Once one of the biggest winners of the pandemic era, Moderna (MRNA) saw explosive growth as demand for its COVID-19 vaccine surged worldwide. Between 2020 and 2022, investors who put their belief in this unknown biotech saw astronomical returns. But as pandemic-driven sales faded, the company’s stock and revenue momentum has slowed, leaving investors questioning its next chapter.

Now, with a growing pipeline of new vaccines and therapies in development, Moderna is striving to show that its success was not a fluke and that a new period of growth awaits.

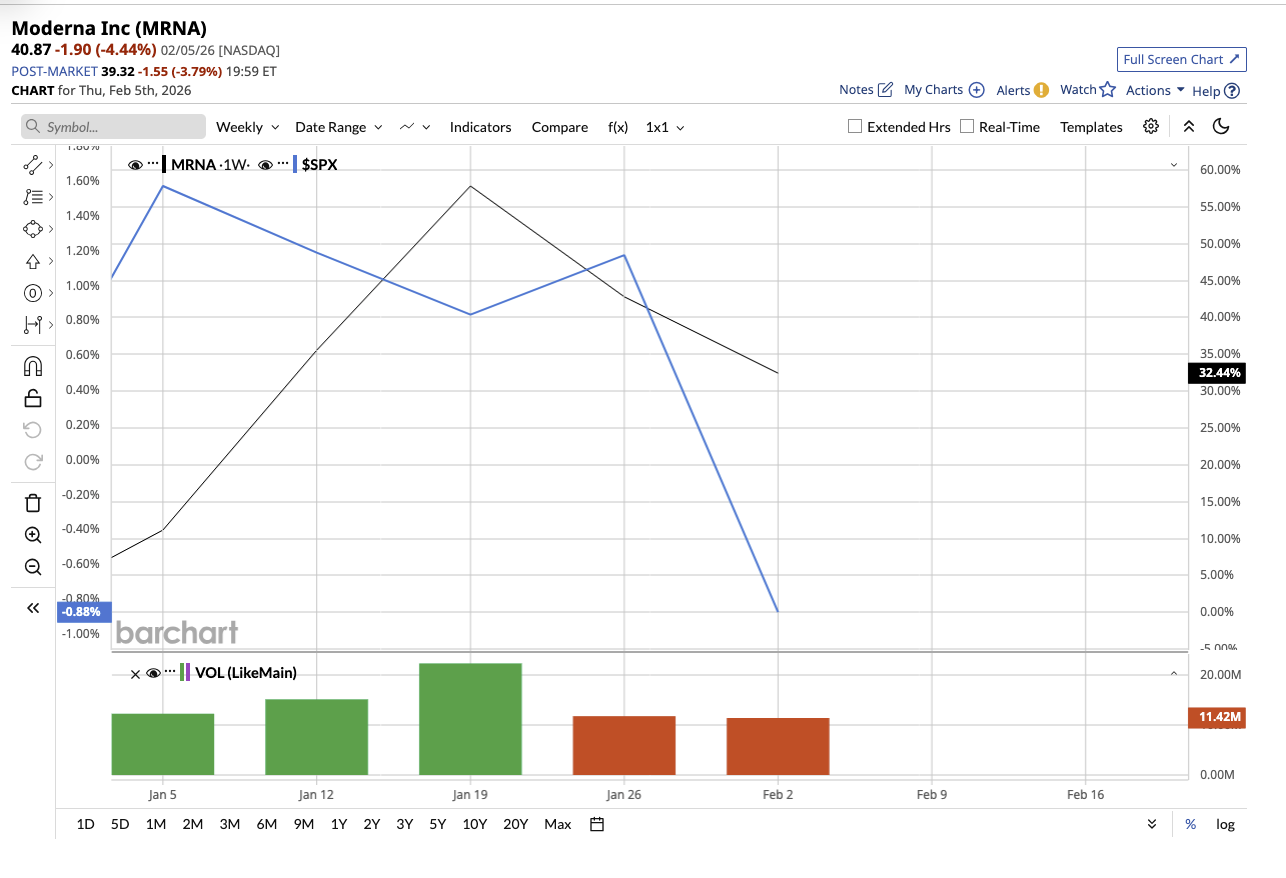

Moderna will report its fourth-quarter and full-year earnings on Feb. 13. MRNA stock has risen 40% so far this year, surpassing the market, but shares are down 25% from the 52-week high of $55.20. With that in mind, let's examine whether the stock is a buy prior to earnings.

Commercial Performance Still Driven by COVID Vaccines

In the third quarter, Moderna reported revenue of $1 billion, primarily driven by sales of its approved vaccines. Total product sales reached $973 million, with additional revenue of $43 million from collaborations, grants, royalties, and stand-ready fees. COVID vaccines remained the leading revenue source, with $971 million in sales during the quarter, including $781 million in the U.S. and $190 million worldwide. The company debuted their upgraded COVID vaccine, mNEXSPIKE, during the 2025-2026 respiratory season, and it has already garnered widespread adoption, accounting for 55% of Moderna's COVID immunization volume.

In RSV, Moderna's mRESVIA vaccine generated $2 million in sales during the quarter and is now approved for adults aged 60 and older in 40 countries, including approval for high-risk adults aged 18 to 59 in 31 of those countries. Despite these developments, total revenue fell 45% year-over-year (YOY), owing mostly to decreased COVID vaccination rates and the lack of a $140 million prior-year adjustment that had increased prior-year quarter figures. Retail channels accounted for 72% of vaccinations in the fall of 2024 and are expected to decrease for full-year 2025 as well. However, even amid declining vaccination demand, Moderna increased its COVID retail market share to 42%.

