Social network Snapchat (NYSE: SNAP) announced better-than-expected revenue in Q4 CY2025, with sales up 10.2% year on year to $1.72 billion. Its GAAP profit of $0.03 per share was significantly above analysts’ consensus estimates.

Is now the time to buy Snap? Find out by accessing our full research report, it’s free.

Snap (SNAP) Q4 CY2025 Highlights:

- Revenue: $1.72 billion vs analyst estimates of $1.70 billion (10.2% year-on-year growth, 0.9% beat)

- EPS (GAAP): $0.03 vs analyst estimates of -$0.03 (significant beat)

- Adjusted EBITDA: $357.7 million vs analyst estimates of $299.2 million (20.8% margin, 19.5% beat)

- Operating Margin: 2.9%, up from -1.7% in the same quarter last year

- Free Cash Flow Margin: 12%, up from 6.2% in the previous quarter

- Daily Active Users: 474 million, up 21 million year on year

- Market Capitalization: $10.49 billion

“Our Q4 results began to reflect the impact of our strategic pivot toward profitable growth, translating into revenue diversification and meaningful margin expansion,” said Evan Spiegel, CEO.

Company Overview

Founded by Stanford University students Evan Spiegel, Reggie Brown, and Bobby Murphy, and originally called Picaboo, Snapchat (NYSE: SNAP) is an image centric social media network.

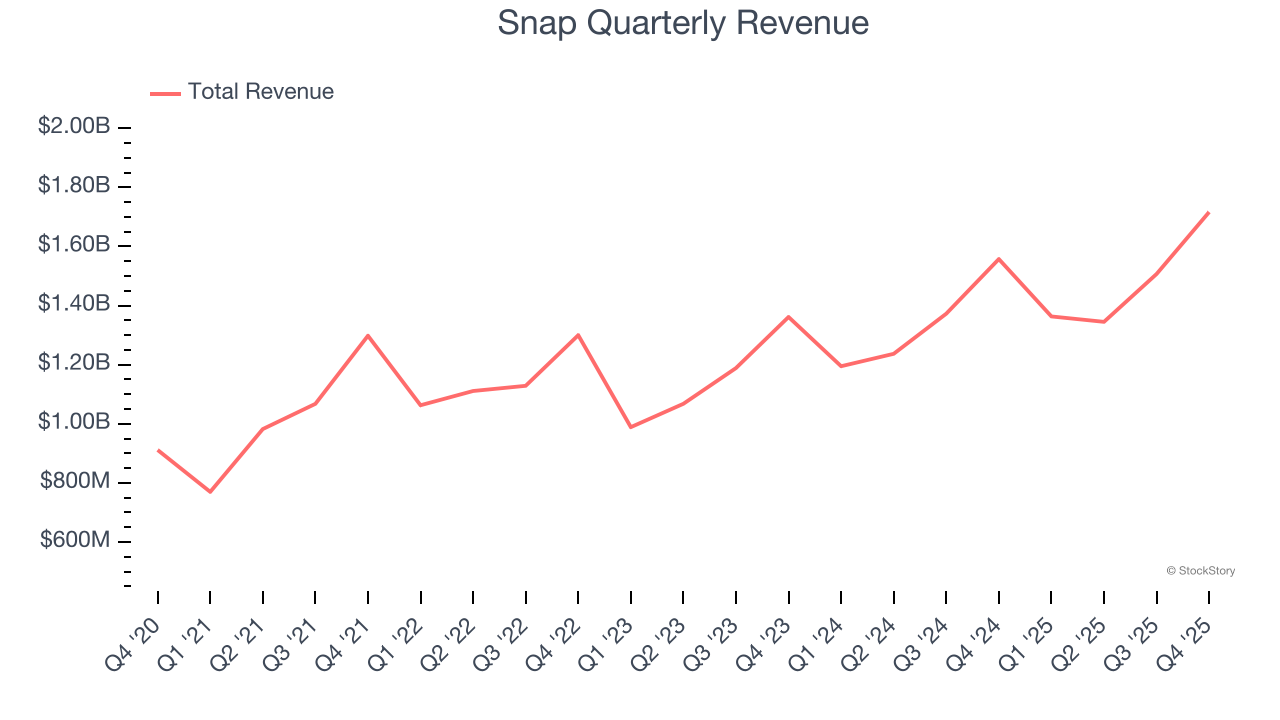

Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Unfortunately, Snap’s 8.8% annualized revenue growth over the last three years was mediocre. This wasn’t a great result compared to the rest of the consumer internet sector, but there are still things to like about Snap.

