Over the last six months, Driven Brands’s shares have sunk to $14.61, producing a disappointing 18.4% loss - a stark contrast to the S&P 500’s 14.7% gain. This might have investors contemplating their next move.

Is there a buying opportunity in Driven Brands, or does it present a risk to your portfolio? Get the full breakdown from our expert analysts, it’s free for active Edge members.

Why Is Driven Brands Not Exciting?

Even with the cheaper entry price, we're cautious about Driven Brands. Here are three reasons there are better opportunities than DRVN and a stock we'd rather own.

1. Core Business Falling Behind as Demand Plateaus

Investors interested in Industrial & Environmental Services companies should track organic revenue in addition to reported revenue. This metric gives visibility into Driven Brands’s core business because it excludes one-time events such as mergers, acquisitions, and divestitures along with foreign currency fluctuations - non-fundamental factors that can manipulate the income statement.

Over the last two years, Driven Brands failed to grow its organic revenue. This performance was underwhelming and implies it may need to improve its products, pricing, or go-to-market strategy. It also suggests Driven Brands might have to lean into acquisitions to accelerate growth, which isn’t ideal because M&A can be expensive and risky (integrations often disrupt focus).

2. Cash Burn Ignites Concerns

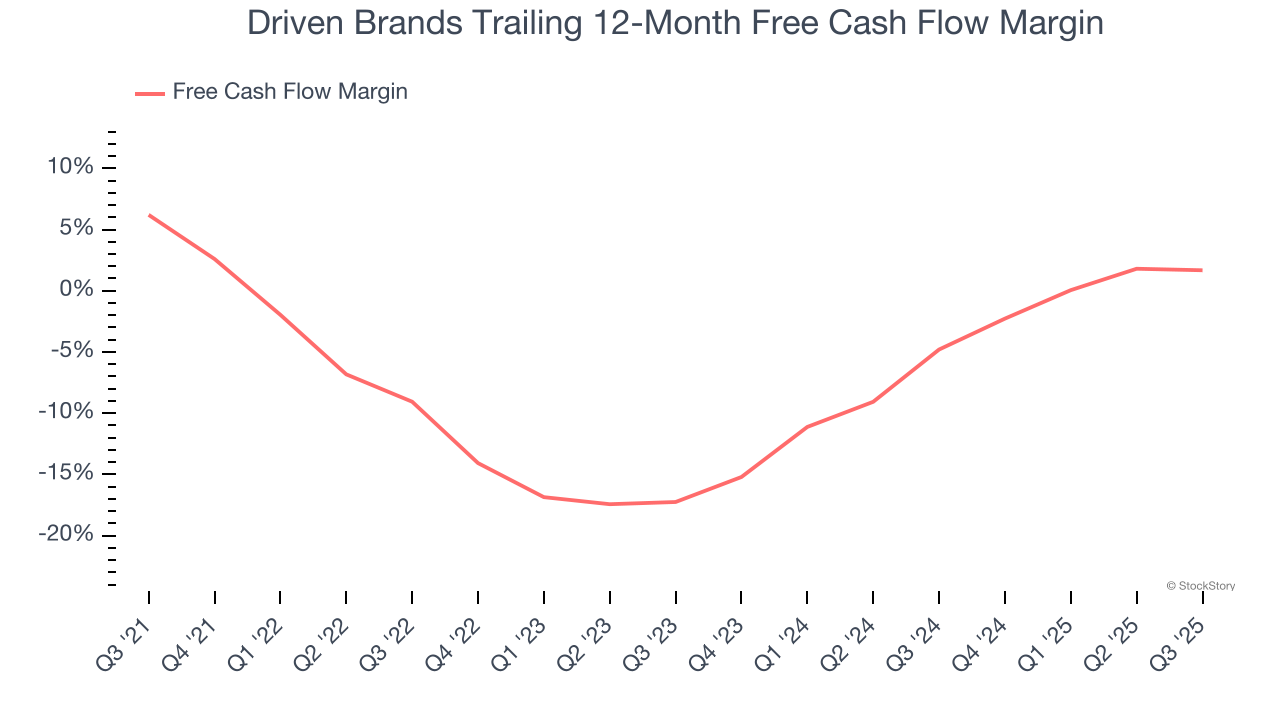

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

While Driven Brands posted positive free cash flow this quarter, the broader story hasn’t been so clean. Driven Brands’s demanding reinvestments have drained its resources over the last five years, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin averaged negative 5.6%, meaning it lit $5.57 of cash on fire for every $100 in revenue. This is a stark contrast from its adjusted operating margin, and its investments in working capital/capital expenditures are the primary culprit.

