TORONTO, ON / ACCESSWIRE / September 22, 2023 / Northern Superior Resources Inc. ("Northern Superior" or the "Company") (TSXV:SUP)(OTCQX:NSUPF) is pleased to announce that it has filed the technical report pursuant to the Mineral Resource Estimate ("MRE") prepared in accordance with the National Instrument 43-101, Standard for Disclosure for Mineral Projects ("NI 43-101") for the Philibert gold property, located 60 kilometres southwest of Chibougamau, Québec, Canada (the "Philibert Project"; Northern Superior: 75%, SOQUEM: 25%).

Highlights Include:

- 48.46 million tonnes of Inferred Mineral Resource averaging 1.10 grams of gold per tonne for 1,708,800 ounces of gold;

- 7.88 million tonnes of Indicated Mineral Resource averaging 1.10 grams of gold per tonne for 278,9200 ounces of gold;

- Mineral resource estimated at a cut-off grade of 0.35 g/t gold;

- Metallurgical testing with flotation concentrate returns recoveries up to 95.6% (see press release dated July 6, 2023) and 93% used for the pit optimization;

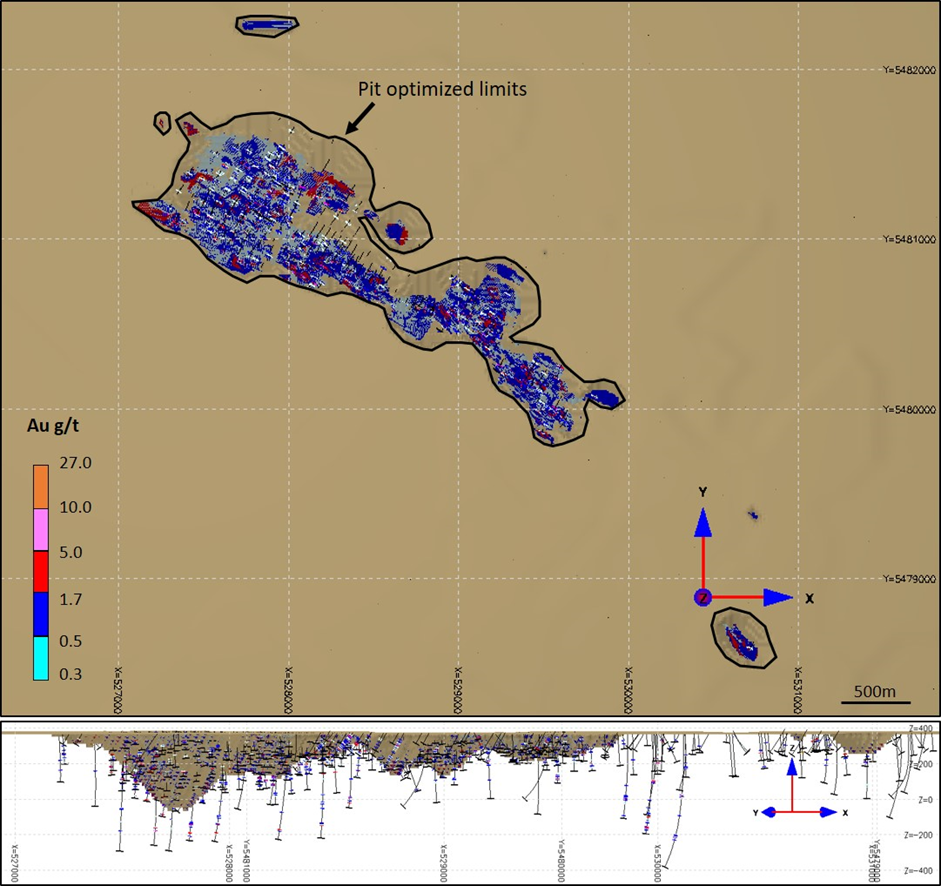

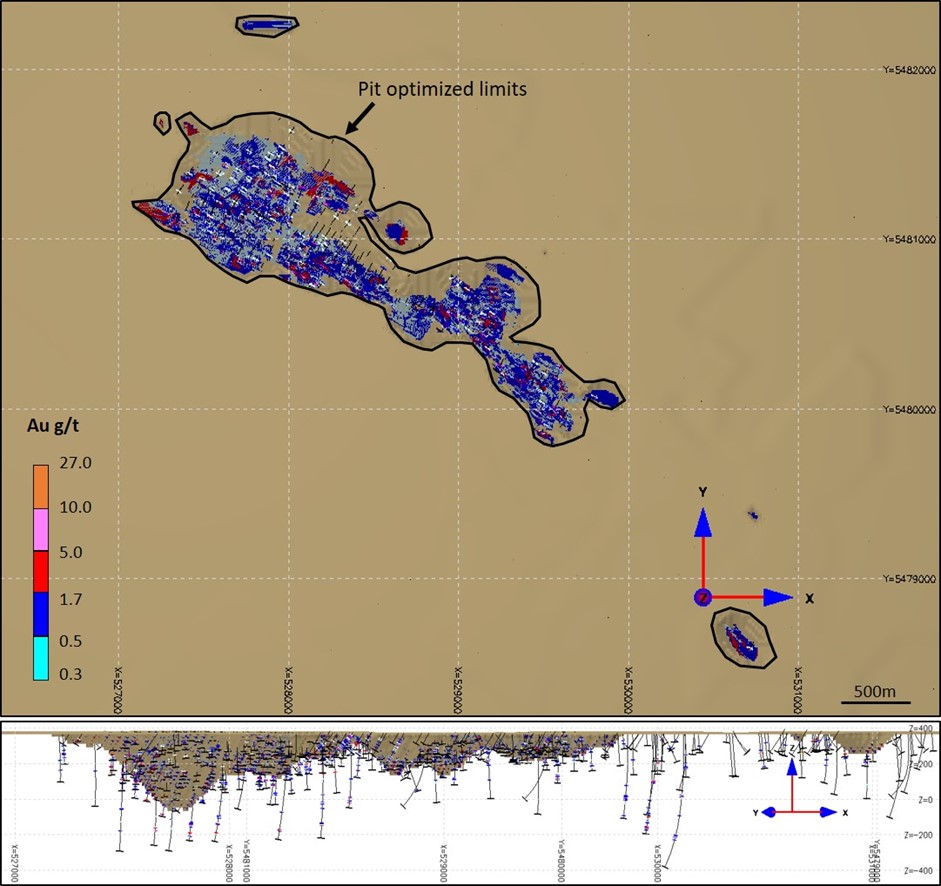

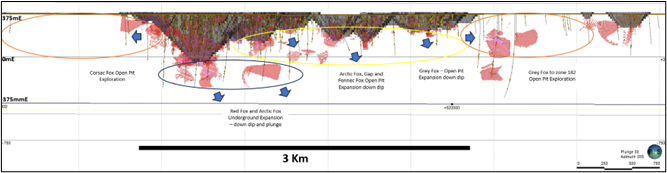

- While the previous mineral resource estimate on the Philibert Project focused exclusively on underground resources from the western domains, with 239,202 ounces at 5.68 g/t gold,[1] the MRE announced today does not include any of the underground potential (Figure 2). Such potential will be further explored, evaluated and potentially included in a subsequent mineral resource estimate;

- Further expansion is anticipated with: i) certain zones along strike and down dip proven mineralized while requiring further drilling to qualify as resource, and ii) the potential for parallel zones to replicate the Philibert mineralization to the North (see Figure 2); and

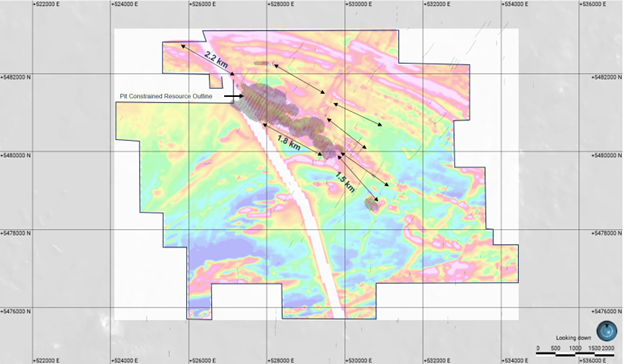

- Work conducted to date on the Philibert Project based on 3 km of mineralization while geophysics is indicative of an additional 4 km of mineralization spreading East and West (see Figure 3).

