Apple (AAPL) is a U.S. technology company that initially focused on personal computers, pioneering graphical user interfaces. Under CEO Tim Cook's leadership since 2011, Apple has revolutionized consumer electronics further with iconic products ranging from new models of the iPhone, iPad, Mac, and the Apple Watch to services like iCloud, the App Store, and Apple Music. Renowned for seamless hardware-software integration, innovative design, and a premium ecosystem, Apple's retail stores and global supply chain underscore its dominance in tech, serving billions of active devices.

Founded in 1976, Apple is headquartered in Cupertino, California, boasting more than $3.8 trillion in market capitalization. Here's what investors should know about AAPL stock heading into 2026.

About AAPL Stock

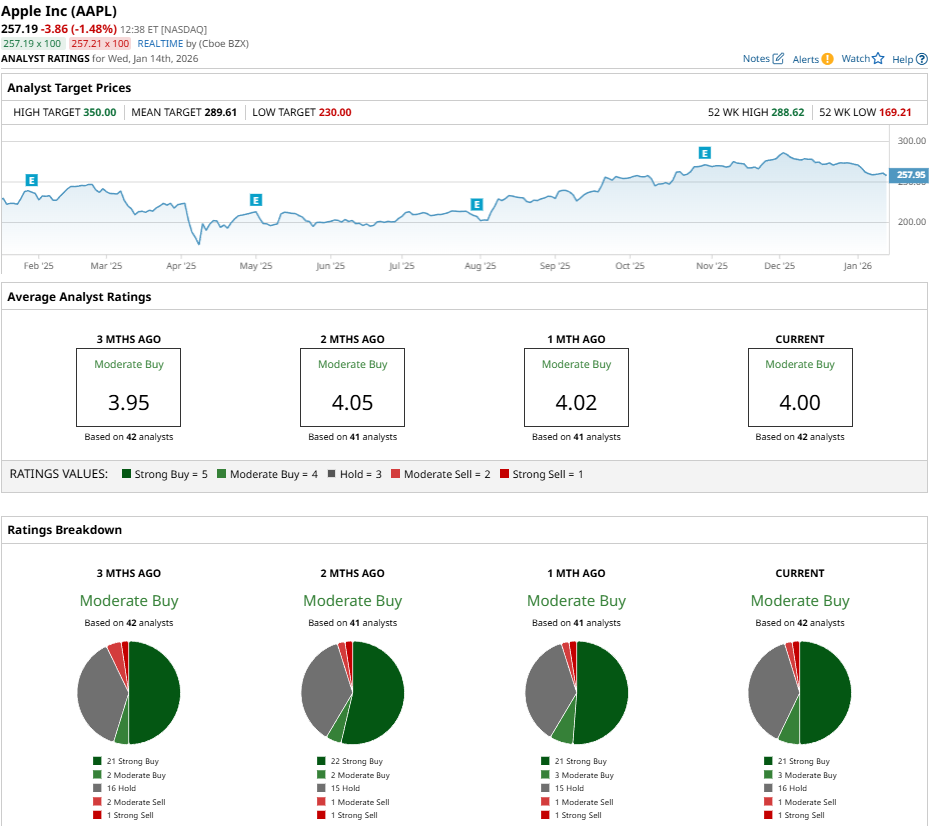

Shares of AAPL stock trade about 10% below the 52-week high of $289 but 53% above the $169 low, consolidating after a strong 2025 run. Over the past five days, shares are up 0.1%, down by 5% in the past month, up 4% over three months, and up 9% over the past 12 months.

Over the past year, AAPL stock has underperformed the S&P 500 ($SPX), which saw a 17% return during the same 12-month period as AI enthusiasm favored peers while Apple awaited its full Apple Intelligence rollout. The stock currently trades below its 50-day moving average ($272) but above the 200-day moving average ($234), with a beta of about 1.2 signaling moderate volatility relative to the benchmark.

Apple Beats With Q4 Results

Apple posted fiscal fourth-quarter 2025 revenue of $102.5 billion, up 8% year-over-year (YOY) and beating analyst estimates of $101.3 billion. Diluted EPS of $1.85 saw a 13% jump YOY, beating estimates of $1.73 as iPhone revenue hit a record $49 billion and services at $28.8 billion. Full fiscal 2025 revenue topped $416 billion, which was a record.

Gross margin expanded to 47.2% (from 46.2% in the prior-year period), driving $32.4 billion in operating income and $27.5 billion in net income. Operating cash flow was $29.7 billion. Installed device base hit all-time highs across categories, and services subscriber growth remained robust, although exact counts were undisclosed.

For Q1 fiscal 2026, Apple guided revenue growth of 10% to 12% YOY, led by iPhone and services, with gross margin of 47% to 48%. CFO Kevan Parekh noted double-digit EPS growth and high customer loyalty fueling the active device base record.

How Apple Could Add $100 Per Share

Wedbush analysts, led by Dan Ives, rank Apple among the top AI plays for 2026 beyond Nvidia (NVDA). That puts it alongside Microsoft (MSFT), Palantir (PLTR), Tesla (TSLA), and CrowdStrike (CRWD).

Apple's AI opportunity shines through its massive 2.4 billion iOS devices and 1.5 billion iPhones. “AI monetization piece could add $75 to $100 per share to the Apple story over the coming few years,” Ives said. Wedbush expects Tim Cook to remain CEO through at least 2027, guiding the companu's AI transition and monetization from its loyal consumer base.

This positions Apple as a consumer AI powerhouse, leveraging installed base scale for services and device upgrades in the AI era.

What Do Analysts Think of AAPL Stock?

As one of the Big Tech stocks, AAPL stock is always on the radar of experts. Shares have a consensus “Moderate Buy” rating among analysts with a mean price target of $289.61, reflecting potential upside of 12% from the current price. Of the 42 analysts with coverage, 21 have a “Strong Buy” rating, three analysts provide a “Moderate Buy” rating, 16 have a “Hold” rating, one analyst has a “Moderate Sell,” and one has a “Strong Sell” rating.

On the date of publication, Ruchi Gupta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- ‘It Makes No Sense To Me’: Nvidia’s Jensen Huang Slams Americans Who ‘Vilified Energy,’ Praises Trump for ‘Sticking His Neck Out’

- Morgan Stanley Says Chip Sales Weakened in November. What Does That Mean for Nvidia Stock?

- Taiwan Semi Stock Moves Into Overbought Territory on Earnings Pop, But Is There Still a Case for Buying TSMC Here?

- Dear Tesla Stock Fans, Mark Your Calendars for February 14