The Mexican Peso has gained significantly against the U.S. Dollar during 2025, by 22%, as higher interest rates in Mexico and U.S. companies moving manufacturing closer to home (and to Mexico) have strengthened the peso. A relatively weaker U.S. Dollar has made the peso strong at the start of 2026.

Other contributing factors:

- Interest Rate Differential: Mexico's central bank was raising rates while the U.S. Federal Reserve was reducing rates, making peso-denominated assets more attractive.

- Economic Confidence: Strong wage growth, a booming tourism sector driven by U.S. and Canadian tourists, Mexico set new records for international visitors and tourism revenue, and spending and stable economic conditions under President Sheinbaum have also supported the peso.

Key Factors Supporting 2026 Peso Strength:

- High Interest Rates: Banxico's continued high rates relative to the U.S. make Mexican assets attractive for carry trades, boosting the peso.

- Foreign Investment: Continued "nearshoring" with the U.S. and Canada, along with overall Foreign Direct Investment (FDI) into Mexico, will continue driving strong demand for pesos.

- Tourism: Growing international arrivals and tourism revenue strengthen the currency.

- U.S. Monetary Policy: A dovish Federal Reserve, signaling rate cuts, would reduce the dollar's appeal and support the peso.

- Domestic Stability: Perceived progress on security and effective economic management under President Sheinbaum can boost confidence.

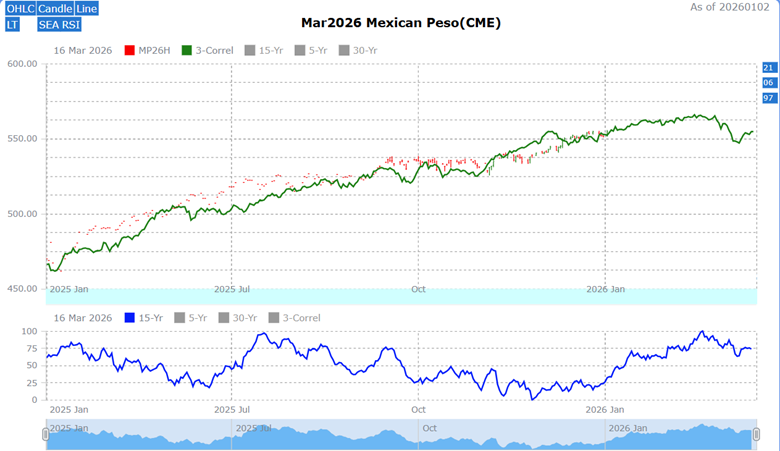

Technical Picture:

Source: Barchart

Since bottoming in January 2025, the Mexican Peso has rallied consistently and continues to respect the uptrending 50-day SMA (blue). With so much attention on the metals markets, the peso has been a silent sleeper, creeping higher without much notice. Is there anything left in this rally?

How Does the Peso Perform During January?

Source: Barchart Seasonal Returns

Over the past 15 years, Barchart research has found that, on average, the peso has appreciated by 0.00055. Making January the second-best month of the year, behind March.

The seasonal returns chart highlights recurring trends in asset performance over specific months of the year, offering insights into potential price movements. Investors use seasonality to identify patterns and inform their decisions, but it's essential to remember that these patterns reflect past data and may not predict future performance. By analyzing the percentage of positive months and average gains or losses, traders can identify above-average tendencies. Caution is advised, however, as relying solely on seasonality can lead to missed opportunities or increased risks.

Longer Term Seasonality and Correlated Market Years Outlook

Source: Moore Research Center, Inc. (MRCI)

The chart above from MRCI shows that the March Mexican Peso futures have been highly correlated (green) with the three previous years: 1997: 92%, 2006: 93%, and 2021: 91%. The current correlation pattern peaks in mid-February, then tails off into early March, leaving plenty of opportunity for new money to enter the market.

The next leg up in the correlated years began in early January. At the same time, MRCI's seasonal research has found that the 15-year pattern (blue) begins about the same time.

The Mexican Peso has a clear daily-timeframe uptrend. Barchart's seasonal analysis shows that January is the second-strongest month of the year. MRCI correlated market years show three years >90% correlation. MRCI seasonal research shows that the 15-year seasonal pattern has begun to trend up in early January. A trader could use this data to complement their own strategy and risk management, making an informed decision about whether the trade is right for them.

As a crucial reminder, while seasonal patterns can provide valuable insights, they should not be the basis for trading decisions. Traders must consider technical and fundamental indicators, risk management strategies, and market conditions to make informed, balanced trading decisions.

Assets to Trade the Mexican Peso

Traders looking to play the Mexican Peso usually go for the USD/MXN spot forex pair—it's by far the most popular and liquid way to get exposure, especially since Mexico's economy is so tied to the For bigger players or those wanting more structure, there are Mexican Peso futures on the CME, symbol M6, which are great for hedging or speculating on longer moves.

In Closing…

Looking ahead into 2026, the Mexican Peso still has a lot going for it. The fundamentals haven't really changed—Banxico is likely to keep rates elevated relative to the Fed, which is probably cutting further; nearshoring keeps pouring dollars into Mexico that need to be converted to pesos; and tourism numbers look set to stay strong. Add in the political stability that markets seem to be pricing in under the current administration, and it's hard to see the peso giving up its gains anytime soon. The technical picture backs that up too, with the pair respecting that rising 50-day moving average and seasonal patterns pointing to January and March as historically solid months for peso strength.

That said, nothing runs straight up forever. Global risk sentiment can flip fast—if commodity prices tank or there's a sudden dollar rebound on some surprise U.S. data, USD/MXN could snap back higher in a hurry. Traders chasing this move should keep risk management tight, watch those key support levels, and remember that seasonality and correlations are helpful clues, not guarantees. Whether you're trading the spot pair, rolling CME peso futures, or just holding some MXN exposure, the setup looks constructive for now—but staying nimble is always the clever play in forex.

On the date of publication, Don Dawson did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.