PVH Corp (NYSE: PVH) is a global apparel company best known for its Calvin Klein and Tommy Hilfiger brand clothing, apparel and accessories. The consumer discretionary sector company is segmented into 6 departments, including Tommy Hilfiger and Calvin Klein North America and International divisions and Heritage Brands Wholesale and Retail divisions. The company has been cutting edge with contemporary and modern design trends. The company recovered from its post-pandemic hangover as margins improved while inventories shrank and consumer spending was buoyant.

However, its recent earnings guidance cut caused investors to hit the brakes as shares collapsed 22% despite the authorization of a $2 billion stock buyback program. This caused competitor stocks like Capri Holdings Limited (NYSE: CPRI), maker of Versace, Jimmy Choo, and Michael Kors products and Ralph Lauren Co. (NYSE: RL) to sell off in sympathy.

Strong Quarter, But Guidance Was Soft

PVH Corp reported Q4 2023 EPS of $3.71, beating $3.53 consensus analyst estimates by 19 cents. Earnings before interest and tax (EBIT) on a GAAP basis was $357 million, including a $5 million positive impact from forex, compared to $297 million in the year-ago period. Revenues were unchanged YoY to $2.49 billion still beating $2.42 billion consensus estimates. The company sold its Heritage Brands women’s intimates business at the close of the fourth quarter. Interest expense fell to $20 million, down from $22 million in the year-ago period. The company approved a $2 billion stock buyback program through July 2028. Stay on top of the stock market sectors on MarketBeat.

Ugly Downside Guidance

PVH Corp. issued downside fiscal Q1 2024 EPS of $2.15 versus $2.59 consensus estimates. Revenues are expected to fall 11% at $1.90 billion versus $2.08 billion consensus estimates. Full-year 2024 EPS is expected between $10.75 to $11.00 versus $12.11 consensus estimates. Full-year 2024 revenues are expected to be between $8.57 billion and 8.66 billion versus the consensus estimates of $9.04 billion.

Macroeconomic Conditions Divisive Across Regions

International revenues rose 4% YoY, driven mainly by Asia Pacific growth, which offset the challenging macroeconomic conditions in Europe. This impacted the wholesale channel. Tommy Hilfiger's revenues rose 1% YoY, while Tommy Hilfiger International saw revenues decline 1%. Tommy Hilfiger North America saw a 4% revenue increase. Calvin Klein's revenue increased 4% YoY. Calvin Klein International's revenue increased by 12%, while Calvin Klein North America's revenue fell 8% YoY.

Department Stores Cautious Over Inventory Glut

The weakness in wholesale overshadowed the strong growth in direct-to-consumer (DTC). This can be attributed to major department stores like Macy's Inc. (NYSE: M) and Nordstrom Inc. (NYSE: JWN) being ever more cautious on inventory levels as they recover from post-pandemic inventory glut. Wholesale revenues fell 10% YoY, which was inclusive of the 3% reduction from the Heritage Brands women's intimates business. Wholesale customers took a cautious approach to managing their inventory levels by ordering less. Get AI-powered insights on MarketBeat.

Margin Improvement

Gross margins improved to 60.3% versus 55.9% in the year-ago period. This was attributed to benefits from lower products, freight and logistics costs and a favorable shift in the channel mix regionally. Inventories fell 21% YoY as the company proactively managed inventory levels.

CEO Insights

PVH Corp. CEO Stefan Larsson noted how the company drove double-digit growth in its owned and operated e-commerce and high-single-digit growth in its stores. Larsson noted how the company ended 2023 in great shape, with inventory down 21% YoY, producing significant cash flow to buy back $550 million of stock. They have grown their European business to 20% larger than it was in 2019. Asia is a growth engine taking share with double-digit revenue growth.

Larsson remained upbeat, brushing off the lowered guidance, "From a number's perspective, this translates into our guidance for 2024 of revenue down 6% to 7% or down approximately 3% to 4% on a comparable basis, excluding the sale of our Heritage Brands intimates business at 53rd week in 2023. We're driving further gross margin expansion and despite the deleverage from our European business, we will maintain our EBIT margins versus 2023.”

