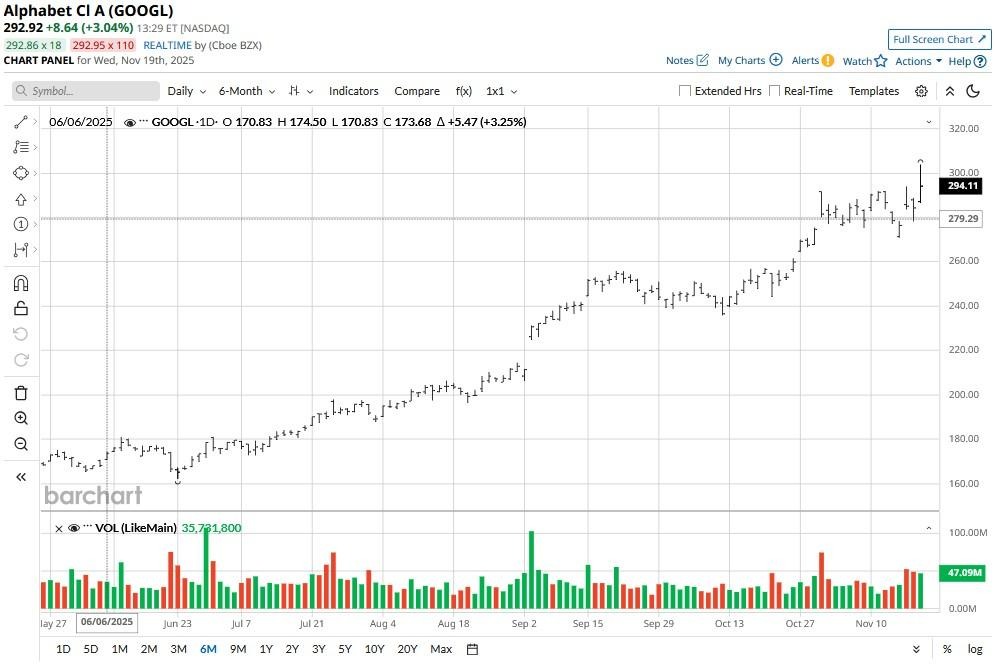

Alphabet (GOOGL) shares inched higher to hit a new all-time high of nearly $304 on Wednesday after the tech giant launched Gemini 3, its most sophisticated artificial intelligence (AI) model to date.

In its press release, the tech titan also confirmed plans of immediately embedding this multimodal AI offering into its search engine and other products, marking a step-change in its strategy.

At the time of writing, Google stock is trading well over 100% above its year-to-date low in April.

Significance of Gemini 3 for Google Stock

GOOGL shares are extending gains following the launch of “Gemini 3” mostly because it positions the company to better compete with rivals like OpenAI and Microsoft (MSFT).

The launch reassures investors that Alphabet isn’t lagging in the AI arms race, with immediate integration into flagship products showcasing strategic clarity and near-term monetization potential.

As a multimodal LLM, Gemini 3 enhances Google’s core products, including Search, Workspace, and Cloud, with more advanced generative capabilities.

All in all, the launch is a major catalyst for Alphabet shares as it signals a meaningful leap forward in its overall artificial intelligence competitiveness.

Why Else Are GOOGL Shares Attractive

Deepak Mathivanan – a senior analyst at Cantor Fitzgerald – also agrees that the launch of Gemini 3 makes Google shares more attractive to own heading into 2026.

“Model advancements, historically, have had a notable benefit to user growth for AI apps and token consumption on enterprise workloads,” he told clients in a research note today.

Additionally, legendary investor Warren Buffett’s conglomerate holding firm Berkshire Hathaway (BRK.A) (BRK.B) has recently built a $4.3 billion stake in Alphabet, further strengthening its investment case.

Most importantly, despite a massive surge over the past seven months, GOOGL stock is trading at a forward price-earnings (P/E) multiple of 27x only, which makes it a relatively undervalued AI play.

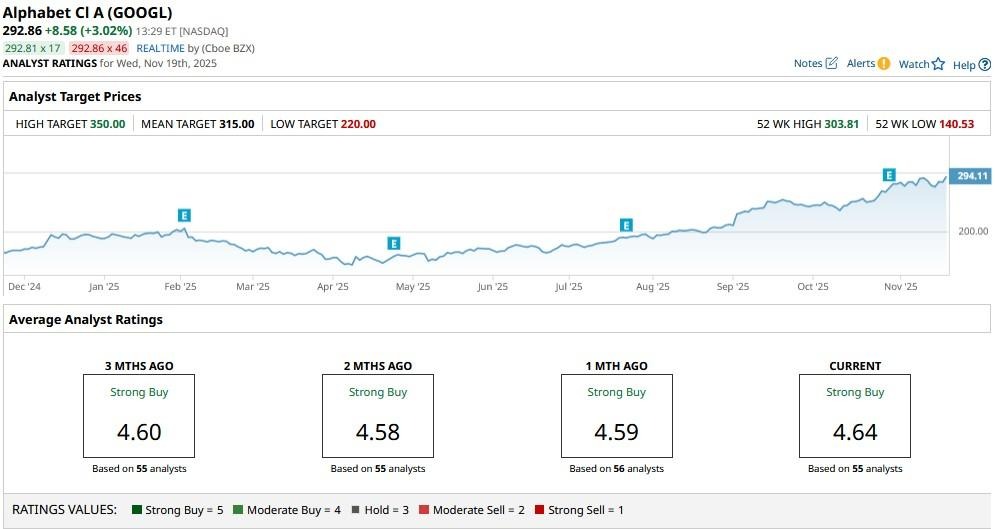

Wall Street Recommends Investing in Alphabet

Other Wall Street analysts also remain bullish on Google stock for the next 12 months.

According to Barchart, the consensus rating on GOOGL shares currently sits at “Strong Buy” with price targets going as high as $350 indicating potential upside of nearly 17% from here.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Here’s How You Can Have Your Cake with AMD Stock and Eat It Too – With Just 6.6% Downside Risk

- As Arm Bets on AI Infrastructure with Nvidia, Should You Buy, Sell, or Hold ARM Stock?

- Adobe Is Buying Semrush. Is It Too Late to Buy SEMR Stock?

- Analysts Think This Tech Stock Will Power the Next Wave of Hyperscaler Growth. They Just Gave It a New Street-High Price Target.