The past six months have been a windfall for Elanco’s shareholders. The company’s stock price has jumped 64.6%, setting a new 52-week high of $23.81 per share. This was partly thanks to its solid quarterly results, and the run-up might have investors contemplating their next move.

Is now the time to buy Elanco, or should you be careful about including it in your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free for active Edge members.

Why Is Elanco Not Exciting?

Despite the momentum, we don't have much confidence in Elanco. Here are three reasons there are better opportunities than ELAN and a stock we'd rather own.

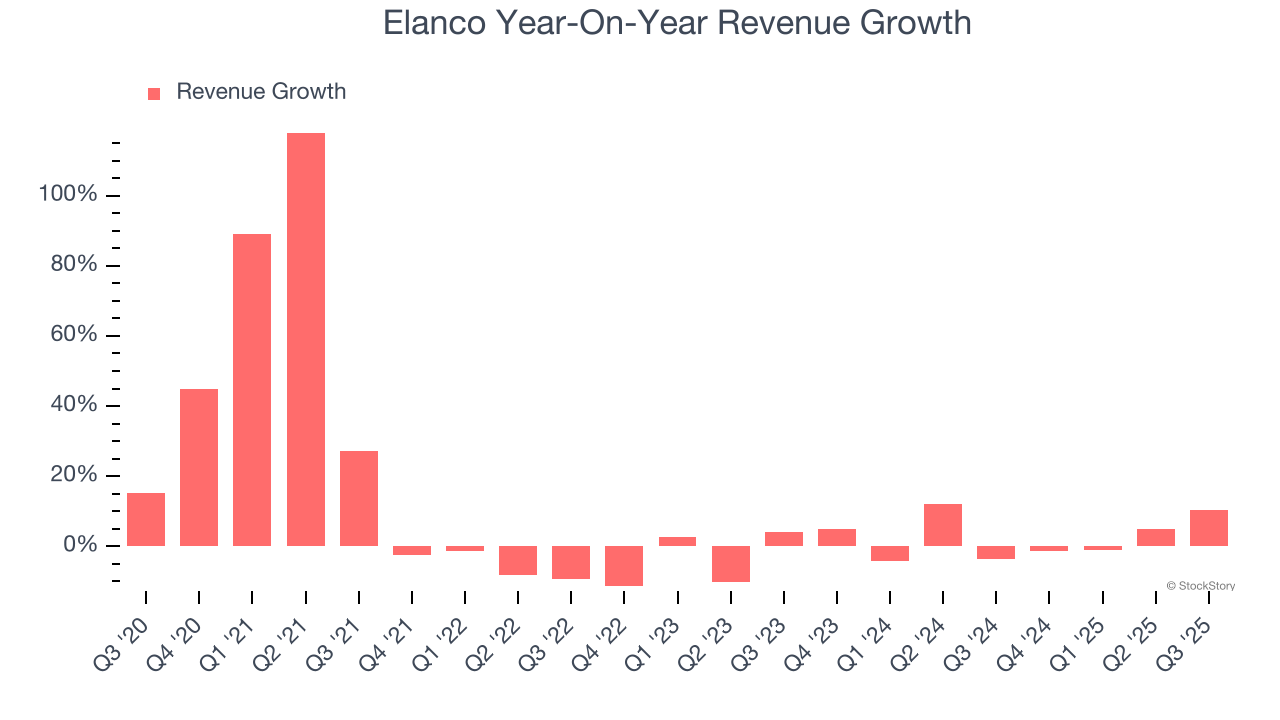

1. Lackluster Revenue Growth

We at StockStory place the most emphasis on long-term growth, but within healthcare, a stretched historical view may miss recent innovations or disruptive industry trends. Elanco’s recent performance shows its demand has slowed as its annualized revenue growth of 2.5% over the last two years was below its five-year trend.

