 2022. Assays are pending, however, on a visual basis the predictive geologic model developed by Group Ten Metals is effectively targeting expansion of known horizons of sulphide mineralization, including high-grade intervals identified in the 2019 and 2020 drill campaigns, and identifying numerous untested targets at Stillwater West. Drill core is in various stages of processing with first results expected over the coming weeks and continuing over the coming months. Expansion drilling is expected to resume in Q2 2022 upon review and integration of 2021 results.

The 2021 portion of the expansion IP survey is also complete, with approximately 25 line-kilometers focused on the Chrome Mountain and high-grade Pine target areas at the west side of the highly successful 2020 survey. Very high-level anomalies in untested areas were identified in preliminary results that will be presented in a coming news release as final information becomes available. The second phase of the expanded IP survey is expected to resume in 2022 in the central and eastern portions of the 2020 survey grid.

Rhodium

Rhodium has been identified at potentially significant co-product grades of 0.03 to 0.10 g/t Rh in drill results in four of the five deposit areas at Stillwater West, with shorter intervals ranging up to 0.50 g/t Rh. The lack of historic rhodium assay data has prevented assessment of the rhodium content at the Central and Crescent deposits and in some parts of the other deposits. For this reason, the Company believes rhodium levels are currently understated at Stillwater West and will continue to include complete rhodium assays in future campaigns with the objective of fully integrating rhodium in future resource updates.

Rhodium is a rare platinum group element that is primarily used as a specialized catalyst alongside platinum and palladium in automotive catalytic converters. It is mined solely as a co-product at grades that are often below 0.1 g/t. South Africa dominates global production, and there is very little mine supply in North America. Sibanye-Stillwater, adjacent to Group Ten's Stillwater West project, is the primary US producer.

Supply constraints for rhodium have supported elevated prices since 2017. At recent values, rhodium trades at more than 12 times the value of platinum on a spot price basis at over USD$13,000 per ounce, meaning 0.1 g/t Rh equates to approximately 1.2 g/t platinum equivalent.

Metallurgy

Preliminary metallurgical assessments by Group Ten Metals returned strong nickel tenor in sulphides drilled by the Company in 2020. In addition, favorable historic bench-scale metallurgical results completed by AMAX in the 1970s at the Iron Mountain target area demonstrate the potential for effective nickel and copper sulphide flotation and PGE recovery. Sample collection for more detailed metallurgical testing is on-going as part of the expanding development of Stillwater West, with a view to including full metallurgical assessment in future studies.

Carbon Capture at Stillwater West

All five deposits in the 2021 Resource contain desirable nickel sulphide mineralization that has been shown to require a much lower environmental footprint in subsequent processing to nickel metal or nickel sulphate in comparison to the laterite nickel ores that dominate global production. As part of Group Ten's commitment to global sustainability initiatives, the Company is also examining the potential for large-scale carbon sequestration with the objective of further reducing and possibly eliminating the carbon footprint of a potential mining operation at Stillwater West.

Preliminary results demonstrate the presence of certain minerals that are known to have high capacity to bind carbon dioxide by a natural process known as mineral carbonation. As announced in a news release on September 23, 2021, the Company has entered a second phase of research with Dr. Greg Dipple and his team at the University of British Columbia, Canada, to assess the capacity of rock samples from Stillwater West to bind carbon dioxide for permanent disposal as part of a potential mining operation.

In addition to being strongly aligned with Group Ten's Environmental, Social and Governance guidelines and principles, the incorporation of carbon uptake may bring financial benefits via initiatives such as the 45Q Tax Credit for Carbon Oxide Sequestration that is now in place in the US.

Qualified Person

The Stillwater West PGE-Ni-Cu-Co + Au project 2021 Resource estimate was prepared by Allan Armitage, P.Geo., of SGS Geological Services, an independent Qualified Person, in accordance with the guidelines of the Canadian Securities Administrators' National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101") with an effective date of October 7, 2021. Armitage conducted a site visit to the property on August 9 and 10, 2021

Estimation Methodology and Parameters

Completion of the 2021 Resource involved the assessment of a drill hole database, which included all data for surface drilling completed through the fall of 2020, as well as 3D mineral resource models, and available written reports. SGS used 83 holes and 18,386 meters of drill data to delineate five deposits in the 2021 Resource estimate, from a total database of 216 drill holes and 32,465 meters of core data compiled by the Company. All holes from Group Ten's 2019 and 2020 drill campaigns were included. No assay data has been received to date from the 2021 drill program.

