Biopharmaceutical drug delivery company Halozyme Therapeutics (NASDAQ: HALO) reported Q3 CY2025 results exceeding the market’s revenue expectations, with sales up 22.1% year on year to $354.3 million. The company’s full-year revenue guidance of $1.34 billion at the midpoint came in 1.5% above analysts’ estimates. Its non-GAAP profit of $1.72 per share was 5.5% above analysts’ consensus estimates.

Is now the time to buy Halozyme Therapeutics? Find out by accessing our full research report, it’s free for active Edge members.

Halozyme Therapeutics (HALO) Q3 CY2025 Highlights:

- Revenue: $354.3 million vs analyst estimates of $343.8 million (22.1% year-on-year growth, 3.1% beat)

- Adjusted EPS: $1.72 vs analyst estimates of $1.63 (5.5% beat)

- Adjusted EBITDA: $238.3 million vs analyst estimates of $233.7 million (67.3% margin, 2% beat)

- Adjusted EPS guidance for the full year is $6.30 at the midpoint, beating analyst estimates by 22.5%

- EBITDA guidance for the full year is $910 million at the midpoint, above analyst estimates of $699.2 million

- Operating Margin: 61.5%, up from 56.3% in the same quarter last year

- Free Cash Flow Margin: 49.6%, up from 39.3% in the same quarter last year

- Market Capitalization: $7.91 billion

Company Overview

Known for transforming hours-long intravenous infusions into minutes-long subcutaneous injections, Halozyme Therapeutics (NASDAQ: HALO) develops and licenses its proprietary ENHANZE technology that enables subcutaneous delivery of injectable drugs that would otherwise require intravenous administration.

