As the Q3 earnings season comes to a close, it’s time to take stock of this quarter’s best and worst performers in the online marketplace industry, including Instacart (NASDAQ: CART) and its peers.

Marketplaces have existed for centuries. Where once it was a main street in a small town or a mall in the suburbs, sellers benefitted from proximity to one another because they could draw customers by offering convenience and selection. Today, a myriad of online marketplaces fulfill that same role, aggregating large customer bases, which attracts commission-paying sellers, generating flywheel scale effects that feed back into further customer acquisition.

The 12 online marketplace stocks we track reported a strong Q3. As a group, revenues beat analysts’ consensus estimates by 2.3% while next quarter’s revenue guidance was in line.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 15.9% since the latest earnings results.

Instacart (NASDAQ: CART)

Powering more than one billion grocery orders since its founding, Instacart (NASDAQ: CART) is an online grocery shopping and delivery platform that partners with retailers to help customers shop from local stores through its app or website.

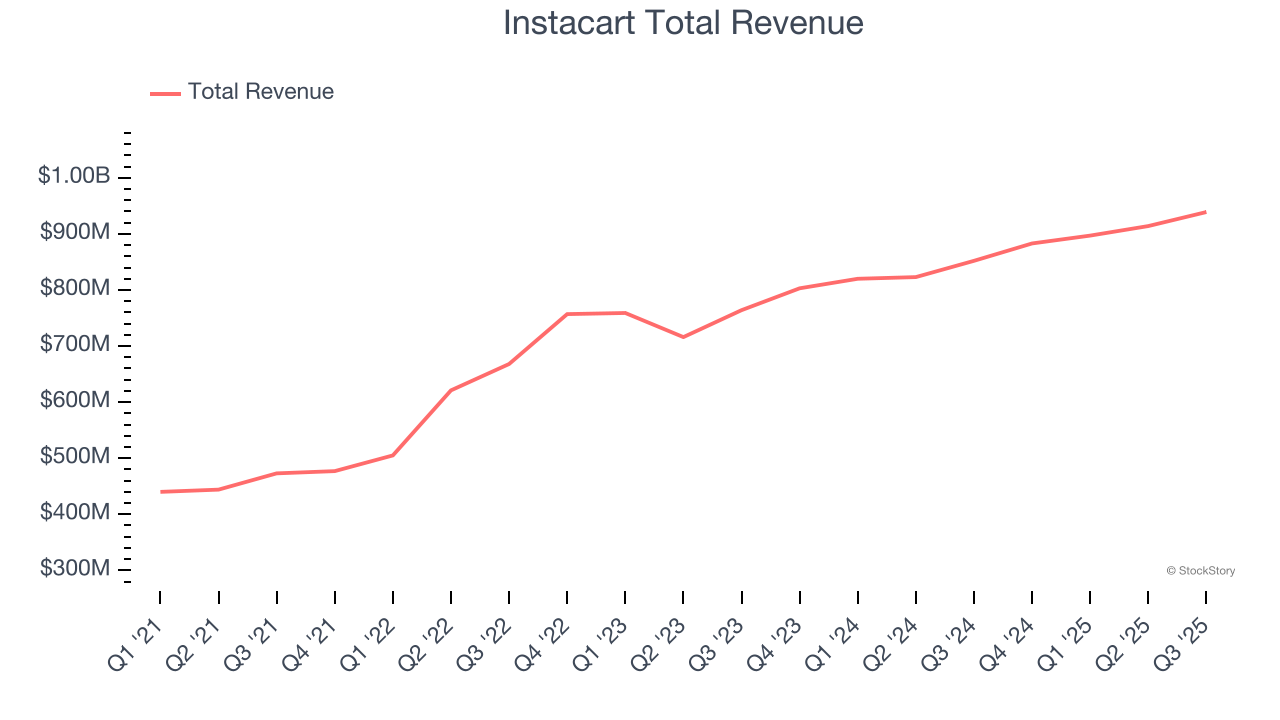

Instacart reported revenues of $939 million, up 10.2% year on year. This print exceeded analysts’ expectations by 0.5%. Overall, it was a strong quarter for the company with a solid beat of analysts’ EBITDA estimates and a narrow beat of analysts’ revenue estimates.

The market was likely pricing in the results, and the stock is flat since reporting. It currently trades at $36.62.