Management anticipates full-year U.S. revenue of $1 billion to $1.3 billion, indicating ongoing volatility due to seasonal vaccination trends. The company drastically slashed spending, saving $2.1 billion over the last four quarters. Research and development costs fell 30% to $801 million after Phase 3 trials were finished. However, Moderna reported a net loss of $200 million due to decreased revenue. It ended the quarter with $6.6 billion in cash and investments. Importantly, Moderna continues to aim for cash breakeven in 2028.

Pipeline Progress Remains Central to Long-Term Growth

Moderna’s pipeline progress remains crucial to regaining investors’ trust in its comeback story. The company currently has three approved products. Out of those, two programs reported positive Phase 3 results, while five additional candidates are in clinical studies with registrational potential. Management sees them as the key to future revenue growth. In respiratory vaccines, Moderna published promising Phase 3 efficacy data for its seasonal flu vaccine candidate mRNA-1010, with regulatory filings likely in the U.S., Canada, Australia, and Europe before January 2026. Its flu-plus-COVID combination vaccine, mRNA-1083, is being reviewed by the European Medicines Agency, with plans to refile in Canada and await U.S. Food and Drug Administration (FDA) direction in the United States. Meanwhile, the norovirus vaccine program continues in Phase 3.

However, not all programs were successful. Moderna has halted the Phase 3 CMV vaccine investigation, although the Phase 2 trial for bone marrow transplant patients is still ongoing. Beyond vaccines, Moderna continues expanding into oncology and rare diseases. It is undergoing a personalized cancer vaccine program with multiple late-stage studies underway. This is being developed in partnership with Merck (MRK). The Phase 3 adjuvant melanoma trial is fully enrolled, while additional Phase 2 and Phase 3 studies are ongoing across lung cancer, bladder cancer, renal cell carcinoma, and metastatic melanoma.

While the company did not provide any guidance for Q4, analysts expect Moderna to report a GAAP loss of $2.60 per share in the quarter, down from a loss of $2.91 in the prior-year quarter. Revenue could fall by 37% to $623.9 million. For the full year, management expects revenue to be around $1.6 billion to $2 billion, in line with consensus estimates, reflecting improved visibility into seasonal vaccine demand. International revenue could be between $600 million and $700 million for the year, supported by contracted volumes and strategic partnerships. Analysts expect revenue to climb by 8.9% to $2.04 billion in 2026.

Whether Moderna can truly stage a comeback now depends on turning its broad mRNA platform into sustainable commercial success beyond COVID, a transition that could take time. Hence, investors with a high risk appetite and a long-term investment horizon who trust that Moderna could make a comeback will find this a good buy now.

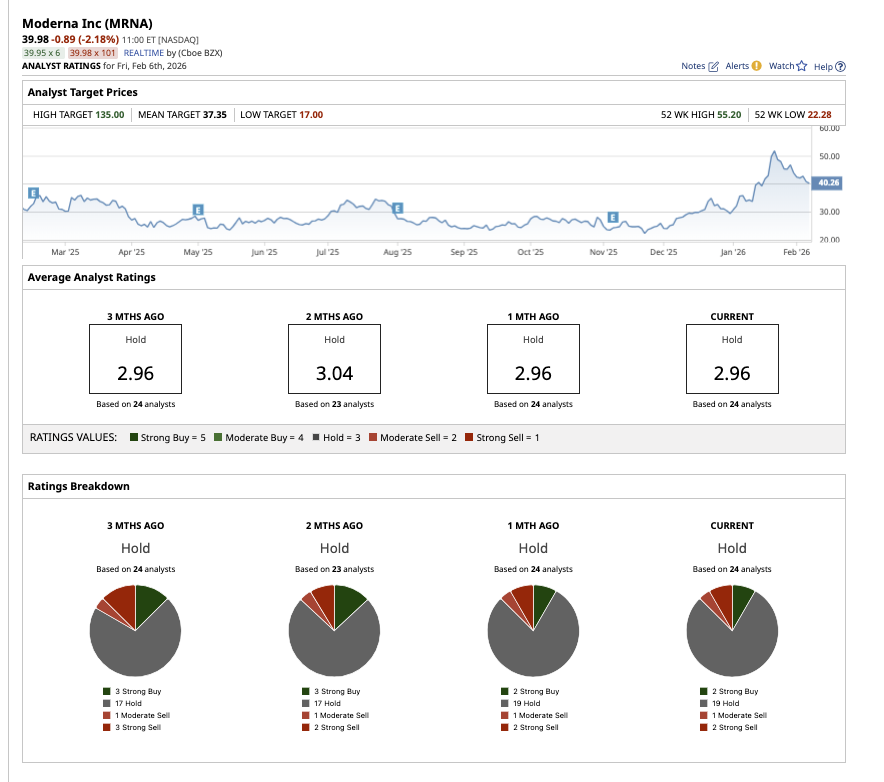

Is Moderna a Buy, Hold, or Sell on Wall Street?

Overall, analysts rate MRNA stock as a consensus “Hold.” Of the 24 analysts covering the stock, two rate it as a “Strong Buy,” 19 rate it as a “Hold,” one calls it a “Moderate Sell,” and two rate MRNA as a “Strong Sell.” Shares of Modrna have surpassed the average target price of $37.35. However, the high price estimate of $135 suggests upside potential of 228% over the next 12 months.

On the date of publication, Sushree Mohanty did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Should You Buy the Post-Earnings Dip in Amazon Stock?

- As Kyndryl Stock Plunges Into Deeply Oversold Territory, Should You Buy the Dip?

- Nvidia Reportedly Faces Gaming GPU Delays: Does That Weaken the Bull Case for NVDA Stock Here?

- Why Even Mega-Bull Dan Ives Lowered His Price Target on Amazon Stock After the CapEx Shock