Wireless chipmaker Qualcomm (NASDAQ: QCOM) met Wall Street’s revenue expectations in Q4 CY2025, with sales up 5% year on year to $12.25 billion. On the other hand, next quarter’s revenue guidance of $10.6 billion was less impressive, coming in 4.9% below analysts’ estimates. Its non-GAAP profit of $3.50 per share was 2.9% above analysts’ consensus estimates.

Is now the time to buy Qualcomm? Find out by accessing our full research report, it’s free.

Qualcomm (QCOM) Q4 CY2025 Highlights:

- Revenue: $12.25 billion vs analyst estimates of $12.21 billion (5% year-on-year growth, in line)

- Adjusted EPS: $3.50 vs analyst estimates of $3.40 (2.9% beat)

- Adjusted Operating Income: $4.41 billion vs analyst estimates of $4.29 billion (36% margin, 2.8% beat)

- Revenue Guidance for Q1 CY2026 is $10.6 billion at the midpoint, below analyst estimates of $11.15 billion

- Adjusted EPS guidance for Q1 CY2026 is $2.55 at the midpoint, below analyst estimates of $2.87

- Operating Margin: 27.5%, down from 30.5% in the same quarter last year

- Free Cash Flow Margin: 36%, similar to the same quarter last year

- Inventory Days Outstanding: 109, down from 145 in the previous quarter

- Market Capitalization: $157.2 billion

Company Overview

Having been at the forefront of developing the standards for cellular connectivity for over four decades, Qualcomm (NASDAQ: QCOM) is a leading innovator and a fabless manufacturer of wireless technology chips used in smartphones, autos and internet of things appliances.

