Stride has gotten torched over the last six months - since August 2025, its stock price has dropped 42% to $87.23 per share. This might have investors contemplating their next move.

Following the pullback, is now a good time to buy LRN? Find out in our full research report, it’s free.

Why Are We Positive On LRN?

Formerly known as K12, Stride (NYSE: LRN) is an education technology company providing education solutions through digital platforms.

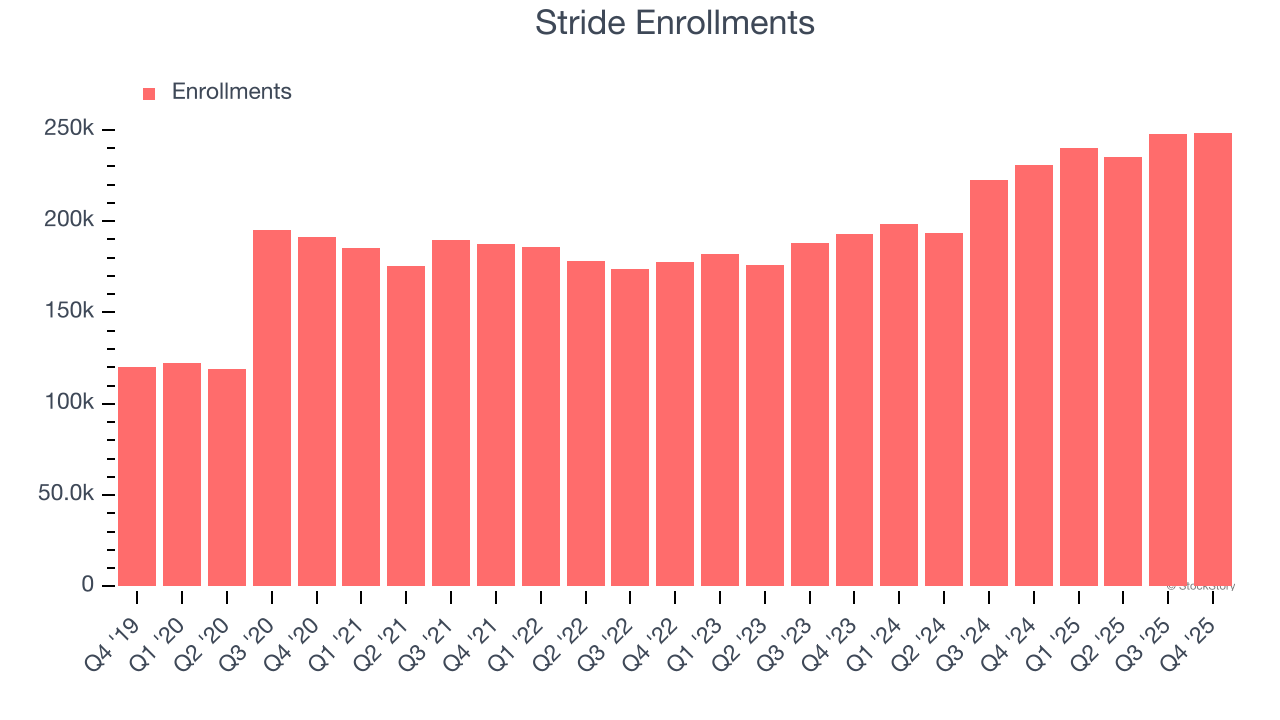

1. Growth in Enrollments Shows Increasing Demand

Revenue growth can be broken down into changes in price and volume (for companies like Stride, our preferred volume metric is enrollments). While both are important, the latter is the most critical to analyze because prices have a ceiling.

Stride’s enrollments punched in at 248,500 in the latest quarter, and over the last two years, averaged 14.8% year-on-year growth. This performance was fantastic and shows its services have a unique value proposition.

