Western Digital (WDC) emerged the top-performing S&P 500 Index ($SPX) stock this year, as AI tailwinds and corporate restructuring drove institutional capital to the data storage giant.

Still, Morgan Stanley analysts believe the Nasdaq-listed firm will push higher in 2026. Last week, they maintained their “Overweight” rating and $228 price objective on WDC stock.

Their constructive call on Western Digital stock is significant given it’s already trading at roughly 6x its price in early April.

Is It Too Late to Invest in Western Digital Stock?

Despite its meteoric rally, WDC stock remains attractive for the coming year partly because it has recently replaced Lululemon (LULU) in the Nasdaq-100 Index ($IUXX).

Index inclusion serves as a stamp of approval for the company’s new, leaner business model (after the SanDisk (SNDK) spinoff) and triggers forced buying from passive funds that manage billions of dollars.

Western Digital reinstated its dividend and announced a massive $2 billion stock buyback initiative this year, effectively becoming even more attractive as a long-term holding.

More importantly, current quarter estimates signal continued momentum ahead. WDC is expected to earn $1.80 a share in Q2, up more than 16% on a year-over-year basis.

WDC Shares to Benefit From AI Tailwinds

According to Morgan Stanley, artificial intelligence (AI) tailwinds will drive Western Digital stock up another 26% next year.

AI models are trained on hundreds of petabytes of data and – in turn – generate more content, logs, and metadata as well. All of it needs to be stored cost-effectively, and that’s where WDC steps in.

From a valuation perspective, the picture is just as attractive. Western Digital is going for less than 25x forward earnings at the time of writing, versus over 40x for some of the other AI beneficiaries like Nvidia (NVDA).

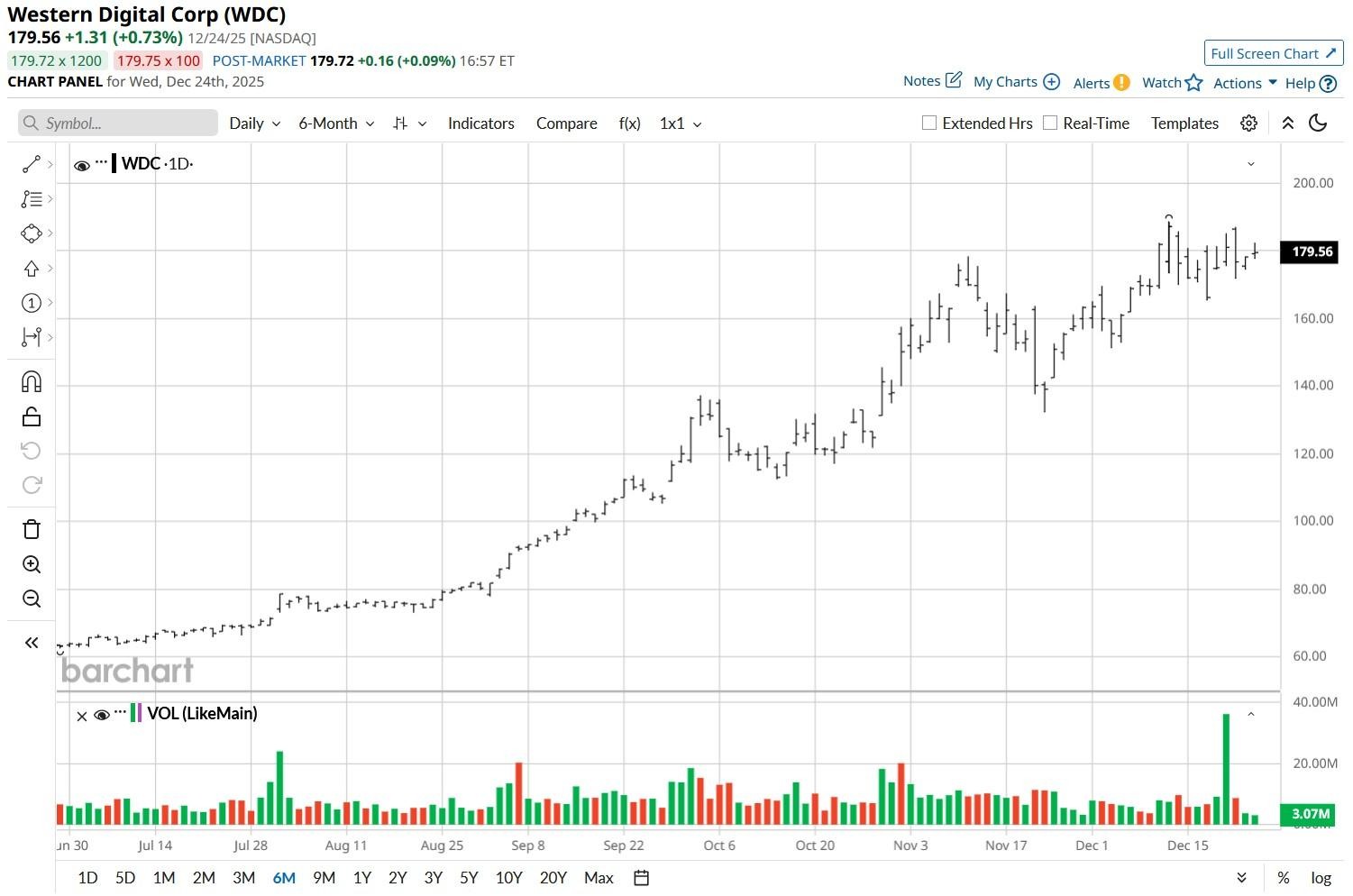

Finally, WDC has its 100-day relative strength index (RSI) set at 62 currently, indicating the bullish momentum is far from exhaustion heading into 2026.