Inverse Distance squared restricted to mineralized domains were used to Interpolate grades for the main elements of interest including Ni (ppm), Cu (ppm), Co (ppm), Pt (g/t), Pd (g/t) and Au (g/t), as well as NiEq (%), NiEq_R (%), Rh (ppb), Cr (ppm), and S (%) into block models. Composites of 1 meter have been capped where appropriate. Fixed specific gravity values of 2.90 - 3.10 g/cm3 (depending on deposit) were used to estimate the 2021 Resource tonnage from block model volumes. Waste in all areas was given a fixed density of 2.9 g/cm3.

The constrained 2021 Resource grade blocks were quantified above the base case cut-off grade. At this base case cut-off grade the deposits show excellent geologic and grade continuity. The project is at an early stage of exploration and all deposits are open along strike and down dip. The cut-off grades should be re-evaluated in light of future prevailing market conditions (metal prices, exchange rates, mining costs etc.).

The constrained 2021 Resources are presented undiluted and in situ (no minimum thickness), constrained by continuous 3D wireframe models, and are considered to have reasonable prospects for eventual economic extraction. Based on a review of the project location, size, geometry, continuity of mineralization and proximity to surface of the deposits, and spatial distribution of the five main deposits of interest (all within a 8.7 kilometer strike length), it is envisioned that the deposits may be mined by open pit or bulk tonnage underground methods. The results from the pit optimization are used solely for the purpose of testing the "reasonable prospects for economic extraction" by open pit mining methods and do not represent an attempt to estimate mineral reserves. There are no mineral reserves on the project. The results are used as a guide to assist in the preparation of a Mineral Resource statement and to select an appropriate resource reporting cut-off grade. Pit optimization does not represent an economic study. Future engineering studies will be needed to develop optimal bulk tonnage mining methods.

The estimate of Mineral Resources may be materially affected by environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant issues. There is no certainty that all or any part of the Inferred Mineral Resource will be upgraded to an Indicated or Measured Mineral Resource as a result of continued exploration.

About Stillwater West

Group Ten is rapidly advancing the Stillwater West PGE-Ni-Cu-Co + Au project towards becoming a world-class source of low-carbon, sulphide-hosted nickel, copper, and cobalt, critical to the electrification movement, as well as key catalytic metals including platinum, palladium and rhodium used in catalytic converters, fuel cells, and the production of green hydrogen. Stillwater West positions Group Ten as the second-largest landholder in the Stillwater Complex, with a 100%-owned position adjoining and adjacent to Sibanye-Stillwater's PGE mines in south-central Montana, USA1. The Stillwater Complex is recognized as one of the top regions in the world for PGE-Ni-Cu-Co mineralization, alongside the Bushveld Complex and Great Dyke in southern Africa, which are similar layered intrusions. The J-M Reef, and other PGE-enriched sulphide horizons in the Stillwater Complex, share many similarities with the highly prolific Merensky and UG2 Reefs in the Bushveld Complex. Group Ten's work in the lower Stillwater Complex has demonstrated the presence of large-scale disseminated and high-sulphide battery metals and PGE mineralization, similar to the Platreef in the Bushveld Complex2. Drill campaigns by the Company, complemented by a substantial historic drill database, have delineated five deposits of Platreef-style mineralization across a core 9.2-kilometer span of the project, all of which are open for expansion into adjacent targets. Multiple earlier-stage Platreef-style and reef-type targets are also being advanced across the remainder of the 32-kilometer length of the project based on strong correlations seen in soil and rock geochemistry, geophysical surveys, geologic mapping, and drilling.

About Group Ten Metals Inc.

