Cosmetics company e.l.f. Beauty (NYSE: ELF) beat Wall Street’s revenue expectations in Q4 CY2025, with sales up 37.8% year on year to $489.5 million. The company’s full-year revenue guidance of $1.61 billion at the midpoint came in 2.3% above analysts’ estimates. Its non-GAAP profit of $1.24 per share was 71.4% above analysts’ consensus estimates.

Is now the time to buy e.l.f. Beauty? Find out by accessing our full research report, it’s free.

e.l.f. Beauty (ELF) Q4 CY2025 Highlights:

- Revenue: $489.5 million vs analyst estimates of $460.1 million (37.8% year-on-year growth, 6.4% beat)

- Adjusted EPS: $1.24 vs analyst estimates of $0.72 (71.4% beat)

- Adjusted EBITDA: $123 million vs analyst estimates of $82.65 million (25.1% margin, 48.9% beat)

- The company lifted its revenue guidance for the full year to $1.61 billion at the midpoint from $1.56 billion, a 2.9% increase

- Management raised its full-year Adjusted EPS guidance to $3.08 at the midpoint, a 8.8% increase

- EBITDA guidance for the full year is $324.5 million at the midpoint, above analyst estimates of $306.9 million

- Operating Margin: 13.8%, up from 9.9% in the same quarter last year

- Free Cash Flow was $52.79 million, up from -$19.76 million in the same quarter last year

- Market Capitalization: $5.06 billion

Company Overview

Short for "eyes, lips, face", e.l.f. Beauty (NYSE: ELF) is a developer of high-quality beauty products at accessible price points.

Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul.

With $1.52 billion in revenue over the past 12 months, e.l.f. Beauty is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage with retailers. On the bright side, it can grow faster because it has a longer list of untapped store chains to sell into.

As you can see below, e.l.f. Beauty’s 45.2% annualized revenue growth over the last three years was incredible. This is an encouraging starting point for our analysis because it shows e.l.f. Beauty’s demand was higher than many consumer staples companies.

This quarter, e.l.f. Beauty reported wonderful year-on-year revenue growth of 37.8%, and its $489.5 million of revenue exceeded Wall Street’s estimates by 6.4%.

Looking ahead, sell-side analysts expect revenue to grow 17.6% over the next 12 months, a deceleration versus the last three years. Despite the slowdown, this projection is healthy and indicates the market is forecasting success for its products.

The 1999 book Gorilla Game predicted Microsoft and Apple would dominate tech before it happened. Its thesis? Identify the platform winners early. Today, enterprise software companies embedding generative AI are becoming the new gorillas. a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

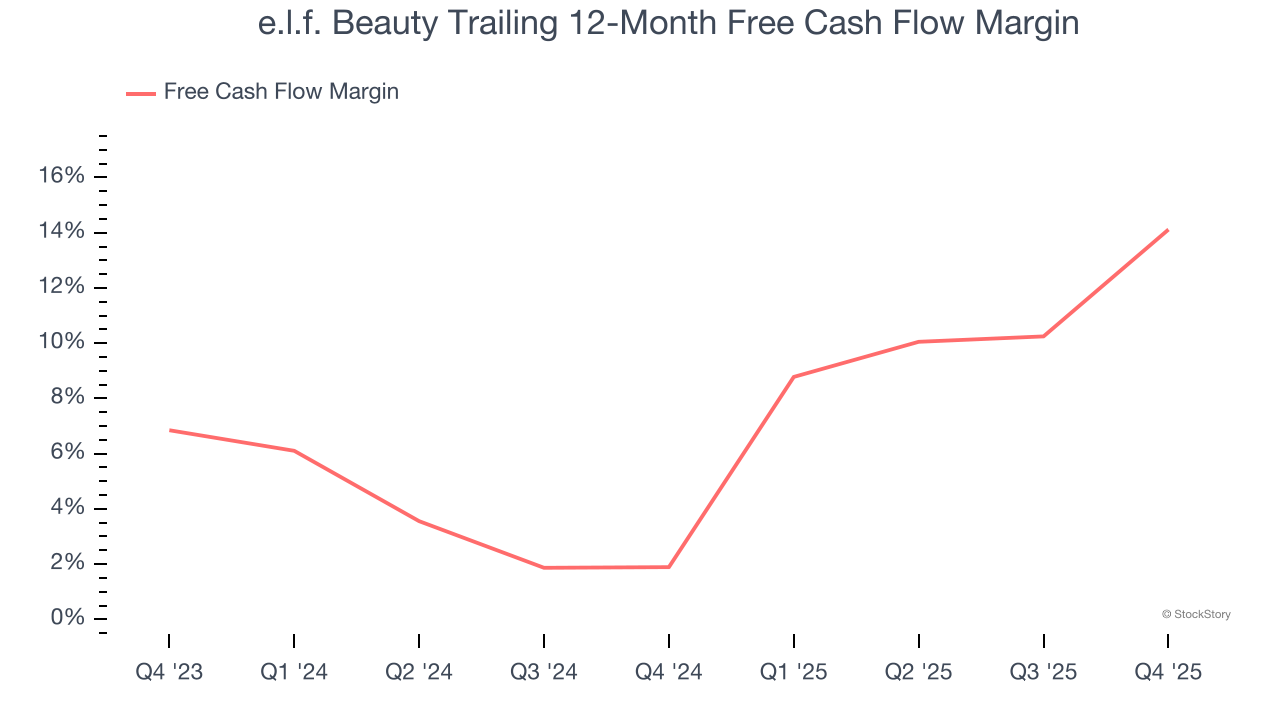

e.l.f. Beauty has shown impressive cash profitability, driven by its attractive business model that gives it the option to reinvest or return capital to investors. The company’s free cash flow margin averaged 8.5% over the last two years, better than the broader consumer staples sector.

Taking a step back, we can see that e.l.f. Beauty’s margin expanded by 12.2 percentage points over the last year. This is encouraging, and we can see it became a less capital-intensive business because its free cash flow profitability rose more than its operating profitability.

e.l.f. Beauty’s free cash flow clocked in at $52.79 million in Q4, equivalent to a 10.8% margin. Its cash flow turned positive after being negative in the same quarter last year, building on its favorable historical trend.

Key Takeaways from e.l.f. Beauty’s Q4 Results

It was good to see e.l.f. Beauty beat analysts’ revenue and EPS expectations convincingly this quarter. We were also excited that the company raised full-year guidance for those two metrics. Zooming out, we think this quarter featured some important positives. The stock traded up 2.1% to $86.97 immediately after reporting.

Sure, e.l.f. Beauty had a solid quarter, but if we look at the bigger picture, is this stock a buy? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here (it’s free).