Boston, Massachusetts-based State Street Corporation (STT) is a financial services company that specializes in serving institutional investors. Valued at a market cap of $33.4 billion, the company offers investment servicing, investment management, and brokerage/trading solutions.

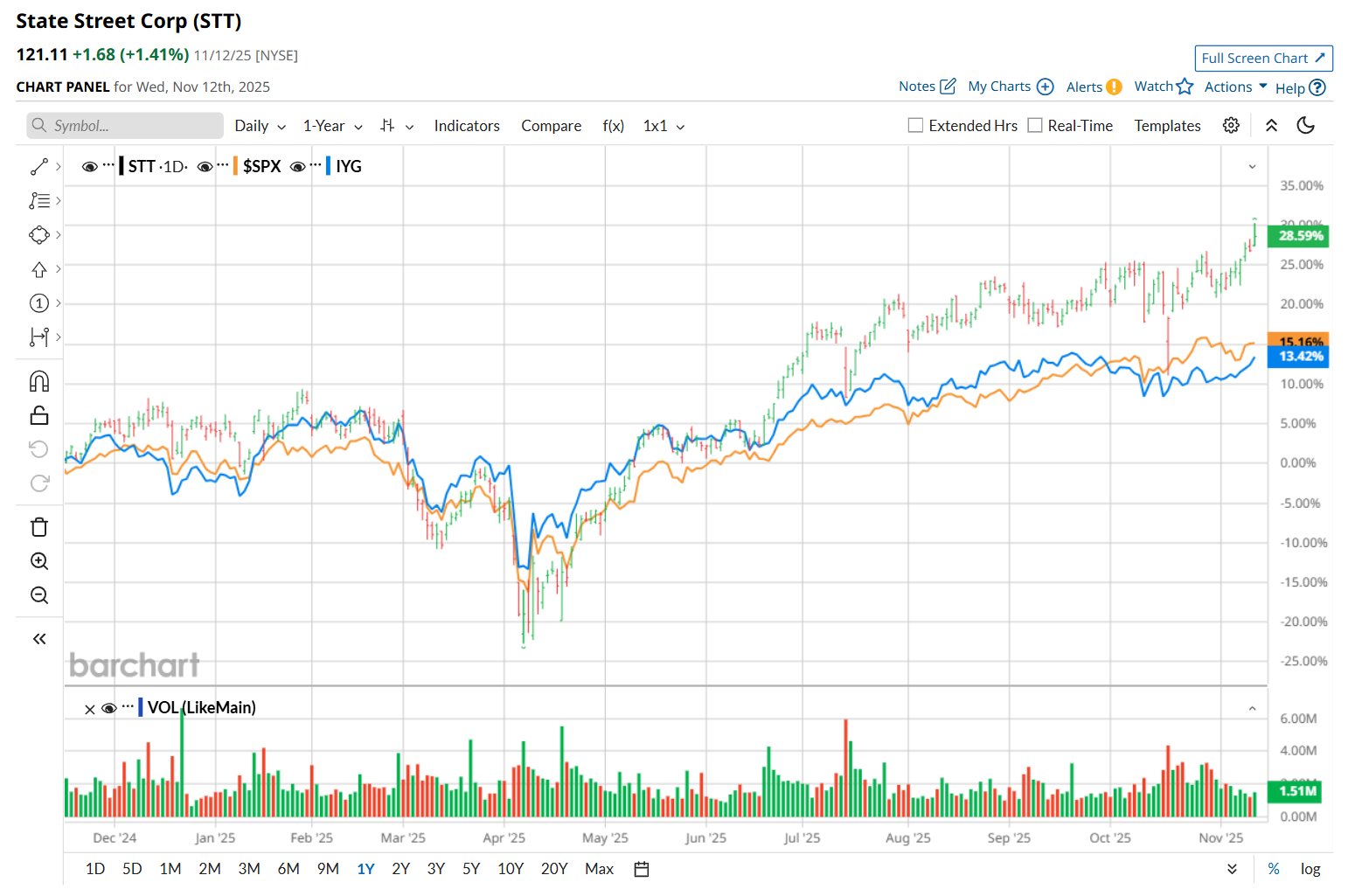

Shares of this asset management company have outperformed the broader market over the past 52 weeks. STT has soared 27.2% over this time frame, while the broader S&P 500 Index ($SPX) has gained 14.5%. Moreover, on a YTD basis, the stock is up 23.4%, compared to SPX’s 16.5% return.

Zooming in further, STT has also outpaced the iShares U.S. Financial Services ETF’s (IYG) 13.1% uptick over the past 52 weeks and 15.9% rise on a YTD basis.

On Oct. 17, shares of STT plunged 1.4% after its Q3 earnings release. Due to higher fee revenue, the company’s total revenue improved 8.8% year-over-year to $3.5 billion, topping consensus estimates. Meanwhile, its EPS came in at $2.78, up 23% from the year-ago quarter and 4.8% ahead of analyst expectations. Additionally, its Assets Under Management (AUM) improved 15.1% from the same period last year to $5.4 trillion, supported by higher quarter-end market levels and continued net inflows. Notably, the stock rebounded the next day, advancing 3.5% as investor sentiment improved.

