As popular as pets are, pet stocks have been in the toilet and can't seem to get out. The landscape is littered (no pun intended) with broken stocks like online e-commerce retailer Chewy Inc. (NYSE: CHWY) shares down 56%, PetMed Express Inc. (NASDAQ: PETS) is down 71.7%, and Petco Health and Wellness Inc. (NASDAQ: WOOF) down 75% in the last year. However, one consumer staples sector name stands out: Freshpet Inc. (NASDAQ: FRPT). Freshpet shares are trading up 24% year-to-date (YTD). Their business is going gangbusters, and the stock reflects this.

High-Quality Pet Food

Freshpet is a manufacturer of high-quality refrigerated pet food. Their products are minimally processed and formulated with the highest quality real meat, vegetables, grains and fruits. Plus, they're kept refrigerated to maintain freshness. The meats are farm-raised and steam-cooked to preserve nutrients. They sell under various brands, including VITAL, Nature's Fresh, Homestyle Creations, Spring & Sprout and Deli Fresh. Keep in mind that their food is refrigerated, not frozen. They can be found in the refrigerated section of pet stores, assuming they have one.

Freshpet is riding the growing demand for fresh, high-quality, premium pet food. Their distribution network involves being available at major grocery chains, warehouse clubs and online. Their products can be found at Target Co. (NYSE: TGT), Kroger Co. (NYSE: KR), Petco, Safeway, ShopRite and Amazon.com Inc (NASDAQ: AMZN).

Crushing Q4 2023 Estimates

Freshpet reported Q4 2023 EPS of 31 cents more than tripling consensus analyst estimates of 8 cents and beating by 23 cents. Net income was $15.3 million compared to a net loss of $2.9 million in the year-ago period. Adjusted EBITDA was $31.3 million compared to $18.8 million in the year-ago period. Revenues surged 29.9% YoY to $215.4 million versus $204.93 consensus estimates. Freshpet exceeded company guidance for the sixth straight year. The company closed out the year with $296.9 million of cash and cash equivalents.

Full-year 2023 Financial Highlights

For 2023, net sales grew 28.8% YoY to $766.9 million. Net loss was $33.6 million compared to $59.5 million in the year-ago quarter. Adjusted EBITDA was $66.6 million versus $20.1 million a year ago. Gross profit was $250.9 million or 32.7% as a percentage of net sales compared to $186 million or 31.2% of net sales for the prior year. The increase in gross profit was driven by improved leverage on plant expenses, reduced quality costs, and lower input costs partially offset by depreciation expense.

Raising Guidance

The company raised full-year 2024 revenue guidance to at least $950 million versus $948.17 million consensus estimates. Revenues should grow at least 24% YoY. Adjusted EBITDA is expected to be between $100 million and $110 million, and Capex is expected to be around $210 million.

CEO Insights

Freshpet CEO Billy Cyr stated he believes the company has reached an inflection point on its journey to becoming a sizeable and profitable business in the emerging fresh pet food segment. The Feed the Growth strategy implemented in 2017 was driven by the belief that fresh pet food was a scale-driven business that needed to leverage its first-mover advantage. The company received a significant increase in its retail presence at its retail partner's stores. The number of new fridge placements rose to a record 5,251 for a total of 34,274 fridges at retail or over 1.7 million cubic feet of retail space. Freshpet foods can be found in 26,777 stores, over 22% of which have multiple fridges in the United States.

Long Runway for Growth

Cyr noted that digital sales rose 58% YoY on its way to generating over $100 million net orders in 2024. The total pet food category is a $52 billion industry, of which $36 billion is dog food. Freshpet has a 3% piece of that, leaving a long runway for growth. Household penetration rose 19% YoY to 11.55 million in 2023. The fastest-growing house penetration is among Gen-Z consumers. Cyr concluded, "In summary, we had a very good year, and we believe we are on the cusp of profitability with greater scale and efficiency due to increased business intensity and concentration and disciplined capital management."

Freshpet analyst ratings and price targets are at MarketBeat. Freshpet peers and competitor stocks can be found with the MarketBeat stock screener.