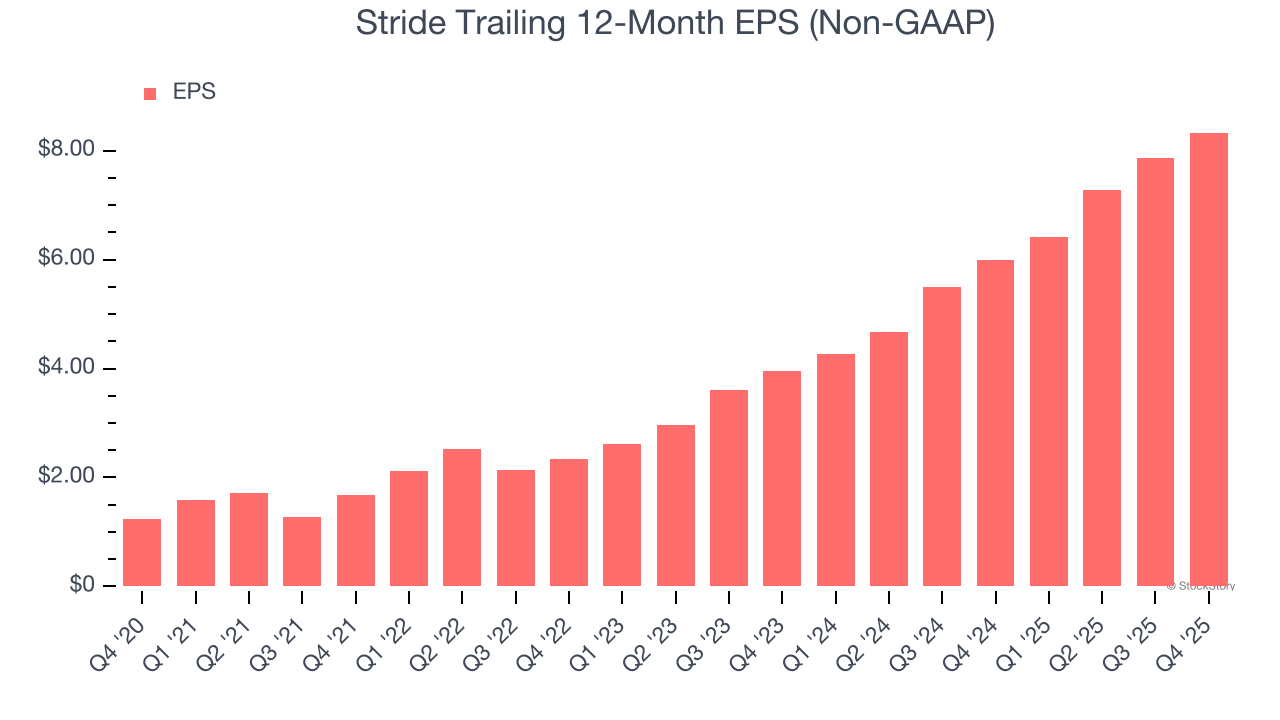

2. Outstanding Long-Term EPS Growth

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Stride’s EPS grew at an astounding 46.4% compounded annual growth rate over the last five years, higher than its 14.6% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

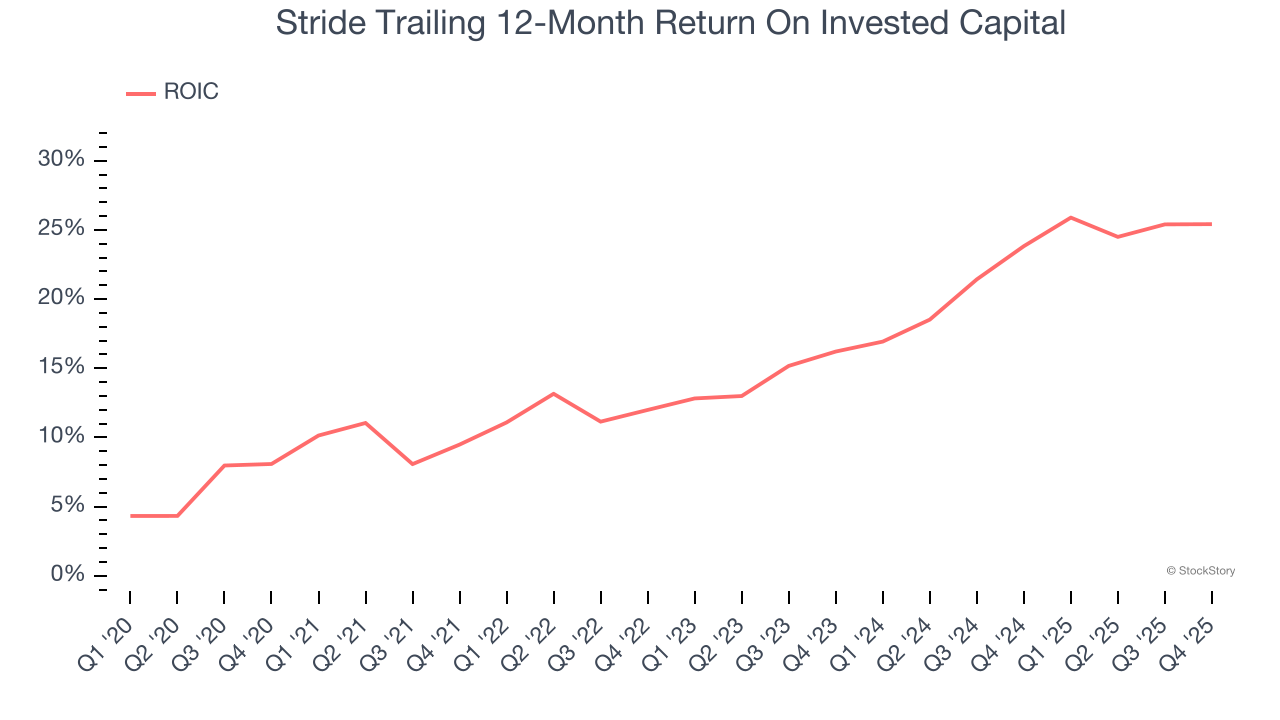

3. New Investments Bear Fruit as ROIC Jumps

A company’s ROIC, or return on invested capital, shows how much operating profit it makes compared to the money it has raised (debt and equity).

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Stride’s ROIC has increased significantly over the last few years. This is a great sign when paired with its already strong returns. It could suggest its competitive advantage or profitable growth opportunities are expanding.

Final Judgment

These are just a few reasons why Stride is one of the best business services companies out there. After the recent drawdown, the stock trades at 10.1× forward P/E (or $87.23 per share). Is now the time to initiate a position? See for yourself in our comprehensive research report, it’s free.

Stocks We Like Even More Than Stride

Your portfolio can’t afford to be based on yesterday’s story. The risk in a handful of heavily crowded stocks is rising daily.

The names generating the next wave of massive growth are right here in our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.