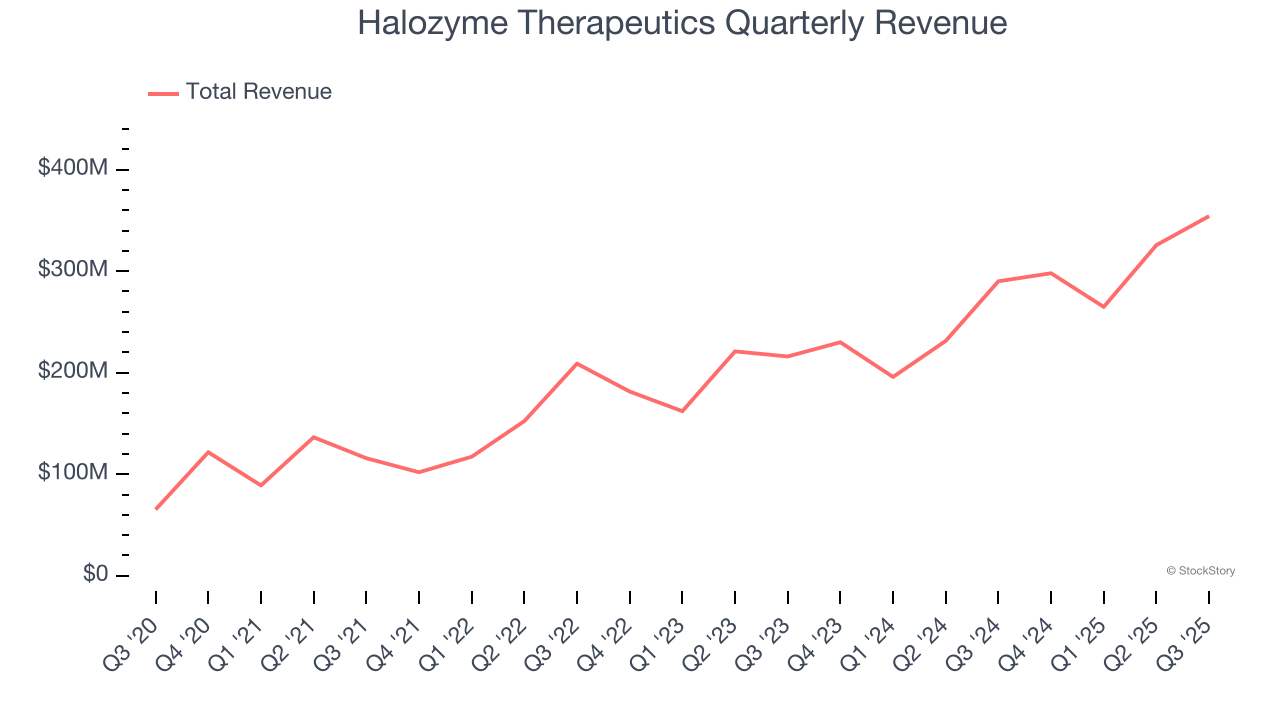

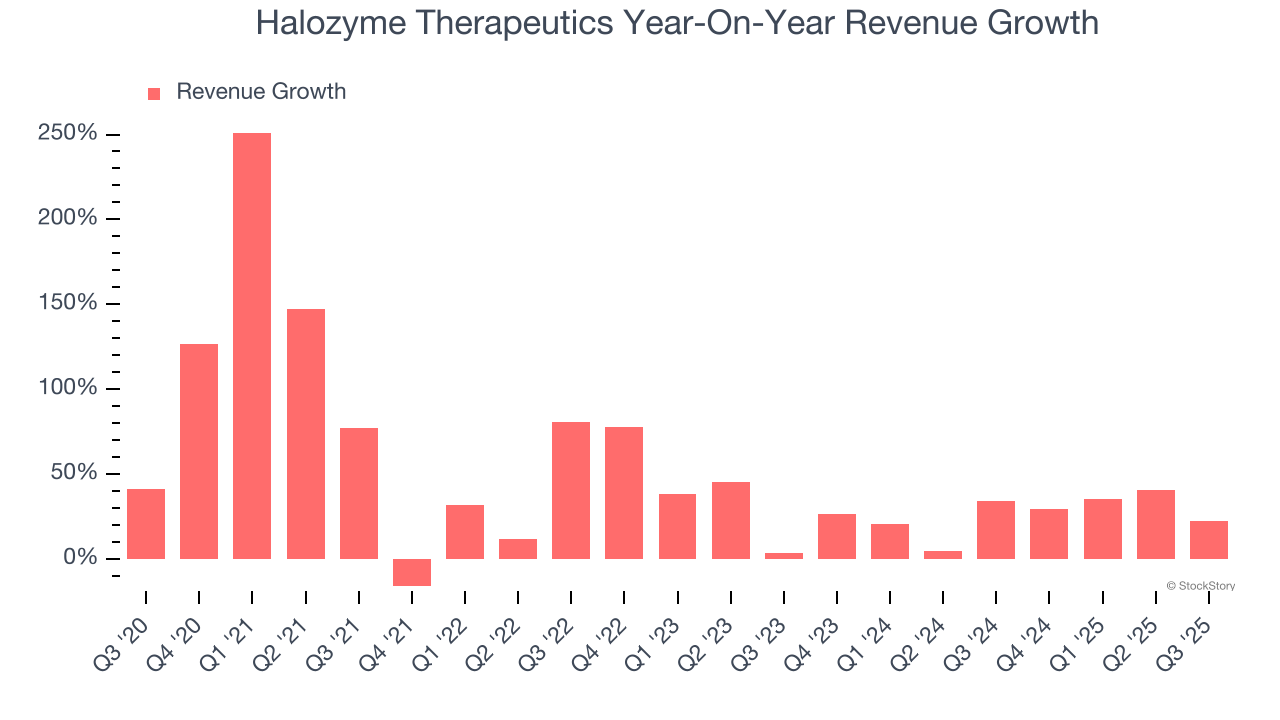

Revenue Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can have short-term success, but a top-tier one grows for years. Over the last five years, Halozyme Therapeutics grew its sales at an incredible 44.2% compounded annual growth rate. Its growth beat the average healthcare company and shows its offerings resonate with customers, a helpful starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within healthcare, a half-decade historical view may miss recent innovations or disruptive industry trends. Halozyme Therapeutics’s annualized revenue growth of 26.2% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.