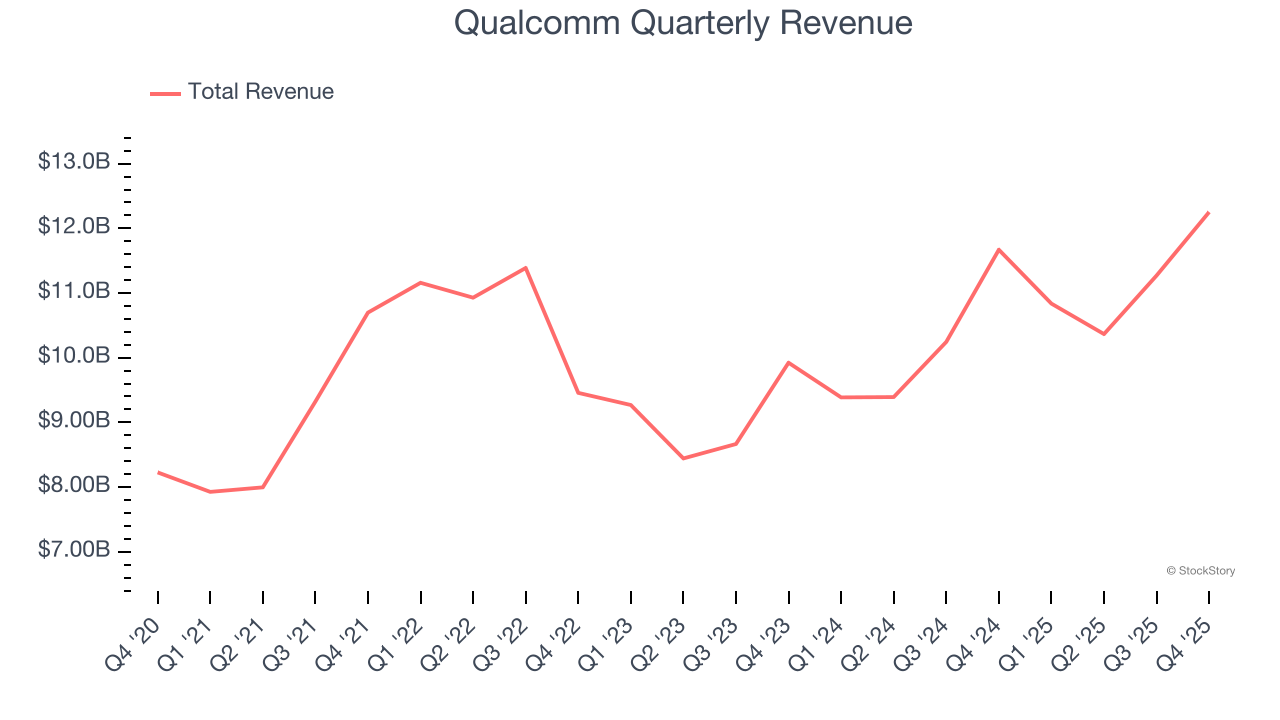

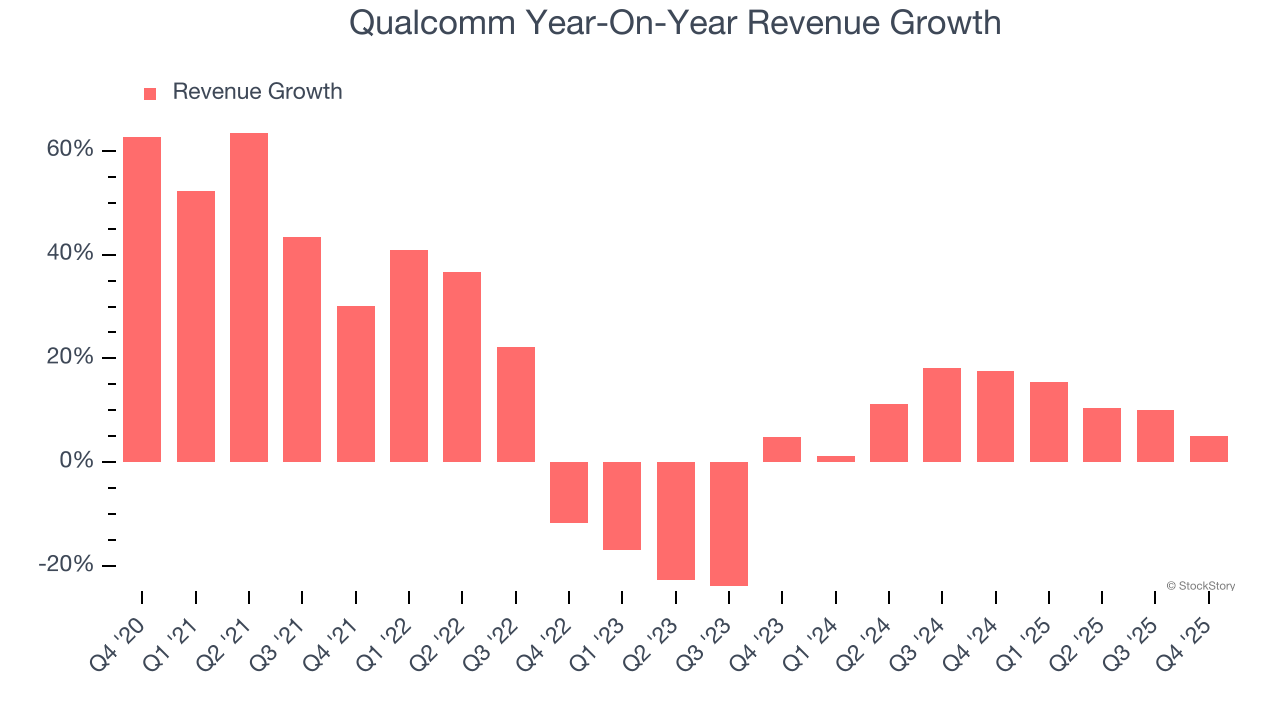

Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last five years, Qualcomm grew its sales at a solid 12.5% compounded annual growth rate. Its growth beat the average semiconductor company and shows its offerings resonate with customers, a helpful starting point for our analysis. Semiconductors are a cyclical industry, and long-term investors should be prepared for periods of high growth followed by periods of revenue contractions.

We at StockStory place the most emphasis on long-term growth, but within semiconductors, a half-decade historical view may miss new demand cycles or industry trends like AI. Qualcomm’s annualized revenue growth of 11% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.

This quarter, Qualcomm grew its revenue by 5% year on year, and its $12.25 billion of revenue was in line with Wall Street’s estimates. Beyond meeting estimates, this marks 9 straight quarters of growth, showing that the current upcycle has had a good run - a typical upcycle usually lasts 8-10 quarters. Company management is currently guiding for a 2.2% year-on-year decline in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to remain flat over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and suggests its products and services will face some demand challenges. At least the company is tracking well in other measures of financial health.