For the current fiscal year, ending in December, analysts expect STT’s EPS to grow 17.3% year over year to $10.17. The company’s earnings surprise history is promising. It topped the consensus estimates in each of the last four quarters.

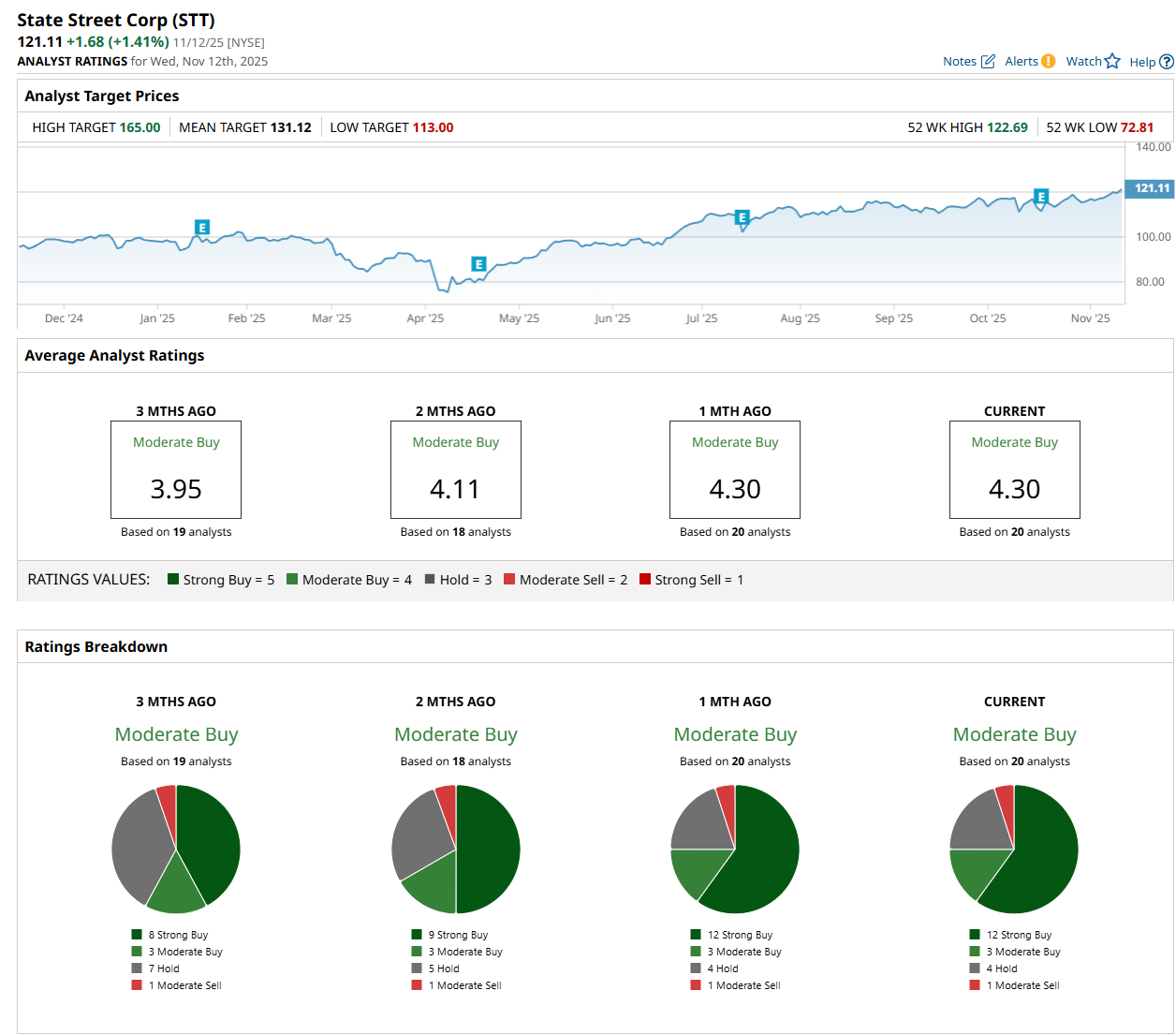

Among the 20 analysts covering the stock, the consensus rating is a "Moderate Buy,” which is based on 12 “Strong Buy,” three "Moderate Buy,” four “Hold,” and one "Moderate Sell” rating.

This configuration is considerably more bullish than two months ago, with nine analysts suggesting a “Strong Buy” rating.

On Nov. 4, JPMorgan Chase & Co. (JPM) analyst Vivek Juneja maintained a “Hold” rating on STT and set a price target of $131, indicating an 8.2% potential upside from the current levels.

The mean price target of $131.12 represents an 8.3% premium from STT’s current price levels, while the Street-high price target of $165 suggests an ambitious 36.2% potential upside from the current levels.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- United Airlines (UAL): Hidden Behind the Shutdown Deal is a Secret Informational Arbitrage Opportunity

- Penn Entertainment Is Breaking up With ESPN in Sports Betting Deal. Should You Sell PENN Stock Here?

- Loop Capital Says This Semiconductor Stock Is Poised for Big Gains Ahead in 2026

- Should You Buy the Dip in Intellia Therapeutics Stock?