This quarter, Halozyme Therapeutics reported robust year-on-year revenue growth of 22.1%, and its $354.3 million of revenue topped Wall Street estimates by 3.1%.

Looking ahead, sell-side analysts expect revenue to grow 28.1% over the next 12 months, an improvement versus the last two years. This projection is eye-popping and implies its newer products and services will catalyze better top-line performance.

While Wall Street chases Nvidia at all-time highs, an under-the-radar semiconductor supplier is dominating a critical AI component these giants can’t build without. Click here to access our free report one of our favorites growth stories.

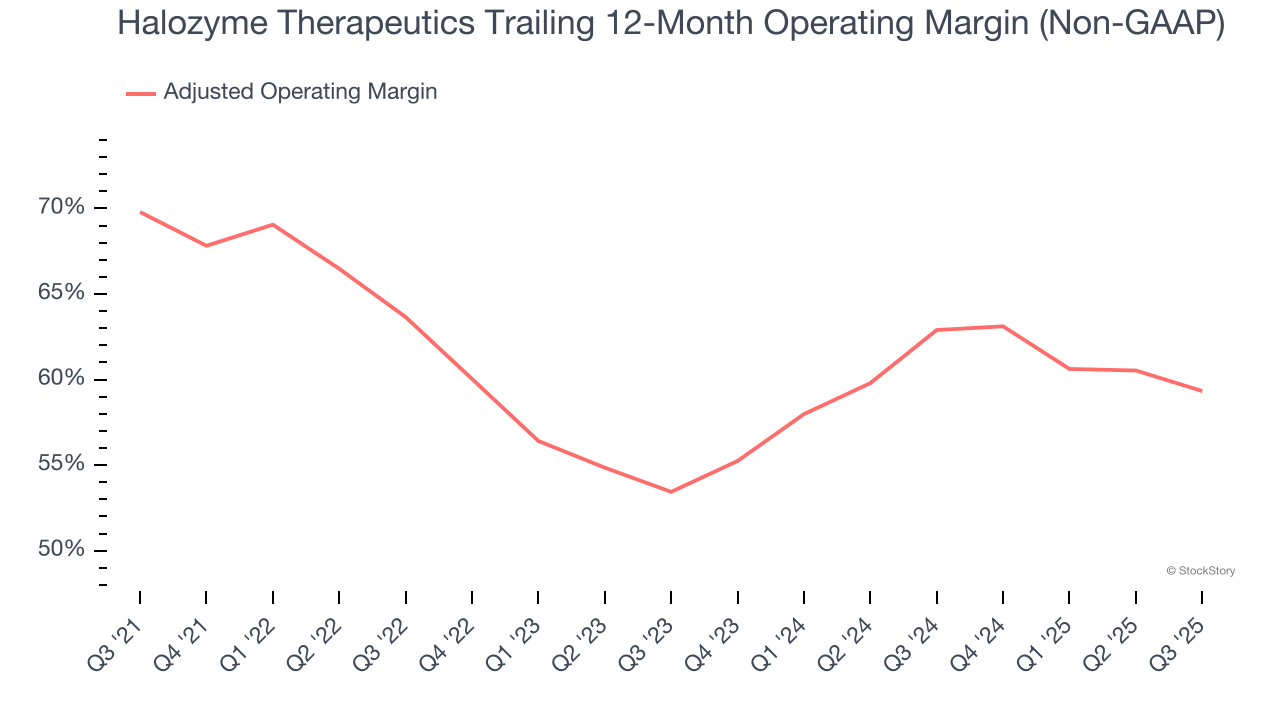

Adjusted Operating Margin

Adjusted operating margin is a key measure of profitability. Think of it as net income (the bottom line) excluding the impact of non-recurring expenses, taxes, and interest on debt - metrics less connected to business fundamentals.