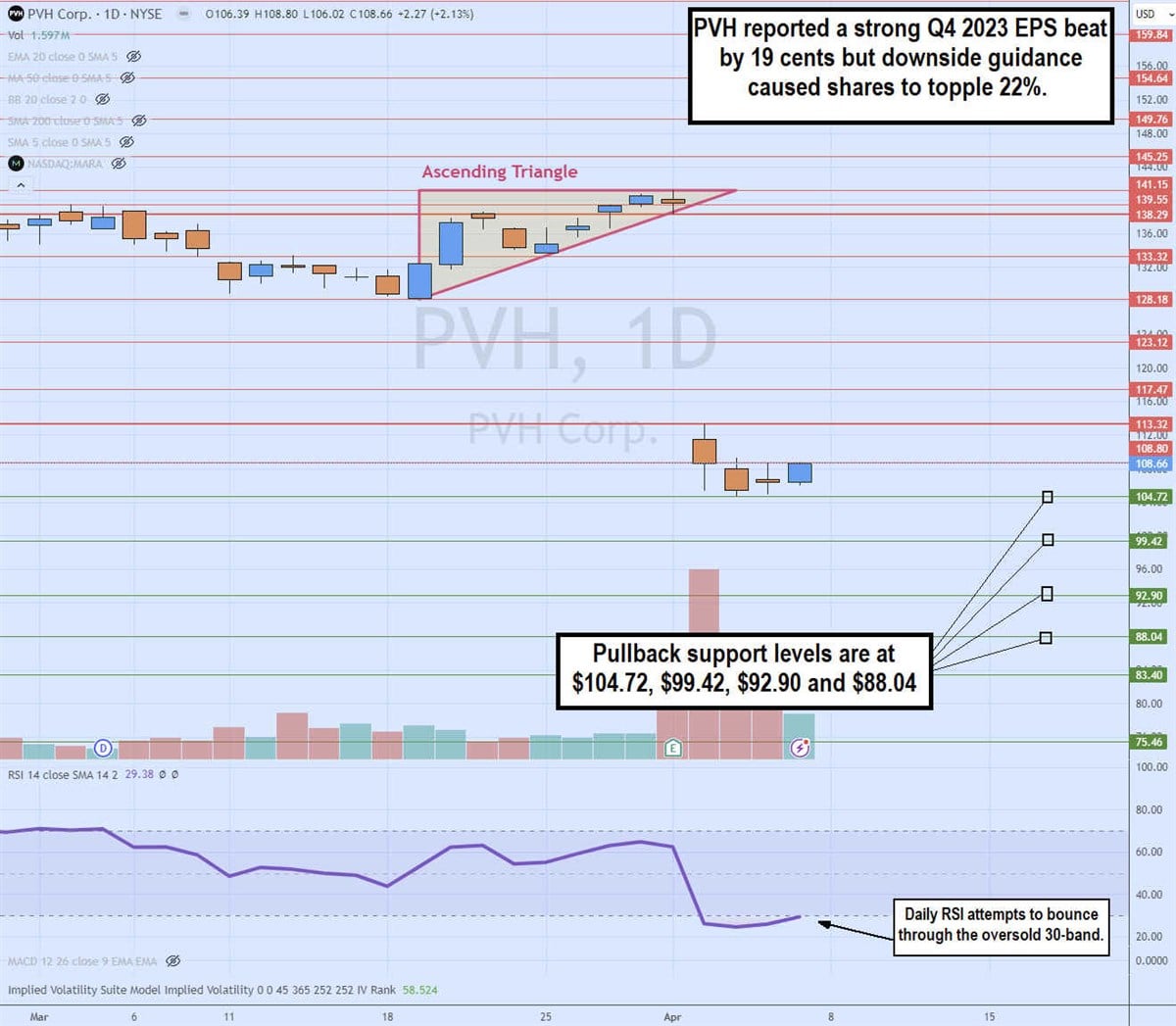

Daily Ascending Triangle Breakdown Pattern

The PVH candlestick chart illustrates an ascending triangle breakdown pattern. Prior to the earnings report, PVH had formed an ascending trendline from the $128.18 swing low comprised of higher lows on pullbacks. The flat-top horizontal trendline formed at $141.15 heading into Q4 2023 earnings. The weak guidance caused a gap down to $113.32 and a 22% price collapse. The daily relative strength index (RSI) is attempting to coil through the oversold 30-band. Pullback support levels are at $104.72, $99.42, $92.90 and $88.04.

PVH Corp. analyst ratings and price targets are at MarketBeat. The MarketBeat stock screener can help you find PVH Corp's peers and competitor stocks.