First Bancorp has followed the market’s trajectory closely, rising in tandem with the S&P 500 over the past six months. The stock has climbed by 14.6% to $53.42 per share while the index has gained 10.8%.

Is now the time to buy First Bancorp, or should you be careful about including it in your portfolio? See what our analysts have to say in our full research report, it’s free for active Edge members.

Why Is First Bancorp Not Exciting?

We don't have much confidence in First Bancorp. Here are three reasons there are better opportunities than FBNC and a stock we'd rather own.

1. Long-Term Revenue Growth Disappoints

From lending activities to service fees, most banks build their revenue model around two income sources. Interest rate spreads between loans and deposits create the first stream, with the second coming from charges on everything from basic bank accounts to complex investment banking transactions.

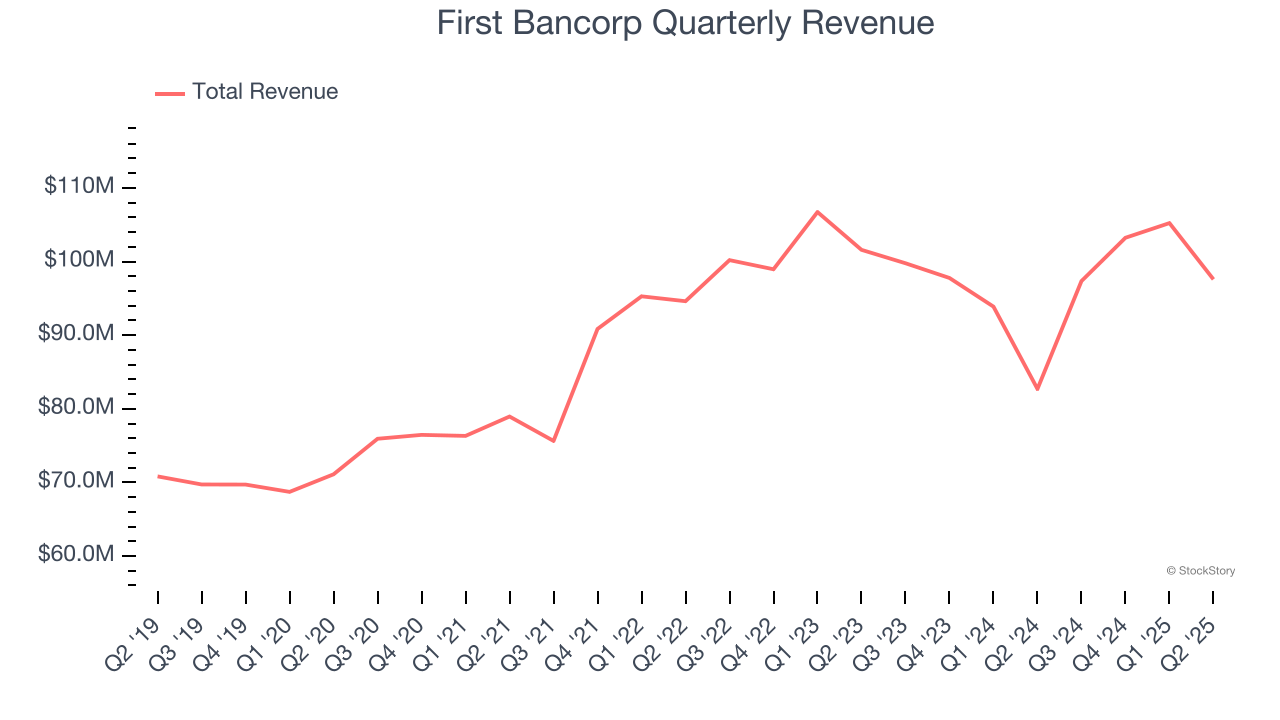

Over the last five years, First Bancorp grew its revenue at a tepid 7.6% compounded annual growth rate. This fell short of our benchmark for the banking sector.