The MRE, independently prepared by GoldMinds Geoservices Inc. ("GoldMinds"), comprises a total Indicated and Inferred Mineral Resources (as defined in the Canadian Institute of Mining, Metallurgy and Petroleum ("CIM") Definition Standards for Mineral Resources & Mineral Reserves incorporated by reference into NI 43-101) of 278,900 ounces of gold indicated and 1,708,800 ounces of gold inferred and has an effective date of August 04, 2023.

The Philibert Project is located only 9 kilometres from the Nelligan Project ("Nelligan"), owned by IAMGOLD Corporation and Vanstar Mining Resources Inc., which was awarded the "Discovery of the Year" by the Québec Mineral Exploration Association (AEMQ) in 2019. Nelligan recently witnessed a 72% increase in its NI 43-101 resource estimate, and now encompasses a total of 1.99 million ounces at 0.84 g/t in the indicated category and 3.60 million ounces at 0.87 g/t in the inferred category, using a 0.35 g/t cut-off.[2]

Simon Marcotte, President & Chief Executive Officer of Northern Superior, commented: "With the Philibert Project having already achieved considerable size on its first NI 43-101 resource, coupled with its untapped potential, a relatively high-grade nature for a bulk tonnage operation which, generally speaking, provides for shorter payback periods, and attributes such as a low nugget effect, a low overburden cover, and favorable initial metallurgical recovery results, it is clear that the Philibert Project has firmly established itself as a cornerstone of the Chibougamau Gold Camp, which is swiftly gaining recognition. We look forward to continuing being part of this exciting development at a time when capital allocation is increasingly prioritized towards large and scalable opportunities as well as tier-1 jurisdictions such as Quebec. I seize this opportunity to congratulate our team and all parties involved in driving the project to this stage and I express my gratitude to the team at Soquem without whom this opportunity would have never arisen."

Table 1: Mineral Resource Estimates Philibert Property (Rounded values)

Notes:

