Concentrix’s stock price has taken a beating over the past six months, shedding 26.1% of its value and falling to $41.58 per share. This was partly driven by its softer quarterly results and might have investors contemplating their next move.

Given the weaker price action, is this a buying opportunity for CNXC? Find out in our full research report, it’s free for active Edge members.

Why Does Concentrix Spark Debate?

With a team of approximately 450,000 employees across 75 countries, Concentrix (NASDAQ: CNXC) designs and delivers customer experience solutions that help global brands manage their customer interactions across digital channels and contact centers.

Two Positive Attributes:

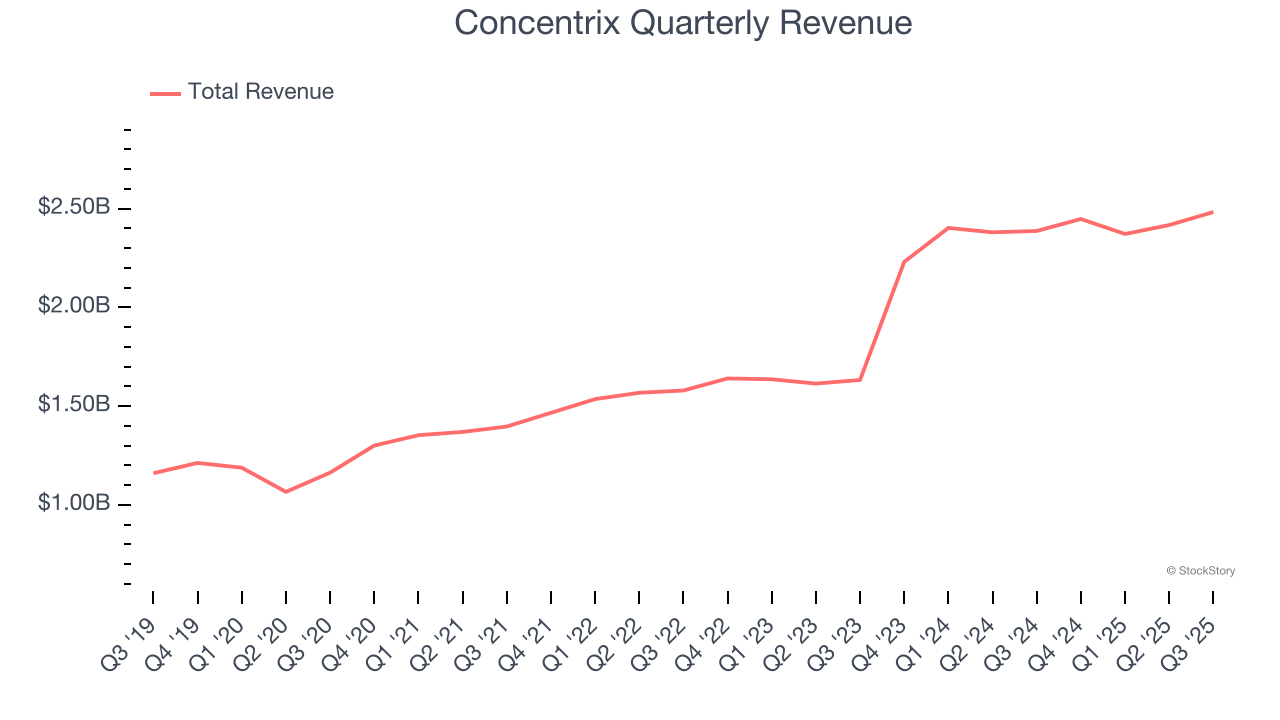

1. Skyrocketing Revenue Shows Strong Momentum

A company’s long-term sales performance is one signal of its overall quality. Any business can have short-term success, but a top-tier one grows for years. Luckily, Concentrix’s sales grew at an incredible 16% compounded annual growth rate over the last five years. Its growth surpassed the average business services company and shows its offerings resonate with customers.