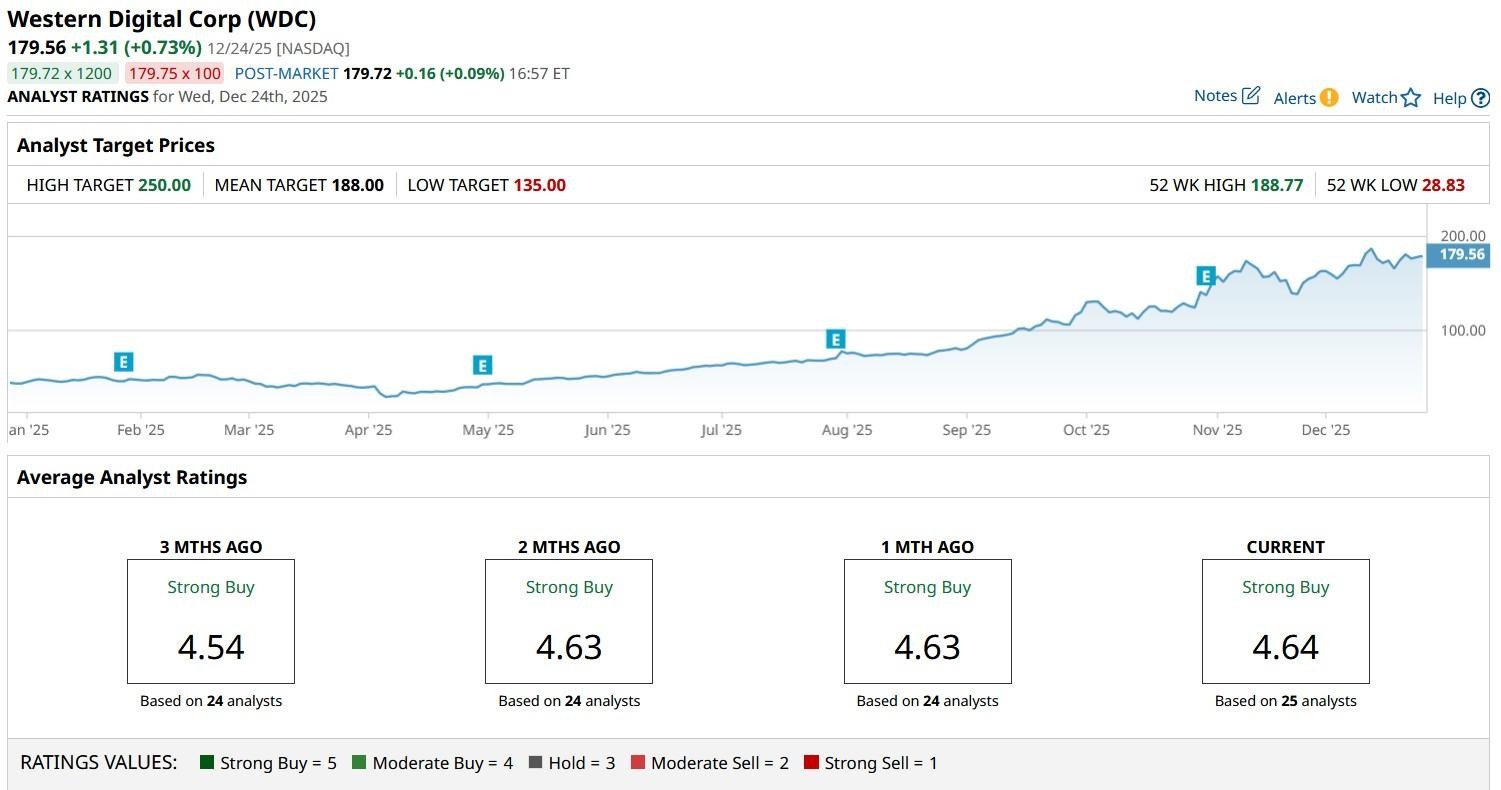

What’s the Consensus Rating on Western Digital?

Wall Street analysts also recommend sticking with Western Digital shares for the next 12 months.

The consensus rating on WDC stock remains at “Strong Buy” with price targets going as high as $250, indicating potential upside of some 40% from here.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Dan Ives Is Betting on Cyber-AI for 2026. 1 Stock to Load Up on Now.

- Plug Power Stock Underperformed in 2025. Will 2026 Be Different?

- Micron Stock Stole the Show in 2025. Options Data Says It Will Trade at These Levels in 2026.

- Berkshire Hathaway Is About to Have a New CEO. How Should You Play Its Stock for 2026?