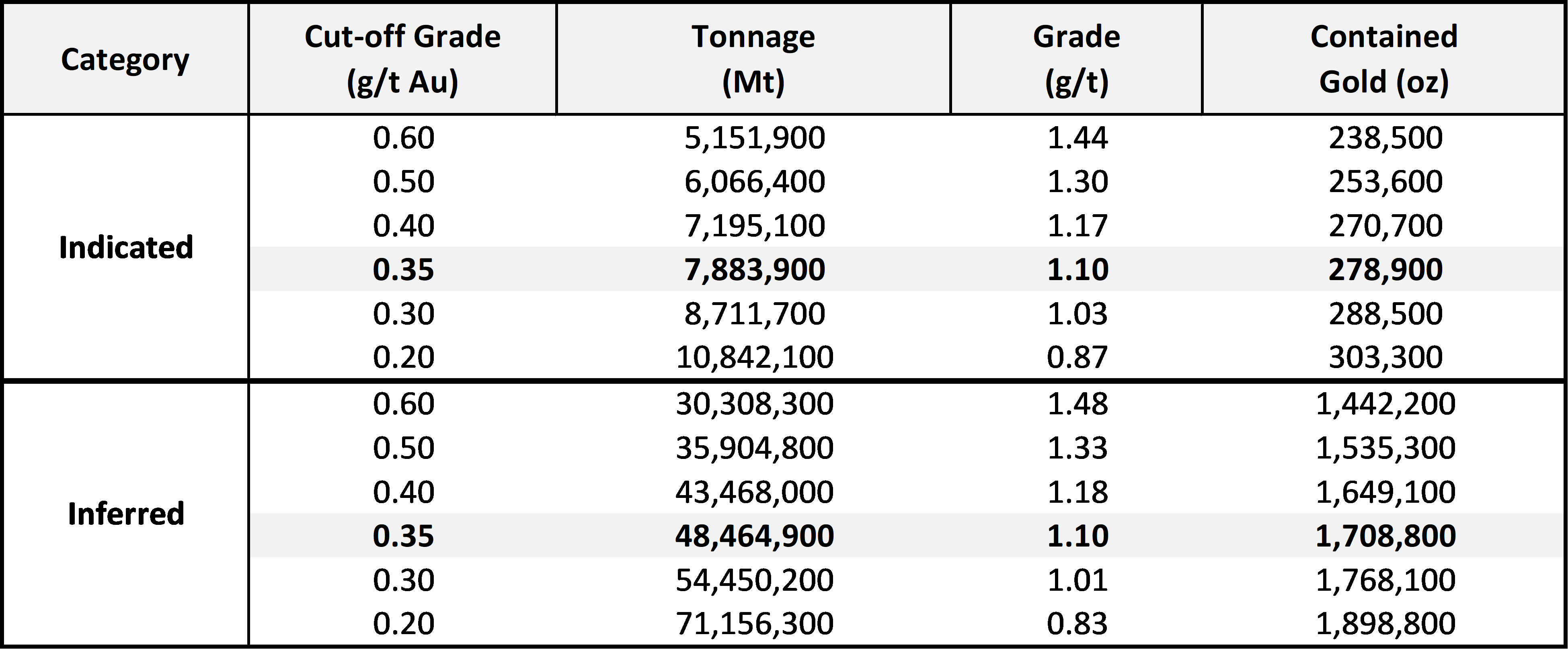

- Mineral resources which are not mineral reserves do not have demonstrated economic viability. The estimate of mineral resources may be materially affected by environmental, permitting, legal, title, market or other relevant issues. The quantity and grade of reported inferred Resources are uncertain in nature and there has not been sufficient work to define these inferred resources as indicated or measured resources.

- The database used for this mineral estimate includes drill results obtained from historical records and up to the recent 2023 drill program.

- Mineral Resources are reported at a cut-off grade of 0.35 g/t Au for the pit-constrained. This cut-off is calculated at a gold price of US$1,746.58 with an exchange rate of 1.3 US$/C$ per troy ounce.

- The pit-constrained resources were based on the following parameters: mining cost 3.25$/t, processing, transport + G&A costs $15/t, Au recovery 93%, bedrock slope angle of 45 degrees.

- The geological interpretation of the deposits was based on lithologies and the observation that mineralized domains.

- The mineral resource presented here were estimated with a block size of 5m X 5m X 5m for the pit-constrained.

- The blocks were interpolated from equal length composites calculated from the mineralized intervals. Prior to compositing, high-grade gold assays were capped to 26.74 g/t Au applied on 1-meter composites for the pit-constrained.

- The mineral estimation was completed using the inverse distance squared methodology utilizing three passes. For each pass, search ellipsoids followed the geological interpretation trends were used. For passe 1 and 2 a minimum of 4 composites and maximum of 12 composites with a maximum of 3 composites from the same drillhole (a minimum of two drillholes are needed to estimate each block). For passe 3 minimum of 3 composites and maximum of 6 composites were used.

- The Mineral Resources have been classified under the guidelines of the CIM Standards on Mineral Resources and Reserves, Definitions and Guidelines prepared by the CIM Standing Committee on Reserve Definitions and adopted by CIM Council (2014), and procedures for classifying the reported Mineral Resources were undertaken within the context of the Canadian Securities Administrators NI 43-101. The classification using a minimum of three drillholes within 30 metres of each other or less defines indicated resources. The inferred resources were classified using 1 pass extends by a maximum of 120 metres and 30 metres thick using one drillhole with a minimum of 2 composites.

- In order to accurately estimate the resources, the claim limits were taken into consideration for the pit optimization.

- Tonnage estimates are based on rock densities of 2.8 tonnes per cubic metre for all the zones. Results are presented undiluted and in situ.

- This mineral resource estimate is dated August 04, 2023 and the effective date for the drillhole database used to produce this updated mineral resource estimate is May 25, 2023. Tonnages and ounces in the tables are rounded to nearest hundred. Numbers may not total due to rounding. The metal contents are presented in troy ounces (tonnes x grade / 31.10348).