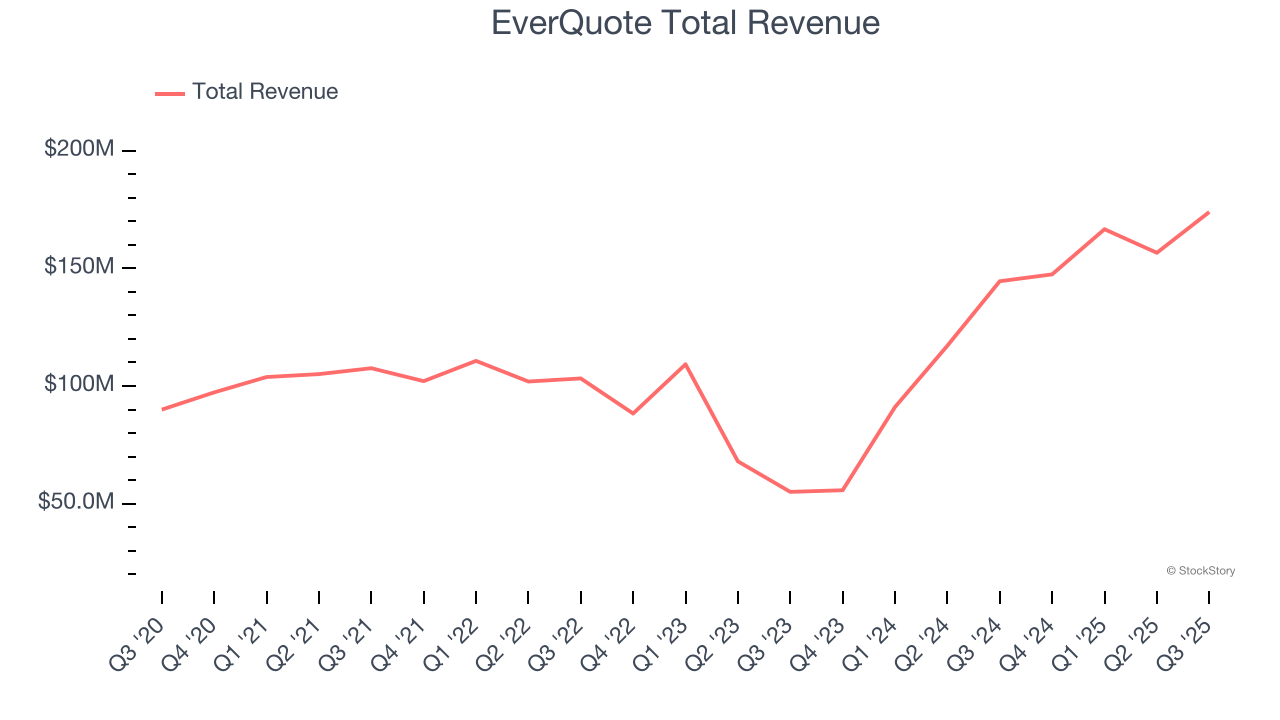

Best Q3: EverQuote (NASDAQ: EVER)

Aiming to simplify a once complicated process, EverQuote (NASDAQ: EVER) is an online insurance marketplace where consumers can compare and purchase various types of insurance from different providers

EverQuote reported revenues of $173.9 million, up 20.3% year on year, outperforming analysts’ expectations by 4.3%. The business had an exceptional quarter with an impressive beat of analysts’ EBITDA estimates and revenue guidance for next quarter exceeding analysts’ expectations.

Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 18.9% since reporting. It currently trades at $18.18.

Is now the time to buy EverQuote? Access our full analysis of the earnings results here, it’s free.

Weakest Q3: ACV Auctions (NYSE: ACVA)

Founded in 2014, ACV Auctions (NASDAQ: ACVA) is an online auction marketplace for car dealers and wholesalers to buy and sell used cars.

ACV Auctions reported revenues of $199.6 million, up 16.5% year on year, in line with analysts’ expectations. It was a disappointing quarter as it posted full-year revenue guidance slightly missing analysts’ expectations and full-year EBITDA guidance missing analysts’ expectations significantly.

ACV Auctions delivered the highest full-year guidance raise but had the weakest performance against analyst estimates in the group. The company reported 218,065 units sold, up 9.9% year on year. As expected, the stock is down 7.7% since the results and currently trades at $7.53.

Read our full analysis of ACV Auctions’s results here.

eBay (NASDAQ: EBAY)

Originally known as the first online auction site, eBay (NASDAQ: EBAY) is one of the world’s largest online marketplaces.

eBay reported revenues of $2.82 billion, up 9.5% year on year. This result beat analysts’ expectations by 3.2%. Aside from that, it was a mixed quarter as it also logged an impressive beat of analysts’ EBITDA estimates but a slight miss of analysts’ number of active buyers estimates.

eBay had the weakest full-year guidance update among its peers. The company reported 134 million active buyers, up 0.8% year on year. The stock is down 13.7% since reporting and currently trades at $85.86.

Read our full, actionable report on eBay here, it’s free.

Cars.com (NYSE: CARS)

Originally started as a joint venture between several media companies including The Washington Post and The New York Times, Cars.com (NYSE: CARS) is a digital marketplace that connects new and used car buyers and sellers.

Cars.com reported revenues of $181.6 million, up 1.1% year on year. This print met analysts’ expectations. However, it was a mixed quarter as it underperformed in some other aspects of the business.

The company reported 19,526 active buyers, up 1.4% year on year. The stock is up 9.3% since reporting and currently trades at $11.38.

Read our full, actionable report on Cars.com here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Top 6 Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.