This quarter, Snap reported year-on-year revenue growth of 10.2%, and its $1.72 billion of revenue exceeded Wall Street’s estimates by 0.9%.

Looking ahead, sell-side analysts expect revenue to grow 14.4% over the next 12 months, an acceleration versus the last three years. This projection is noteworthy and implies its newer products and services will fuel better top-line performance.

While Wall Street chases Nvidia at all-time highs, an under-the-radar semiconductor supplier is dominating a critical AI component these giants can’t build without. Click here to access our free report one of our favorites growth stories.

Daily Active Users

User Growth

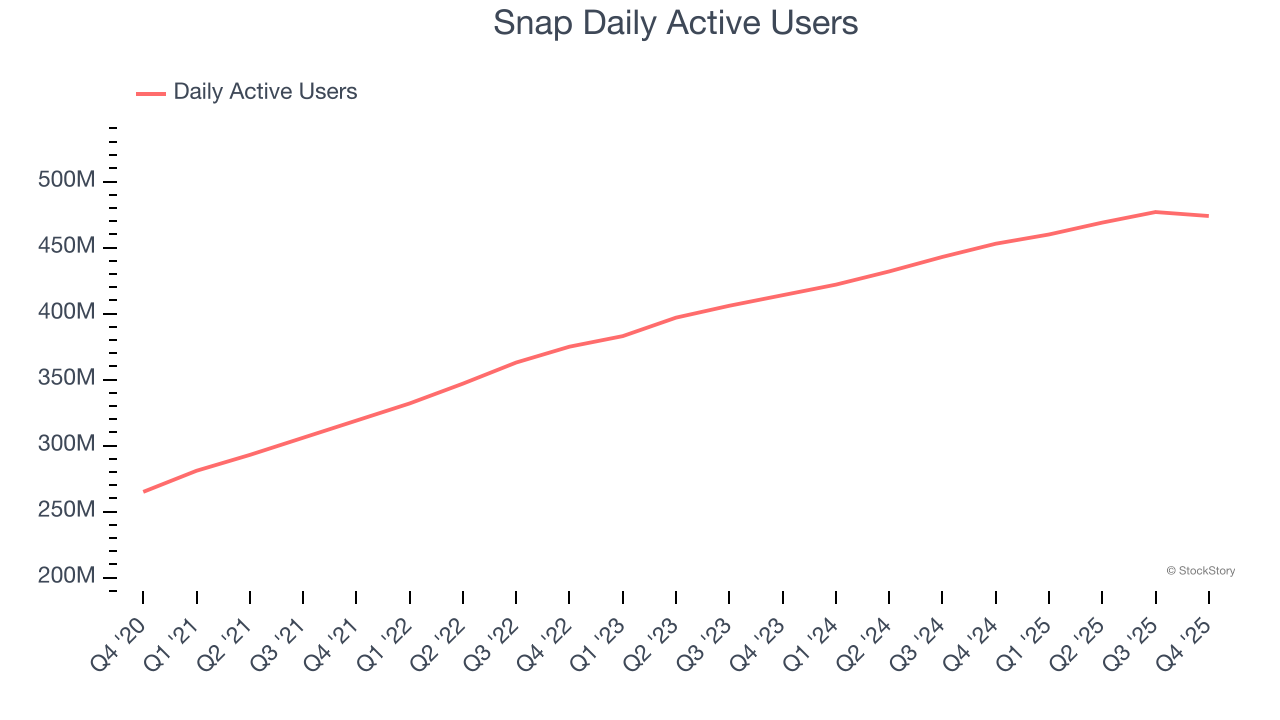

As a social network, Snap generates revenue growth by increasing its user base and charging advertisers more for the ads each user is shown.

Over the last two years, Snap’s daily active users, a key performance metric for the company, increased by 8.4% annually to 474 million in the latest quarter. This growth rate is decent for a consumer internet business and indicates people enjoy using its offerings.