- The Qualified Persons are not aware of any known environmental, permitting, legal, title-related, taxation, socio-political, or marketing issues or any other relevant issue not reported in the Technical Report that could materially affect the Mineral Resource Estimate.

Table 2: Table showing the sensitivity to cut-off grade for Indicated and Inferred blocks inside the optimized pit (rounded values).

Mineral Resources Methodology and Assumptions

The Company and GoldMinds compiled, verified, and modelled all technical information available from the Project. A total of 17 wireframes were built for key structures hosting and constraining gold mineralization. Mineralization is hosted in a quartz rich differentiated gabbro sill named the Philibert Horizon, part of the Obatogamau Formation, and focused within west-northwest to northwest trending silicified shear zones with moderate dips to the northeast. Mineralization is characterized by strong silicification, ankerite, sericite and fuchsite alteration and quartz-tourmaline and dark grey quartz veining with rare visible gold and up to 10% disseminated pyrite and pyrrhotite mineralization. The Interpretation was made from cross-sections in Genesis software where selections of mineralization intervals on cross-sections and plan views were combined to generate 3D wireframes. The wireframes are generally snapped to mineralized zones intercepts. A minimum true thickness of 3.0 m was used for the creation of the domains to produce valid solids.

The assay values of the Philibert property were exported for statistical analysis. GoldMinds compiled and reviewed the basic statistics of the gold mineralization and exported only the composites within the envelopes for statistics analysis.

The blocks were interpolated from equal length composites calculated from the mineralized intervals. Prior to compositing, high-grade gold assays were capped to 26.74 Au g/t. The distribution is continuous and values higher than 26.74 g/t seem to be considerably isolated and off from the distribution.

The search ellipsoid orientation and dimensions were determined based on the geologist's interpretations and follow the wireframes orientations. Search ellipsoids were used to select the composites (point data) used in the estimation of the block grade.

In order to calculate tonnage from the volumetric estimates of the block models, a fixed specific gravity ("S.G.") of 2.8 t/m3 was used. This density reflects the typical mineralized interval composed mainly by gabbro and quartz gabbro lithologies. It is recommended to carry additional density measurements on fresh cores during the next drilling program in order to monitor the density.

The wireframes have been filled by regular blocks (5mE x 5mN x 5mZ) and only composites within the wireframes have been used to estimate the block grades. These block models were used for pit optimization and the estimation of the pit-constrained mineral resource. The mineral estimation was completed using the inverse distance to the square methodology utilizing three passes. Search ellipsoids were used to select the composites (point data) and followed the wireframes.

The technical content scientific aspects of this press release have been prepared by Merouane Rachidi, Ph.D. Geologist, and Claude Duplessis, P.Eng., independent Qualified Persons of GoldMinds.

The technical report, prepared in accordance with the NI 43-101, is available on SEDAR+ (www.sedarplus.ca) under the Company's issuer profile. The effective date of the current MRE is August 04, 2023.

Quality Control - Sampling and Laboratory

In 2021 and 2022 all NQ-size split core assays reported were obtained by fire assay with atomic absorption finish and samples returning values over 5 g/t Au in 2021 and 10 g/t Au in 2022 are re-analyzed, utilizing standard Fire Assay-Gravimetric methods. Samples were shipped to AGAT Laboratories with sample preparation done in Val-d'Or, Québec and sample analysis done in Mississauga, Ontario. The quality assurance and quality control protocol include insertion of blank and standard every 25 samples on average, in addition to the regular insertion of blank, duplicate, and standard samples inserted by AGAT Laboratories during the analytical process. All NQ-size split core assays reported for 2023 were obtained by fire assay with ICP-AES finish and samples returning values over 10 ppm Au are re-analyzed, utilizing standard Fire Assay-Gravimetric methods. Samples were shipped to SGS Laboratories with sample preparation done in Val-d'Or, Québec and sample analysis done in Burnaby, British Columbia. Samples with visible gold identified were analyzed by Au - metallic screening on a 1kg sample screened to 106µm, 50g fire assay, gravimetric, AAS or ICP-AES of entire plus fraction and duplicate analysis of minus fraction. The quality assurance and quality control protocol include insertion of blank and standard every 25 samples on average, in addition to the regular insertion of blank, duplicate, and standard samples inserted by SGS Laboratories during the analytical process.