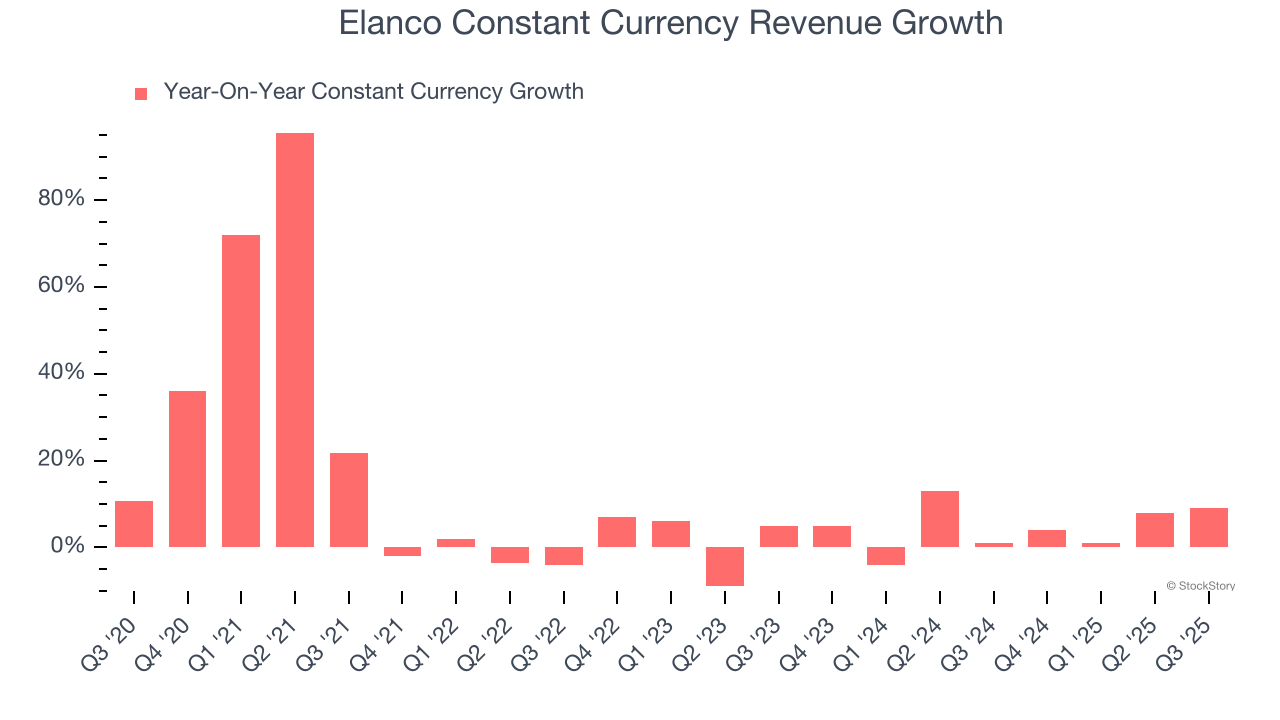

2. Weak Constant Currency Growth Points to Soft Demand

We can better understand Specialty Pharmaceuticals companies by analyzing their constant currency revenue. This metric excludes currency movements, which are outside of Elanco’s control and are not indicative of underlying demand.

Over the last two years, Elanco’s constant currency revenue averaged 4.6% year-on-year growth. This performance slightly lagged the sector and suggests it might have to lower prices or invest in product improvements to accelerate growth, factors that can hinder near-term profitability.

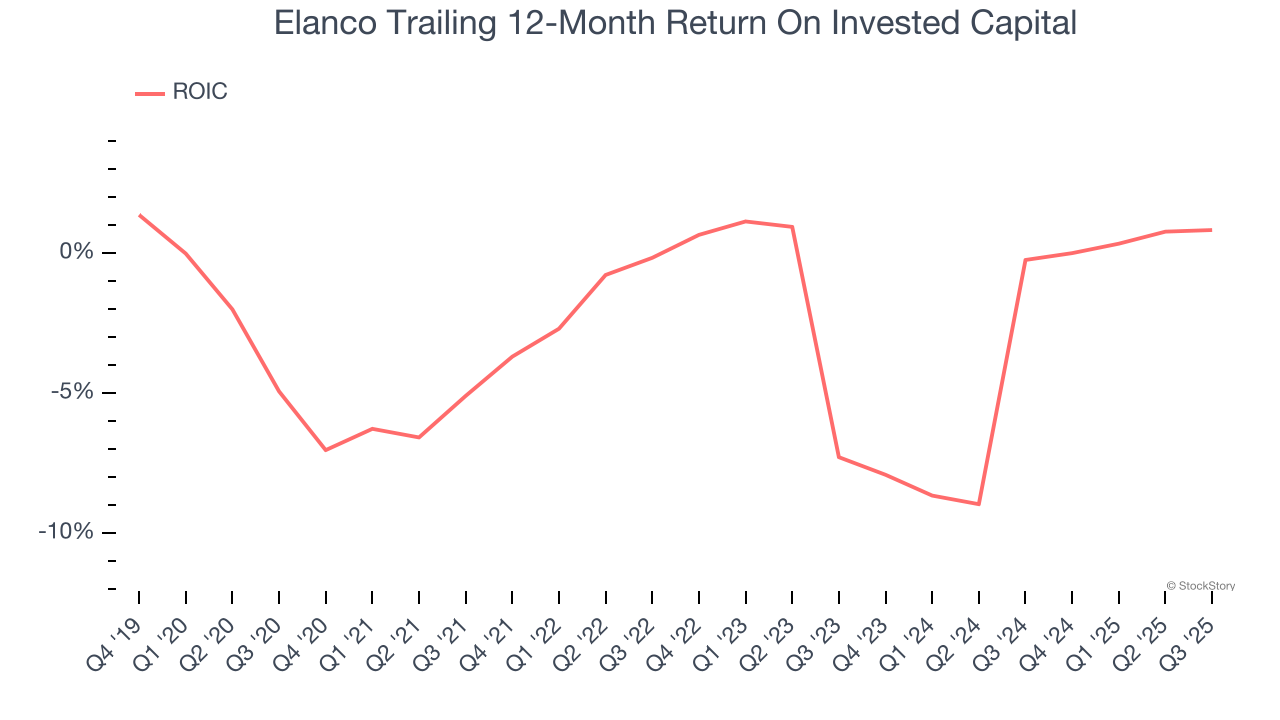

3. Previous Growth Initiatives Have Lost Money

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Elanco’s five-year average ROIC was negative 2.4%, meaning management lost money while trying to expand the business. Investors are likely hoping for a change soon.

Final Judgment

Elanco isn’t a terrible business, but it doesn’t pass our quality test. After the recent rally, the stock trades at 24× forward P/E (or $23.81 per share). Investors with a higher risk tolerance might like the company, but we think the potential downside is too great. We're pretty confident there are more exciting stocks to buy at the moment. We’d recommend looking at an all-weather company that owns household favorite Taco Bell.

Stocks We Like More Than Elanco

Your portfolio can’t afford to be based on yesterday’s story. The risk in a handful of heavily crowded stocks is rising daily.

The names generating the next wave of massive growth are right here in our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.