In Q4, Snap added 21 million daily active users, leading to 4.6% year-on-year growth. The quarterly print was lower than its two-year result, suggesting its new initiatives aren’t accelerating user growth just yet.

Revenue Per User

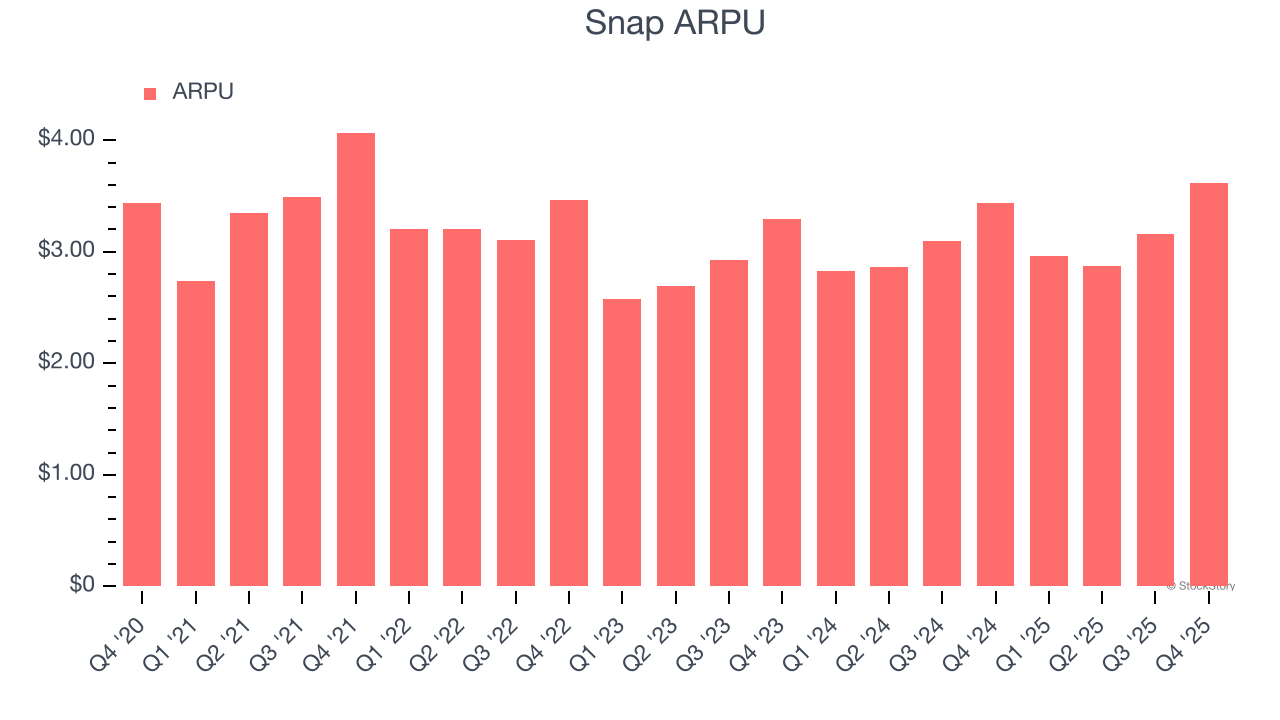

Average revenue per user (ARPU) is a critical metric to track because it measures how much the company earns from the ads shown to its users. ARPU can also be a proxy for how valuable advertisers find Snap’s audience and its ad-targeting capabilities.

Snap’s ARPU growth has been mediocre over the last two years, averaging 4.8%. This isn’t great, but the increase in daily active users is more relevant for assessing long-term business potential. We’ll monitor the situation closely; if Snap tries boosting ARPU by taking a more aggressive approach to monetization, it’s unclear whether users can continue growing at the current pace.

This quarter, Snap’s ARPU clocked in at $3.62. It grew by 5.2% year on year, mirroring the performance of its daily active users.

Key Takeaways from Snap’s Q4 Results

We were impressed by how significantly Snap blew past analysts’ EBITDA expectations this quarter on a slight revenue beat. On the other hand, its number of daily active users slightly missed. Overall, this print had some key positives. The stock traded up 5.1% to $6.24 immediately following the results.

Is Snap an attractive investment opportunity right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here (it’s free).