In 2021 independent sampling of historical witness core was conducted at the SOQUEM facilities in Chibougamau, Québec where re-analysis returned similar results with acceptable gold repeatability. In 2022, GoldMinds conducted independent sampling on 2022 drill core drilled by Northern Superior and check assays were acceptable and repeatable. GoldMinds concluded the analytical results in the Northern Superior database can be relied upon which allows the current public disclosure of the mineral resources estimates.

About Northern Superior Resources Inc.

Northern Superior is a gold exploration company focused on the Chibougamau Camp in Québec, Canada. The Company has consolidated the largest land package in the region, with total land holdings currently exceeding 62,000 hectares. The main properties include Philibert, Lac Surprise, Chevrier and Croteau. Northern Superior also owns significant exploration assets in Northern Ontario highlighted by the district scale TPK Project.

The Philibert Project is located 9 km from IAMGOLD Corporation and Vanstar Mining Resources Inc.'s Nelligan Gold project which was awarded the "Discovery of the Year" by the Québec Mineral Exploration Association (AEMQ) in 2019. To date, more than C$15 million (historical value) have been spent on the Philibert Project, with more than 77,000 metres of drilling completed. Northern Superior holds a majority stake of 75% in the Philibert Project, with the remaining 25% owned by SOQUEM, and retains an option to acquire the full 100% ownership of the project. Chevrier hosts an inferred mineral resource of 652,000 ounces Au (underground and open pit) and an indicated mineral resource of 260,000 ounces Au.[3] Croteau Est hosts an inferred mineral resource of 640,000 ounces Au.[4] Lac Surprise hosts the Falcon Zone Discovery, interpreted to be the western strike extension of IAMGOLD Corporation and Vanstar Mining Resources Inc.'s Nelligan Deposit.

Northern Superior is a reporting issuer in British Columbia, Alberta, Ontario and Québec, and trades on the TSX Venture Exchange under the symbol SUP and the OTCQB Venture Market under the symbol NSUPF. For further information, please refer to the Company's website at www.nsuperior.com or on SEDAR+ (www.sedarplus.ca).

About SOQUEM

SOQUEM, a subsidiary of Investissement Québec, is dedicated to promoting the exploration, discovery, and development of mining properties in Québec. SOQUEM also contributes to maintaining strong local economies. Proud partner and ambassador for the development of Québec's mineral wealth, SOQUEM relies on innovation, research, and strategic minerals to be well-positioned for the future.

Northern Superior Resources Inc. on Behalf of the Board of Directors

Simon Marcotte, CFA, President and Chief Executive Officer

Contact Information

Simon Marcotte, CFA

President and Chief Executive Officer

Tel: (647) 801-7273

info@nsuperior.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Note Regarding Forward-Looking Information

This Press Release contains forward-looking information and statements (collectively, "Forward-Looking Statements") that involve risks and uncertainties, which may cause actual results to differ materially from the statements made herein. When used in this document, the words "may", "would", "could", "will", "intend", "plan", "anticipate", "believe", "estimate", "expect" and similar expressions are intended to identify Forward-Looking Statements. Such statements herein include, but are not limited to, statements regarding the Company's ability to convert inferred resources into measured and indicated resources; parameters and methods used to estimate the mineral resource estimate (the "MRE") at the Philibert Project; the prospects, if any, of the Philibert Project and its other projects in the area; and the significance of historic exploration activities and results. There can be no assurance that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Important factors that could cause actual results to differ materially from the Company's expectations include the results of exploration activities, the Company's financial position and general economic conditions, the ability of exploration activities to accurately predict mineralization; the accuracy of geological modelling; the ability of the Company to complete further exploration activities; the legitimacy of title and property interests in the Philibert Project and its other projects in the area; the accuracy of key assumptions, parameters or methods used to estimate the MRE; the ability of the Company to obtain required approvals; the evolution of the global economic climate; metal prices; environmental expectations; community and non-governmental actions; the Company's ability to secure required funding; and other risks detailed from time to time in the filings made by the Company with securities regulators available at www.sedarplus.ca.

