Dallas, Texas-based Jacobs Solutions Inc. (J) is a global engineering and professional services firm. With a market cap of $16 billion, it provides consulting, design, construction management, and technology-driven solutions across sectors such as infrastructure, transportation, water, energy transition, and advanced manufacturing.

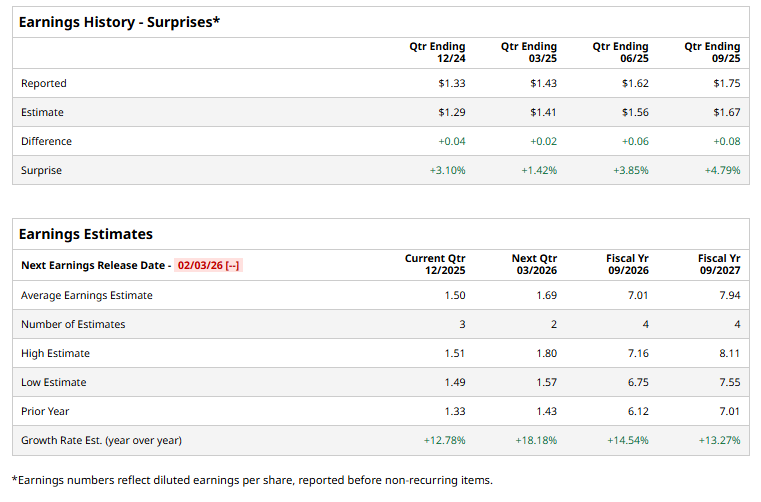

J is scheduled to report its Q1 earnings soon. Ahead of this event, analysts expect the company to report a profit of $1.50 per share, up 12.8% from $1.33 per share in the year-ago quarter. The company has surpassed Wall Street's bottom-line estimates in each of the past four quarters, which is impressive.

For the current year, analysts expect J to report an EPS of $7.01, up 14.5% from $6.12 in fiscal 2025. Moreover, in FY2027, the company’s EPS is expected to rise 13.3% annually to $7.94.

J stock has climbed 3.6% over the past 52 weeks, underperforming the Industrial Select Sector SPDR Fund’s (XLI) 22.3% surge and the S&P 500 Index’s ($SPX) 16.2% uptick during the same time frame.

On Nov. 26, shares of Jacobs rose 1.7% after the company, through its joint venture with Arcadis (AJJV), was selected by Queensland’s Department of Transport and Main Roads as the independent certifier for the Logan and Gold Coast Faster Rail Project, a major initiative to expand rail capacity and improve passenger connectivity between Brisbane and the Gold Coast.

Wall Street analysts are moderately bullish about J’s stock, with a "Moderate Buy" rating overall. Among 16 analysts covering the stock, eight suggest a “Strong Buy,” two suggest a “Moderate Buy,” and six recommend a “Hold.” J’s average analyst price target of $158.21 indicates a potential upside of 14.9% from the current levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart