Palantir Technologies (PLTR) announced that the Defense Information Systems Agency (DISA) has authorized Palantir Federal Cloud Service (PFCS) Forward, according to a company statement. This extends Palantir's existing Impact Level 5 and Impact Level 6 authorizations to include on-premises and tactical edge deployments.

What This Authorization Actually Means

Palantir's software can now be deployed anywhere the U.S. government needs it. That includes traditional data centers, mobile installations, and even small systems in the back of a military vehicle.

The authorization covers Palantir's entire tech stack: Apollo, Gotham, Foundry, and AIP (Artificial Intelligence Platform), as well as the underlying infrastructure such as Rubix.

"The future of warfighting demands software that can operate anywhere—from enterprise data centers to the tactical edge," said Akash Jain, President and CTO of Palantir USG.

The traditional government authorization process is brutal. Every deployment requires mountains of paperwork, security assessments, and months of waiting for an Authorization to Operate (ATO).

PFCS Forward changes that. With a single Provisional Authorization package, customers can significantly reduce time to deployment by inheriting Palantir's authorization instead of starting from scratch for each site.

This is significant for two reasons. First, it dramatically accelerates the military's ability to deploy AI capabilities where they're needed. Second, it opens the door to multivendor architectures, enabling Palantir to work seamlessly with other commercial technology providers at the tactical edge.

The Timing Couldn't Be Better

This authorization comes on the heels of Palantir's explosive Q4 earnings report. The numbers were nothing short of spectacular.

- Total revenue grew 70% year-over-year (YoY) to $1.4 billion, the highest growth rate since the company went public.

- U.S. revenue jumped 93% YoY, now representing 77% of total revenue.

The company's “Rule of 40” score hit 127%, up 46 points from the prior year. For context, the Rule of 40 measures a software company's health by adding revenue growth rate and profit margin. Anything above 40% is considered excellent.

CEO Alex Karp didn't mince words on the earnings call: "You really have to look at this, and the numbers speak volumes that we are an n of 1 category of our own, and we are doing things unlike any other company has done."

Palantir's U.S. government business grew 66% YoY and 17% sequentially in Q4. It closed deals worth $4.3 billion in total contract value during the quarter, the highest TCV quarter in company history.

One standout deal: the U.S. Navy awarded Palantir a contract worth up to $448 million to modernize the shipbuilding supply chain and accelerate delivery of naval vessels.

On the earnings call, CTO Shyam Sankar detailed Palantir's ShipOS platform, which is transforming submarine production. At one shipbuilder, planning time dropped from 160 hours to 10 minutes. At a shipyard, material review went from weeks to less than an hour.

The company is also expanding Maven, its AI platform for military operations, to all combatant commands. Sankar described a live-fire exercise in which Maven coordinated with UAV assets via a new edge agent, MAGE.

While government contracts grab headlines, Palantir's commercial business is also expanding rapidly. U.S. commercial revenue grew 137% YoY and 28% sequentially in Q4.

The company recently announced several strategic partnerships. It extended its multi-year collaboration with Airbus for the Skywise platform, which supports 50,000+ users in aircraft production and airline operations.

Palantir also partnered with Accenture (ACN) and UK-based Sovereign AI (S-AI) to build next-generation AI data centers across EMEA. Palantir's Chain Reaction operating system will orchestrate the entire buildout from power generation to compute deployment.

The Bull and Bear Case for PLTR Stock

Palantir is firing on all cylinders. The DISA authorization removes a major deployment barrier for government customers, while the commercial business is seeing unprecedented adoption of its AIP platform.

The company guided full-year 2026 revenue to $7.19 billion at the midpoint, representing 61% growth. U.S. commercial revenue is expected to exceed $3.14 billion, a growth rate of at least 115%.

Customers are going all in. One utility company expanded from $7 million in annual contract value in Q1 2025 to $31 million by year-end. A healthcare company signed a $96 million deal after two boot camps.

It isn't all sunshine for Palantir, though; international growth remains weak. International commercial revenue grew just 8% YoY in Q4. Karp acknowledged the challenge on the earnings call, noting that allies struggle to buy products more advanced than what they build domestically.

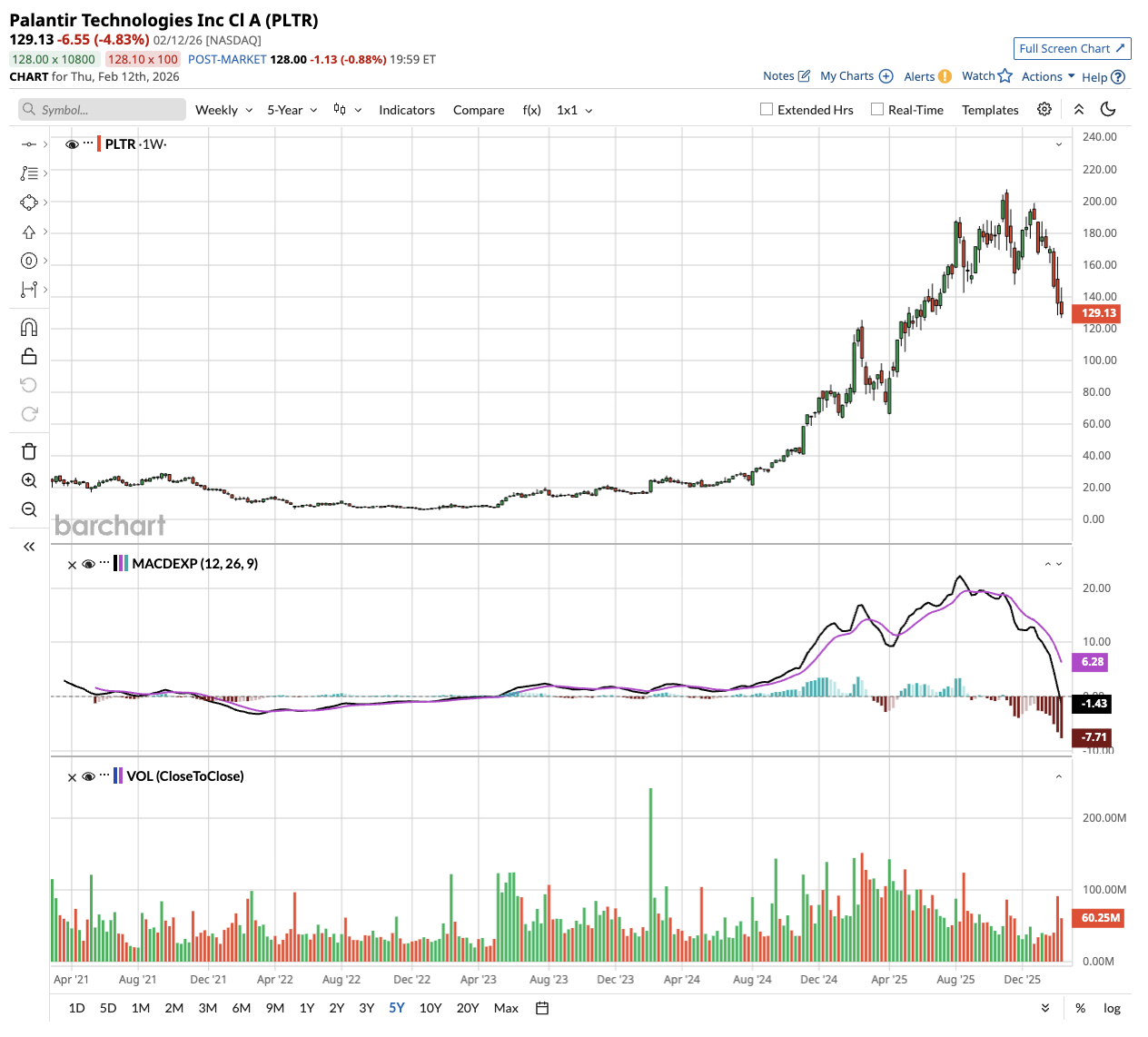

PLTR stock has also had a massive run. Shares are up significantly over the past year, raising questions about its 98x forward earnings multiple.

The Verdict

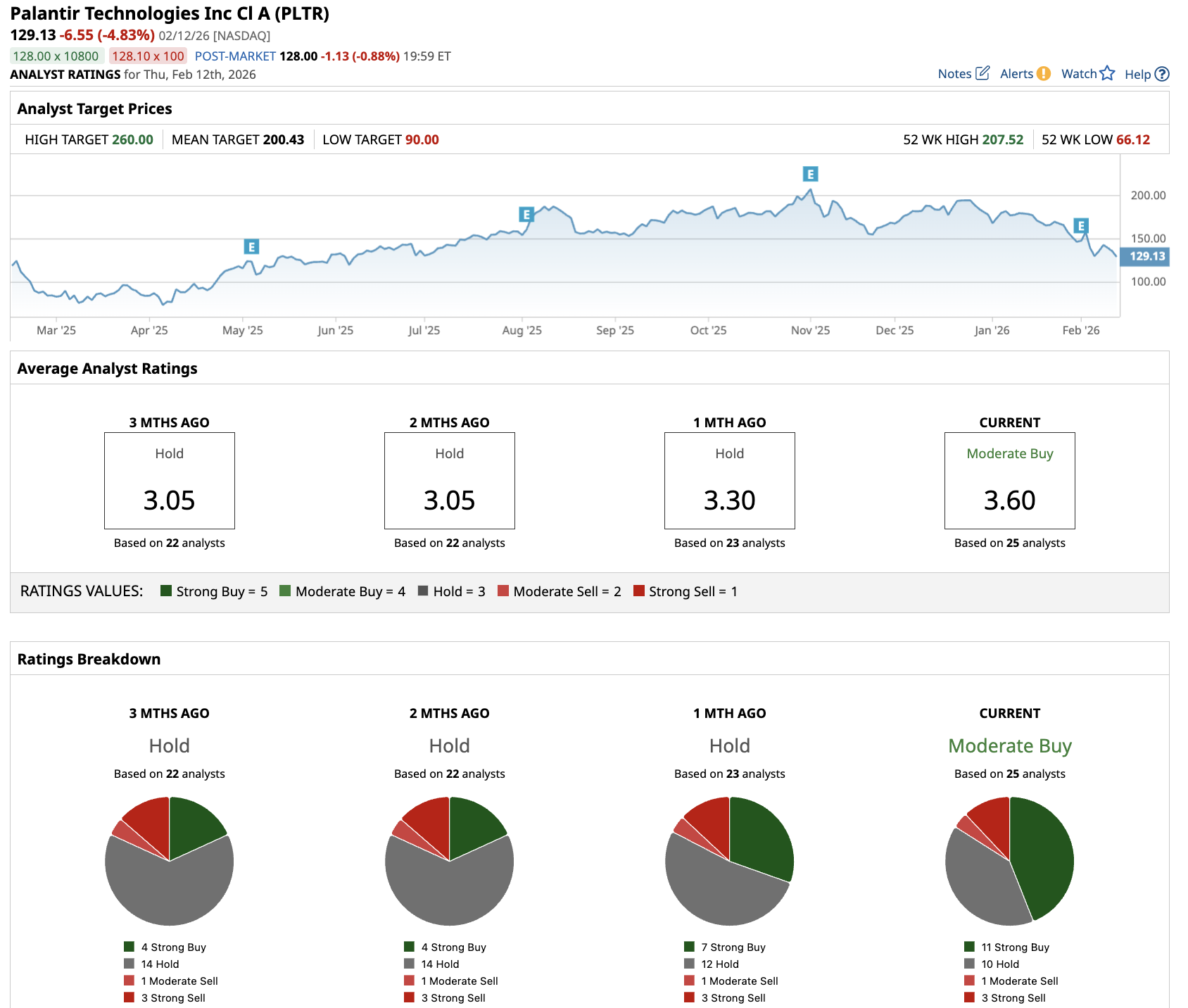

Out of 25 analysts covering PLTR stock, 11 recommend “Strong Buy,” 10 recommend “Hold,” one recommends “Moderate Sell,” and three recommend “Strong Sell.” The average PLTR stock price target is $200, above the current price of $129.

For long-term investors, Palantir's combination of government tailwinds and commercial momentum is compelling. The DISA authorization expands the company's addressable market within defense while reducing deployment friction. And Q4 results show Palantir is growing profitably at scale, something rare in enterprise software. A Rule of 40 score of 127% speaks for itself.

However, PLTR stock isn't cheap by traditional metrics. Investors need conviction that Palantir can sustain triple-digit growth in the U.S. commercial while navigating international headwinds.

If you believe AI is truly transformative for enterprises and that Palantir's ontology-based approach creates a defensible moat, the DISA authorization is another proof point. For existing shareholders, it reinforces the hold thesis. For new investors, patience for a pullback might be warranted given how far shares have run.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart