Pitney Bowes (NYSE: PBI), a global shipping and mailing company that provides technology, logistics, and financial services, today released new findings from its BOXpoll consumer surveys as the end of the peak holiday shipping and returns season coincides with high inflation, continued supply chain pressures, and most U.S. states lifting mask mandates and COVID-19 restrictions. As consumers continue to adapt, some trends are beginning to emerge – including a renewed affinity for at-home delivery.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20220223005773/en/

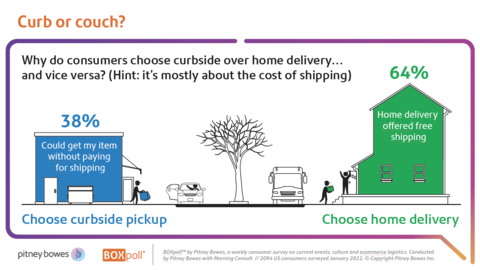

As retailers expand curbside pickup options, 64% of consumers still prefer at-home delivery. (Graphic: Business Wire)

One of the hallmarks of the retail industry’s response to COVID-19 has been the proliferation of curbside pickup, which rose drastically from 7% in December 2019 to 44% by August 2020. Curbside pickup is an attractive option for many omnichannel retailers, allowing them to shift the cost and responsibility of final-mile delivery directly to consumers. During the height of the pandemic, and even the peak holiday shopping season, many consumers were happy to opt for curbside pickup to ensure timely receipt of their goods and to avoid being exposed to COVID-19 in crowded stores.

However, at-home delivery remains king for shoppers. According to a recent BOXpoll survey, when it comes to how consumers want to collect their items, 64% prefer home delivery, while just 23% prefer curbside pickup when given a choice between the two options (12% had no opinion). The only category for which consumers preferred curbside pickup over home delivery was groceries (44% vs. 39%). In all other categories, no more than 25% of consumers preferred curbside pickup.

“While consumers like curbside pickup for time-sensitive or bulky items, our research found that nearly two-thirds of consumers will generally choose home delivery over curbside pickup, despite having to wait,” said Vijay Ramachandran, VP Market Strategy for Global Ecommerce at Pitney Bowes. “For digitally native brands and retailers without the ability to offer curbside, this creates an opportunity to compete with large-format chains.”

Baby Boomers have an especially strong preference for home delivery. Almost three-quarters of the demographic (73%) prefer delivery over curbside, and there was a 35% difference between those who are much more likely (54%) and those who are somewhat more likely (19%) to choose delivery.

The two factors that overwhelmingly drive a choice for home delivery over curbside pickup are free shipping and consumers becoming more flexible with delivery times. More than half (64%) of shoppers say that free delivery on home shipping influences their decision to use it instead of curbside pickup. Conversely, just 38% of consumers would opt for curbside pickup for online purchases (other than groceries) as a way to receive their items without paying for shipping. Thirty-seven percent of consumers would opt for curbside pickup to receive their item faster.

These findings are consistent with previous BOXpoll surveys that found nearly three-quarters of shoppers prioritize cost over delivery speed.

Understanding the significant preference toward at-home delivery over other methods, Pitney Bowes asked consumers about their preferences towards estimated delivery dates provided by retailers. Surprisingly, 59% of all shoppers report that early deliveries are an inconvenience. The top two reasons consumers cited were “not being home on the day of delivery” and “being uncomfortable with deliveries sitting out.”

The survey also revealed that 90% of shoppers say they will contact customer care if their online order doesn’t arrive on the date promised but will give an average grace period of 3 days before doing so. The presentation of delivery days also proved to be important to consumers. Small changes in format such as estimated number of days (“2 days”) slightly beat an estimated date (“February 24”), which is even more preferred than an estimated day of the week, like “Thursday.”

Methodology

The BOXpoll® consumer survey by Pitney Bowes is a weekly consumer survey on current events, culture and ecommerce logistics. Morning Consult conducts weekly polls on behalf of Pitney Bowes among a national sample of more than 2,000 online shoppers. The results included in this press release are extracted from surveys conducted over the past month. The interviews were conducted online, and the data were weighted to approximate a target sample of adults based on age, educational attainment, gender, race, and region. Results from the full survey have a margin of error of +/- 2 percentage points. Visit www.pitneybowes.com/boxpoll for the latest BOXpoll findings.

About Pitney Bowes

Pitney Bowes (NYSE: PBI) is a global shipping and mailing company that provides technology, logistics, and financial services to more than 90 percent of the Fortune 500. Small business, retail, enterprise, and government clients around the world rely on Pitney Bowes to remove the complexity of sending mail and parcels. For the latest news, corporate announcements and financial results visit https://www.pitneybowes.com/us/newsroom.html. For additional information, visit Pitney Bowes at www.pitneybowes.com.

View source version on businesswire.com: https://www.businesswire.com/news/home/20220223005773/en/

Contacts

Brett Cody

Pitney Bowes

(203) 218-1187

brett.cody@pb.com