2. Economies of Scale Give It Negotiating Leverage with Suppliers

With $9.72 billion in revenue over the past 12 months, Concentrix is one of the larger companies in the business services industry and benefits from a well-known brand that influences purchasing decisions.

One Reason to be Careful:

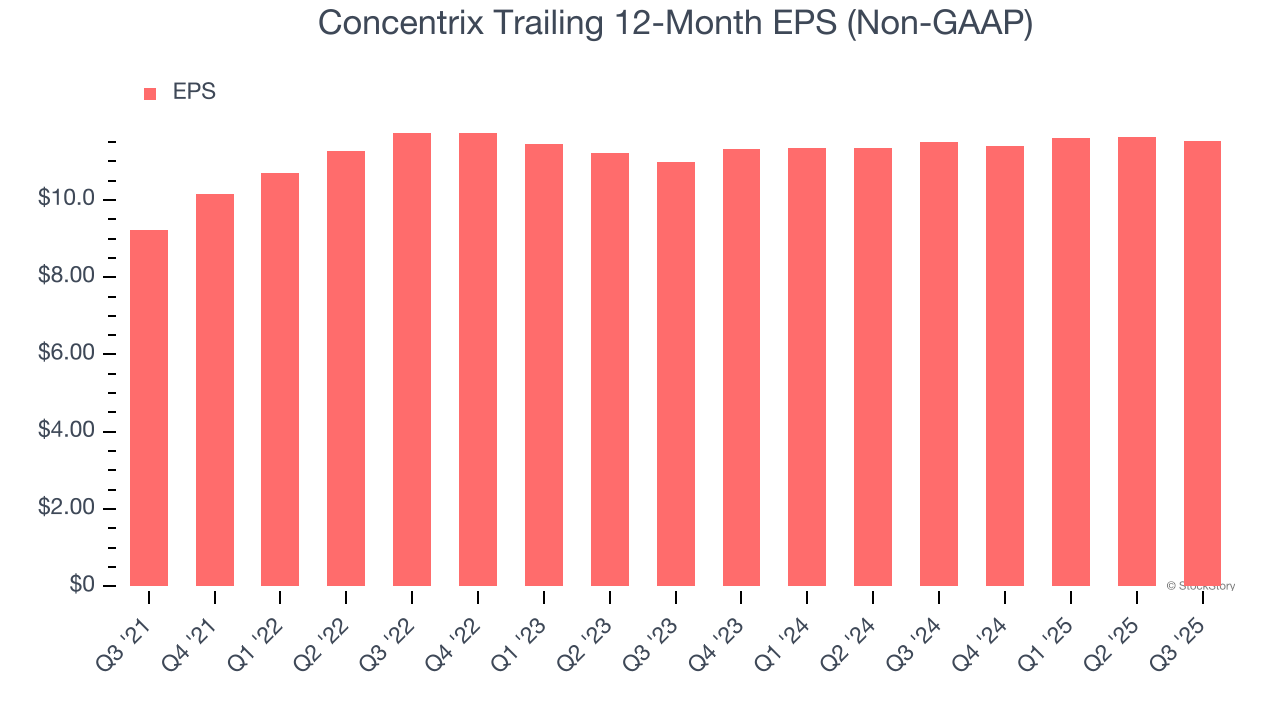

EPS Barely Growing

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Concentrix’s full-year EPS grew at an unimpressive 5.7% compounded annual growth rate over the last four years, worse than the broader business services sector.

Final Judgment

Concentrix’s positive characteristics outweigh the negatives. With the recent decline, the stock trades at 3.5× forward P/E (or $41.58 per share). Is now the right time to buy? See for yourself in our in-depth research report, it’s free for active Edge members.

High-Quality Stocks for All Market Conditions

If your portfolio success hinges on just 4 stocks, your wealth is built on fragile ground. You have a small window to secure high-quality assets before the market widens and these prices disappear.

Don’t wait for the next volatility shock. Check out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.