Halozyme Therapeutics has been a well-oiled machine over the last five years. It demonstrated elite profitability for a healthcare business, boasting an average adjusted operating margin of 60.9%.

Analyzing the trend in its profitability, Halozyme Therapeutics’s adjusted operating margin decreased by 10.5 percentage points over the last five years, but it rose by 5.9 percentage points on a two-year basis. We like Halozyme Therapeutics and hope it can right the ship.

This quarter, Halozyme Therapeutics generated an adjusted operating margin profit margin of 61.5%, down 5.4 percentage points year on year. This contraction shows it was less efficient because its expenses grew faster than its revenue.

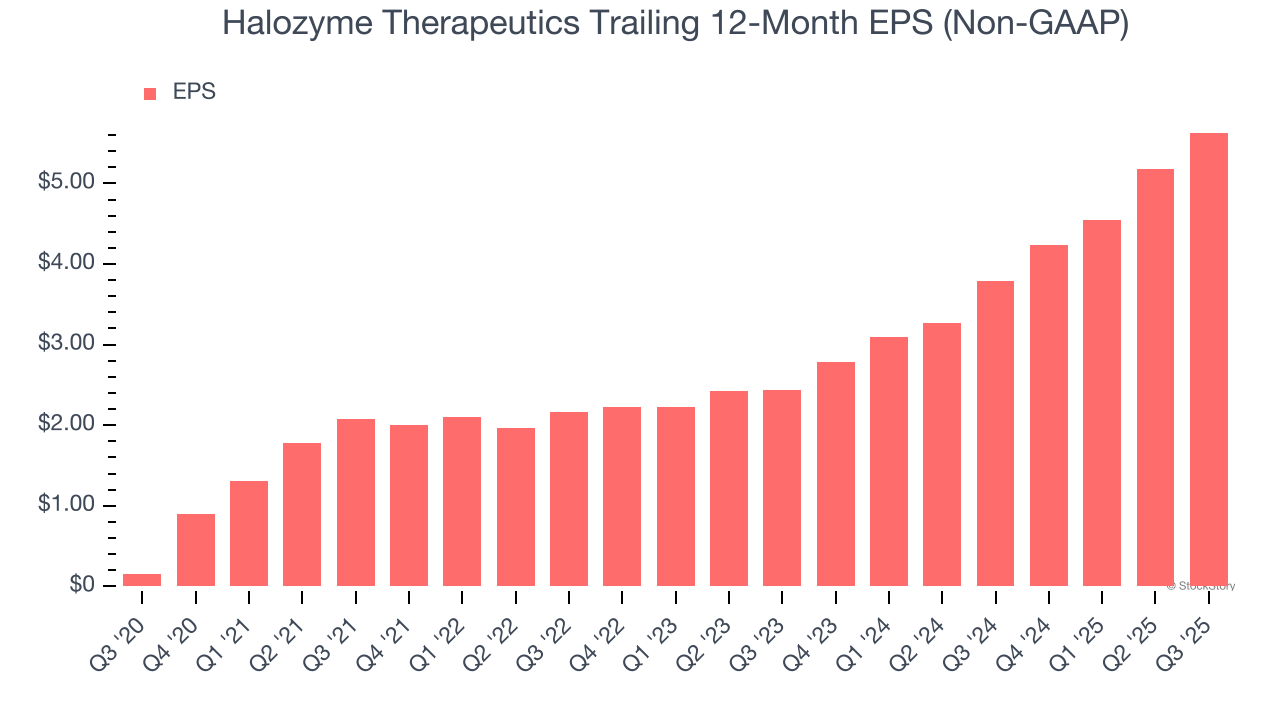

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Halozyme Therapeutics’s EPS grew at an astounding 104% compounded annual growth rate over the last five years, higher than its 44.2% annualized revenue growth. However, this alone doesn’t tell us much about its business quality because its adjusted operating margin didn’t improve.