Group Ten Metals Inc. is a TSX-V-listed Canadian mineral exploration company focused on the development of high-quality platinum, palladium, nickel, copper, cobalt, and gold exploration assets in top North American mining jurisdictions. The Company's core asset is the Stillwater West PGE-Ni-Cu-Co + Au project adjacent to Sibanye-Stillwater's high-grade PGE mines in Montana, USA. Group Ten also holds the high-grade Black Lake-Drayton Gold project adjacent to Treasury Metals' development-stage Goliath Gold Complex in northwest Ontario, and the Kluane PGE-Ni-Cu-Co project on trend with Nickel Creek Platinum‘s Wellgreen deposit in Canada‘s Yukon Territory.

About the Metallic Group of Companies

The Metallic Group is a collaboration of leading precious and base metals exploration companies, with a portfolio of large, brownfield assets in established mining districts adjacent to some of the industry's highest-grade producers of silver and gold, platinum and palladium, and copper. Member companies include Metallic Minerals in the Yukon's high-grade Keno Hill silver district and La Plata silver-gold-copper district of Colorado, Group Ten Metals in the Stillwater PGM-nickel-copper district of Montana, and Granite Creek Copper in the Yukon's Minto copper district. The founders and team members of the Metallic Group include highly successful explorationists formerly with some of the industry's leading explorers/developers and major producers. With this expertise, the companies are undertaking a systematic approach to exploration using new models and technologies to facilitate discoveries in these proven, but under-explored, mining districts. The Metallic Group is headquartered in Vancouver, BC, Canada, and its member companies are listed on the Toronto Venture, US OTC, and Frankfurt stock exchanges.

FOR FURTHER INFORMATION, PLEASE CONTACT:

Michael Rowley, President, CEO & Director

Phone: (604) 357 4790

Toll Free: (888) 432 0075

Email: info@grouptenmetals.com

Web: http://grouptenmetals.com

Quality Control and Quality Assurance

Mr. Allan Armitage, Ph.D., P.Geo., is a Qualified Person in accordance with National Instrument 43-101 and has reviewed and approved the technical content of this news release with respect to the 2021 Resource estimate. As independent QP, Mr. Armitage was responsible for the preparation of the technical information pertaining to the Resource estimate.

Mr. Mike Ostenson, P.Geo., is the Qualified Person for the purposes of National Instrument 43-101, and he has reviewed and approved the technical disclosure outside of the 2021 Resource estimate that is contained in this news release.

Forward-Looking Statements

Forward Looking Statements: This news release includes certain statements that may be deemed "forward-looking statements". All statements in this release, other than statements of historical facts including, without limitation, statements regarding potential mineralization, historic production, estimation of mineral resources, the realization of mineral resource estimates, interpretation of prior exploration and potential exploration results, the timing and success of exploration activities generally, the timing of the timing and results of future resource estimates, permitting time lines, metal prices and currency exchange rates, availability of capital, government regulation of exploration operations, environmental risks, reclamation, titlefuture driling actiivities and the locations of such drilling, and future plans and objectives of the company are forward-looking statements that involve various risks and uncertainties. Although Group Ten believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in the forward-looking statements. Forward-looking statements are based on a number of material factors and assumptions. Factors that could cause actual results to differ materially from those in forward-looking statements include failure to obtain necessary approvals, unsuccessful exploration results, changes in project parameters as plans continue to be refined, results of future resource estimates, future metal prices, availability of capital and financing on acceptable terms, general economic, market or business conditions, risks associated with regulatory changes, defects in title, availability of personnel, materials and equipment on a timely basis, accidents or equipment breakdowns, uninsured risks, delays in receiving government approvals, unanticipated environmental impacts on operations and costs to remedy same, and other exploration or other risks detailed herein and from time to time in the filings made by the companies with securities regulators. Readers are cautioned that mineral resources that are not mineral reserves do not have demonstrated economic viability. Mineral exploration and development of mines is an inherently risky business. Accordingly, the actual events may differ materially from those projected in the forward-looking statements. For more information on Group Ten and the risks and challenges of their businesses, investors should review their annual filings that are available at www.sedar.com.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Group Ten Metals Inc.

View source version on accesswire.com:

https://www.accesswire.com/669062/Group-Ten-Metals-Announces-Inaugural-NI-43-101-Mineral-Resource-Estimate-for-the-Stillwater-West-PGE-Ni-Cu-Co-Au-Project-Montana-USA