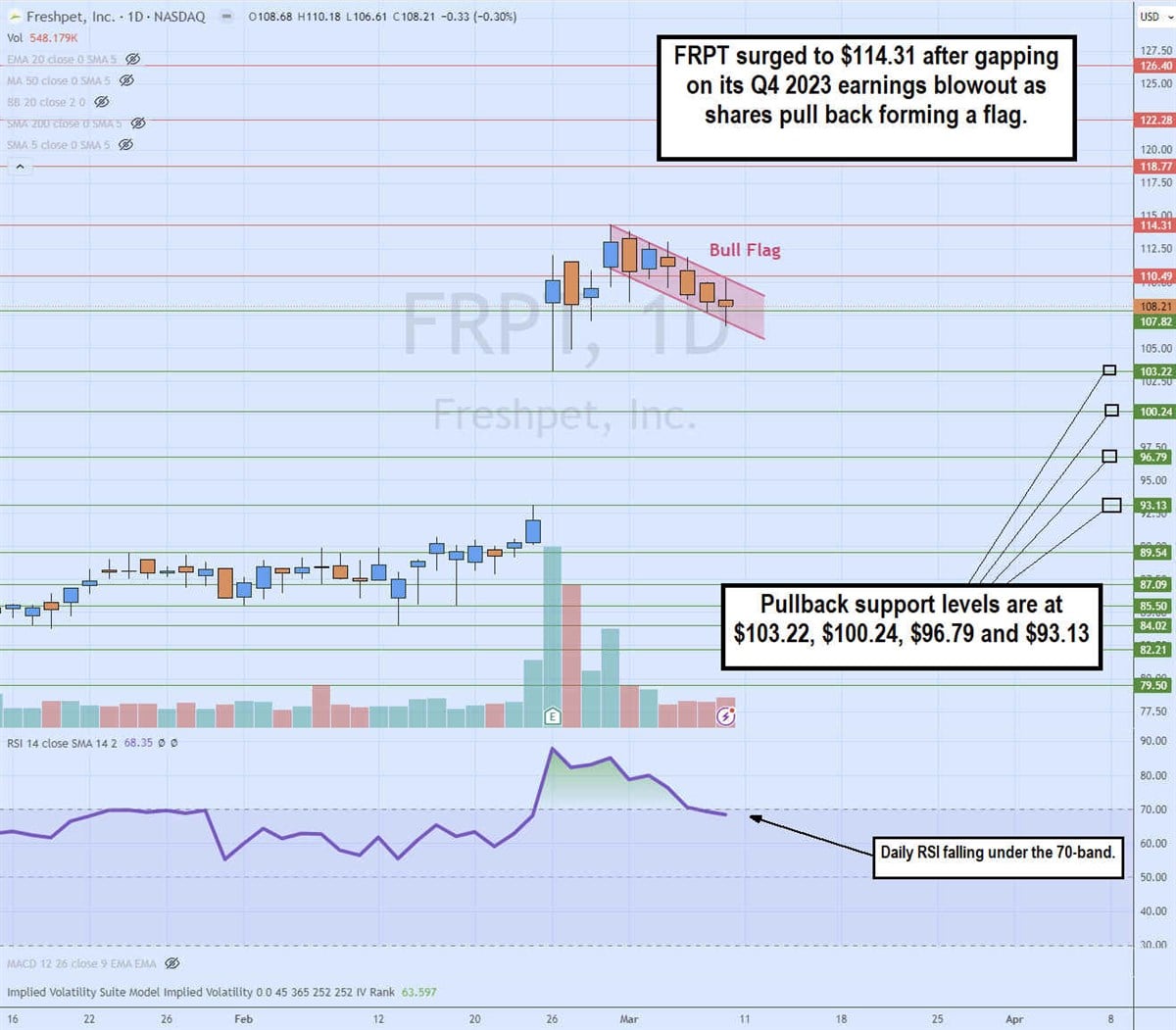

Daily Bull Flag

The daily candlestick chart on FRPT illustrates a bull flag pattern. The flagpole base formed the $84.02 swing low and surged on the earning price gap to $103.22. The rally peak at $114.31 at on February 29, 2024, commenced the flag pullback comprised of lower highs and lower lows in a parallel range. The bull flag breakout triggers when FRPT breaks through the $110.49 resistance as the daily relative strength index (RSI) bounces back up. Pullback support levels are at $103.22, $100.24, $96.79 and $93.13.