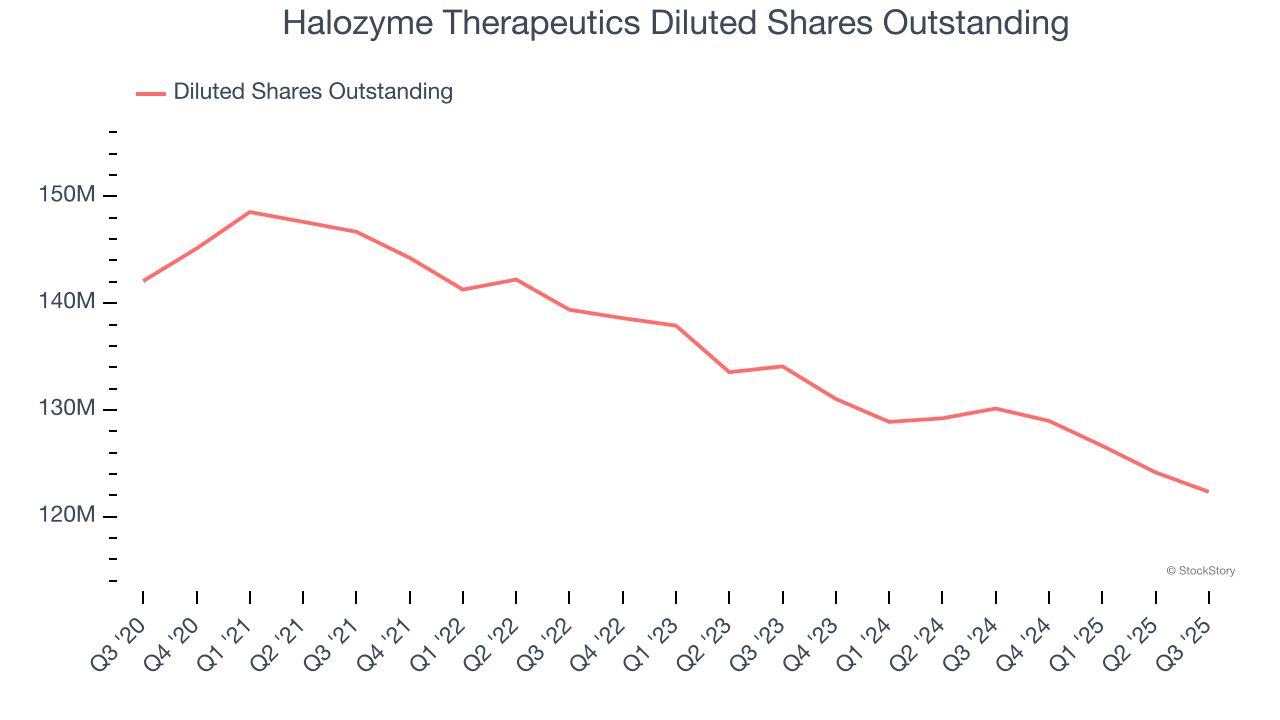

We can take a deeper look into Halozyme Therapeutics’s earnings to better understand the drivers of its performance. A five-year view shows that Halozyme Therapeutics has repurchased its stock, shrinking its share count by 13.9%. This tells us its EPS outperformed its revenue not because of increased operational efficiency but financial engineering, as buybacks boost per share earnings.

In Q3, Halozyme Therapeutics reported adjusted EPS of $1.72, up from $1.27 in the same quarter last year. This print beat analysts’ estimates by 5.5%. Over the next 12 months, Wall Street expects Halozyme Therapeutics’s full-year EPS of $5.63 to grow 35.1%.

Key Takeaways from Halozyme Therapeutics’s Q3 Results

We were impressed by Halozyme Therapeutics’s optimistic full-year EBITDA guidance, which blew past analysts’ expectations. We were also excited its full-year EPS guidance outperformed Wall Street’s estimates by a wide margin. Zooming out, we think this was a good print with some key areas of upside. Investors were likely hoping for more, and shares traded down 1.6% to $66.25 immediately following the results.

Is Halozyme Therapeutics an attractive investment opportunity at the current price? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.