3. EPS Barely Growing

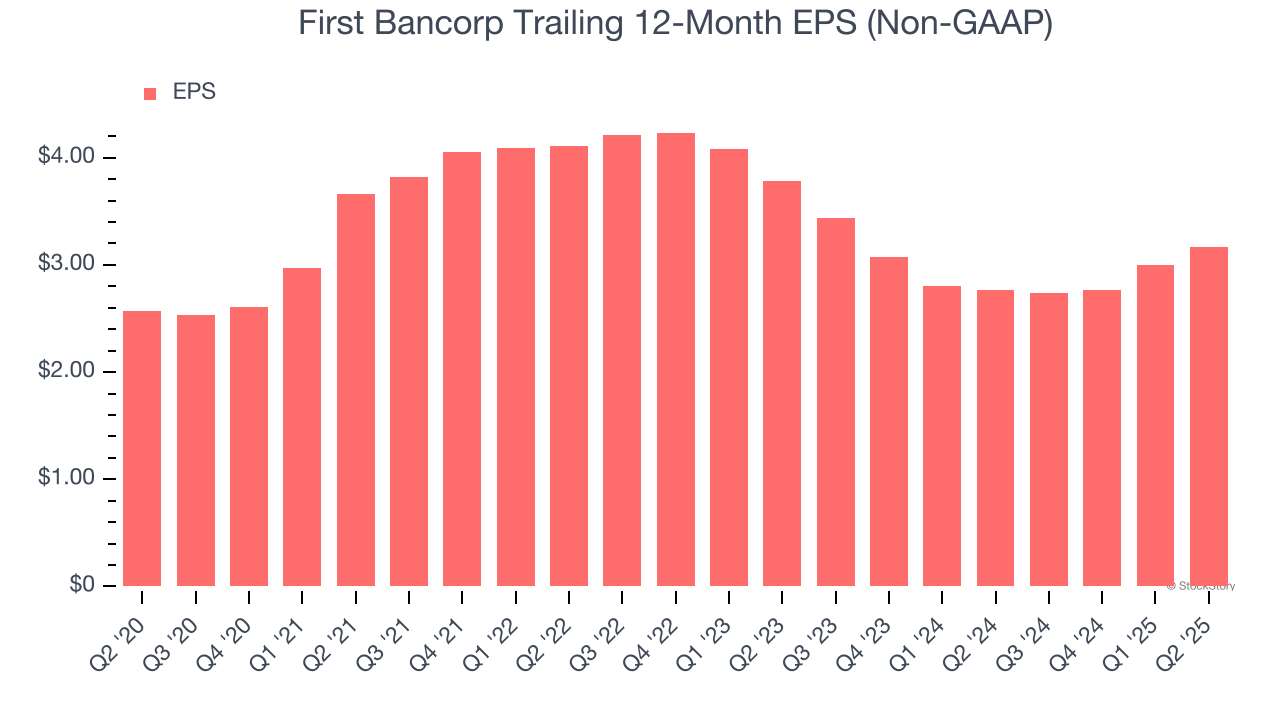

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

First Bancorp’s EPS grew at a weak 4.3% compounded annual growth rate over the last five years, lower than its 7.6% annualized revenue growth. This tells us the company became less profitable on a per-share basis as it expanded.

Final Judgment

First Bancorp’s business quality ultimately falls short of our standards. That said, the stock currently trades at 1.3× forward P/B (or $53.42 per share). Beauty is in the eye of the beholder, but our analysis shows the upside isn’t great compared to the potential downside. We're pretty confident there are superior stocks to buy right now. Let us point you toward the Amazon and PayPal of Latin America.

Stocks We Would Buy Instead of First Bancorp

Your portfolio can’t afford to be based on yesterday’s story. The risk in a handful of heavily crowded stocks is rising daily.

The names generating the next wave of massive growth are right here in our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.