While Wall Street chases Nvidia at all-time highs, an under-the-radar semiconductor supplier is dominating a critical AI component these giants can’t build without. Click here to access our free report one of our favorites growth stories.

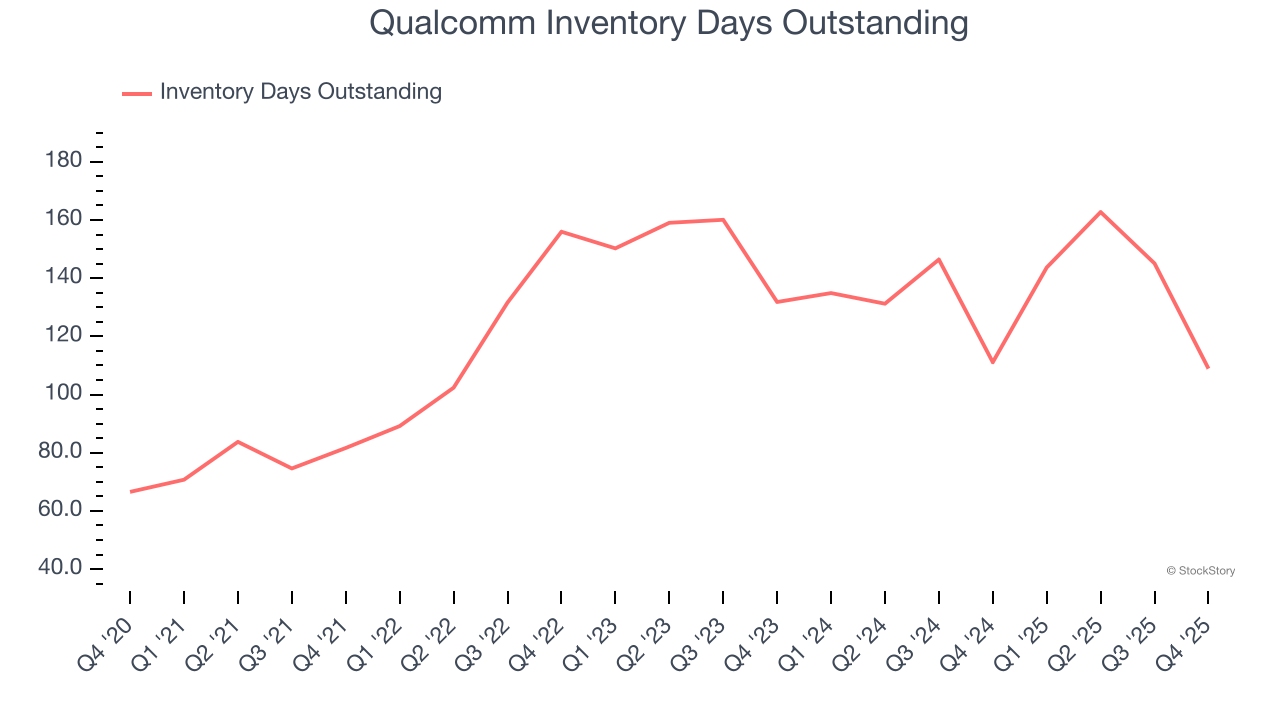

Product Demand & Outstanding Inventory

Days Inventory Outstanding (DIO) is an important metric for chipmakers, as it reflects a business’ capital intensity and the cyclical nature of semiconductor supply and demand. In a tight supply environment, inventories tend to be stable, allowing chipmakers to exert pricing power. Steadily increasing DIO can be a warning sign that demand is weak, and if inventories continue to rise, the company may have to downsize production.

This quarter, Qualcomm’s DIO came in at 109, which is 15 days below its five-year average. At the moment, these numbers show no indication of an excessive inventory buildup.

Key Takeaways from Qualcomm’s Q4 Results

We were impressed by Qualcomm’s strong improvement in inventory levels. We were also happy its adjusted operating income outperformed Wall Street’s estimates. On the other hand, its revenue guidance for next quarter missed. Zooming out, we think this was a mixed quarter. The market seemed to be hoping for more, and the stock traded down 7.7% to $134.28 immediately following the results.

Big picture, is Qualcomm a buy here and now? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here (it’s free).