3. Previous Growth Initiatives Have Lost Money

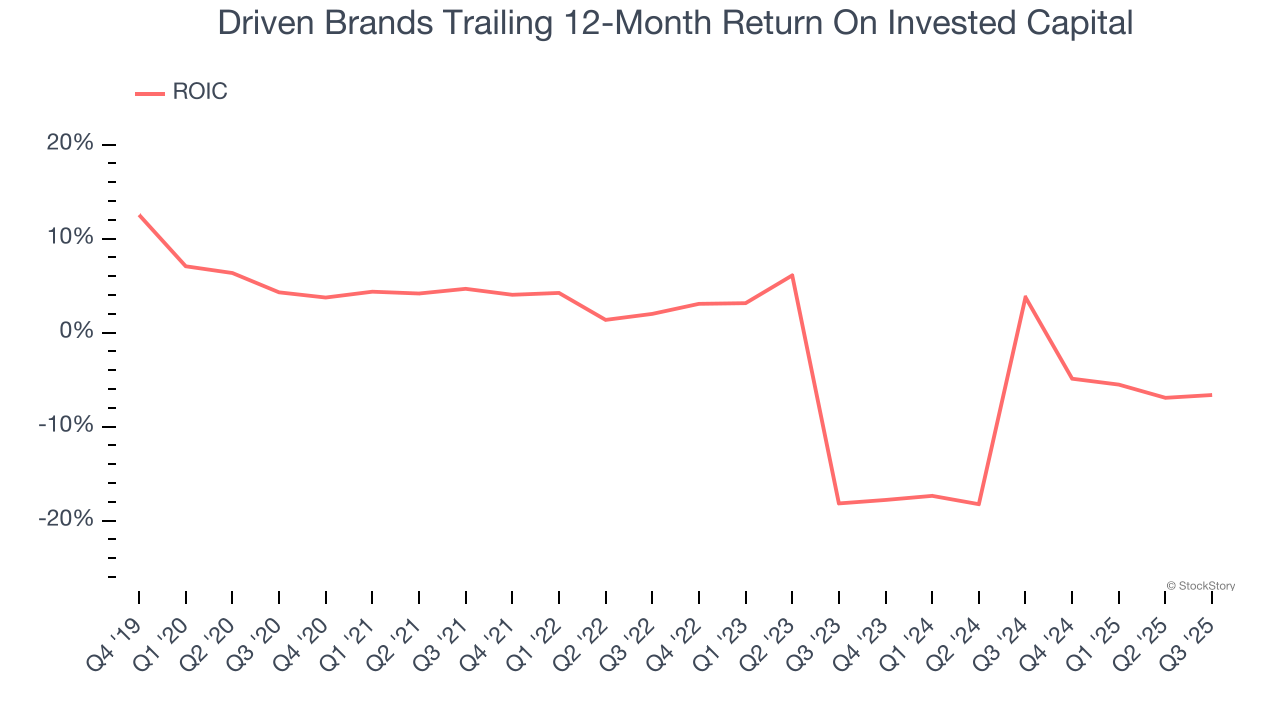

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Driven Brands’s five-year average ROIC was negative 2.9%, meaning management lost money while trying to expand the business. Its returns were among the worst in the business services sector.

Final Judgment

Driven Brands’s business quality ultimately falls short of our standards. After the recent drawdown, the stock trades at 10.5× forward P/E (or $14.61 per share). While this valuation is fair, the upside isn’t great compared to the potential downside. We're pretty confident there are more exciting stocks to buy at the moment. We’d suggest looking at a safe-and-steady industrials business benefiting from an upgrade cycle.

High-Quality Stocks for All Market Conditions

Your portfolio can’t afford to be based on yesterday’s story. The risk in a handful of heavily crowded stocks is rising daily.

The names generating the next wave of massive growth are right here in our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.