The Forward-Looking Statements contained in this news release are expressly qualified in their entirety by this cautionary statement. All Forward-Looking Statements in this news release are made as of the date of this news release and the Company does not undertake to update or revise any such statements contained herein to reflect new events or circumstances, except as may be required by applicable securities laws.

Information Concerning Estimates of Mineral Resources

The disclosure in this news release and referred to herein was prepared in accordance with NI 43-101 which differs from the requirements of the U.S. Securities and Exchange Commission (the "SEC"). The terms "measured mineral resource", "indicated mineral resource" and "inferred mineral resource" used in this news release are in reference to the mining terms defined in the Canadian Institute of Mining, Metallurgy and Petroleum Standards (the "CIM Definition Standards"), which definitions have been adopted by NI 43-101.

Investors are cautioned not to assume that any part or all of mineral resources will ever be converted into reserves. Pursuant to CIM Definition Standards, "inferred mineral resources" are that part of a mineral resource for which quantity and grade or quality are estimated on the basis of limited geological evidence and sampling. Such geological evidence is sufficient to imply but not verify geological and grade or quality continuity. An inferred mineral resource has a lower level of confidence than that applying to an indicated mineral resource and may not be converted to a mineral reserve. However, it is reasonably expected that the majority of inferred mineral resources could be upgraded to indicated mineral resources with continued exploration. Under Canadian rules, estimates of inferred mineral resources may not form the basis of feasibility or pre-feasibility studies. Investors are cautioned not to assume that all or any part of an inferred mineral resource is economically or legally mineable.

Effective February 25, 2019, the SEC adopted new mining disclosure rules under subpart 1300 of Regulation S-K of the United States Securities Act of 1933, as amended (the "SEC Modernization Rules"), with compliance required for the first fiscal year beginning on or after January 1, 2021. The SEC Modernization Rules replace the historical property disclosure requirements included in SEC Industry Guide 7. As a result of the adoption of the SEC Modernization Rules, the SEC now recognizes estimates of "measured mineral resources", "indicated mineral resources" and "inferred mineral resources". Information regarding mineral resources contained or referenced in this news release may not be comparable to similar information made public by companies that report according to U.S. standards. While the SEC Modernization Rules are purported to be "substantially similar" to the CIM Definition Standards, readers are cautioned that there are differences between the SEC Modernization Rules and the CIM Definitions Standards.

[1] Historical information (Internal Report) : Roche Ltée., (1991) Économique, Propriété Philibert. Projet: 11044-001.

[2] Independent Technical Report for the Nelligan Gold Project, Quebec, Canada, February 22, 2023. Prepared in accordance with National Instrument 43-101 Standards of Disclosure for Mineral Projects Technical Report for IAMGOLD Corporation (IAMGOLD) and Vanstar Mining Resources Inc. (Vanstar) by SRK Consulting (Canada) Inc. (SRK).

[3]NI 43-101 Technical Report Mineral Resource Estimation for the Chevrier Main Deposit, Chevrier Project Chibougamau, Quebec, Canada, October 20, 2021, Prepared in accordance with National Instrument 43-101 by Lions Gate Geological Consulting Inc. IOS Services Géoscientifiques Inc. for Northern Superior Resources Inc.

[4] Chalice Gold Mines Limited and Northern Superior Resources Inc. Technical Report on the Croteau Est Gold Project, Québec, September 2015, Prepared in accordance with National Instrument 43-101 by Optiro Pty Ltd ("Optiro") to Chalice Gold Mines Limited and Northern Superior Resources Inc.

SOURCE: Northern Superior Resources Inc.

View source version on accesswire.com:

https://www.accesswire.com/786266/northern-superior-files-43-101-technical-report-for-1708800-gold-ounces-in-inferred-category-and-278900-gold-ounces-in-indicated-category-at-110-gt-in-pit-constrained-resource-estimate-at-philibert